|

市场调查报告书

商品编码

1885895

氮化镓(GaN)电动车充电器市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Gallium Nitride (GaN) EV Charger Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

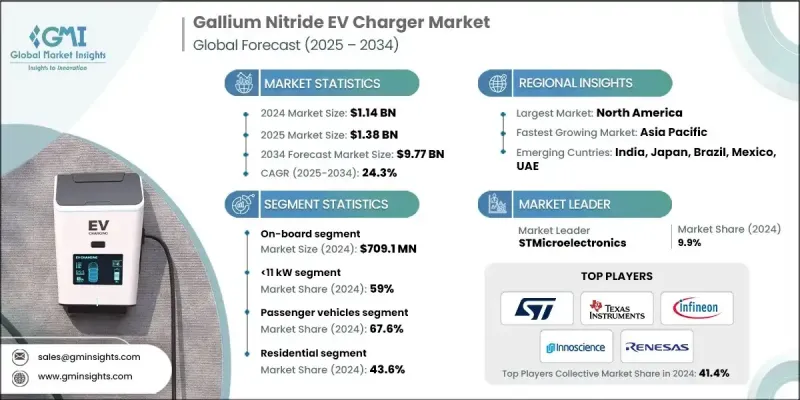

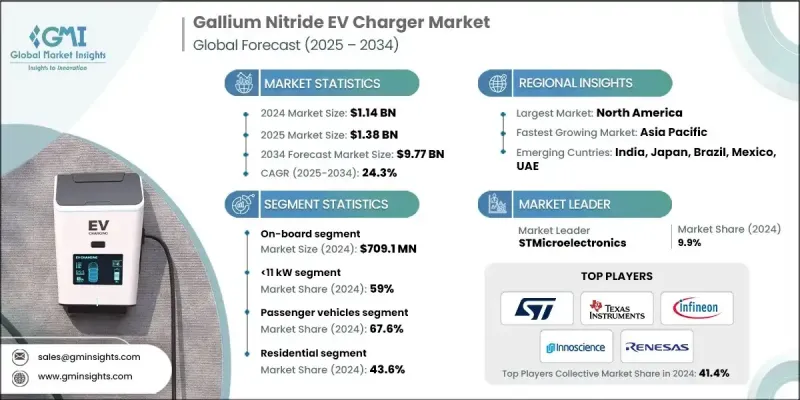

2024 年全球氮化镓 (GaN) 电动车充电器市值为 11.4 亿美元,预计到 2034 年将以 24.3% 的复合年增长率增长至 97.7 亿美元。

市场正从独立的离散装置向整合式半桥级和模组转型,这些整合式半桥级和模组将氮化镓(GaN)开关与驱动器和保护功能相结合。这种整合降低了布局敏感性和电磁干扰(EMI),同时提高了散热性能。公私合作计画加速了宽禁带(WBG)技术的商业化,推动了车载充电器(OBC)和电动车电源系统采用整合式GaN解决方案。汽车製造商正日益整合多功能电源域,从而支援更高水准的装置整合。 OBC转换器的展示表明,与硅基系统相比,GaN可以将功率密度提高170%,重量减轻79%,并在6.6 kW双有源桥原型中实现了99%的峰值效率。 GaN元件可以以比硅更高的频率和更低的导通损耗进行开关,从而可以缩小磁性元件和冷却系统的尺寸,同时在先进的电动车转换器中将损耗降低60-80%。设计团队也正在优化开关频率,以平衡转换器性能和马达寄生损耗。研究表明,采用高HfO2闸极介质的1.2 kV GaN MOSFET可实现极低的闸极漏电流和更高的电流密度。一旦衬底和製程技术成熟,垂直GaN元件有望在1.2 kV应用领域与SiC元件展开竞争。然而,由于成本和可靠性方面的考虑,800 V以上和150 kW牵引应用的汽车级认证仍在开发中,预计要到本世纪末才能实现。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 11.4亿美元 |

| 预测值 | 97.7亿美元 |

| 复合年增长率 | 24.3% |

横向氮化镓元件市场占有率达到70%,预计从2025年到2034年将以16.1%的复合年增长率成长。横向氮化镓装置在电动车电力电子领域占据主导地位,应用于车用电池、直流-直流转换器和高达650V的辅助系统。与硅相比,其在硅基板上的AlGaN/GaN HEMT结构具有高电子迁移率和临界场强,在高阻断电压下可实现低导通电阻。

中压(100-650V)市场在2024年占据了67%的市场份额,预计到2034年将以16%的复合年增长率成长。中压GaN元件已广泛应用,因为大多数车载电池(目前为400V,未来将上升至800V)和许多DC-DC转换器都属于此电压范围。 GaN的高频性能可直接提升6.6-19.2kW车载电池系统中功率因数校正和LLC或谐振转换器级的效率和功率密度。

预计到2024年,中国氮化镓(GaN)电动车充电器市场规模将达到7,340万美元。中国电动车销量占全球近三分之二,其庞大的市场规模使其成为GaN装置最大的潜在市场,因为每辆电动车都需要车载充电器、DC-DC转换器和相容的充电基础设施。这一产能规模使中国遥遥领先日本、韩国和印度等其他区域市场。

全球氮化镓 (GaN) 电动车充电器市场的主要参与者包括 Transphorm、Navitas、德州仪器 (Texas Instruments)、GaN Systems、EPC、意法半导体 (STMicroelectronics)、罗姆半导体 (ROHM Semiconductor)、英飞凌科技 (Infineon Technologies Technologies)、Ingrscience 和 Infinations。各公司正透过加大研发投入来提升 GaN 装置的效能、效率和可靠性,进而巩固自身市场地位。与汽车製造商和充电器製造商的策略合作加速了 GaN 技术的普及应用。拓展产品组合,推出中高压解决方案,取得汽车产业认证,以及开发整合模组,均有助于提高市场渗透率。此外,各公司也致力于透过衬底创新、扩大产能和优化供应链来降低成本。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基准估算和计算

- 基准年计算

- 市场估算的关键趋势

- 初步研究和验证

- 原始资料

- 预报

- 研究假设和局限性

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 电动车普及率不断上升

- 能源效率和永续性

- 车队电气化

- 政府政策和激励措施

- 氮化镓技术的进步

- 产业陷阱与挑战

- 初始成本高

- 整合挑战

- 市场机会

- 与再生能源的融合

- 高功率工业车队充电

- 公共充电网路的扩展

- 智慧充电与电网管理

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 目前技术

- 新兴技术

- 氮化镓元件架构及技术变体

- 横向氮化镓半金属薄膜电晶体架构(300-650V 商用)

- 垂直氮化镓发展路线图(目标电压>1.2 kV)

- 双向氮化镓开关(BDS)技术

- 宽禁带半导体技术概况

- 硅(Si)基准性能及局限性

- GAN技术概述及优势

- 碳化硅(SIC)技术概述

- GAN 与硅的性能比较

- 专利分析

- 价格趋势分析

- 按组件

- 按地区

- 成本分解分析

- 生产统计

- 生产中心

- 消费中心

- 进出口

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

- 製造流程及成本结构

- GaN元件製造流程

- 外延生长(MOCVD、MBE)

- 晶圆加工与光刻

- 切丁和包装

- 测试与品质控制

- 製造成本细分(美元/千瓦)

- 热管理注意事项

- 高开关频率的散热挑战

- 散热器设计与最佳化

- 液冷与风冷

- 热界面材料

- 结温管理

- 电磁干扰/电磁相容性合规性及缓解措施

- 高 DV/DT 和 DI/DT 挑战

- 传导排放

- 辐射发射

- 用于氮化镓充电器的EMI滤波器设计

- PCB布局最佳实践

- 屏蔽和接地策略

- 可靠性和资格标准

- AEC-Q101(汽车分立半导体)

- AEC-Q100(汽车积体电路)

- 汽车业资格要求

- 长期可靠性测试

- 栅极氧化层可靠性

- 动态导通电阻退化

- 贸易分析及进出口动态

- 全球氮化镓装置贸易流

- 主要出口国(中国、台湾、德国、美国)

- 主要进口国

- 关税与贸易壁垒

- 贸易政策影响(美中关係)

- 回流和近岸外包趋势

- 案例研究与实际应用

- ORNL 6.6 kW GaN OBC 演示

- 台达电子氮化镓充电器部署

- 英飞凌 300 毫米 GaN 中试生产

- Navitas GaNFast IC 汽车设计获奖

- Chargepoint GaN 直流电快速充电器

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 重要新闻和倡议

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估算与预测:依产品划分,2021-2034年

- 主要趋势

- 车用充电器

- 外接充电器

- 住宅

- 商业的

- 公共/高功率

第六章:市场估算与预测:依充电容量划分,2021-2034年

- 主要趋势

- 小于11千瓦

- 11-22千瓦

- 大于22千瓦

第七章:市场估价与预测:依车辆类型划分,2021-2034年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- SUV

- 商用车辆

- 低容量性状

- MCV

- C型肝炎

第八章:市场估算与预测:依应用领域划分,2021-2034年

- 主要趋势

- 住宅

- 商业的

- 民众

- 工业的

第九章:市场估算与预测:依配销通路划分,2021-2034年

- 主要趋势

- OEM

- 售后市场

第十章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧

- 荷兰

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳新银行

- 新加坡

- 泰国

- 越南

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十一章:公司简介

- 全球参与者

- ABB E-Mobility

- Infineon Technologies

- ON Semiconductor

- Power Integrations

- Renesas Electronics (Transphorm)

- ROHM Semiconductor

- Schneider Electric

- Siemens eMobility

- STMicroelectronics

- Texas Instruments

- 区域玩家

- BTC Power

- ChargePoint

- EVBox (Engie)

- GaN Systems

- Nexperia

- Panasonic

- Tritium

- Wallbox

- VisIC Technologies

- Chanan

- 新兴参与者和颠覆者

- Cambridge GaN Devices (CGD)

- EPC

- Innoscience Technology

- Navitas Semiconductor

11.3.5 奥德赛半导体技术公司

The Global Gallium Nitride (GaN) EV Charger Market was valued at USD 1.14 billion in 2024 and is estimated to grow at a CAGR of 24.3% to reach USD 9.77 billion by 2034.

The market is transitioning from standalone discrete devices to integrated half-bridge stages and modules that combine GaN switches with drivers and protection features. This integration reduces layout sensitivity and EMI while improving thermal performance. Public-private initiatives have accelerated the commercialization of wide-bandgap (WBG) technologies, driving the adoption of integrated GaN solutions for onboard chargers (OBCs) and electric vehicle power systems. Automakers are increasingly integrating multifunctional power domains, which support higher levels of device integration. Demonstrations of OBC converters indicate that GaN can increase power density by 170% and reduce weight by 79% compared to silicon-based systems, achieving peak efficiencies of 99% in a 6.6 kW dual active bridge prototype. GaN devices can switch at higher frequencies with lower conduction losses than silicon, allowing smaller magnetics and cooling systems while reducing losses by 60-80% in advanced EV converters. Design teams are also optimizing switching frequencies to balance converter performance with motor parasitic losses. Research has shown that 1.2 kV GaN MOSFETs using high-HfO2 gate dielectrics achieve very low gate leakage and higher current density. This positions vertical GaN devices to compete with SiC for 1.2 kV applications once substrate and process technologies mature. However, automotive qualification for 800 V+ and 150 kW traction applications remains under development, with readiness expected toward the end of the decade due to cost and reliability considerations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.14 Billion |

| Forecast Value | $9.77 Billion |

| CAGR | 24.3% |

The lateral GaN devices segment held 70% share and is forecasted to grow at a CAGR of 16.1% from 2025 to 2034. Lateral GaN devices dominate EV power electronics for OBCs, DC-DC converters, and auxiliary systems up to 650 V. Their AlGaN/GaN HEMT structure on silicon provides high electron mobility and critical field strength, delivering low on-resistance at high blocking voltages compared to silicon.

The medium voltage segment (100-650 V) accounted for a 67% share in 2024 and is projected to grow at a CAGR of 16% through 2034. Mid-voltage GaN devices are widely deployed because most OBCs (400 V today, rising to 800 V) and many DC-DC converters fall within this range. GaN's high-frequency performance directly boosts efficiency and power density in power factor correction and LLC or resonant converter stages in 6.6-19.2 kW OBC systems.

China Gallium Nitride (GaN) EV Charger Market generated USD 73.4 million in 2024. Accounting for nearly two-thirds of global EV sales, China's scale generates the largest addressable market for GaN devices, as every EV requires onboard chargers, DC-DC converters, and compatible charging infrastructure. This production volume positions China far ahead of other regional markets like Japan, South Korea, and India.

Key players in the Global Gallium Nitride (GaN) EV Charger Market include Transphorm, Navitas, Texas Instruments, GaN Systems, EPC, STMicroelectronics, ROHM Semiconductor, Infineon Technologies, Innoscience, and Power Integrations. Companies are strengthening their position by investing in R&D to improve GaN device performance, efficiency, and reliability. Strategic collaborations with automakers and charger manufacturers accelerate adoption. Expanding product portfolios with medium- and high-voltage solutions, securing automotive qualification certifications, and developing integrated modules enhances market penetration. Firms also focus on reducing costs through substrate innovations, scaling production capacity, and optimizing supply chains.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Product

- 2.2.2 Charging capacity

- 2.2.3 Vehicle

- 2.2.4 Application

- 2.2.5 Distribution channel

- 2.2.6 Regional

- 2.3 TAM Analysis, 2026-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising EV adoption

- 3.2.1.2 Energy efficiency and sustainability

- 3.2.1.3 Electrification of fleets

- 3.2.1.4 Government policies and incentives

- 3.2.1.5 Technological advancements in GaN

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial cost

- 3.2.2.2 Integration challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with renewable energy

- 3.2.3.2 High-power industrial fleet charging

- 3.2.3.3 Expansion of public charging networks

- 3.2.3.4 Smart charging and grid management

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle east and Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technology

- 3.7.2 Emerging technology

- 3.7.3 GaN device architectures & technology variants

- 3.7.3.1 Lateral GaN hemt architecture (300-650v commercial)

- 3.7.3.2 Vertical GaN development roadmap (>1.2 kv target)

- 3.7.3.3 Bidirectional GaN switch (bds) technology

- 3.7.4 Wide-bandgap semiconductor technology landscape

- 3.7.4.1 Silicon (si) baseline performance & limitations

- 3.7.4.2 Gan technology overview & advantages

- 3.7.4.3 Silicon carbide (sic) technology overview

- 3.7.4.4 Gan vs silicon performance comparison

- 3.8 Patent analysis

- 3.9 Price Trends Analysis

- 3.9.1 By component

- 3.9.2 By region

- 3.10 Cost Breakdown Analysis

- 3.11 Production statistics

- 3.11.1 Production hubs

- 3.11.2 Consumption hubs

- 3.11.3 Export and import

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Manufacturing Process & Cost Structure

- 3.13.1 GaN device fabrication process flow

- 3.13.2 Epitaxial growth (MOCVD, MBE)

- 3.13.3 Wafer processing & lithography

- 3.13.4 Dicing & packaging

- 3.13.5 Testing & quality control

- 3.13.6 Manufacturing cost breakdown ($/kW)

- 3.14 Thermal management considerations

- 3.14.1 Heat dissipation challenges at high switching frequency

- 3.14.2 Heatsink design & optimization

- 3.14.3 Liquid cooling vs air cooling

- 3.14.4 Thermal interface materials

- 3.14.5 Junction temperature management

- 3.15 Emi/emc compliance & mitigation

- 3.15.1 High DV/DT & DI/DT challenges

- 3.15.2 Conducted emissions

- 3.15.3 Radiated emissions

- 3.15.4 Emi filter design for GaN chargers

- 3.15.5 Pcb layout best practices

- 3.15.6 Shielding & grounding strategies

- 3.16 Reliability & qualification standards

- 3.16.1 Aec-q101 (automotive discrete semiconductors)

- 3.16.2 Aec-q100 (automotive integrated circuits)

- 3.16.3 Automotive qualification requirements

- 3.16.4 Long-term reliability testing

- 3.16.5 Gate oxide reliability

- 3.16.6 Dynamic on-resistance degradation

- 3.17 Trade analysis & import/export dynamics

- 3.17.1 Global GaN device trade flows

- 3.17.2 Major exporting countries (China, Taiwan, Germany, U.S.)

- 3.17.3 Major importing countries

- 3.17.4 Tariffs & trade barriers

- 3.17.5 Trade policy impact (U.S.-China relations)

- 3.17.6 Reshoring & nearshoring trends

- 3.18 Case Studies & Real-World Implementations

- 3.18.1 ORNL 6.6 kW GaN OBC demonstration

- 3.18.2 Delta electronics GaN charger deployment

- 3.18.3. Infineon 300 mm GaN pilot production

- 3.18.4 Navitas GaNFast IC automotive design wins

- 3.18.5 Chargepoint GaN-enabled dc fast chargers

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key news and initiatives

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 On-Board Chargers

- 5.3 Off-Board Chargers

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Public / High-Power

Chapter 6 Market Estimates & Forecast, By Charging Capacity, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 <11 kW

- 6.3 11-22 kW

- 6.4 >22 kW

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Passenger vehicles

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicles

- 7.3.1 LCV

- 7.3.2 MCV

- 7.3.3 HCV

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.4 Public

- 8.5 Industrial

Chapter 9 Market Estimates & Forecast, By Distribution channel, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Netherlands

- 10.3.8 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 ANZ

- 10.4.5 Singapore

- 10.4.6 Thailand

- 10.4.7 Vietnam

- 10.4.8 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 ABB E-Mobility

- 11.1.2 Infineon Technologies

- 11.1.3 ON Semiconductor

- 11.1.4 Power Integrations

- 11.1.5 Renesas Electronics (Transphorm)

- 11.1.6 ROHM Semiconductor

- 11.1.7 Schneider Electric

- 11.1.8 Siemens eMobility

- 11.1.9 STMicroelectronics

- 11.1.10 Texas Instruments

- 11.2 Regional Players

- 11.2.1 BTC Power

- 11.2.2 ChargePoint

- 11.2.3 EVBox (Engie)

- 11.2.4 GaN Systems

- 11.2.5 Nexperia

- 11.2.6 Panasonic

- 11.2.7 Tritium

- 11.2.8 Wallbox

- 11.2.9 VisIC Technologies

- 11.2.10 Chanan

- 11.3 Emerging players and disruptors

- 11.3.1 Cambridge GaN Devices (CGD)

- 11.3.2 EPC

- 11.3.3 Innoscience Technology

- 11.3.4 Navitas Semiconductor

11.3.5 Odyssey Semiconductor Technologies