|

市场调查报告书

商品编码

1885885

采购软体市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Procurement Software Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

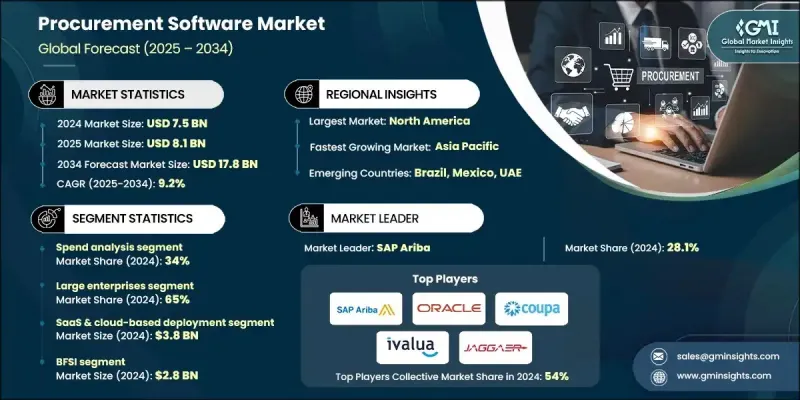

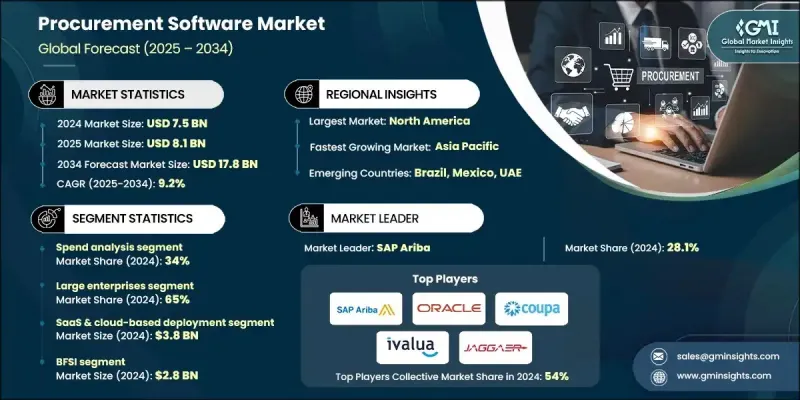

2024 年全球采购软体市场价值为 75 亿美元,预计到 2034 年将以 9.2% 的复合年增长率成长至 178 亿美元。

随着各行各业(包括製造业、银行、金融服务和保险业、医疗保健业、零售业和政府部门)优先考虑数位化营运、加强成本控制和提高供应链透明度,对采购技术的需求持续增长。企业正在加速采用基于云端的采购生态系统,以简化采购活动、加强合规性并实现支出管理的自动化。随着营运效率和治理期望的提高,采购团队正在转向整合式数位平台,以加强与供应商的协作并优化合约生命週期。此外,减少人工流程、集中采购资料和提高全球供应链应变能力的普遍需求也推动了市场的扩张。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 75亿美元 |

| 预测值 | 178亿美元 |

| 复合年增长率 | 9.2% |

先进技术正透过人工智慧驱动的分析、RPA赋能的自动化以及基于物联网的供应链监控,重塑采购工作流程。这些功能能够实现即时支出洞察、预测性分析以及跨供应商网路的自动化风险评估。机器学习模型、数位孪生和动态供应商绩效仪錶板帮助企业更快做出数据驱动的决策,同时提升成本效益和营运灵活性。采用云端电子采购解决方案、数位化合约管理和先进的供应商关係管理工具,进一步增强了整个采购流程的准确性、合规性和工作效率。

预计到2024年,支出分析将占34%的市场份额,并预计在2034年之前以9%的复合年增长率成长。这一领域对于实现财务透明度和分析准确性至关重要。依靠人工智慧增强的支出智慧、结构化资料分类和预测性成本建模的企业可以减少非正规支出,并发现新的效率提升机会。这些工具能够持续展现采购绩效,其能力远超过人工报告方法。

大型企业在2024年占据了65%的市场份额,预计在2025年至2034年期间将以9.5%的复合年增长率成长。它们的领先地位源于对可扩展、互联互通的采购系统的需求,以支持全球营运。这些企业依赖强大的工具来进行企业级支出追踪、自动化供应商评估和跨区域采购。对人工智慧驱动的采购平台和云端整合套件的大力投资,持续巩固了它们的市场主导地位。

美国采购软体市场占88%的市场份额,预计2024年市场规模将达22亿美元。美国强大的技术基础、高度集中的采购软体供应商以及企业数位转型的快速发展,共同支撑了其领先的市场份额。美国企业越来越依赖云端原生平台、人工智慧驱动的供应商分析和工作流程自动化技术,以提高采购的准确性和治理水准。政府主导的旨在促进安全数位化采购和提高透明度的倡议,进一步推动了公共和私营部门对采购软体的采用。

采购软体市场的主要参与者包括 Workday、Synertrade、SAP Ariba、Coupa、Oracle、GEP、Basware、Jaggaer、Ivalua 和 Zycus。采购软体市场的各公司正在实施多种策略以巩固其市场地位。许多公司正在扩展云端原生架构并部署人工智慧驱动的分析,以提高整个采购週期的速度、准确性和决策智慧。供应商正在大力投资自动化技术,包括 RPA 和机器学习,以简化重复性任务并提高使用者效率。与 ERP 供应商、财务软体平台和供应链技术公司建立策略合作伙伴关係有助于扩展整合能力并创建统一的数位生态系统。各公司也正在优先考虑增强资料安全性、合规性功能和可自订的采购模组,以满足各种企业需求。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 采购领域的数位转型

- 人工智慧与分析集成

- 监理合规与风险管理

- 成本优化与效率

- 产业陷阱与挑战

- 实施成本高且复杂

- 资料安全和隐私问题

- 市场机会

- 中小企业采用率成长

- 永续和绿色采购

- 人工智慧和机器学习的融合

- 供应商协作与风险管理

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 采购中的人工智慧和机器学习

- 生成式人工智慧应用及变革性影响

- 机器人流程自动化 (RPA) 集成

- 用于供应商验证和追溯的区块链

- 物联网 (IoT) 用于库存和资产追踪

- 进阶分析与预测智能

- 合约分析中的自然语言处理(NLP)

- 用于发票处理的电脑视觉和OCR技术

- 用于供应链模拟的数位孪生

- 边缘运算和分散式采购

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 技术演进时程及里程碑

- 技术性能提升预测

- 成本削减路线图和经济目标

- 生产规模扩大时程和产能规划

- 新兴科技整合与融合

- 市场渗透情景及采纳曲线

- 颠覆性技术威胁及市场影响

- 长期市场机会与策略远见

- 技术转移与商业化途径

- 创新生态系与合作网络

- 价格趋势

- 按地区

- 副产品

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 最佳情况

- 政府和公共部门电子采购重点

- 政府和公共部门电子采购重点

- 全球电子采购改革倡议

- 印度宝石(政府电子市场)

- 法国电子采购与电子发票改革

- 欧盟电子采购计划

- 美国联邦政府电子采购现代化

- 亚太地区电子化政府采购

- 拉丁美洲和新兴市场

- 正在进行中的重大公共采购项目

- 公共部门数位化路线图及投资

- 新兴交付模式与架构演进

- 软体即服务 (SaaS) 的演变

- 采购平台即服务 (PaaS)

- 管理式采购服务 (MPS)

- API优先的无头采购架构

- 采购市场演变

- 嵌入式采购与采购即服务

- 模组化和可组合的采购套件

- 供应链及交付模式分析

- SaaS订阅模式

- 实施与专业服务

- 託管服务与业务流程外包 (BPO) 集成

- 合作伙伴生态系统及通路策略

- 直接销售模式与间接销售模式

- 客户成功与留存策略

- 用户采纳与变革管理

- 用户采纳率及挑战

- 变革管理最佳实践

- 培训与赋能需求

- 一般买家与高级用户的体验

- 行动应用与现场采购

- 游戏化与用户参与策略

- 高阶主管支持与利害关係人协调

- 购买者旅程与决策过程

- 采购软体评估标准

- RFP及供应商选择流程

- 概念验证和试点项目

- 利害关係人协调与共识建立

- 自建、购买或合作决策

- 供应商评估评分卡和框架

- 合约谈判及商业条款

- 采购成熟度模型与数位转型路线图

- 采购成熟度评估框架

- 数位采购转型阶段

- 路线图制定与优先排序

- 快速见效与策略性倡议

- 能力建构与组织准备

- 转型关键绩效指标及成功指标

- 安全、合规与风险管理

- 网路安全威胁及缓解策略

- 资料安全和加密标准

- 存取控制和身分管理

- 审计追踪和合规性报告

- 供应商风险管理与第三方安全

- 灾难復原与业务连续性计划

- 采购零信任架构

- 供应链网路风险管理

- 性能基准和服务水平协议

- 系统正常运作时间和可用性标准

- 反应时间和性能指标

- 支援与服务等级协议

- 供应商绩效评分卡

- 行业基准比较

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估算与预测:依软体模组划分,2021-2034年

- 主要趋势

- 支出分析

- 电子采购

- 电子采购

- 合约管理

- 供应商管理

- 其他的

第六章:市场估算与预测:依组织规模划分,2021-2034年

- 主要趋势

- 大型企业

- 中小企业

第七章:市场估算与预测:依部署模式划分,2021-2034年

- 主要趋势

- SaaS 和云端部署

- 杂交种

- 现场

第八章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 金融服务业

- 政府和公共部门

- 製造业

- 医疗保健与生命科学

- 零售及消费品

- 电信

- 其他的

第九章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 比利时

- 荷兰

- 瑞典

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 新加坡

- 韩国

- 越南

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- Global Player

- Basware

- Coupa Software

- GEP

- Ivalua

- JAGGAER

- Oracle

- SAP Ariba

- Tradeshift

- Workday

- Zycus

- Regional Player

- Anvil

- Beroe

- Cirtuo

- Esker

- Planergy

- Proactis

- Sievo

- SpendHQ

- Synertrade

- Zip

- 新兴参与者

- Corcentric

- Kodiak Hub

- Medius

- Raindrop

- ZHENYUN

The Global Procurement Software Market was valued at USD 7.5 billion in 2024 and is estimated to grow at a CAGR of 9.2% to reach USD 17.8 billion by 2034.

Demand for procurement technology continues to rise as organizations prioritize digital-first operations, stronger cost control, and improved supply chain transparency across sectors, including manufacturing, BFSI, healthcare, retail, and government. Enterprises are accelerating the adoption of cloud-based procurement ecosystems to streamline sourcing activities, strengthen compliance, and automate spend management. As operational efficiency and governance expectations increase, procurement teams are shifting toward integrated digital platforms that enhance collaboration with suppliers and optimize contract lifecycles. The market's expansion is also supported by the widespread need to reduce manual processes, centralize procurement data, and improve responsiveness in global supply networks.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.5 Billion |

| Forecast Value | $17.8 Billion |

| CAGR | 9.2% |

Advanced technologies are reshaping procurement workflows through AI-driven analytics, RPA-enabled automation, and IoT-based supply chain monitoring. These capabilities enable real-time spend insights, predictive forecasting, and automated risk evaluation across supplier networks. Machine learning models, digital twins, and dynamic supplier performance dashboards help organizations make faster, data-backed decisions while elevating cost savings and operational agility. Adoption of cloud e-sourcing solutions, digital contract management, and sophisticated supplier relationship management tools further strengthens accuracy, compliance, and workflow efficiency throughout procurement operations.

The spend analysis held a 34% share in 2024 and is anticipated to grow at a CAGR of 9% through 2034. This segment is critical for achieving financial transparency and analytical accuracy. Companies relying on AI-enhanced spend intelligence, structured data classification, and predictive cost modeling can reduce unmanaged spending and uncover new efficiency opportunities. These tools provide continuous visibility into procurement performance, surpassing the capabilities of manual reporting methods.

The large enterprises held a 65% share in 2024 and will grow at a CAGR of 9.5% during 2025-2034. Their leadership stems from the need for scalable, interconnected procurement systems that support global operations. These organizations depend on robust tools for enterprise-wide spend tracking, automated supplier assessments, and multi-region sourcing. Strong investment in AI-led procurement platforms and cloud-integrated suites continues to reinforce their dominant position.

United States Procurement Software Market held an 88% share and generated USD 2.2 billion in 2024. The country's strong technological foundation, large concentration of procurement software providers, and rapidly advancing digital adoption among enterprises support its leading share. U.S. organizations are increasingly relying on cloud-native platforms, AI-enabled supplier analyses, and workflow automation technologies to enhance sourcing accuracy and governance. Government-driven initiatives promoting secure digital procurement and enhanced transparency further boost adoption across public and private sectors.

Key Procurement Software Market participants include Workday, Synertrade, SAP Ariba, Coupa, Oracle, GEP, Basware, Jaggaer, Ivalua, and Zycus. Companies in the Procurement Software Market are executing several strategies to reinforce their market position. Many are expanding cloud-native architectures and deploying AI-driven analytics to enhance speed, accuracy, and decision intelligence across procurement cycles. Vendors are investing heavily in automation technologies, including RPA and machine learning, to streamline repetitive tasks and improve user efficiency. Strategic partnerships with ERP providers, financial software platforms, and supply chain technology firms help broaden integration capabilities and create unified digital ecosystems. Firms are also prioritizing enhanced data security, regulatory compliance features, and customizable procurement modules to meet diverse enterprise needs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Software module

- 2.2.3 Organization size

- 2.2.4 Deployment model

- 2.2.5 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Digital transformation in procurement

- 3.2.1.2 AI & analytics integration

- 3.2.1.3 Regulatory compliance & risk management

- 3.2.1.4 Cost optimization & efficiency

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High implementation costs & complexity

- 3.2.2.2 Data security & privacy concerns

- 3.2.3 Market opportunities

- 3.2.3.1 SME adoption growth

- 3.2.3.2 Sustainable & green procurement

- 3.2.3.3 AI and machine learning integration

- 3.2.3.4 Supplier collaboration and risk management

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Artificial intelligence & machine learning in procurement

- 3.4.2 Generative ai applications & transformational impact

- 3.4.3 Robotic process automation (RPA) integration

- 3.4.4 Blockchain for supplier verification & traceability

- 3.4.5 Internet of things (IOT) for inventory & asset tracking

- 3.4.6 Advanced analytics & predictive intelligence

- 3.4.7 Natural language processing (NLP) for contract analysis

- 3.4.8 Computer vision & OCR for invoice processing

- 3.4.9 Digital twins for supply chain simulation

- 3.4.10 Edge computing & distributed procurement

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation Landscape

- 3.7.1 Technology evolution timeline & milestones

- 3.7.2 Performance improvement projections by technology

- 3.7.3 Cost reduction roadmap & economic targets

- 3.7.4 Manufacturing scale-up timeline & capacity planning

- 3.7.5 Emerging technology integration & convergence

- 3.7.6 Market penetration scenarios & adoption curves

- 3.7.7 Disruptive technology threats & market impact

- 3.7.8 Long-term market opportunities & strategic vision

- 3.7.9 Technology transfer & commercialization pathways

- 3.7.10 Innovation ecosystem & collaboration networks

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and Environmental Aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.12 Best case scenarios

- 3.13 Government & public sector e-procurement focus

- 3.13.1 Government & public sector e-procurement focus

- 3.13.2 Global e-procurement reform initiatives

- 3.13.3 India gem (government e-marketplace)

- 3.13.4 France E-procurement & e-invoicing reforms

- 3.13.5 European union e-procurement initiatives

- 3.13.6 U.S. federal E-procurement modernization

- 3.13.7 Asia pacific E-government procurement

- 3.13.8 Latin America & emerging markets

- 3.13.9 Ongoing major public procurement projects

- 3.13.10 Public sector digitalization roadmaps & investment

- 3.14 Emerging delivery models & architectural evolution

- 3.14.1 Software-as-a-service (SAAS) Evolution

- 3.14.2 Platform-as-a-service (PAAS) for Procurement

- 3.14.3 Managed procurement services (MPS)

- 3.14.4 API-first & headless procurement architecture

- 3.14.5 Procurement marketplace evolution

- 3.14.6 Embedded procurement & procurement-as-a-service

- 3.14.7 Modular & composable procurement suites

- 3.15 Supply Chain & Delivery Model Analysis

- 3.15.1 SaaS subscription models

- 3.15.2 Implementation & professional services

- 3.15.3 Managed services & BPO integration

- 3.15.4 Partner ecosystem & channel strategy

- 3.15.5 Direct vs indirect sales models

- 3.15.6 Customer success & retention strategies

- 3.16 User Adoption & Change Management

- 3.16.1 User adoption rates & challenges

- 3.16.2 Change management best practices

- 3.16.3 Training & enablement requirements

- 3.16.4 Casual buyer vs power user experience

- 3.16.5 Mobile adoption & field procurement

- 3.16.6 Gamification & user engagement strategies

- 3.16.7 Executive sponsorship & stakeholder alignment

- 3.17 Buyer Journey & Decision-Making Process

- 3.17.1 Procurement software evaluation criteria

- 3.17.2 RFP & vendor selection process

- 3.17.3 Proof-of-concept & pilot programs

- 3.17.4 Stakeholder alignment & consensus building

- 3.17.5 Build vs buy vs partner decisions

- 3.17.6 Vendor evaluation scorecards & frameworks

- 3.17.7 Contract negotiation & commercial terms

- 3.18 Procurement maturity models & digital transformation roadmaps

- 3.18.1 Procurement maturity assessment frameworks

- 3.18.2 Digital procurement transformation stages

- 3.18.3 Roadmap development & prioritization

- 3.18.4 Quick wins vs strategic initiatives

- 3.18.5 Capability building & organizational readiness

- 3.18.6 Transformation KPIS & success metrics

- 3.19 Security, Compliance & Risk Management

- 3.19.1 Cybersecurity threats & mitigation strategies

- 3.19.2 Data security & encryption standards

- 3.19.3 Access control & identity management

- 3.19.4 Audit trails & compliance reporting

- 3.19.5 Vendor risk management & third-party security

- 3.19.6 Disaster recovery & business continuity planning

- 3.19.7 Zero trust architecture for procurement

- 3.19.8 Supply chain cyber risk management

- 3.20 Performance Benchmarks & SLAs

- 3.20.1 System uptime & availability standards

- 3.20.2 Response time & performance metrics

- 3.20.3 Support & service level agreements

- 3.20.4 Vendor performance scorecards

- 3.20.5 Industry benchmark comparisons

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Software Module, 2021 - 2034 ($ Bn)

- 5.1 Key trends

- 5.2 Spend analysis

- 5.3 E-sourcing

- 5.4 E-procurement

- 5.5 Contract management

- 5.6 Supplier management

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($ Bn)

- 6.1 Key trends

- 6.2 Large Enterprises

- 6.3 SME

Chapter 7 Market Estimates & Forecast, By Deployment Model, 2021 - 2034 ($ Bn)

- 7.1 Key trends

- 7.2 SaaS & cloud-based deployment

- 7.3 Hybrid

- 7.4 On-premises

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($ Bn)

- 8.1 Key trends

- 8.2 BFSI

- 8.3 Government & public sector

- 8.4 Manufacturing

- 8.5 Healthcare & life sciences

- 8.6 Retail & consumer goods

- 8.7 Telecommunications

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($ Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Belgium

- 9.3.7 Netherlands

- 9.3.8 Sweden

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 Singapore

- 9.4.6 South Korea

- 9.4.7 Vietnam

- 9.4.8 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Global Player

- 10.1.1 Basware

- 10.1.2 Coupa Software

- 10.1.3 GEP

- 10.1.4 Ivalua

- 10.1.5 JAGGAER

- 10.1.6 Oracle

- 10.1.7 SAP Ariba

- 10.1.8 Tradeshift

- 10.1.9 Workday

- 10.1.10 Zycus

- 10.2 Regional Player

- 10.2.1 Anvil

- 10.2.2 Beroe

- 10.2.3 Cirtuo

- 10.2.4 Esker

- 10.2.5 Planergy

- 10.2.6 Proactis

- 10.2.7 Sievo

- 10.2.8 SpendHQ

- 10.2.9 Synertrade

- 10.2.10 Zip

- 10.3 Emerging Players

- 10.3.1 Corcentric

- 10.3.2 Kodiak Hub

- 10.3.3 Medius

- 10.3.4 Raindrop

- 10.3.5 ZHENYUN