|

市场调查报告书

商品编码

1519945

电池原料:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Battery Raw Material - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

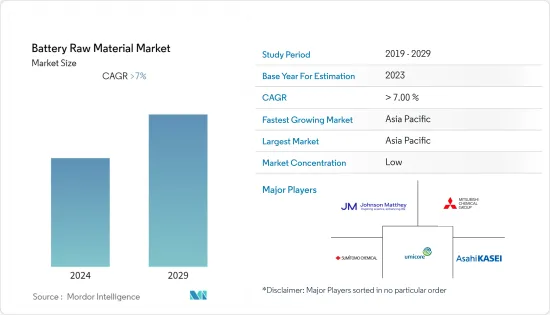

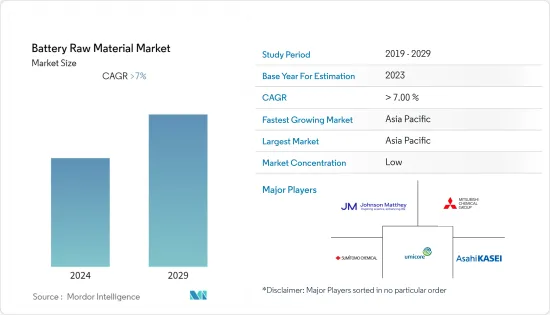

电池原料市场规模预计2024年将达到587亿美元,2029年将达到972.3亿美元,在预测期间(2024-2029年)复合年增长率为10.62%。

COVID-19 大流行扰乱了电池材料市场。封锁措施、工厂关闭和行动限制扰乱了采矿作业、矿石加工设施和物流网络,影响了原料的供应。汽车、电子、能源等各行业经济活动的恢復促进了电池材料市场的復苏。

主要亮点

- 由于汽车和家电领域的使用增加,电池原料市场正在迅速扩大。

- 然而,电池原料市场的成长预计将受到有关电池储存和运输的严格安全法规的阻碍。

- 钒流技术的研发活动不断增加,以及对行动电子产品和消费设备的需求不断增加,预计将为未来几年的电池原料市场提供机会。

- 中国、印度等国家汽车电池和家电电池消费量的不断增长是亚太地区主导全球市场的因素。

电池原物料市场趋势

主导市场的汽车细分市场

- 随着电动车的快速普及,汽车产业正进入重大变革时期时期。锂离子电池作为重要的能源储存,需要多种关键原料。随着全球电动车销量持续快速成长,对这些电池材料的需求迅速增加,推动汽车领域的电池材料市场成长。

- 根据国际汽车工业协会(OICA)发布的预测,2022年全球汽车销售量约为8,163万辆。

- 此外,根据联邦机动车辆和运输办公室(弗伦斯堡)的数据,德国註册的纯电动车总数将从 2020 年的 136,617 辆增加到 2023 年的 1,013,009 辆。

- 在消费性电子和汽车领域,中国、日本、韩国和印度等亚太国家正大幅增加电池原料的使用量,预计将成为预测期内的市场驱动力。

- 全球电动车充电基础设施的扩张正在增强消费者对电动车的信心,并刺激电动车的采用。政府、公用事业和私人公司正在大力投资充电站、快速充电网路和智慧电网技术的部署。透过这种方式,我们支持电动车持有量的增加。这些基础设施的发展正在为电池原材料创造一个强劲的市场,以满足汽车锂离子电池日益增长的需求。

- 根据联邦网路局公布的资料,截至2023年10月,德国拥有电动车平均速度充电公共站点87,155个,公共快速充电站21,111个。

- 电动车的日益普及符合清洁能源政策。中国政府打算放宽对汽车製造商进口车的限制,以缩小供需差距。

- 在预测期内,电池材料市场预计将受到上述所有因素的推动。

亚太地区主导市场

- 亚太地区是从汽车到电子再到可再生能源等众多产业的重要製造地。该地区拥有众多电池製造商、电池芯製造商和电池原料供应商。製造设施的集中正在推动亚太地区对电池原料的需求。

- 亚太地区的电动车市场在中国、日本和韩国等国家快速成长。这些国家是全球最大的电动车生产国和消费国。电动车用锂离子电池的生产需要大量的锂、钴、镍、石墨等电池原料,这使得亚太地区在电池原料市场占有优势。

- 中国工业协会(CAAM)发布的资料显示,2022年中国纯电动车销量约540万辆,较2021年成长83.5%。同年,中国插电式混合动力汽车销量与前一年同期比较成长151.91%,达到150万辆以上。

- 日本汽车检验登记资讯协会(AIRIA)公布的资料显示,2023年日本电动乘用车的使用量约为162,390辆,较10年前增加。

- Vahan资料显示,在印度,2023 年 3 月电动车销量为 139,789 辆,而 2022 年 3 月为 77,128 辆,较去年同期成长 82%。总合而言,2022 财年的销量从 4,58,746 辆成长到 11,80,597 辆,成长了 157%。

- 因此,预测期内该地区对电池原料的需求预计将受到所有这些市场开拓的推动。

电池原物料产业概况

电池原料市场较为分散,有少数大型企业和许多小型企业。主要企业(排名不分先后)包括优美科、旭化成、庄信万丰、住友化学、三菱化学。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 消费性电子产品的需求不断成长

- 增加在汽车产业的应用

- 抑制因素

- 关于电池储存和运输的严格安全规定

- 其他限制因素

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(以金额为准的市场规模)

- 依电池类型

- 铅酸蓄电池

- 锂离子

- 其他电池种类(镍氢电池、固态电池)

- 按原料分

- 正极

- 负极

- 电解

- 分隔器

- 按用途

- 家用电器

- 车

- 工业的

- 用于通讯

- 其他(可再生能源储存)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 泰国

- 马来西亚

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 土耳其

- 俄罗斯

- 北欧的

- 其他欧洲国家

- 世界其他地区

- 南美洲

- 中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Asahi Kasei Corporation

- BASF SE

- Celgard LLC

- ENTEK

- ITOCHU Corporation

- Johnson Matthey

- Mitsubishi Chemical Corporation.

- NICHIA CORPORATION

- Sumitomo Chemical Co. Ltd

- Targray Technology International Inc.

- Umicore

第七章 市场机会及未来趋势

- 电池钒液流技术研发

- 对可携式电子产品和消费性设备的需求增加

The Battery Raw Material Market size is estimated at USD 58.70 billion in 2024, and is expected to reach USD 97.23 billion by 2029, growing at a CAGR of 10.62% during the forecast period (2024-2029).

The COVID-19 pandemic disrupted the battery materials market. Lockdown measures, factory closures, and restrictions on movement led to disruptions in mining operations, ore processing facilities, and logistics networks, impacting the supply of raw materials. The resumption of economic activities across industries, including automotive, electronics, and energy, contributed to the recovery of the battery raw materials market.

Key Highlights

- The market for battery raw materials is proliferating due to the increasing use of these products in the automotive and consumer electronics sectors.

- However, the growth of the battery raw materials market is expected to be hampered by strict safety regulations for batteries through storage and transport.

- The rising research and development activities in vanadium flow technology and increasing demand for portable electronics and consumer devices are expected to provide opportunities for the battery raw material market in the coming years.

- The growing consumption of automotive and consumer electronics batteries in countries such as China and India is driving Asia-Pacific to dominate the global market.

Battery Raw Material Market Trends

Automotive Segment to Dominate the Market

- With the rapid rise in the adoption of electric vehicles, the car industry is undergoing a significant change. Various critical raw materials are required for the Lithium-ion battery, which is a crucial energy storage. As EV sales continue to surge globally, the demand for these battery raw materials has skyrocketed, driving growth in the automotive segment of the battery raw materials market.

- According to the estimate released by the International Organization of Motor Vehicle Manufacturers (OICA), around 81.63 million vehicles were sold around the world in 2022.

- Furthermore, according to the Federal Motor Transport Authority, Flensburg, the registration of the total number of battery electric cars in Germany increased from 136,617 units in 2020 to 1,013,009 units in 2023.

- In the consumer electronics and automotive sectors, Asia-Pacific countries such as China, Japan, South Korea, and India are experiencing strong growth in the use of battery raw materials, which is expected to drive the market over the forecast period.

- The expansion of EV charging infrastructure worldwide has bolstered consumer confidence in EVs and fueled the adoption of electric vehicles. Governments, utilities, and private companies are investing heavily in the deployment of charging stations, fast-charging networks, and smart grid technologies. Thus, this supports the growing fleet of EVs. This infrastructure development has created a robust market for battery raw materials to meet the increasing demand for lithium-ion batteries in automotive applications.

- According to the data published by the Federal Network Agency, in Germany, there were 87,155 public sites with average speed recharging for EVs available in October 2023 and 21,111 public quick charge stations.

- The increase in the adoption of electric vehicles aligns with the clean energy policy. The Chinese government intends to relax restrictions on the import of vehicles by automobile manufacturers into China in order to narrow the supply gap for demand.

- The market for battery materials is expected to be driven by all of the above factors during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is an important manufacturing hub for a wide range of sectors, from automotive to electronics and renewables. The region hosts a large number of battery manufacturers, cell producers, and suppliers of battery raw materials. This concentration of manufacturing facilities drives demand for battery raw materials in Asia-Pacific.

- The Asia-Pacific market for electric vehicles is growing at a rapid rate in countries such as China, Japan, and South Korea. These countries are the biggest producers and consumers of electric vehicles in the world. The production of lithium-ion batteries for EVs requires significant quantities of battery raw materials such as lithium, cobalt, nickel, and graphite, contributing to the dominance of Asia-Pacific in the battery raw materials market.

- According to the data published by the China Association of Automobile Manufacturers (CAAM), in China, approximately 5.4 million battery electric vehicles were sold in 2022, an increase of 83,5 % compared to 2021. In the same year, there was an increase of 151.91% in sales of plugin hybrids to over 1.5 million vehicles in China from a year earlier.

- According to the data published by the Automobile Inspection & Registration Information Association, Japan (AIRIA), in 2023, the number of electric passenger cars in use in Japan increased to about 162.39 thousand vehicles, which was an increase from 10 years ago.

- In India, according to Vahan's data, EV sales in March 2023 increased by 82 % Y-o-Y, with 1,39,789 units sold compared to 77,128 EVs sold in March 2022. In total, sales increased by a staggering 157% in the period, from 4,58,746 to 11,80,597 during fiscal year 2022.

- Therefore, the demand for battery raw materials in the region during the forecast period is expected to be driven by all these market developments.

Battery Raw Material Industry Overview

The battery raw material market is fragmented, with the presence of a few large-sized players and a large number of small players operating. The major players (not in any particular order) include Umicore, Asahi Kasei Corporation, Johnson Matthey, Sumitomo Chemical Co. Ltd, and Mitsubishi Chemical Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from Consumer Electronics

- 4.1.2 Rising Application in Automotive Industry

- 4.2 Restraints

- 4.2.1 Stringent Safety Regulations for Batteries through Storage and Transportation

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Battery Type

- 5.1.1 Lead-acid

- 5.1.2 Lithium-ion

- 5.1.3 Other Battery Types (Nickel-metal Hydride (NiMH), and Solid-state Batteries)

- 5.2 By Material

- 5.2.1 Cathode

- 5.2.2 Anode

- 5.2.3 Electrolyte

- 5.2.4 Separator

- 5.3 By Application

- 5.3.1 Consumer Electronics

- 5.3.2 Automotive

- 5.3.3 Industrial

- 5.3.4 Telecommunication

- 5.3.5 Other Applications (Renewable Energy Storage)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Thailand

- 5.4.1.6 Malaysia

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Turkey

- 5.4.3.7 Russia

- 5.4.3.8 NORDIC

- 5.4.3.9 Rest of Europe

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Asahi Kasei Corporation

- 6.4.2 BASF SE

- 6.4.3 Celgard LLC

- 6.4.4 ENTEK

- 6.4.5 ITOCHU Corporation

- 6.4.6 Johnson Matthey

- 6.4.7 Mitsubishi Chemical Corporation.

- 6.4.8 NICHIA CORPORATION

- 6.4.9 Sumitomo Chemical Co. Ltd

- 6.4.10 Targray Technology International Inc.

- 6.4.11 Umicore

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Research and Development in Vanadium Flow Technology in Batteries

- 7.2 Increasing Demand for Portable Electronics and Consumer Devices