|

市场调查报告书

商品编码

1885812

碳捕获利用化学品市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Carbon Capture Utilization Chemicals Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

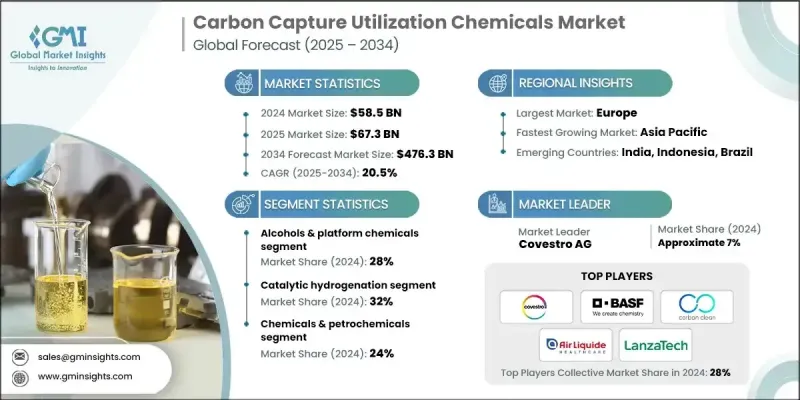

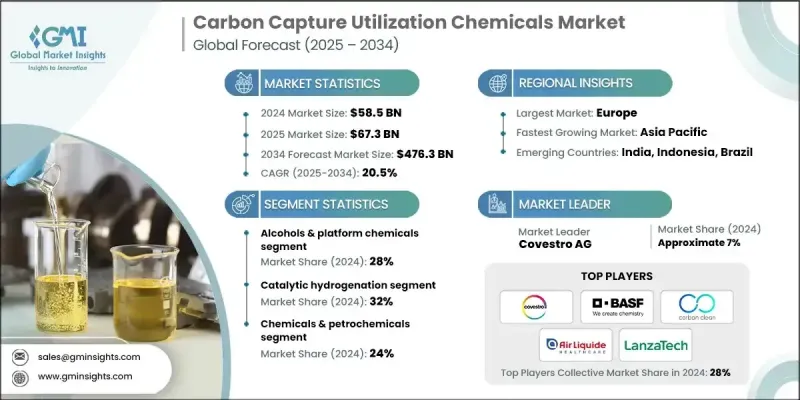

2024 年全球碳捕获利用化学品市场价值为 585 亿美元,预计到 2034 年将以 20.5% 的复合年增长率成长至 4,763 亿美元。

全球企业正将低碳和负碳材料作为其长期净零排放策略的优先考虑因素,这导致对利用捕获的二氧化碳生产的解决方案的需求不断增长。製造商正在扩大低排放材料的采购目标,多个行业正在采用二氧化碳基产品来减少供应链排放。催化、电解和系统整合技术的加速发展正在降低成本并提高性能,而新兴催化剂技术的出现则进一步提升了二氧化碳转化的效率和稳定性。高效能电解系统实现了更高的电流密度,并透过紧凑的系统设计降低了资本投资。市场也正从小型示范转向全面商业化运营,将可再生氢、高浓度二氧化碳源和生物能源系统相结合的整合生产模式正在为部署创造强有力的途径。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 585亿美元 |

| 预测值 | 4763亿美元 |

| 复合年增长率 | 20.5% |

2024年,醇类和平台化学品市占率为28%,预计到2034年将以23%的复合年增长率成长。这一增长前景与利用捕获的二氧化碳和可再生氢生产甲醇和乙醇的规模扩大密切相关。多个地区的商业设施已开始生产再生甲醇,这是化学和燃料市场的重要原料。

2024年,催化加氢领域占据了32%的市场份额,预计到2034年将以22.5%的复合年增长率成长。成熟的催化剂系统、完善的製程设计和成熟的工业应用为其商业潜力提供了支撑。新一代甲醇合成催化剂,以Cu、ZnO和Al₂O₃为主要成分,选择性可达99%以上,同时产率与传统製程相当。基于钴和铁的催化剂系统能够将二氧化碳衍生的合成气转化为合成烃,并透过调整操作条件来控制产率。

2024年,建筑业占据20%的市场份额,预计将以25%的复合年增长率成长。需求成长主要得益于二氧化碳减排混凝土材料和低碳水泥的广泛应用。各大地区基础设施投资的增加,使得建筑材料对低排放的要求更加严格,进一步增强了市场成长动能。

2024年,欧洲碳捕获利用化学品市场份额达到32%,这得益于旨在促进大规模碳管理的重大气候政策。区域性措施的目标是到2030年将二氧化碳储存能力扩大到每年5000万吨,同时制定了到2040年发展跨境二氧化碳商品市场的长期计划,目标是每年捕获2.8亿吨二氧化碳。

全球碳捕获利用化学品市场的主要企业包括:Climeworks AG、Aker Carbon Capture ASA、Carbon Upcycling Technologies Inc.、Covestro AG、Air Liquide SA、Liquid Wind AB、Econic Technologies Ltd.、Blue Planet Systems Corporation、Carbon Recycling International (CRI)、SK Innovation Co., Ltd.、Alix Systems Corporation、Cercling International (CRI)、SK Innovation Co., SESF、EnbonC. Inc.、Solidia Technologies, Inc.、Avantium NV、Carbon Clean Solutions Ltd.、三菱化学集团、Novomer Inc. 和 SABIC。这些碳捕获利用化学品市场的领导者正透过扩大商业产能、建立贯穿整个产业链的长期合作伙伴关係以及大力投资下一代催化剂和电解技术来巩固其竞争地位。许多公司也正在优化将捕获的二氧化碳与可再生氢气结合的整合系统,以降低生产成本并提高系统效率。与能源、化学和建筑公司进行策略合作有助于简化承购协议并确保稳定的需求。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 依产品类型

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品类型划分,2021-2034年

- 主要趋势

- 醇类和平台化学品

- 聚合物和塑料

- 烯烃和碳氢化合物

- 合成气及中间体

- 建筑材料和骨材

- 特种化学品及其他化学品

第六章:市场估计与预测:依技术划分,2021-2034年

- 主要趋势

- 电化学转化

- 催化氢化

- 气体发酵和生物转化

- 热化学转化

- 矿化作用和碳酸化作用

- 直接化学合成

第七章:市场估算与预测:依最终用途产业划分,2021-2034年

- 主要趋势

- 汽车

- 内部组件

- 外部元件

- 引擎盖下的应用

- 建筑施工

- 住宅建筑

- 商业建筑

- 基础建设与土木工程

- 包装

- 食品饮料包装

- 工业包装

- 消费品包装

- 化学品和石油化工产品

- 基础化学品生产

- 特种化学品

- 农业化学品

- 航空

- 商业航空

- 货物及货运

- 军事与国防

- 卫生保健

- 医疗器材

- 药品包装

- 医院及临床用品

- 农业

- 农作物生产

- 肥料和土壤改良剂

- 农业设备

- 电子产品和消费品

- 消费性电子产品

- 家用电器

- 体育用品

第八章:市场估算与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- Air Liquide SA

- Aker Carbon Capture ASA

- Avantium NV

- BASF SE

- Blue Planet Systems Corporation

- Carbon Clean Solutions Ltd.

- Carbon Recycling International (CRI)

- Carbon Upcycling Technologies Inc.

- CarbonCure Technologies Inc.

- Climeworks AG

- Covestro AG

- Econic Technologies Ltd.

- LanzaTech Global, Inc.

- Liquid Wind AB

- Mitsubishi Chemical Group Corporation

- Novomer Inc.

- SABIC

- SK Innovation Co., Ltd.

- Solidia Technologies, Inc.

- TotalEnergies SE

- Others

The Global Carbon Capture Utilization Chemicals Market was valued at USD 58.5 billion in 2024 and is estimated to grow at a CAGR of 20.5% to reach USD 476.3 billion by 2034.

Companies across the world are prioritizing low-carbon and carbon-negative materials as part of their long-term net-zero strategies, leading to rising demand for solutions produced from captured carbon dioxide. Manufacturers are broadening procurement goals for lower-emission materials, and multiple industries are adopting CO2-based products to cut supply-chain emissions. Accelerated advancements in catalysis, electrolysis, and system integration are lowering costs and improving performance, supported by emerging catalyst technologies that deliver stronger efficiency and stability in CO2 conversion. High-performance electrolysis systems are achieving increased current densities, which reduces capital investment through compact system design. The market is also shifting from small-scale demonstrations to full commercial operations, with integrated production models combining renewable hydrogen, concentrated CO2 sources, and bioenergy systems to create powerful pathways for deployment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $58.5 Billion |

| Forecast Value | $476.3 Billion |

| CAGR | 20.5% |

The alcohols and platform chemicals segment held 28% share in 2024 and is projected to grow at a 23% CAGR by 2034. This outlook is linked to expanding production of methanol and ethanol derived from captured CO2 and renewable hydrogen. Commercial facilities in multiple regions are already producing renewable methanol that serves as a key feedstock for chemical and fuel markets.

The catalytic hydrogenation segment accounted for 32% share in 2024 and is anticipated to grow at a CAGR of 22.5% through 2034. Its commercial potential is supported by mature catalyst systems, well-defined process designs, and proven industrial implementation. Next-generation methanol synthesis catalysts featuring Cu, ZnO, and Al2O3 compositions are reaching selectivity levels above 99% while achieving yields like conventional processes. Catalyst systems based on cobalt and iron enable the conversion of CO2-derived syngas into synthetic hydrocarbons, with output tailored by adjusting operating conditions.

The construction segment held 20% share in 2024 and is projected to grow at a CAGR of 25%. Demand growth is driven by expanding adoption of CO2-enhanced concrete materials and low-carbon cement. Increasing investments in infrastructure across major regions are incorporating stricter specifications for lower-emission building inputs, which is strengthening market momentum.

Europe Carbon Capture Utilization Chemicals Market held 32% share in 2024, supported by major climate policies designed to promote large-scale carbon management. Regional initiatives aim to expand CO2 storage capacity to 50 million tons per year by 2030, alongside long-term plans to develop a cross-border CO2 commodity market by 2040 targeting 280 million tons in annual capture.

Prominent companies operating in the Global Carbon Capture Utilization Chemicals Market include Climeworks AG, Aker Carbon Capture ASA, Carbon Upcycling Technologies Inc., Covestro AG, Air Liquide S.A., Liquid Wind AB, Econic Technologies Ltd., Blue Planet Systems Corporation, Carbon Recycling International (CRI), SK Innovation Co., Ltd., TotalEnergies SE, CarbonCure Technologies Inc., BASF SE, LanzaTech Global, Inc., Solidia Technologies, Inc., Avantium N.V., Carbon Clean Solutions Ltd., Mitsubishi Chemical Group Corporation, Novomer Inc., and SABIC. Leading players in the Carbon Capture Utilization Chemicals Market are strengthening their competitive position by scaling commercial production capacity, forming long-term partnerships across industrial value chains, and investing heavily in next-generation catalyst and electrolysis technologies. Many companies are also optimizing integrated systems that combine captured CO2 with renewable hydrogen to reduce production costs and improve system efficiency. Strategic collaborations with energy, chemical, and construction firms help streamline offtake agreements and secure stable demand.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product Type

- 2.2.3 Technology

- 2.2.4 End Use Industry

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By Product type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Alcohols & platform chemicals

- 5.3 Polymers & plastics

- 5.4 Olefins & hydrocarbons

- 5.5 Syngas & intermediates

- 5.6 Building materials & aggregates

- 5.7 Specialty & other chemicals

Chapter 6 Market Estimates and Forecast, By Technology, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Electrochemical conversion

- 6.3 Catalytic hydrogenation

- 6.4 Gas fermentation & biological conversion

- 6.5 Thermochemical conversion

- 6.6 Mineralization & carbonation

- 6.7 Direct chemical synthesis

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Automotive

- 7.2.1 Interior components

- 7.2.2 Exterior components

- 7.2.3 Under-the-hood applications

- 7.3 Construction & building

- 7.3.1 Residential construction

- 7.3.2 Commercial buildings

- 7.3.3 Infrastructure & civil engineering

- 7.4 Packaging

- 7.4.1 Food & beverage packaging

- 7.4.2 Industrial packaging

- 7.4.3 Consumer goods packaging

- 7.5 Chemicals & petrochemicals

- 7.5.1 Base chemicals production

- 7.5.2 Specialty chemicals

- 7.5.3 Agrochemicals

- 7.6 Aviation

- 7.6.1 Commercial aviation

- 7.6.2 Cargo & freight

- 7.6.3 Military & defense

- 7.7 Healthcare

- 7.7.1 Medical devices

- 7.7.2 Pharmaceutical packaging

- 7.7.3 Hospital & clinical supplies

- 7.8 Agriculture

- 7.8.1 Crop production

- 7.8.2 Fertilizers & soil amendments

- 7.8.3 Agricultural equipment

- 7.9 Electronics & consumer goods

- 7.9.1 Consumer electronics

- 7.9.2 Home appliances

- 7.9.3 Sporting goods

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Air Liquide S.A.

- 9.2 Aker Carbon Capture ASA

- 9.3 Avantium N.V.

- 9.4 BASF SE

- 9.5 Blue Planet Systems Corporation

- 9.6 Carbon Clean Solutions Ltd.

- 9.7 Carbon Recycling International (CRI)

- 9.8 Carbon Upcycling Technologies Inc.

- 9.9 CarbonCure Technologies Inc.

- 9.10 Climeworks AG

- 9.11 Covestro AG

- 9.12 Econic Technologies Ltd.

- 9.13 LanzaTech Global, Inc.

- 9.14 Liquid Wind AB

- 9.15 Mitsubishi Chemical Group Corporation

- 9.16 Novomer Inc.

- 9.17 SABIC

- 9.18 SK Innovation Co., Ltd.

- 9.19 Solidia Technologies, Inc.

- 9.20 TotalEnergies SE

- 9.21 Others