|

市场调查报告书

商品编码

1892663

直流马达市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)DC Motor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

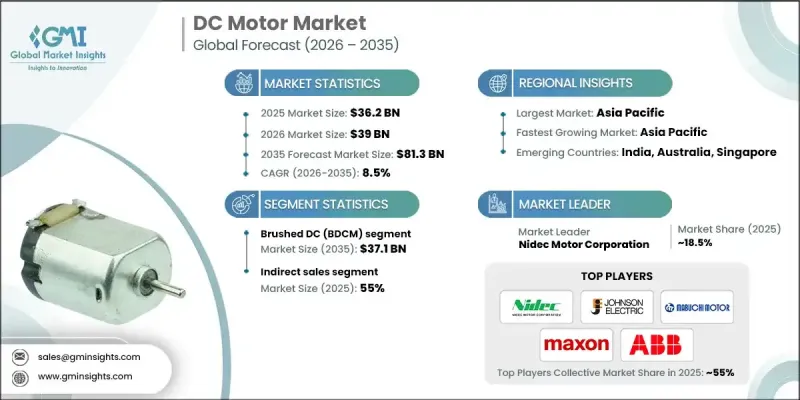

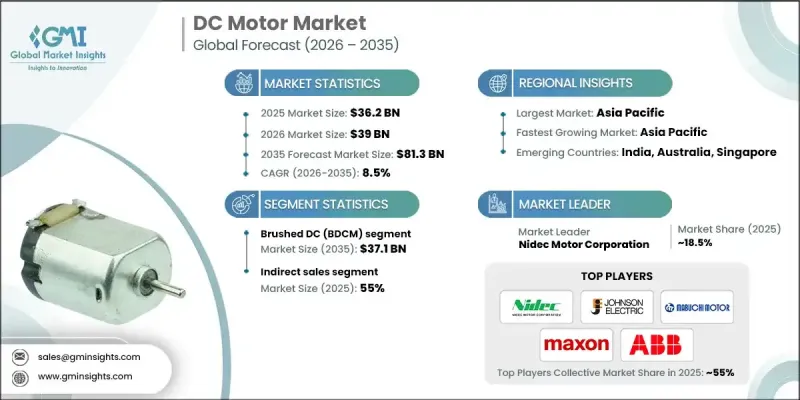

2025年全球直流马达市值为362亿美元,预计到2035年将以8.5%的复合年增长率成长至813亿美元。

随着监管压力、环保意识的增强以及技术的不断进步,电动车市场正在重塑整个产业格局,加速电动车的普及。电动汽车零件生产成本的降低以及对低速高扭矩、高效控制马达的强劲需求,推动了有刷和无刷直流马达在动力系统中的应用。充电网路和电池系统的持续进步进一步刺激了市场需求。工业自动化也成为直流马达成长的主要驱动力,因为这些马达是多个产业自动化机械的核心运作部件。直流马达精确的调速性能以及与数位控制系统的无缝集成,使其成为对精度和适应性要求较高的应用的首选。机器人系统、先进搬运设备和精密工具的日益普及,凸显了直流马达在维持产品品质和生产效率方面的关键作用。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 362亿美元 |

| 预测值 | 813亿美元 |

| 复合年增长率 | 8.5% |

2025年,有刷直流马达(BDCM)市场规模达203亿美元,预计2035年将成长至371亿美元。由于其设计简洁、结构经济高效且製造流程简单,该细分市场在消费性电子领域仍占有重要地位。其机械换向系统使得产品易于製造商生产和维护,同时买家所需的初始投资也有限。这些优势使得有刷直流马达在那些价格因素比性能要求更为重要的市场中成为极具吸引力的选择。

到2025年,间接销售通路的销售额将达到199亿美元,占总销售额的55%。透过第三方供应商、经销商和区域分销商等合作伙伴进行间接分销,能够为企业提供更广泛的市场准入和更快捷的交付能力。关键产业内完善的网路使製造商无需建造庞大的内部销售基础设施即可更有效率地扩大规模。预计在发展中地区,经销商拥有丰富的本地经验,能够简化产品部署和客户服务流程,因此该通路将进一步拓展。

2025年美国直流马达市场规模达54亿美元,预计2026年至2035年将以7.7%的复合年增长率成长。美国电动车市场份额的持续成长(从2011年的0.2%成长至2021年的4.6%)为电动车系统中使用的直流马达带来了持续的成长动力。政府支持的旨在2030年部署数百万辆电动车和充电站的基础设施计画预计将进一步刺激市场需求。随着移动出行平台投资的增加,用于传动系统部件、冷却装置、水泵和辅助系统的直流马达预计将迎来显着的市场扩张,使美国成为移动出行领域直流马达应用成长最快的地区之一。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 机会

- 成长潜力分析

- 未来市场趋势

- 监理框架

- 按地区

- 波特五力分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 产品组合基准测试

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依马达类型划分 2022-2035 年

- 有刷直流马达(BDCM)

- 无刷直流电(BLDC)

第六章:市场估算与预测:依功率等级划分,2022-2035年

- 6.2. 微型马达(< 1W)

- 6.3. 小功率马达(1W - 750W)

- 6.4. 整体式马力马达(750W - 75 kW)

- 6.5. 大型马达(>75 kW)

第七章:市场估算与预测:依最终用途产业划分,2022-2035年

- 汽车

- 机器人技术

- 消费性电子和家电

- 工业自动化和製造

- 医疗器材和医疗保健

- 暖通空调和楼宇自动化

- 航太与国防

- 农业和建筑业

- 海洋与造船

- 其他的

第八章:市场估算与预测:依配销通路划分,2022-2035年

- 直销

- 间接销售

第九章:市场估计与预测:依地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十章:公司简介

- ABB

- AMETEK

- Allied Motion, Inc.

- ARC Systems Inc

- Continental AG

- DENSO Corporation

- Dunkermotoren GmbH

- Johnson Electric Holdings Limited.

- Mabuchi Motor

- Maxon Motor

- Minebea Mitsumi

- Nidec Motor Corporation

- ORIENTAL MOTOR CORP

- Robert Bosch

- Zhejiang Songtian Automotive Motor System Co., Ltd

The Global DC Motor Market was valued at USD 36.2 billion in 2025 and is estimated to grow at a CAGR of 8.5% to reach USD 81.3 billion by 2035.

The expanding electric vehicle landscape is reshaping the industry as regulatory pressures, rising environmental awareness, and steady technological improvements continue to accelerate EV adoption. Lower production costs for EV components and the strong need for high-torque, efficiently controlled motors at low speeds have increased the use of both brushed and brushless DC motors in propulsion systems. Ongoing advancements in charging networks and battery systems are further boosting demand. Industrial automation is also becoming a major contributor to DC motor growth, as these motors act as the operational core for automated machinery across multiple sectors. Their precise speed regulation and seamless integration with digital control systems make them the preferred choice for applications that require accuracy and adaptable performance. The growing utilization of robotic systems, advanced handling equipment, and precision tools highlights the essential role DC motors play in maintaining production quality and throughput.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $36.2 Billion |

| Forecast Value | $81.3 Billion |

| CAGR | 8.5% |

The brushed DC (BDCM) category reached USD 20.3 billion in 2025 and is forecast to rise to USD 37.1 billion by 2035. This segment remains influential across consumer electronics due to its straightforward design, cost-effective structure, and reduced manufacturing complexity. Their mechanical commutation systems allow for a product that is easy for manufacturers to produce and maintain, while also requiring limited initial investment from buyers. These attributes make BDCMs an appealing option in markets where pricing considerations outweigh enhanced performance requirements.

The indirect sales channel generated USD 19.9 billion in 2025, accounting for a 55% share. Indirect distribution through partners such as third-party vendors, dealers, and regional distributors provides companies with broader market access and faster delivery capabilities. Well-established networks within key sectors enable manufacturers to scale more efficiently without building extensive in-house sales infrastructures. This channel is expected to expand in developing regions where distributors possess strong local insight and can streamline product deployment and customer service.

U.S. DC Motor Market was valued at USD 5.4 billion in 2025 and is projected to achieve a CAGR of 7.7% from 2026 to 2035. The rising share of electric vehicles in the U.S., increasing from 0.2% in 2011 to 4.6% in 2021, has created consistent momentum for DC motors used in EV systems. Government-backed infrastructure plans aiming to deploy millions of EVs and charging stations by 2030 are expected to intensify demand. As investment increases across mobility platforms, DC motors used in drivetrain components, cooling units, pumps, and auxiliary systems are expected to see significant market expansion, positioning the U.S. as one of the fastest-growing regions for mobility-focused DC motor applications.

Key companies in the Global DC Motor Market include ABB, AMETEK, Allied Motion, Inc., ARC Systems Inc., Continental AG, DENSO Corporation, Dunkermotoren GmbH, Johnson Electric Holdings Limited, Mabuchi Motor, Maxon Motor, Minebea Mitsumi, Nidec Motor Corporation, ORIENTAL MOTOR CORP, Robert Bosch, and Zhejiang Songtian Automotive Motor System Co., Ltd. Companies competing in the Global DC Motor Market are implementing several strategies to strengthen their overall position. Many are investing in advanced motor design to enhance torque density, energy efficiency, and digital compatibility, supporting the shift toward automation and electrified mobility. Firms are also expanding manufacturing capacity and regional production hubs to meet rising global demand while reducing lead times. Strategic collaborations with EV manufacturers, industrial automation firms, and system integrators are helping companies secure long-term supply agreements. Organizations are diversifying product portfolios to serve emerging applications, while also adopting sustainability-driven practices to align with environmental regulations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Motor type trends

- 2.2.3 Power rating trends

- 2.2.4 End use industry trends

- 2.2.5 Distribution channel trends

- 2.3 CXO perspective: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

- 2.5 Strategic recommendations

- 2.5.1 Supply chain diversification strategy

- 2.5.2 Product portfolio enhancement

- 2.5.3 Partnership and alliance opportunities

- 2.5.4 Cost management and pricing strategy

- 2.6 Decision framework

- 2.6.1 Investment priority matrix

- 2.6.2 ROI analysis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Regulatory framework

- 3.5.1 By region

- 3.6 Porter's five forces analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Product portfolio benchmarking

- 4.7 Key developments

- 4.7.1 Mergers & acquisitions

- 4.7.2 Partnerships & collaborations

- 4.7.3 New Product Launches

- 4.7.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Motor Type 2022 - 2035 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Brushed DC (BDCM)

- 5.3 Brushless DC (BLDC)

Chapter 6 Market Estimates & Forecast, By Power Rating, 2022 - 2035 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Micro Motors (< 1W)

- 6.3 Fractional HP Motors (1W - 750W)

- 6.4 Integral HP Motors (750W - 75 kW)

- 6.5 Large Motors (>75 kW)

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2022 - 2035 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Automotive

- 7.3 Robotics

- 7.4 Consumer Electronics and Appliance

- 7.5 Industrial Automation and Manufacturing

- 7.6 Medical Devices and Healthcare

- 7.7 HVAC and Building Automation

- 7.8 Aerospace and Defense

- 7.9 Agriculture and Construction

- 7.10 Marine and Shipbuilding

- 7.11 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Direct Sales

- 8.3 Indirect Sales

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 U.K.

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 10.1 ABB

- 10.2 AMETEK

- 10.3 Allied Motion, Inc.

- 10.4 ARC Systems Inc

- 10.5 Continental AG

- 10.6 DENSO Corporation

- 10.7 Dunkermotoren GmbH

- 10.8 Johnson Electric Holdings Limited.

- 10.9 Mabuchi Motor

- 10.10 Maxon Motor

- 10.11 Minebea Mitsumi

- 10.12 Nidec Motor Corporation

- 10.13 ORIENTAL MOTOR CORP

- 10.14 Robert Bosch

- 10.15 Zhejiang Songtian Automotive Motor System Co., Ltd