|

市场调查报告书

商品编码

1911458

直流马达:市场份额分析、行业趋势和统计数据、成长预测(2026-2031 年)Direct Current (DC) Motor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

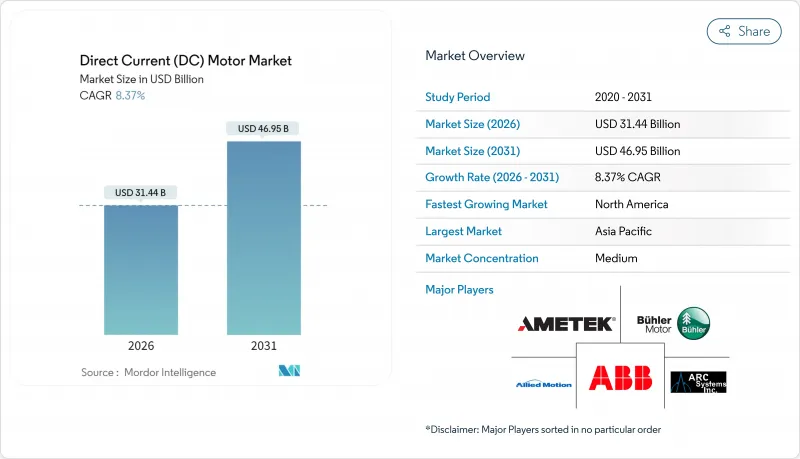

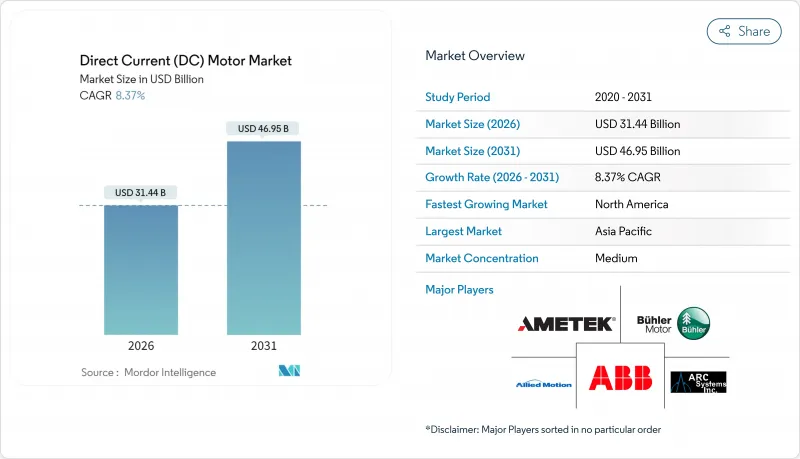

预计到2026年,直流马达市场规模将达到314.4亿美元,高于2025年的290.1亿美元。预计到2031年,该市场规模将达到469.5亿美元,2026年至2031年的复合年增长率为8.37%。

DC马达市场的强劲成长得益于电动车的广泛普及、工业4.0自动化以及可再生能源的日益普及。无刷直流马达(BLDC)因其维护成本更低、效率更高以及支援智慧控制功能等优势,正在逐步取代有刷马达。製造商正在尝试使用铁氧体替代材料来控製成本,同时加强其稀土元素磁铁供应链。对48V汽车系统、物联网驱动的预测性维护以及用于风能和太阳能追踪系统的高功率驱动装置的策略性投资,正在推动直流马达市场的发展。亚太地区凭藉其集中的製造业和政策支持,在DC马达市场占据主导地位;而南美洲则凭藉公用事业规模的太阳能和风能发电设施,实现了最快的收入增长。

全球直流马达市场趋势与洞察

加速推广电动车

随着电池式电动车和混合动力汽车产量的快速增长,DC马达的需求正在转变,牵引、温度控管和辅助系统正逐步向无刷直流马达(BLDC)设计过渡,以实现更精确的扭矩控制和高功率密度。特斯拉的永磁马达策略已展现成本和效率优势,促使各大汽车製造商纷纷效法。欧洲的碳减排法规正在加速这一转型,而中国则透过对整合马达和传动系统的补贴来增强国内产能。稀土资源供应仍然是一个令人担忧的问题,但比亚迪的垂直整合以及美国《通膨控制法案》下的供应激励计画缓解了短期风险。这些因素共同推动DC马达市场快速电气化。

向节能型工业自动化转型

拥抱工业4.0的製造商正在投资智慧型直流驱动器,这些驱动器可将运作中健康数据传输到工厂云端。在西门子MindSphere部署方案中,无刷直流马达将振动和温度资料传输到预测性维护演算法,将计划外停机时间减少高达30%。 ABB的改装智慧感测器扩大了可覆盖的安装基数,并实现了超越新设备销售的全生命週期优化。亚洲不断上涨的人事费用,加上欧盟排放严格的排放法规,进一步强化了这些价值提案。同时,IEC 62443等网路安全标准要求韧体从设计之初就具备安全性。随着工厂向无人营运转型,直流马达市场受益于许多交流电机所不具备的精细控制优势。

与交流感应马达相比,初始成本较高

直流马达解决方案的购置成本通常比同类交流感应马达高出15%至30%,这在资金预算紧张的环境中难以推广应用。新兴经济体的中小型企业优先考虑短期融资,而两年的投资回收期阻碍了许多无刷直流马达改造计划。儘管供应商推出了与节能检验挂钩的月租模式,但这些模式依赖可靠的智慧电錶数据和长期合同,这引起了部分客户的抵触情绪。经济放缓加剧了客户的犹豫不决,也成为限制直流马达市场扩张的最新阻力。

细分市场分析

预计到2025年,无刷直流马达(BLDC)将占直流马达市场62.75%的份额,并在2031年之前以10.02%的复合年增长率增长,巩固其稳固的市场主导地位。内环式设计在冷却风扇、燃油泵和机器人等领域占据主导地位,可实现紧凑的尺寸和高转速性能。外转子式设计则透过降低变速箱损耗和提高可靠性,在直驱式空调和轮毂马达应用中具有优势。随着稀土元素供应趋于稳定,永久磁铁的优势超过了成本风险,确保其在高端应用中的持续普及。

在对成本要求较高的家用电器、起动马达和电动工具领域,有刷马达仍然很受欢迎,因为其简单的驱动电子元件和丰富的维修经验仍然具有吸引力。然而,电刷磨损会限制关键任务环境中的运作,促使原始设备製造商 (OEM) 将产品升级蓝图转向无感测器无刷直流马达 (BLDC)。 48V 车载辅助系统的日益普及推动了能够利用再生能量的电子换向设计的发展。电动车帮浦和线控转向系统持续采用无刷马达设计,正稳步推动直流马达市场向无刷技术创新转型。

额定功率为 75-750W 的马达广泛应用于输送机、暖通空调鼓风机和小型工业泵浦等众多领域,预计到 2025 年将占DC马达市场规模的 46.05%。标准化的封装尺寸和全球通用的 IEC 法兰提高了相容性,并降低了原始设备製造商 (OEM) 的换型成本。大批量订单使製造商能够优化自动化并降低成本,从而巩固了该细分市场的领先地位。

功率超过75kW的马达正以9.51%的复合年增长率高速成长,这主要得益于电动车驱动装置、大型太阳能追踪系统以及需要精确、高扭力控制的重型工业伺服等应用。整合式编码器、温度感测器和碳化硅逆变器带来的效率提升,使其价格溢价物有所值。同时,功率低于75W的马达则主要应用于消费性电子产品领域,在这些领域,小型化、低噪音和电池最佳化比绝对能量转换效率的提升更为重要。整体而言,各个功率频宽的趋势都支撑着直流马达市场的强劲成长。

区域分析

亚太地区将继续保持领先地位,预计到2025年将占全球收入的44.00%。在中国,大型垂直整合企业正在自主生产磁铁、绕组和逆变器。在印度,与生产挂钩的激励政策正在吸引汽车和工业电机的新产能,而日本和韩国则凭藉其在精密工程领域的声誉,为电子和机器人行业供应微型电机。这些结构性优势将确保该地区在预测期后仍将是DC马达市场的关键区域。

北美正经历稳定成长,这得益于联邦政府对清洁能源製造业的税额扣抵以及旨在扩大国内电机生产线的回流计划。墨西哥的汽车产业走廊正在吸收近岸零件外包项目,从而加强跨境供应链。加拿大的矿业和能源产业正在满足特殊需求,指定使用坚固耐用的无刷直流驱动装置用于远端作业。

到2031年,南美洲将以9.18%的复合年增长率引领市场成长。巴西和阿根廷正在运作大型太阳能和风力发电厂,这些电厂需要高扭力直流马达用于迴转驱动装置和变桨控制系统。巴西的工业现代化计画将促进自动化计划,而在地采购政策也将鼓励新建电机工厂。欧洲市场仍将效率放在第一位。德国正在推动机械出口采用IE4+标准,北欧国家则在离岸风力发电引入高压无刷直流马达。区域差异迭加,为直流马达市场的相关人员带来了不同的风险。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 加速推广电动车

- 向节能型工业自动化转型

- 暖通维修改造对无刷直流风扇和鼓风机的需求不断增长

- 政府对高效率马达的激励措施

- 轻型车辆48V电气系统结构

- 支援物联网的智慧型DC马达模组

- 市场限制

- 与交流感应马达相比,初始成本较高

- 稀土元素磁铁供应链波动

- 高开关频率驱动装置中的EMC/EMI合规性挑战

- 紧凑型高功率设计中的温度控管局限性

- 产业价值/价值链分析

- 监管现状和标准

- 技术展望(边缘运算和人工智慧分析)

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 透过电机技术

- 有刷直流电机

- 分支缠绕

- 串联绕组

- 复合绕组

- 永磁直流 (PMDC)

- 无刷直流(BLDC)电机

- 内环无刷直流电机

- 外转子无刷直流电机

- 有刷直流电机

- 透过输出

- 小于75瓦

- 75-750 W

- 0.75-75 kW

- 超过75千瓦

- 按电压等级

- 低于60伏

- 60-300 V

- 超过300伏

- 按最终用途行业划分

- 汽车/运输设备

- 工业机械及自动化

- 空调和冷冻

- 家用电子电器和家用电器

- 医疗和医疗设备

- 石油、天然气和采矿

- 水和污水处理

- 可再生能源系统

- 其他行业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 中东

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- ABB Ltd.

- Allied Motion Technologies Inc.

- AMETEK Inc.

- Arc Systems Inc.

- Buhler Motor GmbH

- Delta Electronics Inc.

- FAULHABER Group

- Franklin Electric Co., Inc.

- Johnson Electric Holdings Limited

- Maxon Motor AG

- MinebeaMitsumi Inc.

- Nidec Corporation

- Oriental Motor Co., Ltd.

- Portescap SA

- Regal Rexnord Corporation

- Robert Bosch GmbH

- Siemens AG

- Toshiba International Corporation

- WEG SA

- Yaskawa Electric Corporation

第七章 市场机会与未来展望

DC motor market size in 2026 is estimated at USD 31.44 billion, growing from 2025 value of USD 29.01 billion with 2031 projections showing USD 46.95 billion, growing at 8.37% CAGR over 2026-2031.

This robust DC motor market growth rides on electric-vehicle penetration, Industry 4.0 automation, and widening renewable-energy deployments. Brushless DC (BLDC) motors are displacing brushed designs because they cut maintenance, elevate efficiency, and support smart-control functions. Manufacturers strengthen supply chains for rare-earth magnets while experimenting with ferrite alternatives to contain costs. Strategic investments in 48 V automotive systems, IoT-enabled predictive maintenance, and high-power drives for wind and solar tracking broaden adoption opportunities. Asia-Pacific dominates the DC motor market thanks to its manufacturing concentration and policy support, whereas South America registers the fastest revenue acceleration due to utility-scale solar and wind installations.

Global Direct Current (DC) Motor Market Trends and Insights

Accelerating Adoption of Electric Vehicles

Soaring battery-electric and hybrid production reshapes DC motor demand as traction, thermal-management, and auxiliary systems switch to BLDC designs for tighter torque control and higher power density. Tesla's permanent-magnet strategy validated cost and efficiency advantages and prompted mainstream OEMs to follow suit. European carbon-reduction rules intensify the shift, while China bolsters domestic capacity through subsidies for integrated motor-drive lines. Although rare-earth sourcing remains a vulnerability, vertical integration by BYD and supply-reward programs under the U.S. Inflation Reduction Act mitigate immediate risks. Combined, these forces keep the DC motor market on a steep electrification trajectory.

Transition to Energy-Efficient Industrial Automation

Manufacturers embracing Industry 4.0 invest in intelligent DC drives that feed live health metrics into plant clouds. Siemens MindSphere deployments show unplanned downtime cuts of up to 30% when BLDC motors stream vibration and temperature data into predictive-maintenance algorithms. ABB retrofittable smart sensors widen addressable installed bases, enabling lifecycle optimization beyond new-equipment sales. The combination of rising labor costs in Asia and stricter emission rules in the EU strengthens value propositions, while cybersecurity standards such as IEC 62443 dictate secure-by-design firmware. As factories target lights-out operations, the DC motor market benefits from control granularity unavailable in many AC alternatives.

Higher Upfront Cost vs. AC Induction Alternatives

DC solutions often command 15-30% higher purchase prices than comparable AC induction units, impeding uptake where capital budgets are tight. Small and midsize enterprises in emerging economies prioritize near-term cash preservation, so two-year payback hurdles rule out many BLDC retrofits. Vendors introduce leasing models tying monthly fees to verified energy savings, yet these structures depend on reliable smart-meter data and long contracts that some customers resist. Economic slowdowns amplify hesitancy, creating short-term headwinds that temper the DC motor market expansion.

Other drivers and restraints analyzed in the detailed report include:

- Growing HVAC Retrofit Demand for BLDC Fans and Blowers

- Government Incentives for High-Efficiency Motors

- Supply-Chain Volatility of Rare-Earth Magnets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The BLDC segment claimed 62.75% of the DC motor market in 2025 and is tracking toward a 10.02% CAGR up to 2031, underscoring its entrenched leadership. Inner-rotor variants dominate cooling fans, fuel pumps, and robotics, delivering compact form factors and high rpm ceilings. Outer-rotor architectures conquer direct-drive HVAC and wheel-motor roles by slashing gearbox losses and boosting reliability. As rare-earth supply stabilizes, permanent-magnet strengths outnumber cost risks, which sustains premium adoption.

Brushed motors linger in cost-sensitive appliances, starter motors, and workshop tools where simple drive electronics and ample service expertise still appeal. Even so, brush wear limits uptime in mission-critical environments, steering OEM roadmaps toward sensorless BLDC upgrades. The push toward 48 V automotive auxiliaries shines a spotlight on electronically commutated designs able to exploit regenerative energy. Continuous design wins in EV pumps and steer-by-wire systems keep the DC motor market tilted firmly toward brushless innovations.

Motors rated 75-750 W captured 46.05% of the DC motor market size in 2025, thanks to ubiquity across conveyors, HVAC blowers, and small industrial pumps. Standardized footprints and global IEC flanges ease interchangeability, shrinking switching costs for OEMs. High-volume orders help manufacturers optimize automation and squeeze cost curves, reinforcing segment dominance.

Motors above 75 kW show a leading 9.51% CAGR as EV traction, utility-scale trackers, and heavy industrial servos request precise high-torque control. Integrated encoders, thermal sensors, and SiC-based inverters extract additional efficiency, justifying premium prices. At the other end, sub-75 W designs serve consumer electronics where miniaturization, low noise, and battery optimization trump absolute energy-conversion gains. Altogether, diverse power-band dynamics safeguard a resilient DC motor market.

The Direct Current (DC) Motor Market Report is Segmented by Motor Technology (Brushed DC Motors, and Brushless DC Motors), Power Rating (Less Than 75W, 75-750W, 0. 75-75kW, and More), Voltage Class (Less Than 60V, 60-300V, and Greater Than 300V), End-Use Industry (Automotive, Industrial, HVAC, Consumer Electronics, Healthcare, Water Treatment, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retains the crown with 44.00% of 2025 revenue as China's vertically integrated giants internalize magnet, winding, and inverter production. Production-linked incentives in India invite fresh capacity for automotive and industrial motors, while Japan and South Korea leverage precision-engineering reputations to supply micro-motors for electronics and robotics. These structural advantages ensure the region remains the anchor of the DC motor market well beyond the forecast horizon.

North America posts steady gains amid federal credits for clean-energy manufacturing and reshoring moves that expand domestic motor lines. Mexico's automotive corridor absorbs nearshored parts programs, strengthening the cross-border supply chain. Canada's mining and energy sectors specify rugged BLDC drives for remote operations, underpinning specialized demand.

South America leads growth at a 9.18% CAGR into 2031 as Brazil and Argentina commission utility-scale solar and wind arrays that require slew drives and pitch systems using high-torque DC motors. Industrial modernization programs in Brazil add automation projects, and local content rules encourage greenfield motor plants. Europe remains an efficiency-first market; Germany pushes IE4+ adoption in machinery exports, while Nordic countries deploy high-voltage BLDC units in offshore wind farms. Collectively, regional nuances diversify risk for DC motor market stakeholders.

- ABB Ltd.

- Allied Motion Technologies Inc.

- AMETEK Inc.

- Arc Systems Inc.

- Buhler Motor GmbH

- Delta Electronics Inc.

- FAULHABER Group

- Franklin Electric Co., Inc.

- Johnson Electric Holdings Limited

- Maxon Motor AG

- MinebeaMitsumi Inc.

- Nidec Corporation

- Oriental Motor Co., Ltd.

- Portescap SA

- Regal Rexnord Corporation

- Robert Bosch GmbH

- Siemens AG

- Toshiba International Corporation

- WEG S.A.

- Yaskawa Electric Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating adoption of electric vehicles

- 4.2.2 Transition to energy-efficient industrial automation

- 4.2.3 Growing HVAC retrofit demand for BLDC fans and blowers

- 4.2.4 Government incentives for high-efficiency motors

- 4.2.5 48-V electrical architectures in light-duty vehicles

- 4.2.6 IoT-enabled smart DC motor modules

- 4.3 Market Restraints

- 4.3.1 Higher upfront cost vs. AC induction alternatives

- 4.3.2 Supply-chain volatility of rare-earth magnets

- 4.3.3 EMC/EMI compliance hurdles for high-switch-frequency drives

- 4.3.4 Thermal-management limits in compact high-power designs

- 4.4 Industry Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape and Standards

- 4.6 Technological Outlook (Edge and AI analytics)

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Motor Technology

- 5.1.1 Brushed DC (BDC) Motors

- 5.1.1.1 Shunt Wound

- 5.1.1.2 Series Wound

- 5.1.1.3 Compound Wound

- 5.1.1.4 Permanent-Magnet DC (PMDC)

- 5.1.2 Brushless DC (BLDC) Motors

- 5.1.2.1 Inner-Rotor BLDC

- 5.1.2.2 Outer-Rotor BLDC

- 5.1.1 Brushed DC (BDC) Motors

- 5.2 By Power Rating (Output)

- 5.2.1 Less than 75 W

- 5.2.2 75 - 750 W

- 5.2.3 0.75 - 75 kW

- 5.2.4 Greater than 75 kW

- 5.3 By Voltage Class

- 5.3.1 Less than 60 V

- 5.3.2 60 - 300 V

- 5.3.3 Greater than 300 V

- 5.4 By End-Use Industry

- 5.4.1 Automotive and Transportation

- 5.4.2 Industrial Machinery and Automation

- 5.4.3 HVAC and Refrigeration

- 5.4.4 Consumer Electronics and Appliances

- 5.4.5 Healthcare and Medical Devices

- 5.4.6 Oil, Gas and Mining

- 5.4.7 Water and Wastewater

- 5.4.8 Renewable Energy Systems

- 5.4.9 Other Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Russia

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 Saudi Arabia

- 5.5.4.1.2 United Arab Emirates

- 5.5.4.1.3 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Egypt

- 5.5.4.2.3 Rest of Africa

- 5.5.4.1 Middle East

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ABB Ltd.

- 6.4.2 Allied Motion Technologies Inc.

- 6.4.3 AMETEK Inc.

- 6.4.4 Arc Systems Inc.

- 6.4.5 Buhler Motor GmbH

- 6.4.6 Delta Electronics Inc.

- 6.4.7 FAULHABER Group

- 6.4.8 Franklin Electric Co., Inc.

- 6.4.9 Johnson Electric Holdings Limited

- 6.4.10 Maxon Motor AG

- 6.4.11 MinebeaMitsumi Inc.

- 6.4.12 Nidec Corporation

- 6.4.13 Oriental Motor Co., Ltd.

- 6.4.14 Portescap SA

- 6.4.15 Regal Rexnord Corporation

- 6.4.16 Robert Bosch GmbH

- 6.4.17 Siemens AG

- 6.4.18 Toshiba International Corporation

- 6.4.19 WEG S.A.

- 6.4.20 Yaskawa Electric Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment