|

市场调查报告书

商品编码

1885923

舷外船市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Outboard Boats Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

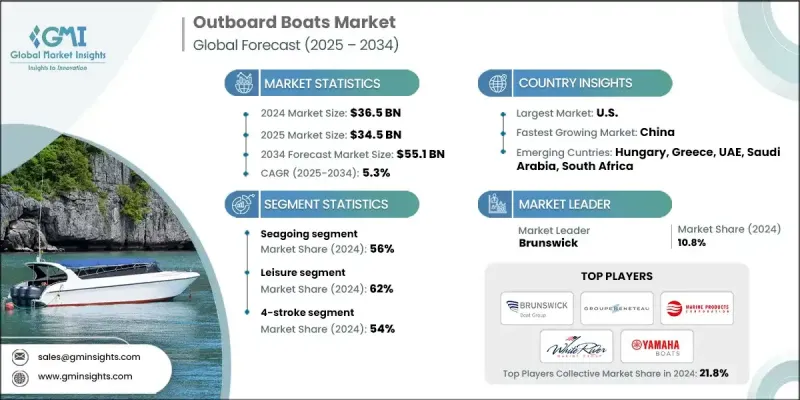

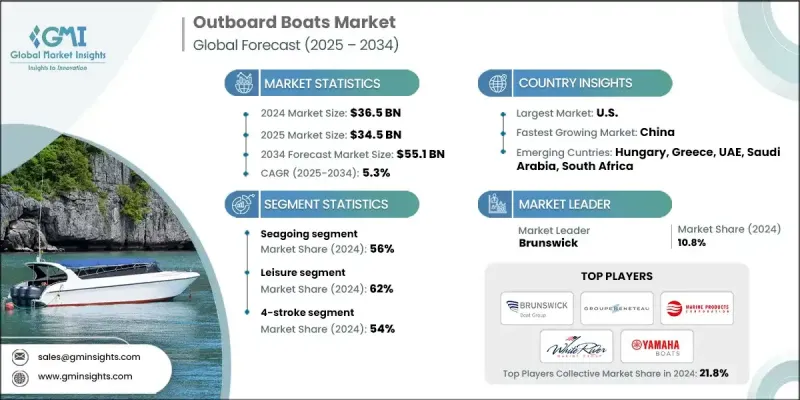

2024 年全球舷外船艇市场价值为 365 亿美元,预计到 2034 年将以 5.3% 的复合年增长率增长至 551 亿美元。

沿海和内陆地区休閒划船和水上运动参与度的不断提高,持续支撑着对高性能引擎的需求。消费者在休閒活动上的支出不断增长、码头网络的扩张以及旅游业的稳步发展,都显着推动了预测期内的市场成长动能。轻量化、燃油效率高、低排放引擎技术的进步,进一步促进了其在休閒和商业领域的应用。监管机构对清洁推进系统的推动,促使人们对四衝程和燃油直喷引擎产生浓厚兴趣,这些引擎正日益被视为可靠的长期解决方案。沿海运输活动、小型渔业和水产养殖业的蓬勃发展,也强化了对能够支持连续运作的可靠舷外机的需求。对沿海基础设施的持续投资,以及向混合动力和电动推进系统的快速转型,预计将在未来十年为製造商创造巨大的成长机会。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 365亿美元 |

| 预测值 | 551亿美元 |

| 复合年增长率 | 5.3% |

2024年,远洋船舶市场占比达56%,预计2025年至2034年将以5.9%的复合年增长率成长。推动这一成长的因素包括沿海旅游、近海旅行和海洋休閒活动的日益普及,这些活动都需要强劲且经久耐用的引擎。此外,由于远洋船舶在严苛的海洋环境中展现出高效性和高可靠性,其在沿海运输、巡逻船队和救援行动中的重要性也日益凸显。

2024年,休閒类产品市占率达62%,预计2025年至2034年间将以5%的复合年增长率成长。人们对休閒巡航、家庭出游和週末水上运动的兴趣日益浓厚,持续推动中小型舷外机的销售成长。可支配收入的增加、城市化生活方式的普及以及人们参与水上活动的增多,进一步刺激了市场需求。政府和私营部门对码头、海滨度假村和游艇俱乐部的投资,也有助于加速休閒游艇产业的长期发展。

美国舷外机船艇市场占86%的市场份额,预计2024年市场规模将达35.7亿美元。美国浓厚的航海文化,得益于广泛的码头建设和消费者的高支出,持续推高了舷外机的需求。个人水上摩托车、渔船和休閒船艇仍然是市场持续成长的主要驱动力。美国领先的製造商正不断推出先进的四衝程发动机和数位化增强型发动机,这些发动机具有排放更低、燃油经济性更高、性能更平稳等优点。

参与舷外机船艇市场的主要公司包括 Brunswick、Cox Powertrain、Hidea Power、Honda、Oxe Marine、Parsun Power Machine、Suzuki Motor、Tohatsu、Volvo Penta 和 Yamaha。这些公司正透过拓展其燃油效率高、低排放和数位化控制的推进系统产品组合,来增强自身的竞争优势。许多公司正大力投资混合动力和电动舷外机技术,以满足未来的环保标准和不断变化的客户需求。与船舶製造商、码头营运商和技术公司建立策略合作伙伴关係,有助于实现下一代推进系统的无缝整合。此外,各公司也正在优化全球服务网络,以提升维护支援并增强客户忠诚度。持续的研发投入专注于减轻引擎重量、提高功率输出以及增强其在各种船舶应用中的耐用性。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基准估算和计算

- 基准年计算

- 市场估算的关键趋势

- 初步研究和验证

- 原始资料

- 预测模型

- 研究假设和局限性

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 休閒划船和休閒旅游的兴起

- 舷外机的技术进步

- 沿海和内陆水利基础设施的扩建

- 对轻型拖车船的需求日益增长

- OEM合作伙伴关係和产品多元化

- 产业陷阱与挑战

- 高昂的初始成本和维修成本

- 季节性使用和气候限制

- 环境法规

- 电动船充电基础设施有限

- 市场机会

- 亚太地区休閒海洋产业的成长

- 电气化和混合动力推进系统

- 租赁和共享平台的扩张

- 售后服务和客製化

- 市场挑战

- 电动舷外机电池续航里程限制

- 来自舷内机和舷外机替代方案的竞争

- 复杂的跨司法管辖区监理合规

- 供应链中断和零件短缺

- 成长驱动因素

- 成长潜力分析

- 主要市场趋势和颠覆性因素

- 未来市场趋势

- 监管环境

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 目前技术

- 先进燃油喷射系统

- 用于海水环境的耐腐蚀材料

- 数位引擎监控与智慧控制

- 新兴技术

- 电动和混合动力舷外推进系统

- 轻质复合材料

- 模组化手提式电源装置

- 联网舷外机(物联网整合)

- 目前技术

- 专利分析

- 生产统计

- 生产中心

- 消费中心

- 进出口

- 价格趋势

- 按地区

- 透过推进

- 定价分析与价值链经济学

- 按马力分類的舷外机价格趋势

- 高马力车型的溢价策略

- 成本结构细分

- 区域价格敏感性

- 成本細項分析

- 组件级成本结构分析

- 製造成本驱动因素和最佳化

- 区域成本差异及其对竞争的影响

- 成本管理策略与竞争定位

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

- 全球贸易与进出口分析

- 按区域导入相依性

- 贸易法规和关税的影响

- 产品生命週期分析

- 舷外机船生命週期阶段

- 舷外机生命週期分析

- 维护计划和服务要求

- 关键产业缺口及公司因应策略

- 已识别的关键差距

- 电动舷外机续航里程及充电基础设施有限

- 合格船舶技术人员短缺

- 智慧船舶技术缺乏标准化

- 报废船舶处置及回收基础设施

- 公司因应策略

- 电力推进领导伙伴关係

- 培训计画及服务网拓展

- 充电基础设施的合作

- 回收利用计划

- 已识别的关键差距

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

- 高端定位策略

- 策略性OEM合作伙伴机会

- 技术标准和认证要求

- 策略市场机会

第五章:市场估算与预测:依水路划分,2021-2034年

- 主要趋势

- 远洋

- 閒暇

- 货物运输

- 人员运输

- 钓鱼

- 政府用途

- 内陆

- 閒暇

- 货物运输

- 人员运输

- 钓鱼

- 政府用途

第六章:市场估算与预测:依应用领域划分,2021-2034年

- 閒暇

- 货物运输

- 人员运输

- 钓鱼

- 政府用途

第七章:市场估算与预测:以推进方式划分,2021-2034年

- 主要趋势

- 汽油

- 柴油引擎

- 电的

第八章:市场估算与预测:依引擎类型划分,2021-2034年

- 主要趋势

- 二衝程

- 四衝程

- 电的

第九章:市场估计与预测:依马力划分,2021-2034年

- 主要趋势

- 低于200马力

- 201至500马力

- 501至1000马力

- 超过1000马力

第十章:市场估价与预测:依船舶划分,2021-2034年

- 主要趋势

- 中央控制台

- 快艇

- 浮桥

- 快艇弓形艇

- 其他的

第十一章:市场估计与预测:按地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧

- 匈牙利

- 希腊

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十二章:公司简介

- 全球参与者

- Bennington Marine

- Brunswick

- Grady-White Boats

- Malibu Boats

- White River Marine

- Regional Champions

- Albemarle Boats

- Blackfin Boats

- Boston Whaler

- Carolina Skiff

- Contender Boats

- Everglades Boats

- Fountain Powerboats

- NauticStar Boats

- Pathfinder Boats

- Robalo Boats

- Sailfish Boats

- Scout Boats

- Sea Fox Boats

- Sea Hunt Boats

- Tidewater Boats

- Wellcraft Boats

- World Cat

- 新兴参与者和颠覆者

- Avalon Pontoons

- Barletta Pontoon Boats

- Harris Pontoons

- Lowe Boats

- Manitou Pontoons

- Premier Pontoons

- Ranger Boats

- Tracker Boats

The Global Outboard Boats Market was valued at USD 36.5 billion in 2024 and is estimated to grow at a CAGR of 5.3% to reach USD 55.1 billion by 2034.

Increasing participation in recreational boating and water sports across coastal and inland regions continues to support demand for high-performance engines. Rising consumer spending on leisure activities, expansion of marina networks, and the steady growth of tourism contribute significantly to market momentum throughout the forecast period. Advancements in lightweight, fuel-efficient, and low-emission engine technology are further strengthening adoption across both recreational and commercial sectors. Regulatory pressure favoring cleaner propulsion systems is driving interest in four-stroke and direct fuel injection engines, which are increasingly viewed as reliable, long-term solutions. Expanding coastal transport activities, artisanal fishing, and aquaculture development are also reinforcing the need for dependable outboard engines capable of supporting continuous operations. Ongoing investments in coastal infrastructure, paired with the rapid transition toward hybrid and electric propulsion, are expected to create substantial growth opportunities for manufacturers over the coming decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $36.5 Billion |

| Forecast Value | $55.1 Billion |

| CAGR | 5.3% |

The seagoing segment accounted for a 56% share in 2024 and is anticipated to grow at a CAGR of 5.9% from 2025 to 2034. Demand is being driven by rising interest in coastal tourism, offshore travel, and marine recreation, all of which require powerful and durable engines. The seagoing category is also gaining importance within coastal transport, patrol fleets, and rescue operations due to its efficiency and high reliability in demanding maritime environments.

The leisure category segment held a 62% share in 2024 and is forecast to grow at a CAGR of 5% between 2025 and 2034. Growing interest in recreational cruising, family outings, and weekend marine sports continues to increase sales of small and mid-range outboard engines. Higher disposable incomes, urbanized lifestyles, and greater participation in marine activities are further stimulating demand. Government and private-sector investments in marinas, waterfront resorts, and boating clubs are helping accelerate the long-term expansion of the leisure boating sector.

U.S. Outboard Boats Market held 86% share, generating USD 3.57 billion in 2024. The strong boating culture in the country, supported by widespread marina development and high consumer spending, continues to elevate demand for outboard engines. Personal watercraft, fishing boats, and recreational vessels remain key contributors to ongoing sales. Leading U.S. manufacturers are increasingly introducing advanced four-stroke and digitally enhanced engines that offer reduced emissions, improved fuel economy, and smoother performance.

Major companies participating in the Outboard Boats Market include Brunswick, Cox Powertrain, Hidea Power, Honda, Oxe Marine, Parsun Power Machine, Suzuki Motor, Tohatsu, Volvo Penta, and Yamaha. Companies in the Outboard Boats Market are strengthening their competitive edge by expanding their portfolios of fuel-efficient, low-emission, and digitally controlled propulsion systems. Many are investing heavily in hybrid and electric outboard technologies to meet future environmental standards and evolving customer preferences. Strategic partnerships with boat manufacturers, marina operators, and technology firms enable seamless integration of next-generation propulsion systems. Firms are also optimizing global service networks to improve maintenance support and enhance customer loyalty. Continuous R&D investments focus on reducing engine weight, boosting power output, and improving durability for varied marine applications.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Waterways

- 2.2.3 Application

- 2.2.4 Propulsion

- 2.2.5 Engine

- 2.2.6 Horsepower

- 2.2.7 Boat

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook

- 2.6 Strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise in recreational boating and leisure tourism

- 3.2.1.2 Technological advancements in outboard engines

- 3.2.1.3 Expansion of coastal and inland water infrastructure

- 3.2.1.4 Growing demand for lightweight, trailer boats

- 3.2.1.5 OEM partnerships and product diversification

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial and maintenance costs

- 3.2.2.2 Seasonal usage and climatic limitations

- 3.2.2.3 Environmental regulations

- 3.2.2.4 Limited charging infrastructure for electric boats

- 3.2.3 Market opportunities

- 3.2.3.1 Growth in Asia Pacific recreational marine sector

- 3.2.3.2 Electrification and hybrid propulsion systems

- 3.2.3.3 Expansion of rental and sharing platforms

- 3.2.3.4 Aftermarket services and customization

- 3.2.4 Market Challenges

- 3.2.4.1 Battery Range Limitations for Electric Outboards

- 3.2.4.2 Competition from Inboard & Stern-Drive Alternatives

- 3.2.4.3 Complex Multi-Jurisdictional Regulatory Compliance

- 3.2.4.4 Supply Chain Disruptions & Component Shortages

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Major market trends and disruptions

- 3.5 Future market trends

- 3.6 Regulatory landscape

- 3.6.1 North America

- 3.6.2 Europe

- 3.6.3 Asia Pacific

- 3.6.4 Latin America

- 3.6.5 MEA

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Technology and innovation landscape

- 3.9.1 Current Technologies

- 3.9.1.1 Advanced Fuel Injection Systems

- 3.9.1.2 Corrosion-Resistant Materials for Saltwater Use

- 3.9.1.3 Digital Engine Monitoring & Smart Controls

- 3.9.2 Emerging Technologies

- 3.9.2.1 Electric & Hybrid Outboard Propulsion

- 3.9.2.2 Lightweight Composite Materials

- 3.9.2.3 Modular & Portable Power Units

- 3.9.2.4 Connected Outboards (IoT Integration)

- 3.9.1 Current Technologies

- 3.10 Patent analysis

- 3.11 Production statistics

- 3.11.1 Production hubs

- 3.11.2 Consumption hubs

- 3.11.3 Export and import

- 3.12 Price trends

- 3.12.1 By region

- 3.12.2 By propulsion

- 3.13 Pricing analysis and value chain economics

- 3.13.1 Outboard pricing trends by hp segment

- 3.13.2 Premium pricing strategies in high-hp models

- 3.13.3 Cost structure breakdown

- 3.13.4 Regional price sensitivity

- 3.14 Cost breakdown analysis

- 3.14.1 Component-level cost structure analysis

- 3.14.2 Manufacturing cost drivers and optimization

- 3.14.3 Regional cost variations and competitive implications

- 3.14.4 Cost management strategies and competitive positioning

- 3.15 Sustainability and environmental aspects

- 3.15.1 Sustainable practices

- 3.15.2 Waste reduction strategies

- 3.15.3 Energy efficiency in production

- 3.15.4 Eco-friendly initiatives

- 3.15.5 Carbon footprint considerations

- 3.16 Global trade and import/export analysis

- 3.16.1 Import dependencies by region

- 3.16.2 Trade regulations and tariff impact

- 3.17 Product lifecycle analysis

- 3.17.1 Outboard boat lifecycle stages

- 3.17.2 Outboard engine lifecycle analysis

- 3.17.3 Maintenance schedules & service requirements

- 3.18 Critical industry gaps & company response strategies

- 3.18.1 Identified critical gaps

- 3.18.1.1 Limited electric outboard range & charging infrastructure

- 3.18.1.2 Shortage of certified marine technicians

- 3.18.1.3 Lack of standardization in smart boat technology

- 3.18.1.4 End-of-life boat disposal & recycling infrastructure

- 3.18.2 Company response strategies

- 3.18.2.1 Partnership for electric propulsion leadership

- 3.18.2.2 Training programs & service network expansion

- 3.18.2.3 Collaboration on charging infrastructure

- 3.18.2.4 Recycling initiatives

- 3.18.1 Identified critical gaps

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

- 4.7 Premium Positioning Strategies

- 4.8 Strategic OEM Partnership Opportunities

- 4.9 Technical Standards and Certification Requirements

- 4.10 Strategic Market Opportunities

Chapter 5 Market Estimates & Forecast, By Waterways, 2021 - 2034 ($Bn, Units, Fleet Size)

- 5.1 Key trends

- 5.2 Seagoing

- 5.2.1 Leisure

- 5.2.2 Transport Of goods

- 5.2.3 Transport Of people

- 5.2.4 Fishing

- 5.2.5 Government use

- 5.3 Inland

- 5.3.1 Leisure

- 5.3.2 Transport Of goods

- 5.3.3 Transport Of people

- 5.3.4 Fishing

- 5.3.5 Government use

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units, Fleet Size)

- 6.1 Leisure

- 6.2 Transport Of goods

- 6.3 Transport Of people

- 6.4 Fishing

- 6.5 Government use

Chapter 7 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units, Fleet Size)

- 7.1 Key trends

- 7.2 Gasoline

- 7.3 Diesel

- 7.4 Electric

Chapter 8 Market Estimates & Forecast, By Engine, 2021 - 2034 ($Bn, Units, Fleet Size)

- 8.1 Key trends

- 8.2 2-stroke

- 8.3 4-stroke

- 8.4 Electric

Chapter 9 Market Estimates & Forecast, By Horsepower, 2021 - 2034 ($Bn, Units, Fleet Size)

- 9.1 Key trends

- 9.2 Below 200 hp

- 9.3 201 to 500 hp

- 9.4 501 to 1000 hp

- 9.5 Above 1000 hp

Chapter 10 Market Estimates & Forecast, By Boat, 2021 - 2034 ($Bn, Units, Fleet Size)

- 10.1 Key trends

- 10.2 Center console

- 10.3 Express cruiser

- 10.4 Pontoon

- 10.5 Runabout bowrider

- 10.6 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 ($Bn, Units, Fleet Size)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.3.8 Hungary

- 11.3.9 Greece

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 ANZ

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Global Players

- 12.1.1 Bennington Marine

- 12.1.2 Brunswick

- 12.1.3 Grady-White Boats

- 12.1.4 Malibu Boats

- 12.1.5 White River Marine

- 12.2 Regional Champions

- 12.2.1 Albemarle Boats

- 12.2.2 Blackfin Boats

- 12.2.3 Boston Whaler

- 12.2.4 Carolina Skiff

- 12.2.5 Contender Boats

- 12.2.6 Everglades Boats

- 12.2.7 Fountain Powerboats

- 12.2.8 NauticStar Boats

- 12.2.9 Pathfinder Boats

- 12.2.10 Robalo Boats

- 12.2.11 Sailfish Boats

- 12.2.12 Scout Boats

- 12.2.13 Sea Fox Boats

- 12.2.14 Sea Hunt Boats

- 12.2.15 Tidewater Boats

- 12.2.16 Wellcraft Boats

- 12.2.17 World Cat

- 12.3 Emerging Players & Disruptors

- 12.3.1 Avalon Pontoons

- 12.3.2 Barletta Pontoon Boats

- 12.3.3 Harris Pontoons

- 12.3.4 Lowe Boats

- 12.3.5 Manitou Pontoons

- 12.3.6 Premier Pontoons

- 12.3.7 Ranger Boats

- 12.3.8 Tracker Boats