|

市场调查报告书

商品编码

1892664

锂金属电池材料市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Lithium Metal Battery Materials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

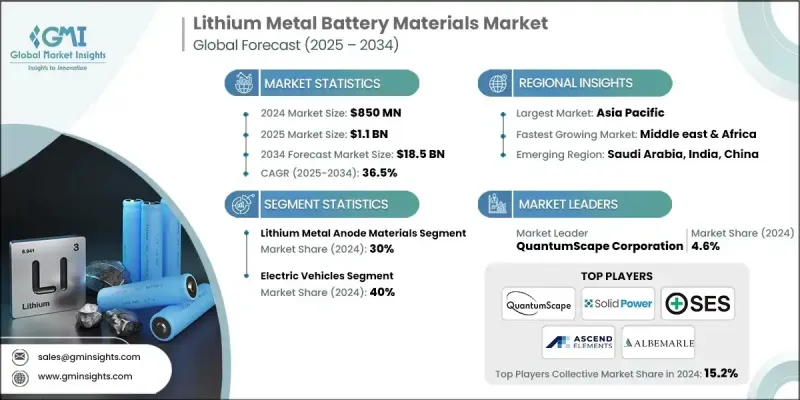

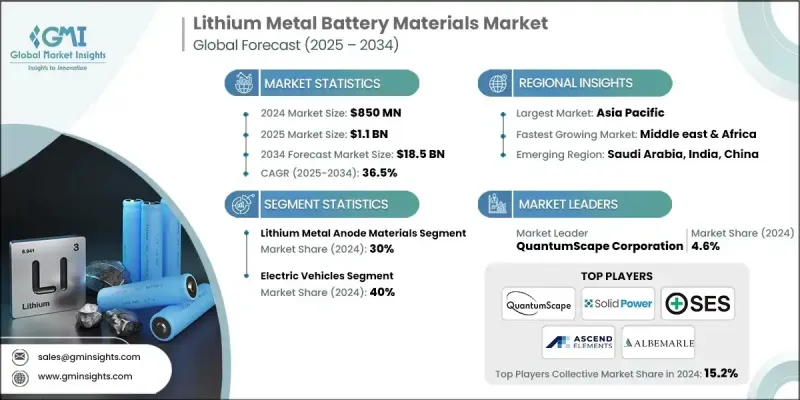

2024 年全球锂金属电池材料市场价值为 8.5 亿美元,预计到 2034 年将以 36.5% 的复合年增长率成长至 185 亿美元。

全球电动车的快速成长推动了对先进电池材料的需求,这些材料需要更高的能量密度、更长的续航里程和更快的充电速度。再生能源和储能解决方案的普及进一步增加了对高效能、高性能电池材料的需求。环保意识的增强,以及各产业对更快充电速度和更高容量电池日益增长的期望,正在加速向锂基解决方案的转型。对固态锂金属电池(SS-LMB)技术的巨额投资正在改变市场格局,汽车製造商和电池製造商正投入数十亿美元进行研发。 SS-LMB解决了传统锂离子电池的安全性和耐久性问题,其理论能量密度超过500 Wh/kg,而液态电解质电池的能量密度约为350 Wh/kg。锂金属负极生产技术的进步,特别是热蒸发技术的进步,正在降低成本,并推动大规模商业化应用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 8.5亿美元 |

| 预测值 | 185亿美元 |

| 复合年增长率 | 36.5% |

到2024年,固态电解质市占率将达到25%。这些材料是下一代锂金属电池的核心,与传统的液态电解质相比,它们具有更高的稳定性、能量密度和安全性。其优异的性能使其成为储能和电动车等先进应用的理想选择。

预计到2024年,电动车市占率将达到40%。消费者对更长续航里程、快速充电、更高安全性和更长循环寿命的需求不断增长,推动了锂金属电池材料的应用。电动车製造商越来越倾向于采用锂基解决方案来满足这些性能标准和监管要求。

2024年,北美锂金属电池材料市占率达25%。包括《通膨抑制法案》在内的政策倡议为国内电池製造和电动车普及提供了强有力的激励,同时私部门对锂电池生产的投资也大幅增长。美国电池产能到2023年已接近70吉瓦时,与几年前几乎为零的产能相比,成长迅速。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场规模及预测:依材料分类,2021-2034年

- 锂金属负极材料

- 纯锂金属箔

- 锂合金阳极

- 复合锂负极

- 固态电解质材料

- 硫化物基电解质

- 氧化物/石榴石电解质

- 聚合物电解质

- 卤化物基电解质

- 液态电解质材料

- 先进液态电解质

- 电解质添加剂

- 保护涂层及人工SEI材料

- 分离材料

- 其他的

第六章:市场规模及预测:依应用领域划分,2021-2034年

- 电动车

- 电池电动车(BEV)

- 插电式混合动力车(PHEV)

- 航太航太

- 商用飞机系统

- 无人机和无人飞行器

- 空间应用

- 消费性电子产品

- 电网和固定式储能

- 医疗器材

- 海洋与海事

- 其他的

第七章:市场规模及预测:依地区划分,2021-2034年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

- 中东和非洲其他地区

第八章:公司简介

- QuantumScape Corporation

- Solid Power, Inc.

- SES AI Corporation

- Ascend Elements

- Saft

- Albemarle

- Pure Lithium Corporation

- Cuberg

- Group14 Technologies

The Global Lithium Metal Battery Materials Market was valued at USD 850 million in 2024 and is estimated to grow at a CAGR of 36.5% to reach USD 18.5 billion by 2034.

The rapid growth of electric vehicles worldwide is fueling demand for advanced battery materials that offer higher energy densities, longer driving ranges, and faster charging capabilities. Adoption of renewable energy and energy storage solutions is further increasing the need for efficient, high-performance battery materials. Environmental awareness, coupled with rising expectations for faster charging and higher-capacity batteries across industries, is accelerating the shift toward lithium-based solutions. Massive investments in solid-state lithium metal battery (SS-LMB) technologies are transforming the market, as automakers and battery manufacturers are dedicating billions to R&D. SS-LMBs address safety and durability issues associated with conventional lithium-ion batteries, offering theoretical energy densities above 500 Wh/kg compared to ~350 Wh/kg for liquid-electrolyte cells. Advances in lithium-metal anode production, particularly through thermal evaporation, are driving down costs and enabling large-scale commercial adoption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $850 Million |

| Forecast Value | $18.5 Billion |

| CAGR | 36.5% |

The solid-state electrolytes segment held a 25% share in 2024. These materials are central to next-generation lithium metal batteries, providing enhanced stability, higher energy density, and improved safety over traditional liquid electrolytes. Their superior properties make them ideal for advanced applications in energy storage and electric mobility.

The electric vehicle segment held a 40% share in 2024. Growing consumer demand for extended driving range, rapid charging, enhanced safety, and long cycle life is driving the adoption of lithium metal battery materials. EV manufacturers increasingly prefer lithium-based solutions to meet these performance standards and regulatory requirements.

North America Lithium Metal Battery Materials Market held a 25% share in 2024. Policy initiatives, including the Inflation Reduction Act, provide substantial incentives for domestic battery manufacturing and EV adoption, while private sector investments in lithium battery production have surged. Battery manufacturing capacity in the U.S. reached nearly 70 GWh in 2023, growing rapidly from negligible production a few years earlier.

Key players in the Global Lithium Metal Battery Materials Market include Albemarle, Cuberg, QuantumScape Corporation, SES AI Corporation, Ascend Elements, Group14 Technologies, Saft, Solid Power, and Pure Lithium Corporation. Companies in the Lithium Metal Battery Materials Market are strengthening their positions through aggressive investment in research and development to enhance energy density, safety, and production efficiency. Strategic partnerships with automakers, technology developers, and supply chain partners are helping to accelerate the commercialization of solid-state batteries. Firms are also expanding production facilities in regions with strong policy support, ensuring proximity to key customers and reducing logistics costs. Intellectual property acquisition, joint ventures, and licensing agreements are employed to secure access to critical materials and technologies. In addition, many companies are emphasizing sustainable practices and recycling initiatives to appeal to environmentally conscious stakeholders while highlighting the superior performance and rapid charging capabilities of their lithium metal battery solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Material

- 2.2.2 Application

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Size and Forecast, By Material, 2021-2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Lithium metal anode materials

- 5.2.1 Pure lithium metal foils

- 5.2.2 Lithium alloy anodes

- 5.2.3 Composite lithium anodes

- 5.3 Solid-state electrolyte materials

- 5.3.1 Sulfide-based electrolytes

- 5.3.2 Oxide/garnet electrolytes

- 5.3.3 Polymer electrolytes

- 5.3.4 Halide-based electrolytes

- 5.4 Liquid electrolyte materials

- 5.4.1 Advanced liquid electrolytes

- 5.4.2 Electrolyte additives

- 5.5 Protective coatings & artificial SEI materials

- 5.6 Separator materials

- 5.7 Others

Chapter 6 Market Size and Forecast, By Application, 2021-2034 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Electric vehicles

- 6.2.1 Battery electric vehicles (BEV)

- 6.2.2 Plug-in hybrid electric vehicles (PHEV)

- 6.3 Aerospace & aviation

- 6.3.1 Commercial aircraft systems

- 6.3.2 Drones & UAVs

- 6.3.3 Space applications

- 6.4 Consumer electronics

- 6.5 Grid & stationary energy storage

- 6.6 Medical devices

- 6.7 Marine & maritime

- 6.8 Others

Chapter 7 Market Size and Forecast, By Region, 2021-2034 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.5.4 Rest of Latin America

- 7.6 Middle East & Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

- 7.6.4 Rest of Middle East & Africa

Chapter 8 Company Profiles

- 8.1 QuantumScape Corporation

- 8.2 Solid Power, Inc.

- 8.3 SES AI Corporation

- 8.4 Ascend Elements

- 8.5 Saft

- 8.6 Albemarle

- 8.7 Pure Lithium Corporation

- 8.8 Cuberg

- 8.9 Group14 Technologies