|

市场调查报告书

商品编码

1885816

船用舷内机市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Inboard Boat Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

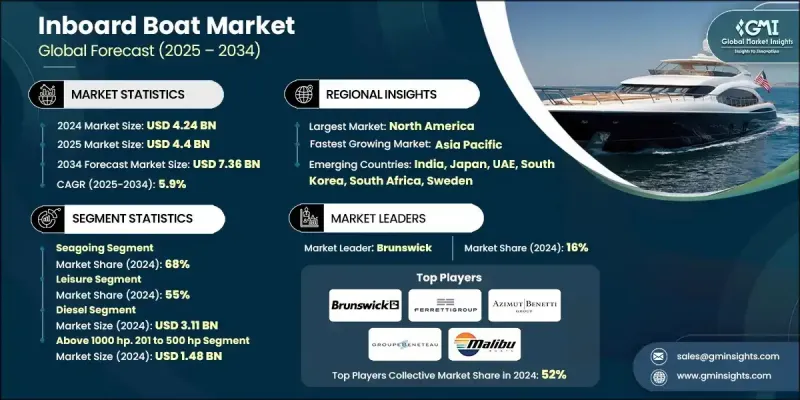

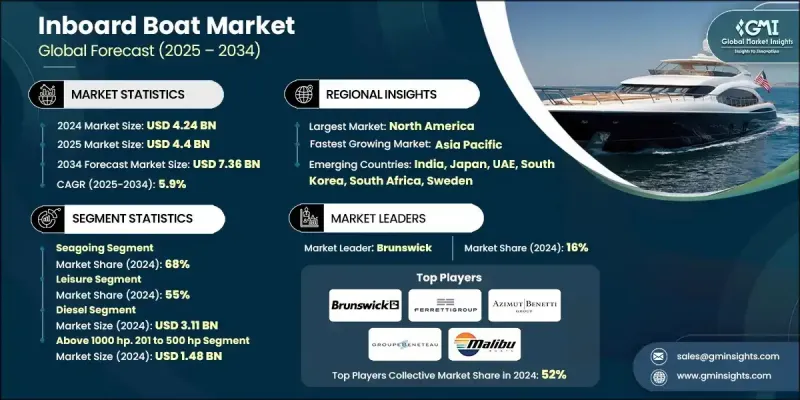

2024 年全球舷内船艇市场价值为 42.4 亿美元,预计到 2034 年将以 5.9% 的复合年增长率增长至 73.6 亿美元。

由于休閒船艇活动的增加、技术创新以及可支配收入的成长,市场正在扩张。包括先进的V型驱动和直驱系统在内的舷内引擎以其高性能、高效率和耐用性而闻名。现代舷内推进系统越来越多地与优化船体设计、燃油消耗、扭矩输出和船舶整体性能的技术相结合。美国EPA Tier 3/4标准、国际海事组织MARPOL附则VI以及欧洲欧盟RCD2等监管框架正在推动原始设备製造商(OEM)采用低氮氧化物燃烧技术、闭环燃油控制和先进的催化处理系统。例如,将于2024年生效的EPA Tier 3标准规定,功率超过600马力的引擎必须减少60%的氮氧化物排放和50%的颗粒物排放。新冠疫情严重扰乱了供应链,并在短期内影响了市场动态。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 42.4亿美元 |

| 预测值 | 73.6亿美元 |

| 复合年增长率 | 5.9% |

2024年,远洋船舶市占率达到68%,预计2025年至2034年将以5.6%的复合年增长率成长。远洋内燃机船舶在沿海、近海和远洋海域作业,对发动机的要求很高,必须能够承受海水腐蚀、远航作业和恶劣海况。这些船舶通常配备500-1000马力的双引擎运动钓鱼系统,巡航艇和拖网渔船则配备200-600马力的单台或双台柴油发动机,以及高功率多引擎配置。

休閒船舶市场在2024年占据55%的市场份额,预计到2034年将以5.1%的复合年增长率成长。该市场涵盖用于巡航、钓鱼和水上运动等活动的休閒船舶。这些船舶的年使用时间通常较低,为50-100小时,消费者的购买决策主要受营运成本、购买价格、生活方式和个人喜好等因素的影响。

2024年,美国舷内机船艇市场规模达18.9亿美元。市场成长受到技术创新和监管因素的影响,其中包括旨在减少氮氧化物和颗粒物排放的美国环保署第三阶段排放标准。汽油引擎需要三元触媒转换器,而功率超过600马力的柴油引擎则采用选择性催化还原(SCR)系统。墨西哥湾沿岸各州和佛罗里达州对配备双柴油舷内机、专为长时间作业而优化的近海渔船需求旺盛。

全球内燃机艇市场的主要参与者包括 Azimut-Benetti、BAVARIA Yachts、Fairline Yachts、Ferretti、Groupe Beneteau、Malibu Boats、MasterCraft Boat、Princess Yachts International、Sanlorenzo、Sunseeker International 和 Yamaha。市场领导者致力于引擎效率、推进系统和船体设计的创新,以提高燃油经济性、扭力输出和船舶整体性能。各公司大力投资研发,整合数位技术,包括引擎诊断、导航系统和物联网性能监控。与码头营运商、分销商和豪华游艇製造商的策略合作有助于扩大市场覆盖范围并改善售后服务。区域扩张和製造设施升级使各公司能够满足不断增长的市场需求并遵守严格的排放法规。行销活动强调生活方式和休閒娱乐的吸引力,以吸引有抱负的消费者。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 原物料供应商

- 零件製造商

- 船舶製造商和原始设备製造商

- 最终用户及售后服务供应商

- 成本结构

- 利润率

- 每个阶段的价值增加

- 影响供应链的因素

- 科技颠覆因素

- 供应链脆弱性因素

- 颠覆者

- 科技驱动的颠覆

- 替代燃料供应中断

- 数位转型带来的颠覆性影响

- 供应商格局

- 对力的影响

- 成长驱动因素

- 严格的排放法规推动技术升级

- 疫情后休閒划船活动参与人数不断增长

- 拖曳运动和水上运动的需求不断增长

- 商用船舶船队现代化要求

- 产业陷阱与挑战

- 混合动力和电动船用系统的初始成本很高

- 排放合规和认证成本的复杂性

- 市场机会

- 排放合规升级改造市场

- 替代燃料基础设施开发

- 成长驱动因素

- 技术趋势与创新生态系统

- 目前技术

- 混合动力推进系统深度解析

- 全电池电力推进深潜

- 用于船舶应用的PEM燃料电池技术

- 氨作为船用燃料

- 新兴技术

- 远端诊断和无线更新

- 自主导航演算法

- 互联船舶的网路安全架构

- 区块链辅助供应链可追溯性

- 目前技术

- 成长潜力分析

- 监管环境

- IMO MARPOL 附录 vi(i-iii 级,NOX ECAS)

- 欧盟休閒船艇指令及NRMM第五阶段

- NMMA 和 ABYC 认证标准

- 零排放指令和绿色港口倡议

- 波特的分析

- PESTEL 分析

- 专利分析

- 成本細項分析

- 价格趋势

- 按细分市场定价

- 船

- 地区

- 高端定价策略及理由

- 价值链成本结构分析

- 按应用和地区分類的价格敏感度

- 汇率波动导致的价格调整

- 按细分市场定价

- 生产统计

- 生产中心

- 消费中心

- 进出口

- 区域基础设施和部署趋势

- 电动船用引擎的充电基础设施

- 替代燃料加註基础设施

- 服务和维护基础设施

- 製造基础设施

- 专利分析

- 按技术领域分類的专利申请趋势(2014-2024 年)

- 专利申请的地理分布

- 主要专利持有者和创新领导者

- 新兴技术专利(混合动力、电动、替代燃料)

- 专利到期分析及仿製药进入市场的机会

- 许可和技术转移活动

- 专利诉讼与纠纷趋势

- 对新进入者的自由运作分析

- 永续性和环境方面

- 减少实体原型製作和测试

- 提高能源效率

- 支援电气化和减排技术

- 生命週期和电子垃圾管理

- 遵守环境法规

- 投资与融资分析

- 主要製造商的研发投入

- 电动船舶推进领域的创投

- 政府对清洁海洋技术的拨款和补贴

- 私募股权和策略投资活动

- 首次公开募股及公开市场活动

- 投资报酬率及退出分析

- 产品线及研发路线图

- 产业研发格局概述

- 数位与自动驾驶技术路线图(2024-2034)

- 按製造商分類的产品线

- 产品开发分析失败

- 最佳情况

- 城市水道的全面电气化

- 全球车队预测性维护网络

- 船舶推动系统的循环经济

- 监管驱动的市场转型

- 数位孪生技术在船舶设计与营运的应用

- 风险评估与缓解策略

- 风险评估标准(可能性和影响)

- 风险监测和预警系统

- 保险与风险转移

- 替代风险

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太

- 拉丁美洲

- 中东和非洲

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

- 高端定位策略

- 策略性OEM合作伙伴关係机会

- 竞争分析与独特卖点

第五章:市场估算与预测:依水路划分,2021-2034年

- 主要趋势

- 远洋

- 内陆

第六章:市场估算与预测:以推进方式划分,2021-2034年

- 主要趋势

- 汽油

- 柴油引擎

- 电的

第七章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- 閒暇

- 货物运输

- 人员运输

- 钓鱼

- 政府用途

第八章:市场估算与预测:依马力划分,2021-2034年

- 主要趋势

- 低于200马力

- 201至500马力

- 501至1000马力

- 超过1000马力

第九章:市场估算与预测:依船舶划分,2021-2034年

- 主要趋势

- 中央控制台

- 快艇

- 浮桥

- 快艇弓形艇

- 其他的

第十章:市场估计与预测:依地区划分,2021-2034年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 比利时

- 荷兰

- 瑞典

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 新加坡

- 韩国

- 越南

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十一章:公司简介

- 全球参与者

- Azimut-Benetti

- Brunswick

- Ferretti

- Groupe Beneteau

- Malibu Boats

- Princess Yachts International

- Yamaha

- 区域玩家

- BAVARIA Yachts

- Chaparral Boats

- Cruisers Yachts

- Fairline Yachts

- Formula Boats

- MasterCraft Boat

- Regal Boats

- Sanlorenzo

- Sunseeker International

- Tiara Yachts

- 新兴玩家

- Bertram Yachts

- Centurion Boats

- Correct Craft

- Damen Shipyards

- Everblue Marine

- Fincantieri

- Gulf Craft

- Hatteras Yachts

- Horizon Yachts

- Ocean Alexander

- Sanlian Marine

- Toyama Shipbuilding

- Viking Yachts

- Wauquiez

The Global Inboard Boat Market was valued at USD 4.24 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 7.36 billion by 2034.

The market is expanding owing to increasing recreational boating, technological innovations, and rising disposable incomes. Inboard engines, including advanced V-drive and direct-drive systems, are known for their high performance, efficiency, and durability. Modern inboard propulsion is increasingly integrated with technologies that optimize hull designs, fuel consumption, torque output, and overall vessel performance. Regulatory frameworks such as the EPA Tier 3/4 in the United States, IMO MARPOL Annex VI globally, and EU RCD2 in Europe are pushing OEMs to adopt low-NOx combustion technologies, closed-loop fuel control, and advanced catalytic treatment systems. For example, the EPA Tier 3 standards, effective from 2024, mandate a 60% reduction in NOx emissions and a 50% reduction in particulate matter for engines exceeding 600 hp. The COVID-19 pandemic significantly disrupted supply chains, affecting market dynamics in the short term.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.24 Billion |

| Forecast Value | $7.36 Billion |

| CAGR | 5.9% |

The seagoing segment held a 68% share in 2024 and is expected to grow at a CAGR of 5.6% from 2025 to 2034. Seagoing inboard boats operate in coastal, offshore, and blue-water conditions that demand engines capable of withstanding saltwater corrosion, long-range operations, and rough waves. These vessels often feature dual-engine sport fishing systems between 500-1000 hp, single or dual diesel engines ranging from 200-600 hp for cruisers and trawlers, and high-powered multi-engine configurations.

The leisure segment held a 55% share in 2024 and is forecast to grow at a CAGR of 5.1% through 2034. This segment covers recreational vessels for activities such as cruising, fishing, and water sports. These boats generally experience low annual usage of 50-100 hours, with consumer decisions heavily influenced by operational costs, purchase price, lifestyle, and aspirational preferences.

U.S. Inboard Boat Market generated USD 1.89 billion in 2024. The market growth is influenced by technical innovations and regulatory drivers, including EPA Tier 3 standards that reduce NOx and particulate matter emissions. Gasoline engines require three-way catalytic converters, while diesel engines over 600 hp utilize selective catalytic reduction (SCR) systems. States along the Gulf Coast and Florida show high demand for offshore fishing boats equipped with twin diesel inboard engines optimized for extended operations.

Key players in the Global Inboard Boat Market include Azimut-Benetti, BAVARIA Yachts, Fairline Yachts, Ferretti, Groupe Beneteau, Malibu Boats, MasterCraft Boat, Princess Yachts International, Sanlorenzo, Sunseeker International, and Yamaha. Market leaders focus on innovation in engine efficiency, propulsion systems, and hull design to improve fuel economy, torque output, and overall vessel performance. Companies invest heavily in R&D to integrate digital technologies, including engine diagnostics, navigation systems, and IoT-enabled performance monitoring. Strategic collaborations with marina operators, distributors, and luxury yacht builders help expand market reach and improve after-sales services. Regional expansions and manufacturing facility upgrades enable companies to meet growing demand and comply with strict emission regulations. Marketing efforts emphasize lifestyle and leisure appeal to attract aspirational consumers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast

- 1.4 Primary research and validation

- 1.5 Some of the primary sources

- 1.6 Data mining sources

- 1.6.1 Secondary

- 1.6.1.1 Paid Sources

- 1.6.1.2 Public Sources

- 1.6.1.3 Sources, by region

- 1.6.1 Secondary

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Waterways

- 2.2.3 Propulsion

- 2.2.4 Application

- 2.2.5 Horsepower

- 2.2.6 Boat

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material suppliers

- 3.1.1.2 Component manufacturers

- 3.1.1.3 Boat builders & OEMs

- 3.1.1.4 End use & after-sales service providers

- 3.1.2 Cost structure

- 3.1.3 Profit margin

- 3.1.4 Value addition at each stage

- 3.1.5 Factors impacting the supply chain

- 3.1.5.1 Technology disruption factors

- 3.1.5.2 Supply chain vulnerability factors

- 3.1.6 Disruptors

- 3.1.6.1 Technology-driven disruptions

- 3.1.6.2 Alternative fuel disruptions

- 3.1.6.3 Digital transformation disruptions

- 3.1.1 Supplier landscape

- 3.2 Impact on forces

- 3.2.1 Growth drivers

- 3.2.1.1 Stringent emission regulations driving technology upgrades

- 3.2.1.2 Growing recreational boating participation post-pandemic

- 3.2.1.3 Rising demand for tow-sport & watersports activities

- 3.2.1.4 Commercial vessel fleet modernization requirements

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial cost of hybrid & electric inboard systems

- 3.2.2.2 Complexity of emission compliance & certification costs

- 3.2.3 Market opportunities

- 3.2.3.1 Retrofit market for emission compliance upgrades

- 3.2.3.2 Alternative fuel infrastructure development

- 3.2.1 Growth drivers

- 3.3 Technology trends & innovation ecosystem

- 3.3.1 Current technologies

- 3.3.1.1 Hybrid-electric propulsion deep dive

- 3.3.1.2 Full battery-electric propulsion deep dive

- 3.3.1.3 Pem fuel cell technology for marine applications

- 3.3.1.4 Ammonia as marine fuel

- 3.3.2 Emerging technologies

- 3.3.2.1 Remote diagnostics & over-the-air updates

- 3.3.2.2 Autonomous navigation algorithms

- 3.3.2.3 Cybersecurity architecture for connected vessels

- 3.3.2.4 Blockchain for supply chain traceability

- 3.3.1 Current technologies

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 IMO MARPOL annex vi (tier i-iii, NOX ECAS)

- 3.5.2 EU recreational craft directive & NRMM stage v

- 3.5.3 NMMA & ABYC certification standards

- 3.5.4 Zero-emission mandates & green port initiatives

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Patent analysis

- 3.9 Cost breakdown analysis

- 3.10 Price trends

- 3.10.1 Pricing by segment

- 3.10.1.1 Boat

- 3.10.1.2 Region

- 3.10.2 Premium pricing strategies and justification

- 3.10.3 Cost structure analysis across value chain

- 3.10.4 Price sensitivity by application and region

- 3.10.5 Price adjustments for currency fluctuations

- 3.10.1 Pricing by segment

- 3.11 Production statistics

- 3.11.1 Production hubs

- 3.11.2 Consumption hubs

- 3.11.3 Export and import

- 3.12 Regional infrastructure & deployment trends

- 3.12.1 Charging infrastructure for electric inboards

- 3.12.2 Alternative fuel bunkering infrastructure

- 3.12.3 Service & maintenance infrastructure

- 3.12.4 Manufacturing infrastructure

- 3.13 Patent analysis

- 3.13.1 Patent filing trends by technology area (2014-2024)

- 3.13.2 Geographic distribution of patent filings

- 3.13.3 Key patent holders & innovation leaders

- 3.13.4 Emerging technology patents (hybrid, electric, alternative fuels)

- 3.13.5 Patent expiration analysis & generic entry opportunities

- 3.13.6 Licensing & technology transfer activity

- 3.13.7 Patent litigation & dispute trends

- 3.13.8 Freedom-to-operate analysis for new entrants

- 3.14 Sustainability and environmental aspects

- 3.14.1 Reducing physical prototyping and testing

- 3.14.2 Energy efficiency improvements

- 3.14.3 Support for electrification and emission reduction technologies

- 3.14.4 Lifecycle and e-waste management

- 3.14.5 Compliance with environmental regulations

- 3.15 Investment & funding analysis

- 3.15.1 R&D investment by major manufacturers

- 3.15.2 Venture capital in electric marine propulsion

- 3.15.3 Government grants & subsidies for clean marine technology

- 3.15.4 Private equity & strategic investment activity

- 3.15.5 IPO & public market activity

- 3.15.6 Investment returns & exit analysis

- 3.16 Product pipeline & R&D roadmap

- 3.16.1 Industry R&D landscape overview

- 3.16.2 Digital & autonomous technology roadmap (2024-2034)

- 3.16.3 Product pipeline by manufacturer

- 3.16.4 Failed product development analysis

- 3.17 Best case scenarios

- 3.17.1 Full electrification of urban waterways

- 3.17.2 Predictive maintenance network across global fleets

- 3.17.3 Circular economy for marine propulsion

- 3.17.4 Regulatory-driven market transformation

- 3.17.5 Digital twin integration in vessel design and operations

- 3.18 Risk assessment & mitigation strategies

- 3.18.1 Risk assessment criteria (likelihood & impact)

- 3.18.2 Risk monitoring & early warning systems

- 3.18.3 Insurance & risk transfer

- 3.18.4 Substitution risk

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia-Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Key developments

- 4.5.1 Mergers & acquisitions

- 4.5.2 Partnerships & collaborations

- 4.5.3 New product launches

- 4.5.4 Expansion plans and funding

- 4.6 Premium positioning strategies

- 4.7 Strategic OEM partnership opportunities

- 4.8 Competitive analysis and USPs

Chapter 5 Market Estimates & Forecast, By Waterways, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Seagoing

- 5.3 Inland

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Gasoline

- 6.3 Diesel

- 6.4 Electric

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Leisure

- 7.3 Transport of goods

- 7.4 Transport of people

- 7.5 Fishing

- 7.6 Government use

Chapter 8 Market Estimates & Forecast, By Horsepower, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Below 200 hp

- 8.3 201 to 500 hp

- 8.4 501 to 1000 hp

- 8.5 Above 1000 hp

Chapter 9 Market Estimates & Forecast, By Boat, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 Center console

- 9.3 Express cruiser

- 9.4 Pontoon

- 9.5 Runabout bowrider

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 North America

- 10.1.1 US

- 10.1.2 Canada

- 10.2 Europe

- 10.2.1 UK

- 10.2.2 Germany

- 10.2.3 France

- 10.2.4 Italy

- 10.2.5 Spain

- 10.2.6 Belgium

- 10.2.7 Netherlands

- 10.2.8 Sweden

- 10.2.9 Russia

- 10.3 Asia Pacific

- 10.3.1 China

- 10.3.2 India

- 10.3.3 Japan

- 10.3.4 Australia

- 10.3.5 Singapore

- 10.3.6 South Korea

- 10.3.7 Vietnam

- 10.3.8 Indonesia

- 10.4 Latin America

- 10.4.1 Brazil

- 10.4.2 Mexico

- 10.4.3 Argentina

- 10.5 MEA

- 10.5.1 South Africa

- 10.5.2 Saudi Arabia

- 10.5.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Azimut-Benetti

- 11.1.2 Brunswick

- 11.1.3 Ferretti

- 11.1.4 Groupe Beneteau

- 11.1.5 Malibu Boats

- 11.1.6 Princess Yachts International

- 11.1.7 Yamaha

- 11.2 Regional Players

- 11.2.1 BAVARIA Yachts

- 11.2.2 Chaparral Boats

- 11.2.3 Cruisers Yachts

- 11.2.4 Fairline Yachts

- 11.2.5 Formula Boats

- 11.2.6 MasterCraft Boat

- 11.2.7 Regal Boats

- 11.2.8 Sanlorenzo

- 11.2.9 Sunseeker International

- 11.2.10 Tiara Yachts

- 11.3 Emerging players

- 11.3.1 Bertram Yachts

- 11.3.2 Centurion Boats

- 11.3.3 Correct Craft

- 11.3.4 Damen Shipyards

- 11.3.5 Everblue Marine

- 11.3.6 Fincantieri

- 11.3.7 Gulf Craft

- 11.3.8 Hatteras Yachts

- 11.3.9 Horizon Yachts

- 11.3.10 Ocean Alexander

- 11.3.11 Sanlian Marine

- 11.3.12 Toyama Shipbuilding

- 11.3.13 Viking Yachts

- 11.3.14 Wauquiez