|

市场调查报告书

商品编码

1885848

石油化学产品回收市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Petrochemical Recycling Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

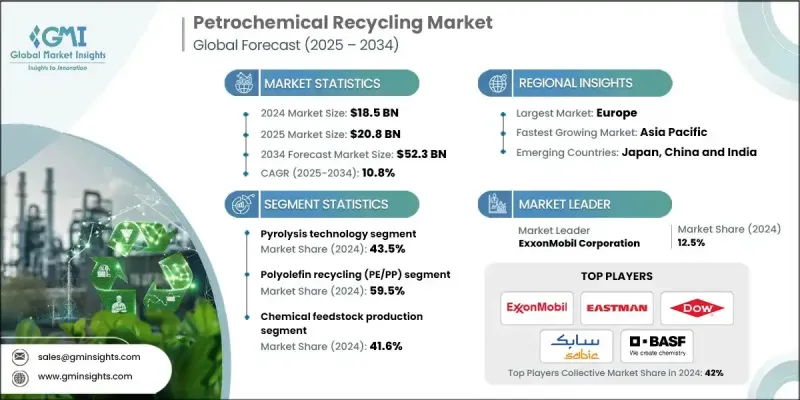

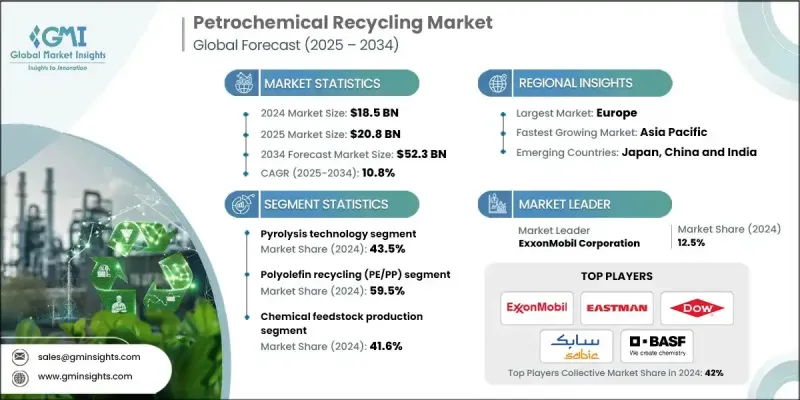

2024 年全球石化回收市场价值为 185 亿美元,预计到 2034 年将以 10.8% 的复合年增长率增长至 523 亿美元。

市场的快速成长反映了对永续塑胶废弃物管理解决方案日益增长的需求,以及先进化学回收技术的不断改进。日益严峻的环境压力和更严格的全球废弃物法规正促使各行业和政府加快创新步伐,扩大回收能力。化学回收因其能够将混合和受污染的塑胶废弃物转化为传统机械系统无法有效处理的可用产品,而日益受到重视。随着全球塑胶消费量的持续攀升,废弃物产生量与回收能力之间的差距凸显了对可扩展化学回收替代方案的迫切需求。主要地区的进展,加上强有力的政策支持和大量的产业投资,正在重塑全球格局,并将石化回收定位为循环经济的关键组成部分。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 185亿美元 |

| 预测值 | 523亿美元 |

| 复合年增长率 | 10.8% |

2024年,热解技术市占率达到43.5%,预计2034年将以10.4%的复合年增长率成长。其主导地位源自于其高度的商业化成熟度以及在无氧条件下分解复杂聚合物结构的能力,从而产生可精炼的碳氢化合物产品。该技术对混合和受污染塑胶的灵活性使其成为处理机械回收无法处理的废弃物流的关键手段。其不断扩展的设施网络和持续的投资支持也印证了其在业界的广泛认可。

2024年,聚烯烃回收领域占59.5%的市场份额,预计2025年至2034年将以10.5%的复合年增长率成长。聚乙烯和聚丙烯等材料因其在全球包装生产中的广泛应用而保持领先地位。它们的热塑性使其与热解和气化等转化技术高度相容,从而能够高效地转化为有价值的烃类衍生物。

2024年,北美石化回收市场占24.8%的份额。该地区受益于可靠的废弃物收集系统、产业投资以及鼓励采用再生材料的扶持性监管措施。旨在加强生产者责任和减少垃圾掩埋的政策巩固了市场成长,并刺激了对化学再生材料的长期需求。

石油化工回收市场的主要企业包括马来西亚国家石油公司(PETRONAS Chemicals Group)、Quantafuel ASA、埃克森美孚公司(ExxonMobil Corporation)、Plastic Energy、利安德巴塞尔工业公司(LyondellBasell Industries)、Recycling Technologies Ltd.、巴斯夫公司(BASF SE)、伊士曼斯化学公司(Eastman Chem) Inc.、陶氏公司(Dow Inc.)、Carbios SA 和沙乌地基础工业公司(SABIC)。这些企业透过投资先进的解聚技术、扩大工厂产能以及签订长期原料供应协议来确保稳定的原料供应,从而提升自身的竞争力。许多公司积极与包装生产商和石油化学製造商合作,将回收产品直接整合到产品价值链中。策略合作伙伴关係能够加速技术开发并支援大规模商业化。此外,各企业也加大研发投入,以提高製程效率、降低能耗并提升回收烃的纯度。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 生产者延伸责任制(EPR)

- 再生材料含量要求及法规

- 塑胶垃圾危机与环境问题

- 产业陷阱与挑战

- 高资本投资需求

- 技术挑战与品质限制

- 市场机会

- 政府资助和投资计划

- 亚太地区新兴市场扩张

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 依技术类型

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依技术类型划分,2021-2034年

- 主要趋势

- 热解技术

- 传统热解系统

- 催化剂辅助的高级热解

- 微波辅助热解

- 解聚(化学分解)

- 溶剂分解过程

- PET回收的糖解作用

- 酵素解聚

- 催化解聚

- 气化技术

- 空气吹气气化系统

- 氧气吹扫气化

- 蒸气气化过程

- 电浆气化技术

- 溶解和溶剂型回收

- 选择性溶解技术

- 溶剂回收与纯化

第六章:市场估算与预测:依原料类型划分,2021-2034年

- 主要趋势

- 聚烯烃回收(PE/PP)

- 高密度聚乙烯(HDPE)回收

- 低密度聚乙烯(LDPE)回收

- 聚丙烯(PP)回收

- 混合聚烯烃流

- PET回收

- 瓶对瓶回收

- 光纤到光纤应用

- 食品级PET回收

- 彩色PET加工

- 混合塑胶垃圾回收

- 多层包装材料

- 受污染的塑胶流

- 电子垃圾塑料

- 汽车塑胶部件

- 特种聚合物回收

- 工程塑胶回收

- 热固性塑胶加工

- 复合材料回收

- 生物基聚合物回收

第七章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- 化工原料生产

- 燃料生产应用

- 新型聚合物的生产

- 特种产品製造

第八章:市场估算与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- ExxonMobil Corporation

- Eastman Chemical Company

- Dow Inc.

- SABIC (Saudi Basic Industries Corporation)

- BASF SE

- LyondellBasell Industries

- PETRONAS Chemicals Group

- Plastic Energy

- Agilyx Corporation

- Pyrowave Inc.

- Recycling Technologies Ltd

- Brightmark LLC

- Quantafuel ASA

- Carbios SA

The Global Petrochemical Recycling Market was valued at USD 18.5 billion in 2024 and is estimated to grow at a CAGR of 10.8% to reach USD 52.3 billion by 2034.

The market's rapid rise reflects the growing need for sustainable solutions to manage plastic waste and the increasing refinement of advanced chemical recycling technologies. Rising environmental pressures and stricter global waste regulations are pushing industries and governments to accelerate innovation and expand recycling capacity. Chemical recycling is gaining traction as it provides a viable pathway for converting mixed and contaminated plastic waste into usable outputs that traditional mechanical systems cannot process effectively. As plastic consumption continues to climb worldwide, the gap between waste generation and recycling capacity highlights the urgent demand for scalable chemical recycling alternatives. Progress across major regions, combined with strong policy backing and substantial industrial investments, is reshaping the global landscape and positioning petrochemical recycling as a critical component of the circular economy.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $18.5 Billion |

| Forecast Value | $52.3 Billion |

| CAGR | 10.8% |

The pyrolysis technology segment held 43.5% share in 2024 and is anticipated to grow at a CAGR of 10.4% through 2034. Its dominance stems from its high commercial readiness and ability to break down complex polymer structures under oxygen-free conditions, yielding hydrocarbon products that can be refined. Its flexibility with mixed and contaminated plastics makes it essential for processing waste streams that mechanical recycling cannot accommodate. Its growing network of facilities and consistent investment support confirm its strong industry acceptance.

The polyolefin recycling segment accounted for a 59.5% share in 2024 and is expected to grow at a CAGR of 10.5% from 2025 to 2034. Materials such as polyethylene and polypropylene maintain a leading position due to their heavy use in global packaging production. Their thermoplastic properties make them highly compatible with conversion technologies such as pyrolysis and gasification, facilitating efficient transformation into valuable hydrocarbon derivatives.

North America Petrochemical Recycling Market held a 24.8% share in 2024. This region benefits from reliable waste collection systems, industry investments, and supportive regulatory measures that encourage recycled content adoption. Policies aimed at strengthening producer responsibility and reducing landfill waste reinforce market growth and stimulate long-term demand for chemically recycled materials.

Key companies in the Petrochemical Recycling Market include PETRONAS Chemicals Group, Quantafuel ASA, ExxonMobil Corporation, Plastic Energy, LyondellBasell Industries, Recycling Technologies Ltd., BASF SE, Eastman Chemical Company, Agilyx Corporation, Brightmark LLC, Pyrowave Inc., Dow Inc., Carbios SA, and SABIC (Saudi Basic Industries Corporation). Companies in the Petrochemical Recycling Market enhance their competitive standing by investing in advanced depolymerization technologies, expanding plant capacity, and forming long-term feedstock agreements to ensure stable input supply. Many firms pursue collaborations with packaging producers and petrochemical manufacturers to integrate recycled outputs directly into product value chains. Strategic partnerships accelerate technology development and support commercialization at scale. Organizations also increase R&D spending to improve process efficiency, reduce energy consumption, and enhance the purity of recycled hydrocarbons.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology type

- 2.2.3 Feedstock type

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Extended producer responsibility (EPR) mandates

- 3.2.1.2 Recycled content requirements & regulations

- 3.2.1.3 Plastic waste crisis & environmental concerns

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High capital investment requirements

- 3.2.2.2 Technical challenges & quality constraints

- 3.2.3 Market opportunities

- 3.2.3.1 Government funding & investment programs

- 3.2.3.2 Emerging market expansion in Asia-Pacific

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By technology type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Technology Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Pyrolysis technology

- 5.2.1 Conventional pyrolysis systems

- 5.2.2 Advanced pyrolysis with catalysts

- 5.2.3 Microwave-assisted pyrolysis

- 5.3 Depolymerization (chemolysis)

- 5.3.1 Solvolysis processes

- 5.3.2 Glycolysis for PET recycling

- 5.3.3 Enzymatic depolymerization

- 5.3.4 Catalytic depolymerization

- 5.4 Gasification technology

- 5.4.1 Air-blown gasification systems

- 5.4.2 Oxygen-blown gasification

- 5.4.3 Steam gasification processes

- 5.4.4 Plasma gasification technology

- 5.5 Dissolution & solvent-based recycling

- 5.5.1 Selective dissolution technologies

- 5.5.2 Solvent recovery & purification

Chapter 6 Market Estimates and Forecast, By Feedstock Type, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Polyolefin recycling (PE/PP)

- 6.2.1 High-density polyethylene (HDPE) recycling

- 6.2.2 Low-density polyethylene (LDPE) recycling

- 6.2.3 Polypropylene (pp) recycling

- 6.2.4 Mixed polyolefin streams

- 6.3 PET recycling

- 6.3.1 Bottle-to-bottle recycling

- 6.3.2 Fiber-to-fiber applications

- 6.3.3 Food-grade PET recycling

- 6.3.4 Colored PET processing

- 6.4 Mixed plastic waste recycling

- 6.4.1 Multi-layer packaging materials

- 6.4.2 Contaminated plastic streams

- 6.4.3 Electronic waste plastics

- 6.4.4 Automotive plastic components

- 6.5 Specialty polymer recycling

- 6.5.1 Engineering plastics recycling

- 6.5.2 Thermoset plastic processing

- 6.5.3 Composite material recycling

- 6.5.4 Bio-based polymer recycling

Chapter 7 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Chemical feedstock production

- 7.3 Fuel production applications

- 7.4 New polymer production

- 7.5 Specialty product manufacturing

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 ExxonMobil Corporation

- 9.2 Eastman Chemical Company

- 9.3 Dow Inc.

- 9.4 SABIC (Saudi Basic Industries Corporation)

- 9.5 BASF SE

- 9.6 LyondellBasell Industries

- 9.7 PETRONAS Chemicals Group

- 9.8 Plastic Energy

- 9.9 Agilyx Corporation

- 9.10 Pyrowave Inc.

- 9.11 Recycling Technologies Ltd

- 9.12 Brightmark LLC

- 9.13 Quantafuel ASA

- 9.14 Carbios SA