|

市场调查报告书

商品编码

1906231

类器官:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Organoids - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

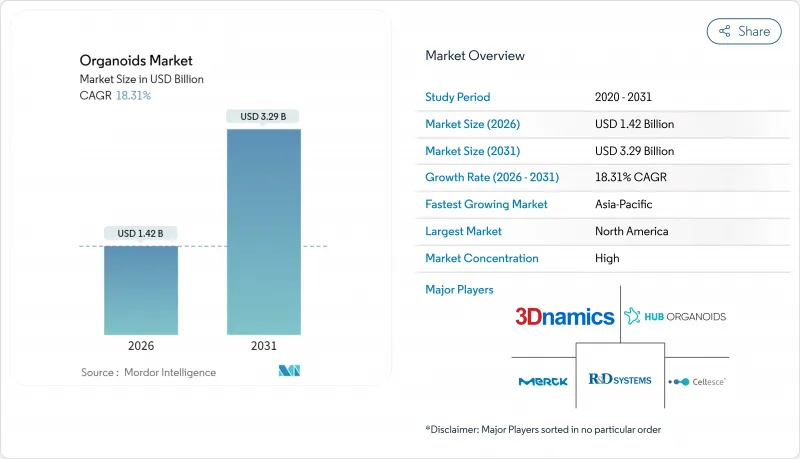

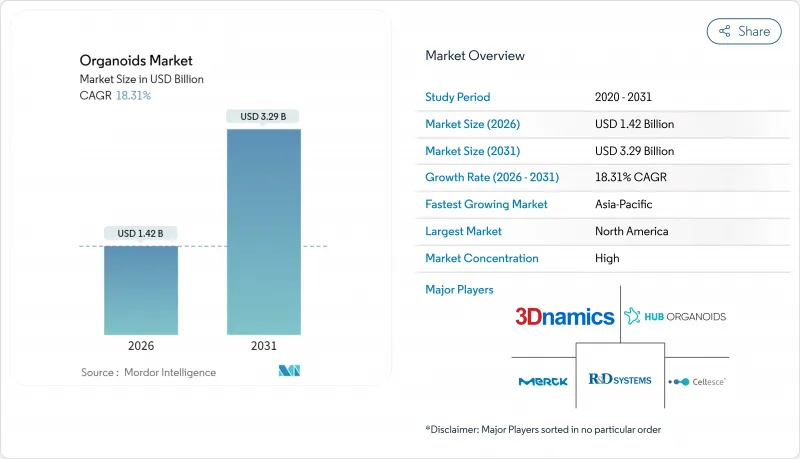

预计类器官市场将从 2025 年的 12 亿美元成长到 2026 年的 14.2 亿美元,到 2031 年将达到 32.9 亿美元,2026 年至 2031 年的复合年增长率为 18.31%。

这一强劲成长是由三大因素共同推动的:监管机构逐步淘汰动物试验、3D生物列印技术的快速成熟以及製药业向与人类相关的疾病模型的转变。史丹佛大学开发的血管化心臟和肝臟类器官克服了以往限制下游生产的尺寸障碍。此外,无基质通讯协定减轻了细胞外水凝胶的成本负担,而细胞外水凝胶的成本一直是个长期存在的难题。癌症治疗计画依赖患者来源的肿瘤类器官来降低高失败率,加上动物试验核准数量的整体下降,这些因素都促进了商业需求,加速了3D人体模型的应用。受託研究机构(CRO)正在扩展其承包类器官服务,随着小规模生物技术公司将复杂的培养流程外包,进一步推动了类器官市场的发展。

全球类器官市场趋势与洞察

在癌症药物开发平臺中快速应用

为了克服癌症药物研发中高达90%的传统失败率,药厂正将源自患者的肿瘤类器官应用于早期药物发现。类器官保留了肿瘤的异质性,使得在进行成本高昂的临床试验之前,即可基于真实的患者生物学特征进行多药联合筛检。这种方法能够即时洞察抗药性机制,并有助于制定适应性给药策略。辛辛那提儿童医院的多区域肝臟类器官在囓齿动物模型中展现出更高的存活率,这表明类器官从静态疾病模型发展成为功能性组织替代物的复杂性。大型製药企业之间的竞争体现在它们纷纷设立专门的类器官研发部门、提交知识产权申请以及为3D肿瘤平台投入创业投资资金投资等方面。

利用病患来源的类器官增加精准医疗试验

类器官指导的临床试验正在推动治疗方案从群体平均值转向真正个人化的转变。一项胰臟癌研究在预测疗效方面达到了 83.3% 的敏感性和 92.9% 的特异性,证实了其临床效用。针对罕见疾病的临床试验正在利用类器官在体外模拟疾病,即使患者样本有限,也能克服招募障碍。 iScience 公司报告了首个人类发炎性肠道疾病移植临床试验,标誌着再生类器官疗法的临床应用正式启动(01343-9)。监管机构正在製定基于类器官的伴随诊断指南,为未来将预测性检测与标靶治疗相结合的产品铺平道路。

耗材和专用细胞外基质水凝胶高成本

动物性基质,例如Matrigel,价格昂贵,每毫升售价200-500美元,占培养成本的60%之多,这限制了其在资金雄厚的实验室之外的广泛应用。批次间的差异导致昂贵的检验週期,进一步加重了预算负担。目前市场上涌现的合成或工程水凝胶可望实现价格稳定和批次间一致性的提升。同时,利用低黏附性塑胶和可控搅拌的无基质培养通讯协定的研究有望完全消除细胞外基质(ECM)的输入,但这些策略需要新的标准操作规程和大量的细胞株重新验证。

细分市场分析

截至2025年,干细胞衍生系统将占据类器官市场62.94%的份额,这表明其符合标准化筛检要求。此细分市场受益于诱导多功能细胞(iPSCs),iPSCs具有在整个生产过程中稳定分化的特性,从而降低了批次间差异,并有助于监管审核。由于成长率可预测且智慧财产权保护清晰,干细胞驱动的类器官市场目前占据最大的收入份额。肿瘤衍生类器官虽然基数较小,但由于肿瘤中心需要用于治疗分层的患者特异性模型,其复合年增长率(CAGR)仍高达19.18%。

诱导多能干细胞重编程、微流体灌注和多细胞共培养技术的交叉融合,正在扩展干细胞和肿瘤系统的生理学研究深度。资料共用联盟已开始存檔与每个细胞系相关的基因组和药理学特征,从而实现跨机构的Meta分析。然而,肿瘤来源的模型必须克服移植率和培养寿命方面的异质性,才能达到干细胞层面的可靠性。

到2025年,药物发现和筛检领域将占类器官市场规模的41.42%,反映出大型製药企业迫切需要降低研发失败率并儘早发现毒性风险。高内涵筛检和微型多孔生物反应器的整合将使每次实验能够生产数万个类器官,接近化合物库的规模。然而,精准医疗和个人化医疗领域将呈现最高的成长轨迹,复合年增长率将达到19.84%。基于类器官的治疗决策,尤其是在结直肠癌和胰腺癌领域获得监管部门批准,将使该应用场景有望快速获得医疗保险报销。

人工智慧流程处理类器官影像分析和单细胞转录组学数据,能够加速先导化合物的筛选,减少人为错误,并发现一些反直觉的生物标记。毒理学和疾病建模领域的应用也将随之而来,尤其是在类器官能够重现囓齿动物研究中无法实现的器官特异性代谢方面。再生医学仍是一个新兴领域,但成功的临床前肝臟和甲状腺移植实验凸显了其变革性潜力。

区域分析

北美地区在2025年初贡献了43.88%的收入,这得益于美国食品药物管理局(FDA)加速非动物模型研发的蓝图,以及美国卫生研究院(NIH)对史丹佛大学等研究中心的大力资助。美国科技巨头如赛默飞世尔科技(Thermo Fisher Scientific)投资41亿美元收购与类器官工作流程相契合的高纯度过滤设备,进一步强化了该领域的生态系统。从多区域肝臟到血管化心臟组织等学术突破正透过技术转移机构直接整合到商业化产品线。

欧洲拥有强大的学术基础,荷兰、德国和英国等国均设有丛集。默克集团收购HUB Organoids公司便是旨在拓展其先进生物学产品组合的策略整合的典范。政策制定者正顺应公众舆论,反对使用动物进行研究,并推动优先发展3D人体模型的津贴体系。儘管由于成员国之间的经济差异,相关技术的采用率有所不同,但诸如创新药物倡议(IMI)等泛欧盟倡议正在帮助协调标准和资金流向。

预计亚太地区将成为成长最快的地区,到2031年复合年增长率将达到21.38%。中国的五年规划已将再生医学列为重点发展领域,并为大学和Start-Ups提供津贴。这些企业正透过合资企业和智慧财产权共用协议与西方製药公司合作。日本拥有成熟的细胞疗法监管体系,能够进行早期人体试验。韩国、澳洲和印度的契约製造资源正在不断扩展,使该地区成为极具吸引力的低成本试点生产基地。儘管外汇波动和人力资源发展的挑战构成风险因素,但政府的支持措施和不断增加的临床试验数量为长期发展提供了支持。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 在肿瘤药物研发流程中快速应用

- 利用病患来源的类器官增加精准医疗试验

- 动物实验核准的减少推动了3D人体模型的发展

- 政府津贴用于干细胞和3D培养基础设施

- 类器官生物样本库货币化模式的兴起

- CRISPR基因编辑的「下一代」类器官引发智慧财产权竞赛

- 市场限制

- 高昂的耗材成本和特殊的细胞外基质水凝胶

- 缺乏检测间重复性标准

- 胚胎样肠胚研究的伦理检验

- 缺乏用于运输活体类器官的冷藏物流

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 类器官生物样本库的现状

第五章 市场规模与成长预测

- 按类型

- 干细胞衍生类器官

- 肿瘤来源的类器官

- 透过使用

- 药物发现与筛检

- 疾病与毒理学建模

- 精准医疗与个人化医疗

- 再生医学

- 其他(例如,基因编辑检验)

- 最终用户

- 製药和生物技术公司

- 学术和研究机构

- 合约研究组织 (CRO) 和合约研发生产力组织 (CDMO)

- 医院和诊断检查室

- 透过技术

- 基于支架的3D培养

- 无需支架/漂浮培养

- 整合微流体/晶片器官

- 3D生物列印辅助类器官

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- GCC

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 市占率分析

- 公司简介

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Corning Inc.

- STEMCELL Technologies Inc.

- Lonza Group AG

- Greiner Bio-One International GmbH

- Cellesce Ltd

- Hubrecht Organoid Technology

- Emulate Inc.

- CN Bio Innovations Ltd

- MIMETAS BV

- InSphero AG

- ATCC

- Sartorius AG

- Eppendorf SE

- Miltenyi Biotec BV & Co. KG

- BICO Group AB

- Hubrecht Organoid Biobank(Hub)

- QGel SA

- Advanced BioMatrix Inc.

第七章 市场机会与未来展望

The organoids market is expected to grow from USD 1.20 billion in 2025 to USD 1.42 billion in 2026 and is forecast to reach USD 3.29 billion by 2031 at 18.31% CAGR over 2026-2031.

The strong upside rests on three converging forces: regulatory mandates that phase out animal testing, fast-maturing 3-D bioprinting, and the pharmaceutical shift to human-relevant disease models. Vascularized heart and liver organoids created at Stanford remove the size barriers that once limited downstream manufacturing, while matrix-free protocols are easing the long-standing cost burden of extracellular hydrogels. Commercial demand is reinforced by oncology programs that now rely on patient-derived tumor organoids to trim high attrition rates, and by the broader decline in animal-testing approvals that accelerates 3-D human model uptake. Contract research organizations (CROs) are scaling turnkey organoid services, putting additional momentum behind the organoids market as smaller biotechs outsource complex culture workflows.

Global Organoids Market Trends and Insights

Rapid Adoption in Oncology Drug-Discovery Pipelines

Pharmaceutical teams are embedding patient-derived tumor organoids into early discovery to curb the historical 90% failure rate of oncology assets. Organoids conserve tumor heterogeneity, enabling multiple drug combinations to be screened against authentic patient biology before costly clinical trials. The approach supplies real-time insight into resistance mechanisms and informs adaptive dosing strategies. Cincinnati Children's multi-zonal liver organoids, which improved rodent survival, illustrate how organoid complexity now extends beyond static disease modeling toward functional tissue replacement. Competitive urgency among big pharma is reflected in dedicated organoid units, IP filings, and venture funding channelled to 3-D tumor platforms.

Rising Precision-Medicine Trials Using Patient-Derived Organoids

Organoid-guided trials are shifting care from population averages to truly individualized regimens. A pancreatic cancer study achieved 83.3% sensitivity and 92.9% specificity in predicting responses, underscoring clinical relevance. Trials focused on rare diseases leverage organoids to overcome recruitment hurdles, modeling pathologies in vitro with only limited patient samples. iScience reported the first human inflammatory bowel disease transplant trial, marking clinical entry for regenerative organoid therapy (01343-9). Regulators are drafting guidance for organoid-based companion diagnostics, clearing a path for future products that link predictive assays with targeted therapeutics.

High Consumable Costs & Specialized ECM Hydrogels

Animal-derived matrices such as Matrigel cost USD 200-500 per mL and account for up to 60% of culture spend, discouraging widespread adoption outside well-funded labs. Batch variability triggers expensive validation cycles that further inflate budgets. Synthetic or engineered hydrogels now entering the market promise price stability and better lot-to-lot consistency. Parallel research on matrix-free protocols-leveraging low-adhesion plastics and controlled agitation-could eliminate ECM inputs altogether, but these strategies require fresh standard-operating procedures and extensive cell-line requalification.

Other drivers and restraints analyzed in the detailed report include:

- Decline in Animal-Testing Approvals Spurring 3-D Human Models

- CRISPR-Edited "Next-Gen" Organoids Creating IP Race

- Lack of Assay-to-Assay Reproducibility Standards

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Stem-cell-derived systems captured 62.94% of organoids market share in 2025, underscoring their suitability for standardized screening requirements. The segment benefits from well-characterized induced pluripotent stem cells that differentiate reliably across production runs, reducing batch variance and easing regulatory audits. The stem-cell-driven organoids market contributes the largest slice of current revenue owing to predictable expansion rates and clear intellectual-property paths. Tumor-derived organoids, while holding a smaller base, are rising at a 19.18% CAGR as oncology centers demand patient-specific avatars for treatment stratification.

The technological intersection of iPSC reprogramming, microfluidic perfusion, and multi-cell co-culture is expanding the physiological depth of both stems and tumor systems. Data sharing consortia have started to archive genomic and pharmacological fingerprints linked to each line, enabling meta-analysis across institutions. Nevertheless, tumor-derived models must still overcome heterogeneity in take rates and culture lifespans before matching stem-cell reliability.

Drug discovery and screening amassed 41.42% of the 2025 organoids market size, reflecting big pharma's urgent need to lower attrition and spot toxic liabilities earlier. Integration of high-content screening with miniaturized multi-well bioreactors now yields tens of thousands of organoids per experiment, approaching compound-library scale. Precision and personalized medicine, however, exhibits the highest trajectory with a 19.84% CAGR. Regulatory recognition of organoid-guided therapy decisions, especially in colorectal and pancreatic cancers, positions this use-case for fast-track reimbursement pathways.

Artificial-intelligence pipelines that parse organoid imaging and single-cell transcriptomics accelerate hit identification, reduce human error, and uncover non-intuitive biomarkers. Toxicology and disease-modeling applications follow closely, especially where organoids replicate organ-specific metabolism absent in rodent studies. Regenerative medicine remains an emerging frontier, yet the successful liver and thyroid preclinical implants underscore its transformative potential.

The Organoids Market Report is Segmented by Type (Stem-Cell-Derived Organoids, Tumor-Derived Organoids), Application (Drug Discovery & Screening, Disease & Toxicology Modelling, and More), End User (Pharmaceutical & Biotech Companies, Academic & Research Institutes, and More), Technology (Scaffold-Based 3-D Culture, and More), and Geography (North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America opened 2025 with 43.88% revenue, buoyed by the FDA roadmap that accelerates non-animal models and by generous National Institutes of Health funding for CuSTOM, Stanford, and other hubs. U.S. conglomerates such as Thermo Fisher Scientific reinforced the ecosystem by allocating USD 4.1 billion to acquire high-purity filtration assets that dovetail with organoid workflows. Academic breakthroughs-from multi-zonal liver to vascularized cardiac tissue-feed directly into commercial pipelines through technology-transfer offices.

Europe sits on a solid academic backbone with clusters in the Netherlands, Germany, and the United Kingdom. Merck KGaA's purchase of HUB Organoids exemplifies strategic consolidation aimed at expanding advanced-biology portfolios. Policymakers align with public sentiment against animal use, driving grant schemes that prioritize 3-D human models. Economic diversity across member states causes uneven adoption rates, but pan-EU initiatives-such as the Innovative Medicines Initiative-help harmonize standards and funding streams.

Asia-Pacific is the fastest-growing territory at 21.38% CAGR to 2031. China's Five-Year Plan prioritizes regenerative medicine, funneling grants to universities and startups that co-develop with Western pharma through joint ventures and IP-sharing arrangements. Japan offers a mature regulatory path for cell-based therapies, enabling earlier human trials. South Korea, Australia, and India are scaling contract manufacturing resources, making the region an attractive site for cost-effective pilot production. While currency fluctuations and training gaps pose risks, government incentives and rising clinical-trial volume underpin long-term expansion.

- Thermo Fisher Scientific

- Merck

- Corning

- Stem Cell Technologies

- Lonza Group

- Greiner Bio One International

- Cellesce

- Hubrecht Organoid Technology

- Emulate

- CN Bio Innovations Ltd

- Mimetas

- InSphero

- ATCC

- Sartorius

- Eppendorf

- Miltenyi Biotec B.V. & Co. KG

- BICO Group AB

- Hubrecht Organoid Biobank (Hub)

- QGel SA

- Advanced BioMatrix Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid adoption in oncology drug-discovery pipelines

- 4.2.2 Rising precision-medicine trials using patient-derived organoids

- 4.2.3 Decline in animal-testing approvals spurring 3-D human models

- 4.2.4 Government grants for stem-cell & 3-D culture infrastructure

- 4.2.5 Organoid biobank monetisation models emerging

- 4.2.6 CRISPR-edited "next-gen" organoids creating IP race

- 4.3 Market Restraints

- 4.3.1 High consumable costs & specialised ECM hydrogels

- 4.3.2 Lack of assay-to-assay reproducibility standards

- 4.3.3 Ethical scrutiny over embryo-like gastruloid work

- 4.3.4 Limited cold-chain logistics for live organoid shipping

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Organoid Biobank Landscape

5 Market Size & Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Stem-cell-derived Organoids

- 5.1.2 Tumor-derived Organoids

- 5.2 By Application

- 5.2.1 Drug Discovery & Screening

- 5.2.2 Disease & Toxicology Modelling

- 5.2.3 Precision & Personalised Medicine

- 5.2.4 Regenerative Medicine

- 5.2.5 Others (e.g., Gene-editing validation)

- 5.3 By End User

- 5.3.1 Pharmaceutical & Biotech Companies

- 5.3.2 Academic & Research Institutes

- 5.3.3 CROs & CDMOs

- 5.3.4 Hospitals & Diagnostics Labs

- 5.4 By Technology

- 5.4.1 Scaffold-based 3-D Culture

- 5.4.2 Scaffold-free / Suspension Culture

- 5.4.3 Micro-fluidic / Organ-on-chip-integrated

- 5.4.4 3-D Bioprinting-assisted Organoids

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Thermo Fisher Scientific Inc.

- 6.3.2 Merck KGaA

- 6.3.3 Corning Inc.

- 6.3.4 STEMCELL Technologies Inc.

- 6.3.5 Lonza Group AG

- 6.3.6 Greiner Bio-One International GmbH

- 6.3.7 Cellesce Ltd

- 6.3.8 Hubrecht Organoid Technology

- 6.3.9 Emulate Inc.

- 6.3.10 CN Bio Innovations Ltd

- 6.3.11 MIMETAS BV

- 6.3.12 InSphero AG

- 6.3.13 ATCC

- 6.3.14 Sartorius AG

- 6.3.15 Eppendorf SE

- 6.3.16 Miltenyi Biotec B.V. & Co. KG

- 6.3.17 BICO Group AB

- 6.3.18 Hubrecht Organoid Biobank (Hub)

- 6.3.19 QGel SA

- 6.3.20 Advanced BioMatrix Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment