|

市场调查报告书

商品编码

1885874

菌丝体蛋白配料市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Mycelium-Based Protein Ingredients Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

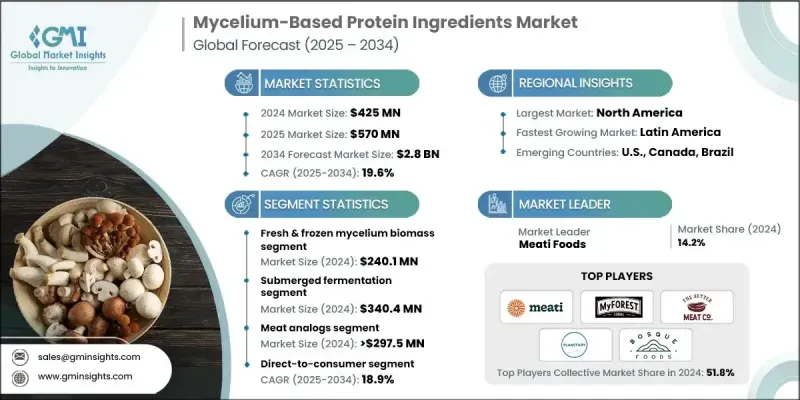

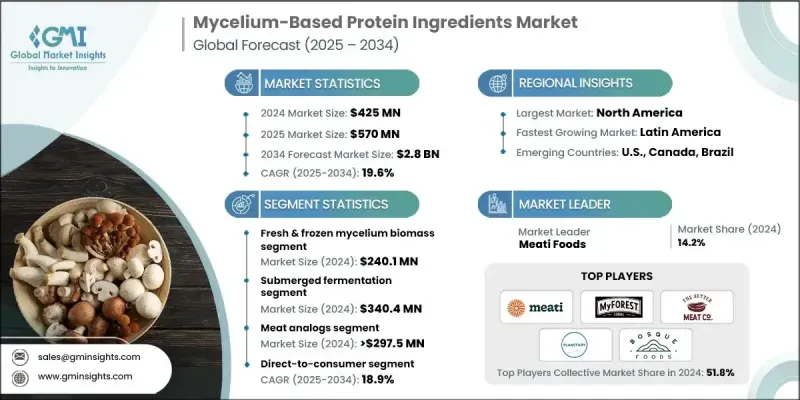

2024 年全球菌丝体蛋白配料市场价值为 4.25 亿美元,预计到 2034 年将以 19.6% 的复合年增长率增长至 28 亿美元。

消费者对环保蛋白质来源的需求不断增长,持续推动着这一领域的扩张,越来越多的人寻求营养丰富且可持续的替代品。这种日益增长的兴趣促使零售商和餐饮服务公司推出更多种类的真菌衍生产品,从而加快了替代蛋白领域的产品开发速度,并扩大了生产能力。发酵科学和生物製程工程的进步正推动生产向大规模化方向发展,而工业生物反应器的设计旨在实现更高的控制精度、更高的产量和更稳定的品质。从试点营运到商业规模生产的转变,得益于资金投入的增加和对新生产基地的大量投资,从而提高了食品製造商可获得的菌丝体原料的供应量。来自公共和私营部门的财政支持正在加速工厂建设,并推动整个供应链的快速扩张。正如生产商和采购商所证实的那样,资金的涌入缩短了商业化进程,透过规模效益降低了成本,并扩大了整体市场容量。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 4.25亿美元 |

| 预测值 | 28亿美元 |

| 复合年增长率 | 19.6% |

受全食品应用和清洁标籤偏好的推动,新鲜和冷冻菌丝体生物质市场预计在2024年达到2.401亿美元。其天然的质地和丰富的膳食纤维使其无需深度加工即可製成整块替代品、肉饼或即食食品。这种产品形式非常适合那些希望缩短成分錶、减少生产步骤、实现规模化生产并更快进入零售和餐饮通路的品牌。

2024年,液态发酵市场规模达3.404亿美元,凭藉其高效性和可扩展性,仍是主要的生产方式。该技术利用大型工业生物反应器,能够精确监控温度、氧气、营养液流量和pH值,从而支持生物质的持续成长和更可预测的产量。改进的製程控制提高了生产效率,而成本效益使其适用于为大型食品製造商和快餐企业供货的公司。

2024年,北美菌丝体蛋白配料市占率将达到36.4%,其中美国市场表现强劲。该地区受益于成熟的发酵设施、经验丰富的配套设施以及对真菌蛋白研发企业的早期投资。大量的创投加速了产能扩张,并支持了零售和餐饮服务业的快速商业化。消费者对高蛋白、清洁标章和环保产品的日益关注,也推动了零售商对菌丝体产品的需求,从而促进了产品多元化。

菌丝体蛋白配料市场的主要企业包括Maia Farms、My Forest Foods、Meati Foods、Bosque Foods、Optimized Foods、Cargill、Planetary、Better Meat Co.和Esencia Foods。这些企业运用多种策略来提升自身的竞争力。许多企业专注于扩大发酵产能和优化生物工艺,以提高产量并降低生产成本。研发投入有助于企业改善产品的质地、风味和营养成分,从而满足食品生产商和消费者的期望。与零售商、配料供应商和餐饮服务业者建立策略合作伙伴关係,可拓展分销网络,并加速市场整合。此外,各品牌也强调清洁标籤定位和永续发展概念,以增强消费者信任。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 消费者对永续蛋白质来源的需求不断增长

- 与畜牧业相比,环境效益较佳

- 发酵技术的进步

- 加大对替代蛋白的投资

- 产业陷阱与挑战

- 与植物性蛋白质相比,生产成本较高

- 消费者认知和接受度有限

- 市场机会

- 临床营养应用的发展

- 与食物垃圾资源化利用结合

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 产品

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品形式划分,2021-2034年

- 主要趋势

- 新鲜和冷冻菌丝生物质

- 干燥菌丝体

- 菌丝粉和麵粉

- 蛋白质分离物和浓缩物

- 整片式

第六章:市场估算与预测:依生产技术划分,2021-2034年

- 主要趋势

- 深层发酵

- 固态发酵

- 连续好氧发酵

- 分批式和补料分批式发酵

第七章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- 肉类替代品

- 汉堡和碎肉

- 整块牛排和肉排

- 培根和香肠

- 鸡块和加工肉类

- 乳製品替代品

- 牛奶和奶油替代品

- 优格及发酵产品

- 起司替代品

- 冰淇淋和冷冻甜点

- 烘焙食品

- 饮料

- 零食和加工食品

- 运动营养与补剂

- 临床营养

- 动物饲料

第八章:市场估算与预测:依配销通路划分,2021-2034年

- 主要趋势

- B2B原料供应商

- 直接面向消费者

- 零售(现代贸易)

- 超市和大型超市

- 便利商店

- 专业健康食品店

- 线上及电子商务

- 传统市集和街头小贩

第九章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十章:公司简介

- Bosque Foods

- Maia Farms

- Planetary

- Meati Foods

- Cargill

- My Forest Foods

- Optimized Foods

- Esencia Foods

- Better Meat Co

The Global Mycelium-Based Protein Ingredients Market was valued at USD 425 million in 2024 and is estimated to grow at a CAGR of 19.6% to reach USD 2.8 billion by 2034.

Rising consumer demand for environmentally conscious protein sources continues to help in this expansion, as more individuals seek nutrient-dense, sustainable alternatives. This growing interest has encouraged retailers and foodservice companies to introduce a wider range of fungi-derived offerings, prompting faster product development and broader manufacturing capabilities across the alternative-protein landscape. Advancements in fermentation science and bioprocess engineering are pushing production toward large-scale capabilities, supported by industrial bioreactors designed to deliver greater control, higher yields, and consistent quality. The shift from pilot operations to commercial-scale facilities is reinforced by increased funding activities and significant investments in new production sites, boosting the availability of mycelium ingredients for food manufacturers. Financial support from both private and public sectors is accelerating the construction of factories and driving rapid expansion across the supply chain. This surge in capital flow shortens commercialization timelines, reduces costs through scale efficiencies, and expands overall market capacity as documented by producers and purchasers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $425 Million |

| Forecast Value | $2.8 Billion |

| CAGR | 19.6% |

The fresh and frozen mycelium biomass segment reached USD 240.1 million in 2024, driven by alignment with whole-food applications and clean-label preferences. Its natural texture and fiber-rich profile allow producers to create whole-cut alternatives, patties, or ready-made meals without heavy processing. This format is ideal for brands looking for shorter ingredient lists, reduced production steps, scalable volume, and quicker entry into retail and foodservice channels.

The submerged fermentation segment was valued at USD 340.4 million in 2024 and continues to serve as the primary production method due to its efficiency and scalability. This technique leverages large industrial bioreactors that allow precise monitoring of temperature, oxygen, nutrient flow, and pH, supporting continuous biomass growth and more predictable output. Improved process control results in higher productivity, while cost efficiencies make it suitable for companies supplying large food manufacturers and quick-service businesses.

North America Mycelium-Based Protein Ingredients Market held a 36.4% share in 2024, led by strong activity in the United States. The region benefits from established fermentation facilities, experienced infrastructure, and early investments in companies developing fungal proteins. Substantial venture funding accelerates capacity growth and supports rapid commercialization in both retail and foodservice sectors. Rising consumer interest in high-protein, clean-label, and environmentally friendly options strengthens the demand for mycelium-based products as retailers seek to diversify their product offerings.

Major companies active in the Mycelium-Based Protein Ingredients Market include Maia Farms, My Forest Foods, Meati Foods, Bosque Foods, Optimized Foods, Cargill, Planetary, Better Meat Co., and Esencia Foods. Companies in the Mycelium-Based Protein Ingredients Market use multiple strategies to enhance their competitive position. Many focus on expanding fermentation capacity and optimizing bioprocesses to increase output while lowering production costs. Investments in R&D help firms improve texture, flavor, and nutritional profiles to meet the expectations of food manufacturers and consumers. Strategic partnerships with retailers, ingredient suppliers, and foodservice operators expand distribution networks and support quicker market integration. Brands also emphasize clean-label positioning and sustainability messaging to strengthen consumer trust.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product Form

- 2.2.3 Production Technology

- 2.2.4 Application

- 2.2.5 Distribution Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising consumer demand for sustainable protein sources

- 3.2.1.2 Environmental benefits over animal agriculture

- 3.2.1.3 Technological advancements in fermentation

- 3.2.1.4 Increasing investment in alternative proteins

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production costs compared to plant proteins

- 3.2.2.2 Limited consumer awareness & acceptance

- 3.2.3 Market opportunities

- 3.2.3.1 Development of clinical nutrition applications

- 3.2.3.2 Integration with food waste valorization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 Product

- 3.8 Future market trends

- 3.9 Technology and Innovation Landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Form, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Fresh & frozen mycelium biomass

- 5.3 Dried mycelium

- 5.4 Mycelium powder & flour

- 5.5 Protein isolates & concentrates

- 5.6 Whole-cut formats

Chapter 6 Market Estimates and Forecast, By Production Technology, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Submerged fermentation

- 6.3 Solid-state fermentation

- 6.4 Continuous aerobic fermentation

- 6.5 Batch & fed-batch fermentation

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Meat analogs

- 7.2.1 Burgers & ground meat

- 7.2.2 Whole-cut steaks & cutlets

- 7.2.3 Bacon & sausages

- 7.2.4 Nuggets & processed meats

- 7.3 Dairy analogs

- 7.3.1 Milk & cream alternatives

- 7.3.2 Yogurt & fermented products

- 7.3.3 Cheese alternatives

- 7.3.4 Ice cream & frozen desserts

- 7.4 Baked goods

- 7.5 Beverages

- 7.6 Snacks & processed foods

- 7.7 Sports nutrition & supplements

- 7.8 Clinical nutrition

- 7.9 Animal feed

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD million) (Kilo Tons)

- 8.1 Key trends

- 8.2 B2B ingredient suppliers

- 8.3 Direct-to-consumer

- 8.4 Retail (modern trade)

- 8.4.1 Supermarkets & hypermarkets

- 8.4.2 Convenience stores

- 8.4.3 Specialty health food stores

- 8.5 Online & e-commerce

- 8.6 Traditional markets & street vendors

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Bosque Foods

- 10.2 Maia Farms

- 10.3 Planetary

- 10.4 Meati Foods

- 10.5 Cargill

- 10.6 My Forest Foods

- 10.7 Optimized Foods

- 10.8 Esencia Foods

- 10.9 Better Meat Co