|

市场调查报告书

商品编码

1885924

资料中心基础设施管理 (DCIM) 市场机会、成长驱动因素、产业趋势分析及预测(2025-2034 年)Data Center Infrastructure Management (DCIM) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

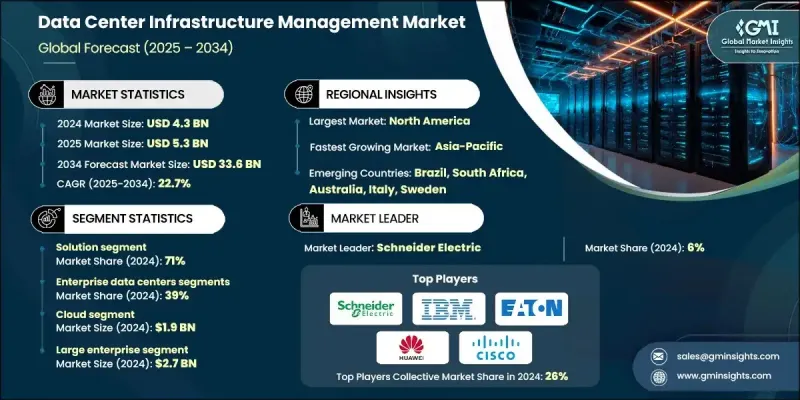

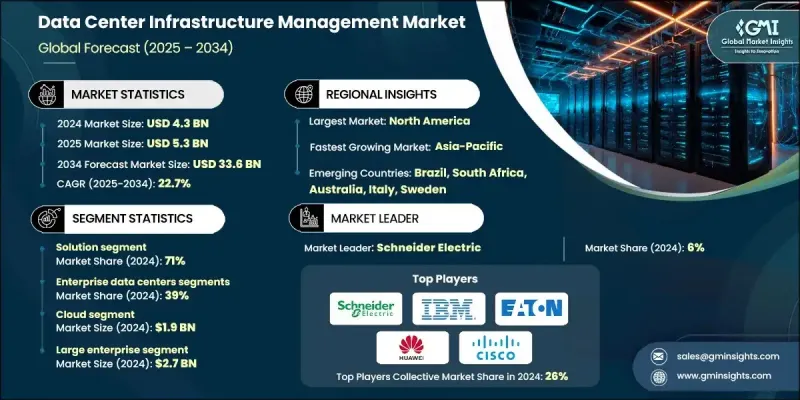

2024 年全球资料中心基础设施管理 (DCIM) 市场价值为 43 亿美元,预计到 2034 年将以 22.7% 的复合年增长率增长至 336 亿美元。

市场扩张的驱动力来自人工智慧工作负载的快速普及、混合云端的复杂性以及日益严格的能源效率法规。传统的容量规划正被人工智慧驱动的预测性维运、数位孪生模拟以及完全融合的IT和营运技术(OT)环境所取代。随着营运商寻求即时了解电力分配、热状况和冷却系统,以维持性能并避免停机,资料中心基础设施管理(DCIM)解决方案已变得不可或缺,尤其是在每个机架功率超过40千瓦的高密度人工智慧训练集群中。此外,全球企业、超大规模和託管资料中心对基础设施优化、永续性报告和成本效益型营运的需求不断增长,也推动了该市场的加速成长。人工智慧、机器学习和预测分析的整合正在重新定义营运管理,并确保现代资料中心环境具有更高的效率、弹性和可扩展性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 43亿美元 |

| 预测值 | 336亿美元 |

| 复合年增长率 | 22.7% |

解决方案板块在2024年占据71%的市场份额,预计2025年至2034年将以23.5%的复合年增长率成长。该板块涵盖资料中心基础设施管理(DCIM)软体平台、监控工具、分析引擎以及软硬体整合设备。现代DCIM解决方案的功能远不止监控,还能提供全面的资产管理、容量规划、预测性维护、数位孪生模拟、电力和冷却优化以及可持续性报告,使营运商能够获得可操作的基础设施洞察。

2024年,企业资料中心市占率达到39%,预计到2034年将以21.7%的复合年增长率成长。这些由企业内部拥有和营运的资料中心,由于其在全球范围内广泛分布于医疗保健、製造业、政府和金融服务等行业,占据了主导地位。不断提高的效率需求、降低成本的目标以及永续发展合规要求,正在推动企业采用资料中心基础设施管理(DCIM)解决方案。

2024年,美国资料中心基础设施管理(DCIM)市场规模达14.8亿美元。北美地区凭藉其高度集中的超大规模营运商、託管服务提供商和企业级资料中心,继续占据主导地位,其中美国贡献了该地区90%的收入。全球约60%的资料中心容量和45%的资料中心能耗都位于美国。美国市场的成长主要受电力消耗不断增长的驱动,这促使企业采用智慧管理解决方案来优化效率、监控能耗并降低营运成本。

全球资料中心基础设施管理 (DCIM) 市场的主要参与者包括伊顿、富士通、思科、施耐德电气、ABB、西门子、艾默生、惠普企业公司、IBM 公司和华为技术有限公司。这些企业正透过投资人工智慧驱动的预测分析、数位孪生建模和先进的监控工具来提升营运效率,从而巩固其市场地位。与超大规模营运商、企业客户和云端服务供应商的策略合作,使得企业能够针对复杂的 IT 和 OT 环境客製化解决方案。此外,各公司还在拓展新兴市场,并提供基于云端的 DCIM 平台,以提高可访问性和可扩展性。增强永续性功能、整合基于物联网的能源管理以及提供全方位维护服务合同,是企业在快速成长的行业中保持客户忠诚度、与竞争对手区分开来并巩固市场领导地位的关键策略。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 零件製造商

- 系统整合商和分销商

- 设施营运商和服务提供者

- 最终用户和企业

- 成本结构

- 利润率

- 每个阶段的价值增加

- 垂直整合趋势

- 颠覆者

- 供应商格局

- 对力的影响

- 成长驱动因素

- 高密度人工智慧和高效能运算工作负载的爆炸性成长

- 向混合云和多云基础设施转型

- 能源成本上涨与强制性能源效率法规

- 边缘资料中心激增

- 产业陷阱与挑战

- 前期整合和部署复杂性高

- 供应商生态系统分散和互通性问题

- 市场机会

- DCIM 2.0 采用

- OT+IT集成,实现全厂数位化孪生

- 成长驱动因素

- 技术趋势与创新生态系统

- 目前技术

- 人工智慧与机器学习

- 生成式人工智慧和大型语言模型

- 数位孪生技术

- 物联网 (IoT) 和边缘运算

- 新兴技术

- 区块链和分散式帐本技术

- 扩增实境(AR)和虚拟实境(VR)

- 量子计算

- 5G及下一代连结技术

- 目前技术

- 成长潜力分析

- 监管环境

- 数据主权和本地化要求

- 环境与永续发展法规

- 建筑规范与安全标准

- 区域监管比较

- 北美洲

- 欧洲

- 亚太

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 专利分析

- 成本細項分析

- 价格趋势

- 竞争性定价策略

- 软体许可价格范围

- 专业服务费率

- 供应商收入模式及策略

- 产品线及研发路线图

- 目前产品世代分析

- 功能集和效能基准测试

- 技术堆迭及架构

- 效能和可扩展性指标

- 优点与局限性

- 下一代产品研发管线

- 已公布的产品发布计划(2024-2026 年)

- Beta 和早期访问计划

- 技术预览与概念验证

- 预期功能增强

- 目前产品世代分析

- 专利分析

- 美国专利商标局专利分类分析

- 主要专利持有者和创新领导者

- 专利池和标准必要专利

- 新兴技术专利热点

- 永续性和环境方面

- 资料中心环境足迹

- 碳定价与排放交易机制

- DCIM在永续发展中的作用

- DCIM协助实现永续发展目标

- 市场采纳与渗透分析

- 技术采纳生命週期

- 采用障碍和促进因素

- 市场渗透率分析

- 客户决策历程

- 用例分析及应用场景

- 使用案例分类与分类

- 依资料中心类型

- 透过功能目标

- 按行业垂直领域

- 按部署规模

- 详细用例分析

- 能源效率优化

- 产能规划与预测

- 预测性维护和故障预防

- 多站点可见性与管理

- 使用案例分类与分类

- 客户和最终用户洞察

- 购买行为与决策过程

- 客户旅程图

- 客户满意度和净推荐值

- 客户痛点和未满足的需求

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太

- 拉丁美洲

- 中东和非洲

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

- 高端定位策略

- 竞争分析与独特卖点

第五章:市场估算与预测:依组件划分,2021-2034年

- 主要趋势

- 解决方案

- 资产管理

- 网管

- 冷却管理

- 电源和温度管理

- 其他的

- 服务

- 安装与集成

- 管理

- 咨询

第六章:市场估算与预测:依资料中心划分,2021-2034年

- 主要趋势

- 企业资料中心

- 託管资料中心

- 超大规模资料中心

- 边缘资料中心

第七章:市场估算与预测:依部署方式划分,2021-2034年

- 主要趋势

- 云

- 杂交种

- 现场

第八章:市场估算与预测:依组织规模划分,2021-2034年

- 主要趋势

- 大型企业

- 中小企业

第九章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- 金融服务业

- 託管

- 活力

- 政府

- 卫生保健

- 製造业

- 资讯科技与电信

- 其他的

第十章:市场估计与预测:依地区划分,2021-2034年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 比利时

- 荷兰

- 瑞典

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 新加坡

- 韩国

- 越南

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十一章:公司简介

- 全球参与者

- ABB

- Eaton

- FNT Software

- Hewlett-Packard Enterprise

- IBM

- Nlyte Software

- Schneider Electric

- Siemens

- Sunbird Software

- Regional champions

- CommScope

- Cormant

- Device42

- EkkoSense

- Emerson

- Fujitsu

- Huawei Technologies

- Hyperview

- Packet Power

- Rittal

- 新兴参与者与创新者

- Arista

- Cisco

- Inspur

- Lenovo

- Modius

- NetApp

- Supermicro

The Global Data Center Infrastructure Management (DCIM) Market was valued at USD 4.3 billion in 2024 and is estimated to grow at a CAGR of 22.7% to reach USD 33.6 billion by 2034.

The market expansion is driven by the rapid adoption of AI workloads, hybrid cloud complexities, and increasingly stringent energy efficiency regulations. Traditional capacity planning is giving way to AI-powered predictive operations, digital twin simulations, and fully converged IT and operational technology (OT) environments. DCIM solutions have become indispensable as operators seek real-time visibility into power distribution, thermal conditions, and cooling systems to maintain performance and avoid downtime, particularly in high-density AI training clusters exceeding 40 kW per rack. Accelerating growth in this market is also linked to the rising need for infrastructure optimization, sustainability reporting, and cost-effective operations across enterprise, hyperscale, and colocation data centers globally. The integration of AI, machine learning, and predictive analytics is redefining operational management and ensuring higher efficiency, resilience, and scalability for modern data center environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.3 Billion |

| Forecast Value | $33.6 Billion |

| CAGR | 22.7% |

The solutions segment held a 71% share in 2024 and is anticipated to grow at a CAGR of 23.5% from 2025 to 2034. This segment includes DCIM software platforms, monitoring tools, analytics engines, and integrated hardware-software appliances. Modern DCIM solutions extend beyond monitoring to provide comprehensive asset management, capacity planning, predictive maintenance, digital twin simulations, power and cooling optimization, and sustainability reporting, enabling operators to gain actionable insights across the infrastructure.

The enterprise data centers segment held a 39% share in 2024 and is expected to grow at a CAGR of 21.7% through 2034. These centers, owned and operated internally by organizations, dominate due to their global prevalence across sectors such as healthcare, manufacturing, government, and financial services. Increasing efficiency demands, cost reduction targets, and sustainability compliance requirements are driving enterprise adoption of DCIM solutions.

U.S. Data Center Infrastructure Management (DCIM) Market generated USD 1.48 billion in 2024. North America continues to dominate due to its high concentration of hyperscale operators, colocation providers, and enterprise data centers, with the U.S. accounting for 90% of regional revenue. Approximately 60% of global data center capacity and 45% of worldwide data center energy consumption are in the United States. The market in the U.S. is driven by rising electricity usage, which fuels the adoption of intelligent management solutions to optimize efficiency, monitor power consumption, and reduce operational costs.

Prominent players in the Global Data Center Infrastructure Management (DCIM) Market include Eaton, Fujitsu, Cisco, Schneider Electric, ABB, Siemens, Emerson, Hewlett-Packard Enterprise Company, IBM Corporation, and Huawei Technologies. Companies in the Data Center Infrastructure Management (DCIM) Market are strengthening their foothold by investing in AI-powered predictive analytics, digital twin modeling, and advanced monitoring tools to improve operational efficiency. Strategic collaborations with hyperscale operators, enterprise clients, and cloud providers allow customization of solutions for complex IT and OT environments. Firms are also expanding into emerging markets and offering cloud-enabled DCIM platforms to increase accessibility and scalability. Enhancing sustainability features, integrating IoT-based energy management, and providing full-service maintenance contracts are key strategies that help maintain customer loyalty, differentiate from competitors, and reinforce market leadership in a rapidly growing industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast

- 1.4 Primary research and validation

- 1.5 Some of the primary sources

- 1.6 Data mining sources

- 1.6.1 Secondary

- 1.6.1.1 Paid Sources

- 1.6.1.2 Public Sources

- 1.6.1.3 Sources, by region

- 1.6.1 Secondary

- 1.7 Inclusion & Exclusion

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Data Center

- 2.2.4 Deployment

- 2.2.5 Organization Size

- 2.2.6 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Component manufacturers

- 3.1.1.2 System integrators & distributors

- 3.1.1.3 Facility operators & service providers

- 3.1.1.4 End use & enterprises

- 3.1.2 Cost structure

- 3.1.3 Profit margin

- 3.1.4 Value addition at each stage

- 3.1.5 Vertical integration trends

- 3.1.6 Disruptors

- 3.1.1 Supplier landscape

- 3.2 Impact on forces

- 3.2.1 Growth drivers

- 3.2.1.1 Explosion of high-density AI & HPC workloads

- 3.2.1.2 Shift toward hybrid & multi-cloud infrastructure

- 3.2.1.3 Rising energy costs & mandatory efficiency regulations

- 3.2.1.4 Edge data center proliferation

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High upfront integration & deployment complexity

- 3.2.2.2 Fragmented vendor ecosystem & interoperability issues

- 3.2.3 Market opportunities

- 3.2.3.1 DCIM 2.0 adoption

- 3.2.3.2 Integration of OT + IT for full facility digital twins

- 3.2.1 Growth drivers

- 3.3 Technology trends & innovation ecosystem

- 3.3.1 Current technologies

- 3.3.1.1 Artificial intelligence & machine learning

- 3.3.1.2 Generative AI & large language models

- 3.3.1.3 Digital twin technology

- 3.3.1.4 Internet of things (IoT) & edge computing

- 3.3.2 Emerging technologies

- 3.3.2.1 Blockchain & distributed ledger technology

- 3.3.2.2 Augmented reality (AR) & virtual reality (VR)

- 3.3.2.3 Quantum computing

- 3.3.2.4 5G & next-generation connectivity

- 3.3.1 Current technologies

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 Data sovereignty & localization requirements

- 3.5.2 Environmental & sustainability regulations

- 3.5.3 Building codes & safety standards

- 3.5.4 Regional regulatory comparison

- 3.5.4.1 North America

- 3.5.4.2 Europe

- 3.5.4.3 Asia-Pacific

- 3.5.4.4 Latin America

- 3.5.4.5 Middle East & Africa

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Patent analysis

- 3.9 Cost breakdown analysis

- 3.10 Price trends

- 3.10.1 Competitive pricing strategies

- 3.10.2 Software licensing price ranges

- 3.10.3 Professional services rates

- 3.10.4 Vendor revenue models & strategies

- 3.11 Product pipeline & R&D roadmap

- 3.11.1 Current product generation analysis

- 3.11.1.1 Feature set & capabilities benchmarking

- 3.11.1.2 Technology stack & architecture

- 3.11.1.3 Performance & scalability metrics

- 3.11.1.4 Strengths & limitations

- 3.11.2 Next-generation product pipeline

- 3.11.2.1 Announced product releases (2024-2026)

- 3.11.2.2 Beta & early access programs

- 3.11.2.3 Technology previews & proof-of-concepts

- 3.11.2.4 Expected feature enhancements

- 3.11.1 Current product generation analysis

- 3.12 Patent analysis

- 3.12.1 USPTO patent classification analysis

- 3.12.2 Key patent holders & innovation leaders

- 3.12.3 Patent pools & standards-essential patents

- 3.12.4 Emerging technology patent hotspots

- 3.13 Sustainability and environmental aspects

- 3.13.1 Data center environmental footprint

- 3.13.2 Carbon pricing & emissions trading schemes

- 3.13.3 DCIM role in sustainability

- 3.13.4 DCIM-enabled sustainability achievements

- 3.14 Market adoption & penetration analysis

- 3.14.1 Technology adoption lifecycle

- 3.14.2 Adoption barriers & enablers

- 3.14.3 Market penetration analysis

- 3.14.4 Customer decision journey

- 3.15 Use case analysis & application scenarios

- 3.15.1 Use case taxonomy & classification

- 3.15.1.1 By data center type

- 3.15.1.2 By functional objective

- 3.15.1.3 By industry vertical

- 3.15.1.4 By deployment scale

- 3.15.2 Detailed use case analysis

- 3.15.2.1 Energy efficiency optimization

- 3.15.2.2 Capacity planning & forecasting

- 3.15.2.3 Predictive maintenance & failure prevention

- 3.15.2.4 Multi-site visibility & management

- 3.15.1 Use case taxonomy & classification

- 3.16 Customer & End use insights

- 3.16.1 Buying behavior & decision-making process

- 3.16.2 Customer journey mapping

- 3.16.3 Customer satisfaction & net promoter score

- 3.16.4 Customer pain points & unmet needs

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia-Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Key developments

- 4.5.1 Mergers & acquisitions

- 4.5.2 Partnerships & collaborations

- 4.5.3 New product launches

- 4.5.4 Expansion plans and funding

- 4.6 Premium positioning strategies

- 4.7 Competitive analysis and USPs

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Solutions

- 5.2.1 Asset management

- 5.2.2 Network management

- 5.2.3 Cooling management

- 5.2.4 Power and temperature management

- 5.2.5 Others

- 5.3 Services

- 5.3.1 Installation & integration

- 5.3.2 Managed

- 5.3.3 Consulting

Chapter 6 Market Estimates & Forecast, By Data Center, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Enterprise data centers

- 6.3 colocation data centers

- 6.4 hyperscale data centers

- 6.5 edge data centers

Chapter 7 Market Estimates & Forecast, By Deployment, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Cloud

- 7.3 Hybrid

- 7.4 On-premises

Chapter 8 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Large enterprise

- 8.3 SME

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 BFSI

- 9.3 Colocation

- 9.4 Energy

- 9.5 Government

- 9.6 Healthcare

- 9.7 Manufacturing

- 9.8 IT & telecom

- 9.9 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 North America

- 10.1.1 US

- 10.1.2 Canada

- 10.2 Europe

- 10.2.1 UK

- 10.2.2 Germany

- 10.2.3 France

- 10.2.4 Italy

- 10.2.5 Spain

- 10.2.6 Belgium

- 10.2.7 Netherlands

- 10.2.8 Sweden

- 10.2.9 Russia

- 10.3 Asia Pacific

- 10.3.1 China

- 10.3.2 India

- 10.3.3 Japan

- 10.3.4 Australia

- 10.3.5 Singapore

- 10.3.6 South Korea

- 10.3.7 Vietnam

- 10.3.8 Indonesia

- 10.4 Latin America

- 10.4.1 Brazil

- 10.4.2 Mexico

- 10.4.3 Argentina

- 10.5 MEA

- 10.5.1 South Africa

- 10.5.2 Saudi Arabia

- 10.5.3 UAE

Chapter 11 Company Profiles

- 11.1 Global players

- 11.1.1 ABB

- 11.1.2 Eaton

- 11.1.3 FNT Software

- 11.1.4 Hewlett-Packard Enterprise

- 11.1.5 IBM

- 11.1.6 Nlyte Software

- 11.1.7 Schneider Electric

- 11.1.8 Siemens

- 11.1.9 Sunbird Software

- 11.2 Regional champions

- 11.2.1 CommScope

- 11.2.2 Cormant

- 11.2.3 Device42

- 11.2.4 EkkoSense

- 11.2.5 Emerson

- 11.2.6 Fujitsu

- 11.2.7 Huawei Technologies

- 11.2.8 Hyperview

- 11.2.9 Packet Power

- 11.2.10 Rittal

- 11.3 Emerging players & innovators

- 11.3.1 Arista

- 11.3.2 Cisco

- 11.3.3 Inspur

- 11.3.4 Lenovo

- 11.3.5 Modius

- 11.3.6 NetApp

- 11.3.7 Supermicro