|

市场调查报告书

商品编码

1885911

资料中心基础设施市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Data Center Infrastructure Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

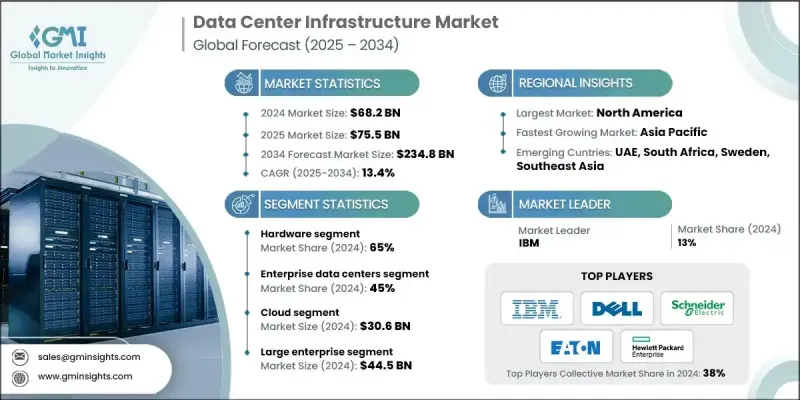

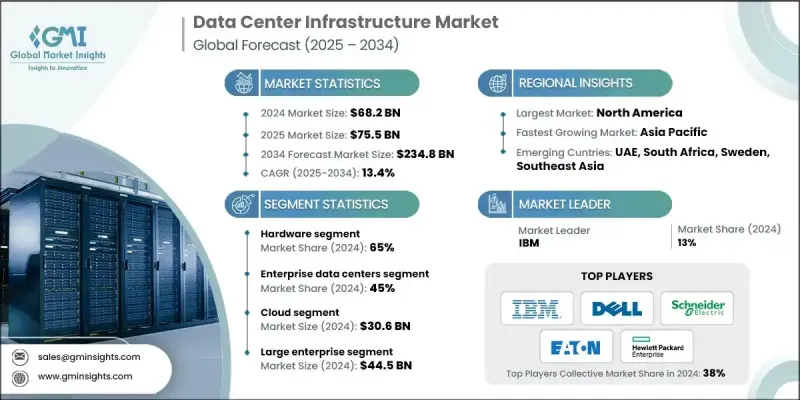

2024 年全球资料中心基础设施市场价值为 682 亿美元,预计到 2034 年将以 13.4% 的复合年增长率成长至 2,348 亿美元。

人工智慧工作负载的日益普及、超大规模云端的成长以及企业数位转型推动了市场扩张。对高密度机架、专用伺服器、GPU 和加速器的需求不断增长,正在重塑电力分配、冷却和网路互连的要求。政府推行的数位化、智慧城市和数据驱动治理等倡议,正在推动更多资料中心的建设,以提高在高工作负载需求下的效率、安全性和创新能力。业界正从传统的 x86 架构转向客製化晶片和专为人工智慧和机器学习任务量身定制的专用加速器。超大规模营运商正在投资采用客製化处理器和人工智慧加速器的专有伺服器设计,以优化效能、能源效率和整体拥有成本。边缘资料中心的经济效益与超大规模部署存在显着差异,而对节能、低碳营运的追求正迫使营运商采用再生能源、热能再利用策略以及更严格的能源绩效标准。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 682亿美元 |

| 预测值 | 2348亿美元 |

| 复合年增长率 | 13.4% |

硬体领域在2024年占据65%的市场份额,预计从2025年到2034年将以12.7%的复合年增长率成长。该领域包括伺服器、储存系统、网路设备、电源分配单元(PDU)、不间断电源(UPS)、冷却基础设施、机架和机箱。硬体需要大量的资本投入和频繁的技术更新换代,才能在不断变化的工作负载中保持效率和效能。

企业资料中心在2024年占据了45%的市场份额,预计在2025年至2034年间将以12.6%的复合年增长率成长。这些由企业内部营运、用于支援IT营运的设施仍然是最大的细分市场,但随着企业向託管和公有云平台迁移,其市场份额正在逐渐下降。许多企业资料中心由于基础设施老旧和冷却系统优化不足,其电源使用效率(PUE)值高于1.8-2.0,这为提高效率提供了空间。

北美资料中心基础设施市场占据38%的市场份额,预计2024年市场规模将达到263亿美元。该地区受益于众多超大规模营运商、科技公司、金融机构和数位基础设施企业的强大布局。受人工智慧基础设施投资的推动,美国市场预计将快速扩张,资料中心电力需求预计将从2024年的约4吉瓦成长到2035年的123吉瓦。

全球资料中心基础设施市场的主要参与者包括伊顿、联想集团、惠普企业(HPE)、思科系统、ABB、IBM、戴尔、富士通、施耐德电气和华为技术有限公司。这些企业正透过专注于高效能伺服器、先进冷却解决方案和下一代网路设备的研发来巩固其市场地位。与云端服务供应商和企业客户的策略合作有助于他们根据特定的工作负载需求客製化解决方案。向新兴市场进行地域扩张以及收购科技新创公司也有助于扩大市场覆盖范围。此外,各公司也正在投资节能设计、低碳营运和人工智慧监控系统,以提高效能、降低营运成本并符合监管标准。提供全面的服务和维护合约以及培训计划,能够进一步增强客户忠诚度并巩固竞争优势。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 零件製造商

- 系统整合商和分销商

- 设施营运商和服务提供者

- 最终用户和企业

- 成本结构

- 利润率

- 每个阶段的价值增加

- 垂直整合趋势

- 颠覆者

- 供应商格局

- 对力的影响

- 成长驱动因素

- 人工智慧和超大规模运算需求

- 云端迁移和持续的超大规模/边缘部署

- 提高能源效率和电力可靠性的现代化改造

- 更重视永续发展和替代能源采购

- 产业陷阱与挑战

- 电力和电网限制

- 供应链、成本上涨和技能短缺

- 市场机会

- 客製化硅片和架构转变

- 边缘密集化和分散式布局

- 成长驱动因素

- 技术趋势与创新生态系统

- 目前技术

- 人工智慧优化基础设施

- 液冷技术

- 后门热交换器

- 晶片直接冷却

- 新兴技术

- 硅光子学与高速互连

- 量子运算基础设施需求

- 神经形态运算基础设施

- 模组化和预製资料中心

- 技术成熟度(TRL)评估

- TRL框架概述

- 液冷技术

- 人工智慧专用基础设施

- 量子运算基础设施

- 目前技术

- 成长潜力分析

- 监管环境

- 数据主权和本地化要求

- 环境与永续发展法规

- 建筑规范与安全标准

- 区域监管比较

- 北美洲

- 欧洲

- 亚太

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 专利分析

- 成本細項分析

- 价格趋势

- 硬体组件价格趋势

- 零售价与批发价

- 冷却技术成本比较

- 总拥有成本(TCO)模型框架

- 电力和能源基础设施

- 再生能源购电协议

- 各区域的电网容量限制

- 电力采购策略框架

- 区域电力可用性评估

- 专利分析

- 按技术领域分類的专利申请趋势

- 软体定义基础设施专利

- 开源技术与专有技术分析

- 专利地理分布

- 永续性和环境方面

- 循环经济与电子垃圾管理

- 再生能源投资回报

- 范围 1、2、3 排放跟踪

- 永续发展报告标准

- 投资与融资分析

- 创投趋势

- 超大规模资本支出趋势

- 託管服务提供者扩张投资

- 按技术类别分類的投资

- 永续发展挂钩融资

- 用例分析及应用场景

- 人工智慧训练基础设施用例

- 加强学习基础设施

- 高效能运算用例

- 5G边缘应用

- 碳中和资料中心运营

- 客户和最终用户洞察

- 首席资讯长/技术长概况及优先事项

- 客户旅程图

- 客户满意度和净推荐值

- 客户痛点和未满足的需求

- 市场采纳与渗透分析

- 技术采纳曲线

- 超融合基础设施渗透

- 按行业垂直领域分類的渗透率

- 地理采纳差异

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太

- 拉丁美洲

- 中东和非洲

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

- 高端定位策略

- 策略性OEM合作伙伴关係机会

- 竞争分析与独特卖点

第五章:市场估算与预测:依组件划分,2021-2034年

- 主要趋势

- 硬体

- 实体基础设施硬体

- IT设备和伺服器

- 储存系统和阵列

- 网路硬体元件

- 电源和散热硬体

- 软体

- 基础设施管理软体

- 虚拟化和虚拟机管理程式软体

- 安全与合规软体

- 监控和分析平台

- 自动化和编排工具

- 服务

- 专业服务

- 託管服务

第六章:市场估算与预测:依产品划分,2021-2034年

- 主要趋势

- 冷却

- 空气冷却系统

- 计算机房空调(CRAC)

- 计算机房空气处理(CRAH)

- 行内冷却单元

- 顶置式冷却系统

- 液冷解决方案

- 晶片直接冷却

- 浸没式冷却系统

- 后门热交换器

- 液体分配单元

- 混合冷却架构

- 冷却配件和组件

- 空气冷却系统

- 力量

- UPS

- 电源分配单元(PDU)

- 发电机和备用电源

- 电力监控管理系统

- IT机架和机柜

- 伺服器机架和机柜

- 网路设备机柜

- 刀锋伺服器机箱

- 左心室/二尖瓣分布

- 开关设备及配电盘

- 变压器和电源调节

- 公车专用道系统

- 电气保护装置

- 网路装置

- 乙太网路交换机

- InfiniBand 交换机

- 路由器和网关

- 负载平衡器和类比数位转换器

- DCIM

第七章:市场估算与预测:依资料中心划分,2021-2034年

- 主要趋势

- 企业资料中心

- 託管资料中心

- 超大规模资料中心

- 边缘资料中心

第八章:市场估算与预测:依部署方式划分,2021-2034年

- 主要趋势

- 云

- 杂交种

- 现场

第九章:市场估算与预测:依组织规模划分,2021-2034年

- 主要趋势

- 大型企业

- 中小企业

第十章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- 金融服务业

- 託管

- 活力

- 政府

- 卫生保健

- 製造业

- 资讯科技与电信

- 其他的

第十一章:市场估计与预测:按地区划分,2021-2034年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 比利时

- 荷兰

- 瑞典

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 新加坡

- 韩国

- 越南

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十二章:公司简介

- 全球参与者

- ABB

- Cisco Systems

- Dell Technologies

- Eaton

- Hewlett Packard Enterprise (HPE)

- IBM

- Lenovo

- NetApp

- Schneider Electric

- Vertiv

- Regional champions

- Fujitsu

- Huawei

- Inspur

- Legrand

- Rittal

- 新兴参与者与创新者

- AMD

- Arista Networks

- Liquidstack

- Micron

- Pure Storage

- Samsung Electronics

- Seagate Technology

- Super Micro Computer

- Western Digital Corporation (WDC)

- Wiwynn

The Global Data Center Infrastructure Market was valued at USD 68.2 billion in 2024 and is estimated to grow at a CAGR of 13.4% to reach USD 234.8 billion by 2034.

The market expansion is fueled by increasing adoption of artificial intelligence workloads, hyperscale cloud growth, and enterprise digital transformation. Rising demand for high-density racks, purpose-built servers, GPUs, and accelerators is reshaping power distribution, cooling, and network interconnect requirements. Government initiatives promoting digitization, smart cities, and data-driven governance are driving the construction of more data centers to improve efficiency, safety, and innovation under heavy workload demands. The industry is shifting from traditional x86 architectures to custom silicon and specialized accelerators tailored for AI and machine learning tasks. Hyperscale operators are investing in proprietary server designs with custom processors and AI accelerators to optimize performance, power efficiency, and total cost of ownership. Edge data center economics differ significantly from hyperscale deployments, while the push for energy-efficient, low-carbon operations is forcing operators to adopt renewable power sourcing, heat-reuse strategies, and stricter energy performance standards.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $68.2 Billion |

| Forecast Value | $234.8 Billion |

| CAGR | 13.4% |

The hardware segment held a 65% share in 2024 and is expected to grow at a CAGR of 12.7% from 2025 to 2034. This segment includes servers, storage systems, networking equipment, power distribution units (PDUs), uninterruptible power supplies (UPS), cooling infrastructure, racks, and enclosures. Hardware requires significant capital investment and frequent technology refresh cycles to maintain efficiency and performance across evolving workloads.

The enterprise data centers segment accounted for a 45% share in 2024 and is anticipated to grow at a CAGR of 12.6% between 2025 and 2034. These facilities, operated internally by organizations to support IT operations, remain the largest segment but are gradually declining as enterprises migrate toward colocation and public cloud platforms. Many enterprise data centers operate with power usage effectiveness (PUE) values above 1.8-2.0 due to legacy infrastructure and under-optimized cooling systems, presenting opportunities for efficiency improvements.

North America Data Center Infrastructure Market held 38% share, valued at USD 26.3 billion in 2024. The region benefits from a strong presence of hyperscale operators, technology firms, financial institutions, and digital infrastructure. The U.S. market is expected to expand rapidly due to AI infrastructure investments, with demand for data center power projected to increase from around 4 GW in 2024 to 123 GW by 2035.

Key players in the Global Data Center Infrastructure Market include Eaton, Lenovo Group, Hewlett Packard Enterprise (HPE), Cisco Systems, ABB, IBM, Dell, Fujitsu, Schneider Electric, and Huawei Technologies. Companies in the Data Center Infrastructure Market are strengthening their presence by focusing on R&D for high-efficiency servers, advanced cooling solutions, and next-generation networking equipment. Strategic partnerships with cloud providers and enterprise clients help them tailor solutions to specific workload requirements. Geographic expansion into emerging markets and acquisitions of technology startups enhance market reach. Firms are also investing in energy-efficient designs, low-carbon operations, and AI-enabled monitoring systems to improve performance, reduce operating costs, and comply with regulatory standards. Offering comprehensive service and maintenance contracts alongside training programs further builds customer loyalty and reinforces competitive positioning.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast

- 1.4 Primary research and validation

- 1.5 Some of the primary sources

- 1.6 Data mining sources

- 1.6.1 Secondary

- 1.6.1.1 Paid Sources

- 1.6.1.2 Public Sources

- 1.6.1.3 Sources, by region

- 1.6.1 Secondary

- 1.7 Inclusion & Exclusion

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Data Center

- 2.2.4 Deployment

- 2.2.5 Organization Size

- 2.2.6 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Component manufacturers

- 3.1.1.2 System integrators & distributors

- 3.1.1.3 Facility operators & service providers

- 3.1.1.4 End use & enterprises

- 3.1.2 Cost structure

- 3.1.3 Profit margin

- 3.1.4 Value addition at each stage

- 3.1.5 Vertical integration trends

- 3.1.6 Disruptors

- 3.1.1 Supplier landscape

- 3.2 Impact on forces

- 3.2.1 Growth drivers

- 3.2.1.1 AI & Hyperscale compute demand

- 3.2.1.2 Cloud migration & continued hyperscaler/edge rollouts

- 3.2.1.3 Modernization for energy efficiency & power resiliency

- 3.2.1.4 Greater focus on sustainability & alternative energy sourcing

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Power & grid constraints

- 3.2.2.2 Supply-chain, cost inflation and skills shortages

- 3.2.3 Market opportunities

- 3.2.3.1 Custom silicon & architecture shift

- 3.2.3.2 Edge densification & distributed footprint

- 3.2.1 Growth drivers

- 3.3 Technology trends & innovation ecosystem

- 3.3.1 Current technologies

- 3.3.1.1 AI-optimized infrastructure

- 3.3.1.2 Liquid cooling technologies

- 3.3.1.3 Rear-door heat exchangers

- 3.3.1.4 Direct-to-chip cooling

- 3.3.2 Emerging technologies

- 3.3.2.1 Silicon photonics & high-speed interconnects

- 3.3.2.2 Quantum computing infrastructure requirements

- 3.3.2.3 Neuromorphic computing infrastructure

- 3.3.2.4 Modular & prefabricated data centers

- 3.3.3 Technology readiness level (TRL) assessment

- 3.3.3.1 TRL framework overview

- 3.3.3.2 Liquid cooling technologies

- 3.3.3.3 AI-specific infrastructure

- 3.3.3.4 Quantum computing infrastructure

- 3.3.1 Current technologies

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 Data sovereignty & localization requirements

- 3.5.2 Environmental & sustainability regulations

- 3.5.3 Building codes & safety standards

- 3.5.4 Regional regulatory comparison

- 3.5.4.1 North America

- 3.5.4.2 Europe

- 3.5.4.3 Asia-Pacific

- 3.5.4.4 Latin America

- 3.5.4.5 Middle East & Africa

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Patent analysis

- 3.9 Cost breakdown analysis

- 3.10 Price trends

- 3.10.1 Hardware component pricing trends

- 3.10.2 Retail vs wholesale pricing

- 3.10.3 Cooling technology cost comparison

- 3.10.4 Total cost of ownership (TCO) model framework

- 3.11 Power & energy infrastructure

- 3.11.1 Renewable energy power purchase agreements

- 3.11.2 Grid capacity constraints by region

- 3.11.3 Power procurement strategy framework

- 3.11.4 Regional power availability assessment

- 3.12 Patent analysis

- 3.12.1 Patent filing trends by technology area

- 3.12.2 Software-defined infrastructure patents

- 3.12.3 Open-source vs proprietary technology analysis

- 3.12.4 Geographic patent distribution

- 3.13 Sustainability and environmental aspects

- 3.13.1 Circular economy & e-waste management

- 3.13.2 Renewable energy investment returns

- 3.13.3 Scope 1, 2, 3 emissions tracking

- 3.13.4 Sustainability reporting standards

- 3.14 Investment & funding analysis

- 3.14.1 Venture capital investment trends

- 3.14.2 Hyperscale capital expenditure trends

- 3.14.3 Colocation provider expansion investment

- 3.14.4 Investment by technology category

- 3.14.5 Sustainability-linked financing

- 3.15 Use case analysis & application scenarios

- 3.15.1 AI training infrastructure use cases

- 3.15.2 Reinforcement of learning infrastructure

- 3.15.3 High-performance computing use cases

- 3.15.4. 5 G edge applications

- 3.15.5 Carbon-neutral data center operations

- 3.16 Customer & End use insights

- 3.16.1 CIO/CTO profile & priorities

- 3.16.2 Customer journey mapping

- 3.16.3 Customer satisfaction & net promoter score

- 3.16.4 Customer pain points & unmet needs

- 3.17 Market adoption & penetration analysis

- 3.17.1 Adoption curve by technology

- 3.17.2 Hyperconverged infrastructure penetration

- 3.17.3 Penetration rate by industry vertical

- 3.17.4 Geographic adoption variance

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia-Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Key developments

- 4.5.1 Mergers & acquisitions

- 4.5.2 Partnerships & collaborations

- 4.5.3 New product launches

- 4.5.4 Expansion plans and funding

- 4.6 Premium positioning strategies

- 4.7 Strategic OEM partnership opportunities

- 4.8 Competitive analysis and USPs

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Physical infrastructure hardware

- 5.2.2 IT equipment and servers

- 5.2.3 Storage systems and arrays

- 5.2.4 Networking hardware components

- 5.2.5 Power and cooling hardware

- 5.3 Software

- 5.3.1 Infrastructure management software

- 5.3.2 Virtualization and hypervisor software

- 5.3.3 Security and compliance software

- 5.3.4 Monitoring and analytics platforms

- 5.3.5 Automation and orchestration tools

- 5.4 Services

- 5.4.1 Professional services

- 5.4.2 Managed services

Chapter 6 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Cooling

- 6.2.1 Air-based cooling systems

- 6.2.1.1 Computer room air conditioning (CRAC)

- 6.2.1.2 Computer room air handling (CRAH)

- 6.2.1.3 In-row cooling units

- 6.2.1.4 Overhead cooling systems

- 6.2.2 Liquid cooling solutions

- 6.2.2.1 Direct-to-chip cooling

- 6.2.2.2 Immersion cooling systems

- 6.2.2.3 Rear door heat exchangers

- 6.2.2.4 Liquid distribution units

- 6.2.3 Hybrid cooling architectures

- 6.2.4 Cooling accessories and components

- 6.2.1 Air-based cooling systems

- 6.3 Power

- 6.3.1 UPS

- 6.3.2 Power Distribution Units (PDUs)

- 6.3.3 Generators and backup power

- 6.3.4 Power monitoring and management system

- 6.4 IT racks & enclosures

- 6.4.1 Server racks and cabinets

- 6.4.2 Network equipment enclosures

- 6.4.3 Blade server chassis

- 6.5 LV/MV distribution

- 6.5.1 Switchgear and distribution panels

- 6.5.2 Transformers and power conditioning

- 6.5.3 Busway system

- 6.5.4 Electrical protection devices

- 6.6 Networking equipment

- 6.6.1 Ethernet switches

- 6.6.2 InfiniBand switches

- 6.6.3 Routers and gateways

- 6.6.4 Load balancers and ADCs

- 6.7 DCIM

Chapter 7 Market Estimates & Forecast, By Data Center, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Enterprise data centers

- 7.3 colocation data centers

- 7.4 hyperscale data centers

- 7.5 edge data centers

Chapter 8 Market Estimates & Forecast, By Deployment, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Cloud

- 8.3 Hybrid

- 8.4 On-premises

Chapter 9 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Large Enterprise

- 9.3 SME

Chapter 10 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 BFSI

- 10.3 Colocation

- 10.4 Energy

- 10.5 Government

- 10.6 Healthcare

- 10.7 Manufacturing

- 10.8 IT & telecom

- 10.9 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 11.1 North America

- 11.1.1 US

- 11.1.2 Canada

- 11.2 Europe

- 11.2.1 UK

- 11.2.2 Germany

- 11.2.3 France

- 11.2.4 Italy

- 11.2.5 Spain

- 11.2.6 Belgium

- 11.2.7 Netherlands

- 11.2.8 Sweden

- 11.2.9 Russia

- 11.3 Asia Pacific

- 11.3.1 China

- 11.3.2 India

- 11.3.3 Japan

- 11.3.4 Australia

- 11.3.5 Singapore

- 11.3.6 South Korea

- 11.3.7 Vietnam

- 11.3.8 Indonesia

- 11.4 Latin America

- 11.4.1 Brazil

- 11.4.2 Mexico

- 11.4.3 Argentina

- 11.5 MEA

- 11.5.1 South Africa

- 11.5.2 Saudi Arabia

- 11.5.3 UAE

Chapter 12 Company Profiles

- 12.1 Global players

- 12.1.1 ABB

- 12.1.2 Cisco Systems

- 12.1.3 Dell Technologies

- 12.1.4 Eaton

- 12.1.5 Hewlett Packard Enterprise (HPE)

- 12.1.6 IBM

- 12.1.7 Lenovo

- 12.1.8 NetApp

- 12.1.9 Schneider Electric

- 12.1.10 Vertiv

- 12.2 Regional champions

- 12.2.1 Fujitsu

- 12.2.2 Huawei

- 12.2.3 Inspur

- 12.2.4 Legrand

- 12.2.5 Rittal

- 12.3 Emerging players & innovators

- 12.3.1 AMD

- 12.3.2 Arista Networks

- 12.3.3 Liquidstack

- 12.3.4 Micron

- 12.3.5 Pure Storage

- 12.3.6 Samsung Electronics

- 12.3.7 Seagate Technology

- 12.3.8 Super Micro Computer

- 12.3.9 Western Digital Corporation (WDC)

- 12.3.10 Wiwynn