|

市场调查报告书

商品编码

1885803

双面太阳能光电模组市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Bifacial Solar PV Module Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

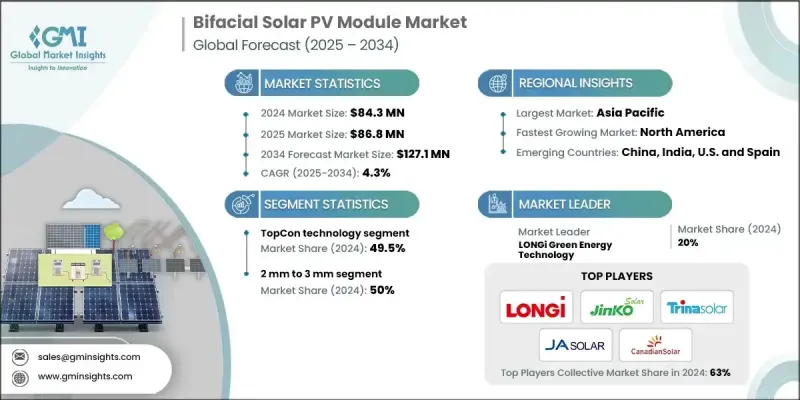

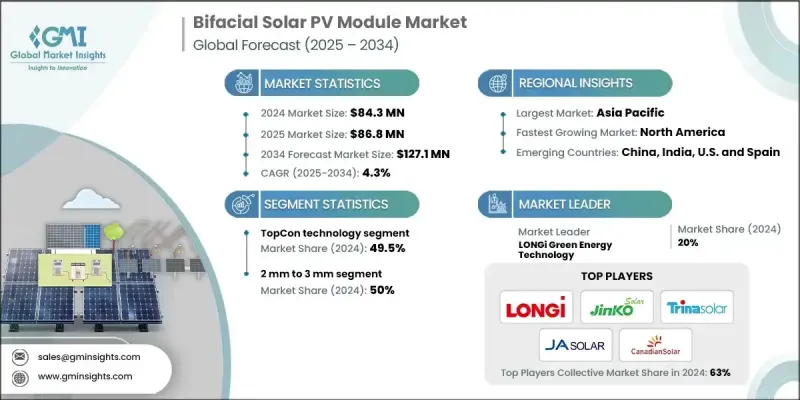

2024年全球双面太阳能光电模组市场规模达8,430万美元,预计2034年将以4.3%的复合年增长率成长至1.271亿美元。

全球公用事业规模太阳能装置的建造动能仍是推动双面组件普及的主要因素。大型开发商从这些组件中获益匪浅,因为它们能够优化场地设计,并与先进的追踪系统无缝集成,最终提高背面辐照度和整体能量输出。双面技术与单轴追踪相结合已成为新建地面安装系统的首选配置,超过一半的新建专案都整合了单轴追踪系统。多项技术经济评估一致表明,双面组件与追踪器结合使用可实现最低的平准化度电成本 (LCOE),这主要得益于追踪系统带来的 15-20% 的能量增益以及双面组件性能带来的额外提升。随着产业加速从 PERC 架构向 n 型架构转型,TOPCon 等技术因其更高的温度係数、更高的双面性以及在高温和高辐照度条件下更优异的性能而持续获得关注。在阳光强烈、地形反射率高的地区,双面组件的产量优势足以弥补其相对于上一代组件的显着成本溢价,从而增强了各个市场的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 8430万美元 |

| 预测值 | 1.271亿美元 |

| 复合年增长率 | 4.3% |

预计到2034年,HJT(异质结晶体管)细分市场将以8.5%的复合年增长率成长,这主要得益于其显着的高双面性、优异的温度特性和强大的弱光效率。儘管较高的生产成本和对封装材料耐久性的担忧限制了其应用,但持续的创新,尤其是针对降低成本和改进材料的创新,正在推动其未来的成长。

预计到2034年,2毫米厚光电模组市场将以5%的复合年增长率成长,这主要得益于其适用于轻量化和特殊应用,例如便携式能源解决方案和楼宇整合式光伏设计。更薄的结构在保持结构性能的同时降低了组件重量,从而减少了运输和BOS(系统平衡)相关成本,并促进了其在屋顶和追踪式光电系统中的更广泛应用。

预计2024年,美国双面太阳能光电模组市场规模将达1,500万美元。该国公用事业规模的光电系统广泛采用追踪系统,从而持续推动了对双面组件的需求。预测显示,未来十年双面率将稳定提升,这将有助于提高容量係数并降低系统成本。

参与全球双面太阳能光电模组市场的主要公司包括晶澳太阳能科技、信实新能源、宝维太阳能集团、索拉利亚公司、晶科能源控股有限公司、REC集团、迈耶·伯格、Sunergy、天合光能、隆基绿色能源科技、First Solar、3Sun、Sipsen、韩华Q CELLS、Astroenergy、SunPowerCansen、Astroenergy、SunPowerZ、Cstroenergy、SunPower、Astroenergy、SunPower)、Risen

全球双面太阳能光电模组市场的企业正专注于技术创新、提升製造效率和拓展全球市场的策略,强化其竞争优势。许多企业正加大对n型电池架构、先进封装材料和更高效率组件形式的投资,以提高输出功率并降低衰减率。扩大产能、优化供应链和实现製造流程自动化有助于降低整体成本,同时扩大市场覆盖范围。与追踪器製造商、EPC公司和公用事业开发商的合作,能够实现系统级性能的全面提升。此外,企业也积极寻求策略合作伙伴关係、建造区域性製造工厂,并丰富产品组合,以满足住宅、商业和公用事业规模等不同领域的需求。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系统

- 监管环境

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 按地区分類的公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 战略仪錶板

- 策略倡议

- 公司标竿分析

- 创新与技术格局

第五章:市场规模及预测:依类型划分,2021-2034年

- 主要趋势

- 双层玻璃

- 玻璃背板

第六章:市场规模及预测:依技术划分,2021-2034年

- 主要趋势

- 四氯乙烯

- 拓普康

- HJT

- 其他的

第七章:市场规模及预测:依应用领域划分,2021-2034年

- 主要趋势

- 住宅

- 商业及工业

- 公用事业

第八章:市场规模及预测:依框架类型划分,2021-2034年

- 主要趋势

- 框

- 无框

第九章:市场规模及预测:依厚度划分,2021-2034年

- 主要趋势

- 小于 2 毫米

- 2毫米至3毫米

- > 3 毫米

第十章:市场规模及预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 荷兰

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 中东和非洲

- 阿联酋

- 沙乌地阿拉伯

- 南非

- 卡达

- 埃及

- 拉丁美洲

- 巴西

- 智利

- 阿根廷

第十一章:公司简介

- 3Sun

- Astroenergy

- Boviet Solar Group

- Canadian Solar

- First Solar

- Hanwha Q CELLS Co., Ltd.

- JA Solar Technology

- JinkoSolar Holding Co., Ltd.

- LONGi Green Energy Technology

- Meyer Burger

- REC Group

- Reliance New Energy

- Risen Energy

- Sharp Corporation

- Seraphim Solar

- Solaria Corporation

- Sunergy

- SunPower Corporation

- Trina Solar

- Vikram Solar

The Global Bifacial Solar PV Module Market reached USD 84.3 million in 2024 and is estimated to grow at a CAGR of 4.3% to reach USD 127.1 million by 2034.

Global momentum toward utility-scale solar installations remains the primary catalyst for increasing adoption of bifacial systems. Large-scale developers benefit significantly from these modules because they allow optimized site design and seamless integration with advanced tracking systems, ultimately boosting rear-side irradiation capture and overall energy output. Bifacial technology combined with single-axis tracking has emerged as the preferred configuration for new ground-mounted setups, with over half of new installations integrating SAT systems. Multiple techno-economic evaluations have consistently shown that pairing bifacial modules with trackers delivers some of the lowest LCOE outcomes, driven by energy gains of 15-20% from tracking and an additional uplift attributed to bifacial performance. As the industry accelerates the shift from PERC to n-type architectures, technologies such as TOPCon continue to gain traction due to their improved temperature coefficients, higher bifaciality, and stronger performance under elevated temperatures and high-irradiance conditions. In regions characterized by intense sunlight and reflective terrain, bifacial modules deliver yield advantages that justify notable cost premiums over earlier-generation modules, strengthening demand across diverse markets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $84.3 Million |

| Forecast Value | $127.1 Million |

| CAGR | 4.3% |

The HJT segment is projected to grow at a CAGR of 8.5% through 2034, supported by its notably high bifaciality levels, favorable temperature profiles, and strong low-light efficiency. Although adoption has been restrained by higher production expenses and concerns regarding encapsulant durability, ongoing innovation focused on cost reduction and material enhancements is shaping future growth.

The 2 mm segment is forecast to grow at a 5% CAGR by 2034, driven by its suitability for lightweight and specialized applications such as portable energy solutions and building-integrated photovoltaic designs. Its thinner structure decreases module weight while maintaining structural performance, enabling reduced transportation and BOS-related expenses and supporting broader uptake among rooftop and tracker-enabled installations.

U.S. Bifacial Solar PV Module Market reached USD 15 million in 2024. Utility-scale deployments in the country utilize tracking systems extensively, generating sustained demand for bifacial modules. Forecasts indicate a steady rise in bifaciality factors over the coming decade, which will contribute to improved capacity factors and lower system-level costs.

Key companies participating in the Global Bifacial Solar PV Module Market include JA Solar Technology, Reliance New Energy, Boviet Solar Group, Solaria Corporation, JinkoSolar Holding Co., Ltd., REC Group, Meyer Burger, Sunergy, Trina Solar, LONGi Green Energy Technology, First Solar, 3Sun, Sharp Corporation, Hanwha Q CELLS Co., Ltd., Astroenergy, SunPower Corporation, Risen Energy, Seraphim Solar, Canadian Solar, and Vikram Solar.

Companies in the Global Bifacial Solar PV Module Market strengthen their competitive position through targeted strategies that focus on technological innovation, manufacturing efficiency, and global expansion. Many firms are increasing investments in n-type cell architectures, advanced encapsulation materials, and higher efficiency module formats to improve output and reduce degradation rates. Scaling production capacity, optimizing supply chains, and automating manufacturing processes help reduce overall costs while supporting wider market reach. Collaboration with tracker manufacturers, EPC firms, and utility developers enables integrated system-level performance gains. Companies also pursue strategic partnerships, regional manufacturing facilities, and diversification of product portfolios to address demand across residential, commercial, and utility-scale segments.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.1.3 Base estimates and calculations

- 1.1.4 Base year calculation

- 1.1.5 Key trends for market estimates

- 1.2 Forecast model

- 1.3 Primary research & validation

- 1.3.1 Primary sources

- 1.4 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Type trends

- 2.4 Technology trends

- 2.5 Application trends

- 2.6 Frame type trends

- 2.7 Thickness trends

- 2.8 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Type, 2021 - 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 Dual glass

- 5.3 Glass backsheet

Chapter 6 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 PERC

- 6.3 TopCon

- 6.4 HJT

- 6.5 Others

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million, Million m2 & MW)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial & Industrial

- 7.4 Utility

Chapter 8 Market Size and Forecast, By Frame type, 2021 - 2034 (USD Million & MW)

- 8.1 Key trends

- 8.2 Framed

- 8.3 Frameless

Chapter 9 Market Size and Forecast, By Thickness, 2021 - 2034 (USD Million & MW)

- 9.1 Key trends

- 9.2 < 2 mm

- 9.3 2 mm to 3 mm

- 9.4 > 3 mm

Chapter 10 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & MW)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.2.3 Mexico

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Netherlands

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Middle East & Africa

- 10.5.1 UAE

- 10.5.2 Saudi Arabia

- 10.5.3 South Africa

- 10.5.4 Qatar

- 10.5.5 Egypt

- 10.6 Latin America

- 10.6.1 Brazil

- 10.6.2 Chile

- 10.6.3 Argentina

Chapter 11 Company Profiles

- 11.1 3Sun

- 11.2 Astroenergy

- 11.3 Boviet Solar Group

- 11.4 Canadian Solar

- 11.5 First Solar

- 11.6 Hanwha Q CELLS Co., Ltd.

- 11.7 JA Solar Technology

- 11.8 JinkoSolar Holding Co., Ltd.

- 11.9 LONGi Green Energy Technology

- 11.10 Meyer Burger

- 11.11 REC Group

- 11.12 Reliance New Energy

- 11.13 Risen Energy

- 11.14 Sharp Corporation

- 11.15 Seraphim Solar

- 11.16 Solaria Corporation

- 11.17 Sunergy

- 11.18 SunPower Corporation

- 11.19 Trina Solar

- 11.20 Vikram Solar