|

市场调查报告书

商品编码

1885795

人工智慧病理分析系统市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)AI-Powered Pathology Analysis System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

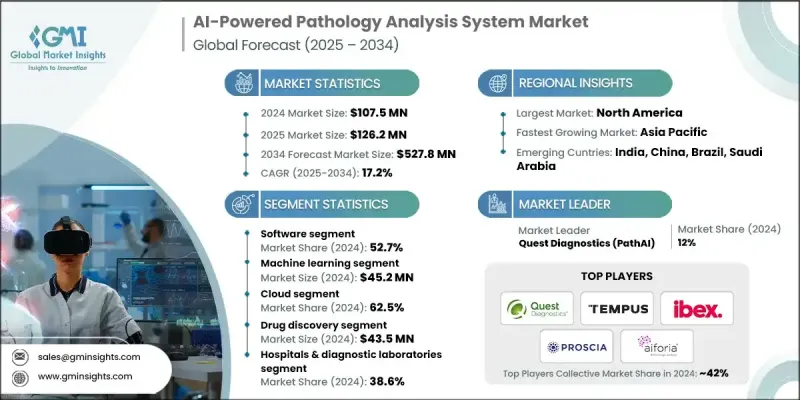

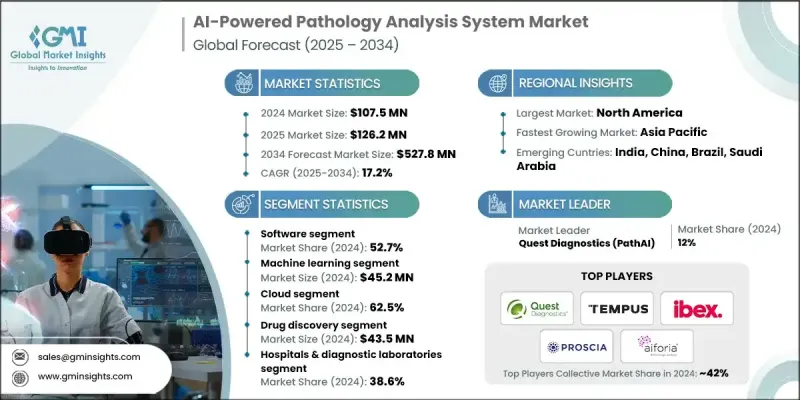

2024 年全球人工智慧病理分析系统市值为 1.075 亿美元,预计到 2034 年将以 17.2% 的复合年增长率增长至 5.278 亿美元。

市场扩张的驱动因素包括数位病理学和远端病理学的日益普及、对更快更准确诊断结果的需求不断增长、慢性病患病率的上升以及人工智慧演算法的持续进步。熟练病理学家的短缺促使人们采用自动化解决方案,而人工智慧与基因组学和多组学资料的整合则创造了先进的诊断能力。数位病理学能够远端存取高解析度切片影像,促进跨地域协作;远端病理学则允许专家在异地会诊病例。人工智慧平台增强了影像分析能力,支援决策制定,并在专家审核前提供即时品质控制。这些系统利用人工智慧分析医学影像,检测疾病模式,并帮助病理学家实现更快、更一致、更准确的诊断。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1.075亿美元 |

| 预测值 | 5.278亿美元 |

| 复合年增长率 | 17.2% |

预计到2024年,软体领域将占据52.7%的市场份额,这主要得益于药物研发和临床试验领域软体应用的不断增长。医院和实验室正越来越多地部署软体解决方案,以实现工作流程自动化并与电子健康记录(EHR)系统集成,从而提高效率和生产力。

2024 年,机器学习领域的估值达到 4,520 万美元,因为包括卷积神经网路 (CNN) 和生成对抗网路 (GAN) 在内的机器学习演算法能够分析复杂的组织病理学模式,从而支持疾病的早期检测。

预计到2024年,北美人工智慧病理分析系统市占率将达到47.7%。该地区受益于先进的医疗基础设施、数位病理学的广泛应用以及对人工智慧研究的大量投入。包括TEMPUS、PHILIPS和PROSCIA在内的美国主要公司正与医院和製药公司合作,在诊断、生物标记开发和临床试验中部署人工智慧解决方案。监管政策的明确以及与电子病历系统的整合进一步推动了该地区人工智慧技术的应用和部署。

人工智慧病理分析系统市场的主要企业包括IBEX、HOLOGIC、QRITIVE、Tribune Health、aiforia、Aiosyn、Mindpeak、VISIOPHARM、PathAI、Roche、Quest Diagnostics、PHILIPS、TEMPUS、Deep Bio、KFBIO和Indica Labs。市场参与者正透过加大研发投入来提升演算法准确性并扩展诊断能力,从而巩固自身市场地位。他们与医院、实验室和製药公司建立策略合作伙伴关係,同时扩大软体部署规模,并将人工智慧整合到临床工作流程中。地理扩张、收购和合作也是其核心策略,此外,他们还将平台与电子病历系统集成,以提高互通性。各公司致力于推出先进的分析工具、基于机器学习的解决方案以及人工智慧驱动的工作流程自动化,以巩固其市场地位,并加速其在诊断、药物开发和临床研究领域的应用。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 产业影响因素

- 成长驱动因素

- 对更快诊断週转时间和更高准确性的需求日益增长

- 慢性病盛行率上升

- 人工智慧演算法的进步

- 数位病理学和远端病理学的应用日益广泛

- 产业陷阱与挑战

- 监管审批的复杂性

- 资料隐私和安全问题

- 市场机会

- 越来越重视将人工智慧融入癌症筛检和早期检测项目

- 开发基于云端的AI病理平台

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 新兴应用和用例

- 投资和融资环境

- 政策演变与变化

- 报销方案

- 波特的分析

- PESTEL 分析

- 差距分析

- 未来市场趋势

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依组件划分,2021-2034年

- 主要趋势

- 软体

- 影像分析与模式识别

- 预测分析工具

- 工作流程自动化软体

- 诊断决策支持

- 硬体

- 全切片影像(WSI)扫描仪

- 数位病理系统

- 显微镜

- 储存系统

- 服务

- 实施与集成

- 咨询与培训

- 託管人工智慧服务

- 维护与支援

第六章:市场估计与预测:依技术划分,2021-2034年

- 主要趋势

- 机器学习(ML)

- 卷积神经网路(CNN)

- 生成对抗网路(GAN)

- 循环神经网路(RNNS)

- 其他神经网络

- 基于电脑视觉的图像分析

- 自然语言处理(NLP)

第七章:市场估算与预测:依部署模式划分,2021-2034年

- 主要趋势

- 云

- 本地部署

第八章:市场估算与预测:依应用案例划分,2021-2034年

- 主要趋势

- 药物发现

- 疾病诊断与预后

- 临床工作流程

- 培训与教育

第九章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 医院和诊断实验室

- 生命科学公司

- 研究机构和学术中心

- 其他最终用途

第十章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十一章:公司简介

- aetherAI

- aiforia

- Aiosyn

- deep bio

- HOLOGIC

- IBEX

- indica labs

- KFBIO

- mindpeak

- PHILIPS

- PROSCIA

- QRITIVE

- Quest Diagnostics (PathAI)

- Roche

- TEMPUS

- tribun HEALTH

- VISIOPHARM

The Global AI-Powered Pathology Analysis System Market was valued at USD 107.5 million in 2024 and is estimated to grow at a CAGR of 17.2% to reach USD 527.8 million by 2034.

The market expansion is driven by the rising adoption of digital pathology and telepathology, the growing need for faster and more accurate diagnostic results, the increasing prevalence of chronic diseases, and continuous advancements in AI algorithms. Shortages of skilled pathologists are encouraging the adoption of automated solutions, while integration of AI with genomic and multi-omics data is creating advanced diagnostic capabilities. Digital pathology enables remote access to high-resolution slide images, facilitating collaboration across geographies, and telepathology allows specialists to consult on cases from distant locations. AI-powered platforms enhance image analysis, support decision-making, and offer real-time quality control prior to expert review. These systems utilize artificial intelligence to analyze medical images, detect disease patterns, and assist pathologists in achieving faster, more consistent, and highly accurate diagnoses.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $107.5 Million |

| Forecast Value | $527.8 Million |

| CAGR | 17.2% |

The software segment held a 52.7% share in 2024, driven by rising adoption in drug discovery and clinical trials. Hospitals and laboratories are increasingly deploying software solutions to automate workflows and integrate with electronic health record (EHR) systems, enhancing efficiency and productivity.

The machine learning segment was valued at USD 45.2 million in 2024, as machine learning algorithms, including convolutional neural networks (CNNs) and generative adversarial networks (GANs), enable analysis of complex histopathological patterns, supporting early disease detection.

North America AI-Powered Pathology Analysis System Market held a 47.7% share in 2024. The region benefits from advanced healthcare infrastructure, high adoption of digital pathology, and substantial investments in AI research. Key US companies, including TEMPUS, PHILIPS, and PROSCIA, are collaborating with hospitals and pharmaceutical firms to deploy AI solutions in diagnostics, biomarker development, and clinical trials. Regulatory clarity and integration with EHR systems further support adoption and deployment in the region.

Leading companies in the AI-Powered Pathology Analysis System Market include IBEX, HOLOGIC, QRITIVE, Tribune Health, aiforia, Aiosyn, Mindpeak, VISIOPHARM, PathAI, Roche, Quest Diagnostics, PHILIPS, TEMPUS, Deep Bio, KFBIO, and Indica Labs. Market players are strengthening their position by investing in R&D to enhance algorithm accuracy and expand diagnostic capabilities. They are forming strategic partnerships with hospitals, laboratories, and pharmaceutical firms, while scaling software deployment and AI integration across clinical workflows. Geographic expansion, acquisitions, and collaborations are also central strategies, along with integrating platforms with EHR systems to improve interoperability. Companies focus on launching advanced analytics tools, machine learning-based solutions, and AI-powered workflow automation to solidify their market presence and accelerate adoption in diagnostics, drug development, and clinical research.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Component trends

- 2.2.3 Technology trends

- 2.2.4 Deployment mode trends

- 2.2.5 Use case trends

- 2.2.6 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for faster diagnostic turnaround time with improved accuracy

- 3.2.1.2 Rising prevalence of chronic diseases

- 3.2.1.3 Advancements in AI algorithms

- 3.2.1.4 Growing adoption of digital pathology and telepathology

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory approval complexities

- 3.2.2.2 Data privacy & security concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Increasing focus on AI integration in cancer screening and early detection programs

- 3.2.3.2 Development of cloud-based AI pathology platforms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Emerging applications and use cases

- 3.7 Investment and funding landscape

- 3.8 Policy evolution and changes

- 3.9 Reimbursement scenario

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Gap analysis

- 3.13 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Component, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Software

- 5.2.1 Image analysis & pattern recognition

- 5.2.2 Predictive analytics tools

- 5.2.3 Workflow automation software

- 5.2.4 Diagnostic decision support

- 5.3 Hardware

- 5.3.1 Whole slide imaging (WSI) scanners

- 5.3.2 Digital pathology systems

- 5.3.3 Microscopes

- 5.3.4 Storage systems

- 5.4 Services

- 5.4.1 Implementation & integration

- 5.4.2 Consulting & training

- 5.4.3 Managed AI services

- 5.4.4 Maintenance & support

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Machine learning (ML)

- 6.2.1 Convolutional neural networks (CNNS)

- 6.2.2 Generative adversarial networks (GANS)

- 6.2.3 Recurrent neural networks (RNNS)

- 6.2.4 Other neural networks

- 6.3 Computer vision-based image analysis

- 6.4 Natural language processing (NLP)

Chapter 7 Market Estimates and Forecast, By Deployment Mode, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Cloud

- 7.3 On-premise

Chapter 8 Market Estimates and Forecast, By Use Case, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Drug discovery

- 8.3 Disease diagnosis & prognosis

- 8.4 Clinical workflow

- 8.5 Training & education

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals & diagnostic laboratories

- 9.3 Life sciences companies

- 9.4 Research institutes & academic centers

- 9.5 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East & Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 aetherAI

- 11.2 aiforia

- 11.3 Aiosyn

- 11.4 deep bio

- 11.5 HOLOGIC

- 11.6 IBEX

- 11.7 indica labs

- 11.8 KFBIO

- 11.9 mindpeak

- 11.10 PHILIPS

- 11.11 PROSCIA

- 11.12 QRITIVE

- 11.13 Quest Diagnostics (PathAI)

- 11.14 Roche

- 11.15 TEMPUS

- 11.16 tribun HEALTH

- 11.17 VISIOPHARM