|

市场调查报告书

商品编码

1885800

消费品零售包装及展示盒市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Retail Packaging and Display Boxes for Consumer Products Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

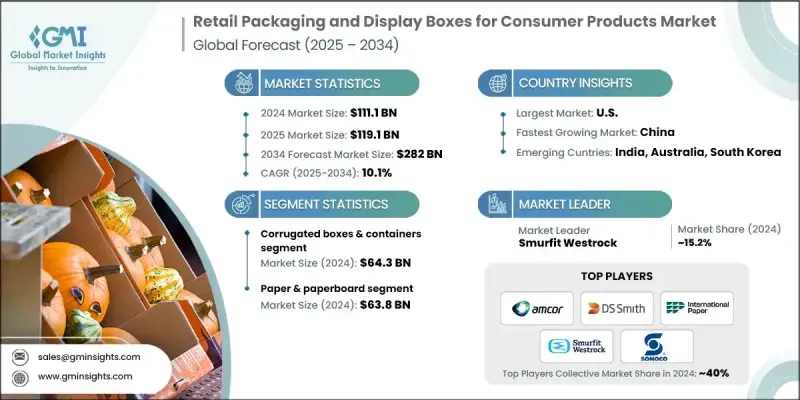

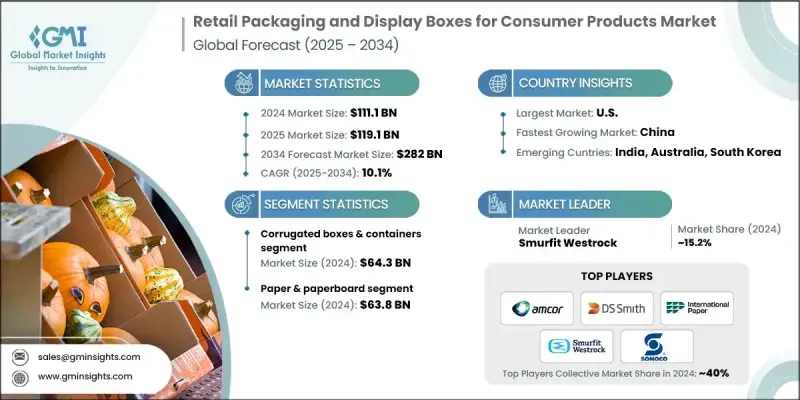

2024 年全球消费品零售包装和展示盒市场价值为 1,111 亿美元,预计到 2034 年将以 10.1% 的复合年增长率增长至 2,820 亿美元。

包装产业正经历变革性的转变,这主要受不断变化的环境法规、消费者期望以及技术创新的驱动。包装企业正在适应日益复杂的监管环境,面临对可回收性、废弃物管理和化学品安全更严格的要求。同时,在物联网 (IoT) 技术的推动下,智慧互联包装正在兴起,使包装能够在整个供应链中即时传递讯息。原料供应商生产的柔性基材、导电油墨和相容感测器的材料,在保持传统包装功能的同时,融入了数位化特性。品牌正越来越多地利用这些创新技术,在保持成本效益和可扩展性的同时,提供互动体验、提升产品可见度并强化永续发展承诺,所有这些都将惠及全球零售和电商通路。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1111亿美元 |

| 预测值 | 2820亿美元 |

| 复合年增长率 | 10.1% |

2024年,瓦楞纸箱及包装容器市场规模达到643亿美元,预计到2034年将以9.7%的复合年增长率成长。其受欢迎的原因在于其多功能性、成本效益以及在零售和电商领域的广泛应用。瓦楞纸材料具有高度可回收性和生物降解性,既符合永续发展目标,也满足了消费者的需求。印刷和模切技术的进步使品牌能够打造出个人化、引人注目且极具货架吸引力的包装。

2024年,纸和纸板产业产值达638亿美元。纸质包装因其可回收性和可生物降解性而备受青睐,既符合监管要求,也符合消费者环保意识。其可灵活应用于折迭纸盒、硬纸盒和展示包装等多种形式,使其成为包括食品、化妆品、电子产品和服装在内的众多产品的理想包装选择。

2024年,美国消费品零售包装与展示盒市场规模将达223亿美元。这一增长得益于美国强大的零售和电子商务基础设施,以及消费者对永续和个人化包装的需求。监管支持和消费者环保意识的提高,促使製造商更加重视可回收和可堆肥包装,从而提升品牌声誉并符合环保法规。

全球消费品零售包装和展示盒市场的主要参与者包括:Graphic Packaging International、Stora Enso、DS Smith、Amcor、Mondi Group、Bennett Packaging、BW Packaging Systems、Weedon Direct、Sonoco Products Company、Karl Knauer Group、Georgia-Pacific、Barry-Wehmiller Corporation、Ashtonco Products Company.各公司正透过拓展永续产品线、投资先进的印刷和模切技术以及提高供应链效率等策略来巩固其市场地位。策略合作和收购有助于扩大地域覆盖范围和客户群。此外,各公司也致力于智慧互动包装的创新、开发环保且经济高效的材料以及增强品牌客製化选项。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 机会

- 成长潜力分析

- 2024年定价分析

- 按地区和产品类型

- 原料成本

- 未来市场趋势

- 风险评估与缓解

- 监理合规风险

- 产能限制影响分析

- 技术转型风险

- 价格波动和成本上涨风险

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品类型划分,2021-2034年

- 主要趋势

- 瓦楞纸箱和货柜

- 单层瓦楞纸箱

- 双层瓦楞纸箱

- 三层壁重型容器

- 特殊笛型配置(E调、F调、微型笛)

- 折迭纸板箱

- 折迭式纸箱

- 自动底部纸箱

- 反向折迭式

- 特殊闭合系统

- 刚性安装盒

- 伸缩盒

- 磁性闭合系统

- 抽屉式盒子

- 书本式及翻盖式包装盒

- 可直接用于展示的包装

- 货架即用包装(SRP)

- 零售包装(RRP)

- 销售点展示

- 独立式展示单元(FSDU)

- 模切展示容器

- 柜檯展示

- 落地展示

- 促销道具

- 季节性展示方案

第六章:市场估算与预测:依材料类型划分,2021-2034年

- 主要趋势

- 塑胶

- 纸和纸板

- 玻璃

- 金属

- 其他(可持续替代方案等)

第七章:市场估计与预测:依价格划分,2021-2034年

- 主要趋势

- 经济

- 中檔

- 优质的

第八章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 食品和饮料

- 新鲜农产品和易腐品

- 加工食品和零食

- 饮料及液体产品

- 乳製品和冷藏产品

- 化妆品及个人护理

- 美容保养产品

- 香水和奢侈化妆品

- 个人卫生用品

- 专业美容工具

- 医药与医疗保健

- 非处方药

- 医疗器材及设备

- 保健品及营养保健品

- 诊断和检测试剂盒

- 电子产品和消费品

- 小家电和小玩意

- 消费性电子配件

- 技术产品及组件

- 游戏及娱乐产品

- 其他(服装和时尚、工具和五金等)

第九章:市场估算与预测:依配销通路划分,2021-2034年

- 主要趋势

- 直销

- 间接销售

第十章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十一章:公司简介

- Amcor

- Ashtonne Packaging

- Barry-Wehmiller Corporation

- Bennett Packaging

- BW Packaging Systems

- DS Smith

- Georgia-Pacific

- Graphic Packaging International

- International Paper Company

- Karl Knauer Group

- Mondi Group

- Smurfit Westrock

- Sonoco Products Company

- Stora Enso

- Weedon Direct

The Global Retail Packaging and Display Boxes for Consumer Products Market was valued at USD 111.1 billion in 2024 and is estimated to grow at a CAGR of 10.1% to reach USD 282 billion by 2034.

The sector is undergoing transformative changes driven by evolving environmental regulations, shifting consumer expectations, and technological innovations. Packaging companies are adapting to a complex regulatory landscape, with stricter requirements on recyclability, waste management, and chemical safety. Simultaneously, smart and connected packaging is emerging, enabled by Internet of Things (IoT) technologies, allowing packages to communicate real-time information across the supply chain. Raw material suppliers produce flexible substrates, conductive inks, and sensor-compatible materials that maintain traditional packaging functionality while integrating digital features. Brands are increasingly leveraging these innovations to deliver interactive experiences, enhance product visibility, and reinforce sustainability commitments, all while maintaining cost efficiency and scalability across global retail and e-commerce channels.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $111.1 Billion |

| Forecast Value | $282 Billion |

| CAGR | 10.1% |

In 2024, the corrugated boxes and containers segment generated USD 64.3 billion and is expected to grow at a CAGR of 9.7% through 2034. Its popularity stems from versatility, cost-effectiveness, and applicability across retail and online commerce. Corrugated materials are highly recyclable and biodegradable, supporting sustainability goals and meeting consumer preferences. Advances in printing and die-cutting technologies allow brands to create personalized, eye-catching packaging with strong shelf appeal.

The paper and paperboard segment generated USD 63.8 billion in 2024. Paper-based packaging is valued for its recyclability and biodegradability, aligning with both regulatory requirements and eco-conscious consumer behavior. Its adaptability across folding cartons, rigid boxes, and display-ready packaging makes it ideal for a wide range of products, including food, cosmetics, electronics, and apparel.

U.S. Retail Packaging and Display Boxes for Consumer Products Market reached USD 22.3 billion in 2024. Growth is driven by the country's robust retail and e-commerce infrastructure, along with consumer demand for sustainable and personalized packaging. Regulatory support combined with heightened consumer awareness is prompting manufacturers to focus on recyclable and compostable formats, enhancing both brand reputation and environmental compliance.

Key players in the Global Retail Packaging and Display Boxes for Consumer Products Market include Graphic Packaging International, Stora Enso, DS Smith, Amcor, Mondi Group, Bennett Packaging, BW Packaging Systems, Weedon Direct, Sonoco Products Company, Karl Knauer Group, Georgia-Pacific, Barry-Wehmiller Corporation, Ashtonne Packaging, Smurfit Westrock, and International Paper Company. Companies are strengthening their presence through strategies such as expanding sustainable product lines, investing in advanced printing and die-cutting technologies, and improving supply chain efficiency. Strategic partnerships and acquisitions help broaden geographic reach and customer base. Firms are also focusing on innovation in smart and interactive packaging, developing eco-friendly and cost-effective materials, and enhancing brand customization options.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product type trends

- 2.2.2 Material Type trends

- 2.2.3 Price trends

- 2.2.4 End Use trends

- 2.2.5 Distribution channel trends

- 2.2.6 Regional trends

- 2.3 CXO perspective: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

- 2.5 Strategic recommendations

- 2.5.1 Supply chain diversification strategy

- 2.5.2 Product portfolio enhancement

- 2.5.3 Partnership and alliance opportunities

- 2.5.4 Cost management and pricing strategy

- 2.6 Decision framework

- 2.6.1 Investment priority matrix

- 2.6.2 Risk-adjusted ROI analysis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry Impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Pricing analysis, 2024

- 3.4.1 By region and product type

- 3.4.2 Raw material cost

- 3.5 Future market trends

- 3.6 Risk assessment and mitigation

- 3.6.1 Regulatory compliance risks

- 3.6.2 Capacity constraint impact analysis

- 3.6.3 Technology transition risks

- 3.6.4 Pricing volatility and cost escalation risks

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Corrugated boxes & container

- 5.2.1 Single-wall corrugated boxes

- 5.2.2 Double-wall corrugated boxes

- 5.2.3 Triple-wall heavy-duty containers

- 5.2.4 Specialty flute configurations (E, F, micro-flute)

- 5.3 Folding paperboard boxes

- 5.3.1 Tuck-end cartons

- 5.3.2 Auto-bottom cartons

- 5.3.3 Reverse-tuck configurations

- 5.3.4 Specialty closure systems

- 5.4 Rigid set-up boxes

- 5.4.1 Telescopic boxes

- 5.4.2 Magnetic closure systems

- 5.4.3 Drawer-style boxes

- 5.4.4 Book-style & clamshell boxes

- 5.5 Display-ready packaging

- 5.5.1 Shelf-ready packaging (SRP)

- 5.5.2 Retail-ready packaging (RRP)

- 5.5.3 Point-of-purchase displays

- 5.5.4 Free-standing display units (FSDU)

- 5.6 Die-cut display containers

- 5.6.1 Counter displays

- 5.6.2 Floor displays

- 5.6.3 Promotional fixtures

- 5.6.4 Seasonal display solutions

Chapter 6 Market Estimates & Forecast, By Material Type, 2021 - 2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Plastic

- 6.3 Paper & paperboard

- 6.4 Glass

- 6.5 Metal

- 6.6 Others (sustainable alternatives, etc.)

Chapter 7 Market Estimates & Forecast, By Price, 2021 - 2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Economy

- 7.3 Mid-range

- 7.4 Premium

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Food & beverages

- 8.2.1 Fresh produce & perishables

- 8.2.2 Processed foods & snacks

- 8.2.3 Beverages & liquid products

- 8.2.4 Dairy & refrigerated products

- 8.3 Cosmetics & personal care

- 8.3.1 Beauty & skincare products

- 8.3.2 Fragrances & luxury cosmetics

- 8.3.3 Personal hygiene products

- 8.3.4 Professional beauty tools

- 8.4 Pharmaceuticals & healthcare

- 8.4.1 Over-the-counter medications

- 8.4.2 Medical devices & equipment

- 8.4.3 Health supplements & nutraceuticals

- 8.4.4 Diagnostic & testing kits

- 8.5 Electronics & consumer goods

- 8.5.1 Small appliances & gadgets

- 8.5.2 Consumer electronics accessories

- 8.5.3 Technology products & components

- 8.5.4 Gaming & entertainment products

- 8.6 Others (apparel and fashion, tools and hardware, etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 U.K.

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 Amcor

- 11.2 Ashtonne Packaging

- 11.3 Barry-Wehmiller Corporation

- 11.4 Bennett Packaging

- 11.5 BW Packaging Systems

- 11.6 DS Smith

- 11.7 Georgia-Pacific

- 11.8 Graphic Packaging International

- 11.9 International Paper Company

- 11.10 Karl Knauer Group

- 11.11 Mondi Group

- 11.12 Smurfit Westrock

- 11.13 Sonoco Products Company

- 11.14 Stora Enso

- 11.15 Weedon Direct