|

市场调查报告书

商品编码

1892817

双面太阳能模组市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Bifacial Solar Module Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

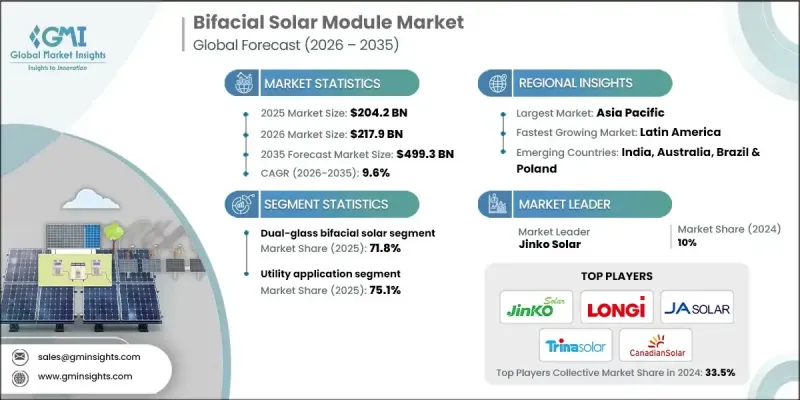

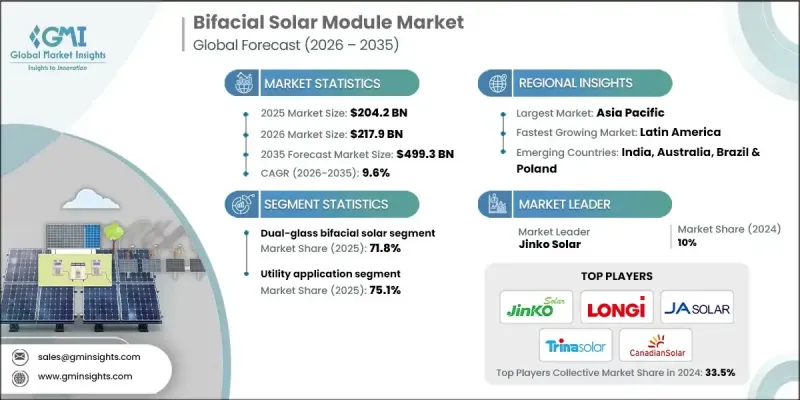

2025年全球双面太阳能模组市场价值2,042亿美元,预计2035年将以9.6%的复合年增长率成长至4,993亿美元。

市场成长势头得益于对高容量太阳能解决方案日益增长的需求,尤其是在大型再生能源开发专案中,这些解决方案能够在相同土地面积上提供更高的电力输出。先进的电池架构,包括n型PERC、TOPCon和异质结技术,透过提高转换效率、降低衰减和增强长期性能,正在加速其应用。双面太阳能组件的设计使其能够从面板的两面捕获太阳辐射,从而利用正面直射阳光和背面反射或散射光进行发电。与传统的单面组件相比,这种配置提高了整体功率输出。在严苛环境下的日益普及促使製造商设计出更具韧性的组件,以确保在更长的使用寿命内提供可靠的性能。电池效率和组件耐久性的不断提升,正在巩固双面技术作为现代太阳能装置中最大化能源产量首选解决方案的地位。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 2042亿美元 |

| 预测值 | 4993亿美元 |

| 复合年增长率 | 9.6% |

到2025年,双面双玻太阳能模组市占率将达到71.8%,预计到2035年将以8.4%的复合年增长率成长。市场成长的主要驱动力是消费者对使用寿命更长、结构强度更高的组件的需求不断增长。双面双玻结构能够提高组件的抗环境压力能力,增强长期可靠性,从而降低营运成本,并为公用事业规模和商业部署带来更高的财务回报。

预计到2035年,商业和工业领域的复合年增长率将达到10.8%。该领域的应用主要受安装空间有限的情况下最大化发电量的需求所驱动。双面组件能够在不增加系统尺寸的情况下实现更高的输出功率,从而提高能源经济效益,并推动其在商业设施中的更广泛应用。

2025年,美国双面太阳能模组市占率达95.8%,预计到2035年将达到390亿美元。对先进太阳能技术的强劲需求,加上大型太阳能装置的不断扩张和联邦政府的扶持性激励政策,持续推动市场渗透率的提升。开发商越来越依赖双面系统来提高专案收益,并优化现有土地资源的能源生产。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系统

- 原物料供应及采购分析

- 製造能力评估

- 供应链韧性与风险因素

- 配电网路分析

- 监管环境

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 成长潜力分析

- 成本结构分析

- 波特的分析

- PESTEL 分析

- 新兴机会与趋势

- 数位化与物联网集成

- 新兴市场渗透

- 投资分析及未来展望

第四章:竞争格局

- 介绍

- 按地区分類的公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 战略仪錶板

- 策略倡议

- 公司标竿分析

- 创新与技术格局

第五章:市场规模及预测:依厚度划分,2022-2035年

- 小于 2 毫米

- 2毫米至3毫米

- > 3 毫米

第六章:市场规模及预测:依类型划分,2022-2035年

- 双面玻璃太阳能

- 玻璃背板双面太阳能电池

第七章:市场规模及预测:依应用领域划分,2022-2035年

- 住宅

- 商业及工业

- 公用事业

第八章:市场规模及预测:依技术划分,2022-2035年

- 钝化射极背面接触(PERC)

- 拓普康

- 异质结(HJT)

第九章:市场规模及预测:依镜框类型划分,2022-2035年

- 框

- 无框

第十章:市场规模及预测:依地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 西班牙

- 荷兰

- 波兰

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 中东和非洲

- 阿联酋

- 土耳其

- 埃及

- 拉丁美洲

- 巴西

- 智利

第十一章:公司简介

- 3Sun

- AE Solar

- Astronergy

- Axitec

- Bluesun Solar

- Boviet Solar

- Canadian Solar

- First Solar

- Hanwha Q CELLS

- JA Solar Technology

- Jinko Solar

- LONGi Green Energy Technology

- Primroot

- Seraphim Solar

- Sharp Corporation

- Silfab Solar

- Sunergy

- Trina Solar

- Vikram Solar

- Yingli Solar

The Global Bifacial Solar Module Market was valued at USD 204.2 billion in 2025 and is estimated to grow at a CAGR of 9.6% to reach USD 499.3 billion by 2035.

Market momentum is supported by rising demand for high-capacity solar solutions that deliver greater electricity output from the same land area, particularly in large-scale renewable energy developments. Advanced cell architectures, including n-type PERC, TOPCon, and heterojunction technologies, are accelerating adoption by improving conversion efficiency, reducing degradation, and enhancing long-term performance. Bifacial solar modules are designed to capture solar radiation from both sides of the panel, allowing energy generation from direct sunlight on the front surface and reflected or diffused light on the rear side. This configuration increases overall power output compared to conventional single-sided modules. Growing deployment in demanding environments has encouraged manufacturers to engineer more resilient module designs that deliver reliable performance over extended operating lifetimes. Continuous improvements in cell efficiency and module durability are strengthening the role of bifacial technology as a preferred solution for maximizing energy yield in modern solar installations.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $204.2 Billion |

| Forecast Value | $499.3 Billion |

| CAGR | 9.6% |

The dual-glass bifacial solar modules segment accounted for 71.8% share in 2025 and is forecast to grow at a CAGR of 8.4% through 2035. Market growth is driven by increasing preference for modules with extended lifespan and higher structural strength. Dual-glass construction improves resistance to environmental stressors and enhances long-term reliability, which supports lower operating expenses and stronger financial returns for both utility-scale and commercial deployments.

The commercial and industrial segment is expected to register a CAGR of 10.8% through 2035. Adoption in this segment is driven by the need to maximize electricity generation where installation space is constrained. Bifacial modules enable higher output without expanding system size, which supports improved energy economics and drives wider use across business facilities.

U.S. Bifacial Solar Module Market held 95.8% share in 2025 and is expected to reach USD 39 billion by 2035. Strong demand for advanced solar technologies, combined with expanding large-scale solar installations and supportive federal incentive structures, continues to boost market penetration. Developers increasingly rely on bifacial systems to enhance project returns and optimize energy production from available land resources.

Key companies active in the Global Bifacial Solar Module Market include Jinko Solar, Canadian Solar, LONGi Green Energy Technology, Trina Solar, JA Solar Technology, Hanwha Q CELLS, First Solar, Sharp Corporation, Vikram Solar, Silfab Solar, Astronergy, AE Solar, Axitec, Boviet Solar, Bluesun Solar, Seraphim Solar, Yingli Solar, Primroot, Sunergy, and 3Sun. Companies operating in the Global Bifacial Solar Module Market focus on multiple strategic initiatives to strengthen their competitive position. Manufacturers prioritize investments in research and development to enhance cell efficiency, reduce power loss, and extend product lifespan. Capacity expansion and vertical integration strategies are adopted to control production costs and ensure stable supply chains. Strategic partnerships with project developers and energy providers help accelerate market penetration and secure long-term contracts. Firms also emphasize geographic expansion to capture demand in high-growth regions while aligning product portfolios with local regulatory frameworks.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Market estimates & forecast parameters

- 1.3 Forecast

- 1.3.1 Key trends for market estimates

- 1.3.1.1 Quantified market impact analysis

- 1.3.2 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario analysis framework

- 1.3.1 Key trends for market estimates

- 1.4 Primary research and validation

- 1.4.1 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Paid Sources

- 1.5.2 Sources, by region

- 1.6 Research trail & scoring components

- 1.6.1 Research trail components

- 1.6.2 Scoring components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

- 1.8 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022 - 2035

- 2.2 Business trends

- 2.3 Thickness trends

- 2.4 Type trends

- 2.5 Application trends

- 2.6 Technology trends

- 2.7 Frame type trends

- 2.8 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Cost structure analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

- 3.7.1 Political factors

- 3.7.2 Economic factors

- 3.7.3 Social factors

- 3.7.4 Technological factors

- 3.7.5 Legal factors

- 3.7.6 Environmental factors

- 3.8 Emerging opportunities & trends

- 3.8.1 Digitalization & IoT integration

- 3.8.2 Emerging market penetration

- 3.9 Investment analysis and future outlook

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2025

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Thickness, 2022 - 2035 (USD Billion)

- 5.1 Key trends

- 5.2 < 2 mm

- 5.3 2 mm to 3 mm

- 5.4 > 3 mm

Chapter 6 Market Size and Forecast, By Type, 2022 - 2035 (USD Billion)

- 6.1 Key trends

- 6.2 Dual-Glass Bifacial Solar

- 6.3 Glass-Backsheet Bifacial Solar

Chapter 7 Market Size and Forecast, By Application, 2022 - 2035 (USD Billion)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial & Industrial

- 7.4 Utility

Chapter 8 Market Size and Forecast, By Technology, 2022 - 2035 (USD Billion)

- 8.1 Key trends

- 8.2 Passivated Emitter Rear Contact (PERC)

- 8.3 TOPCon

- 8.4 Heterojunction (HJT)

Chapter 9 Market Size and Forecast, By Frame Type, 2022 - 2035 (USD Billion)

- 9.1 Key trends

- 9.2 Framed

- 9.3 Frameless

Chapter 10 Market Size and Forecast, By Region, 2022 - 2035 (USD Billion)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 Spain

- 10.3.3 Netherlands

- 10.3.4 Poland

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Australia

- 10.4.3 India

- 10.4.4 Japan

- 10.5 Middle East & Africa

- 10.5.1 UAE

- 10.5.2 Turkey

- 10.5.3 Egypt

- 10.6 Latin America

- 10.6.1 Brazil

- 10.6.2 Chile

Chapter 11 Company Profiles

- 11.1 3Sun

- 11.2 AE Solar

- 11.3 Astronergy

- 11.4 Axitec

- 11.5 Bluesun Solar

- 11.6 Boviet Solar

- 11.7 Canadian Solar

- 11.8 First Solar

- 11.9 Hanwha Q CELLS

- 11.10 JA Solar Technology

- 11.11 Jinko Solar

- 11.12 LONGi Green Energy Technology

- 11.13 Primroot

- 11.14 Seraphim Solar

- 11.15 Sharp Corporation

- 11.16 Silfab Solar

- 11.17 Sunergy

- 11.18 Trina Solar

- 11.19 Vikram Solar

- 11.20 Yingli Solar