|

市场调查报告书

商品编码

1892679

量子超导材料市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Superconducting Materials for Quantum Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

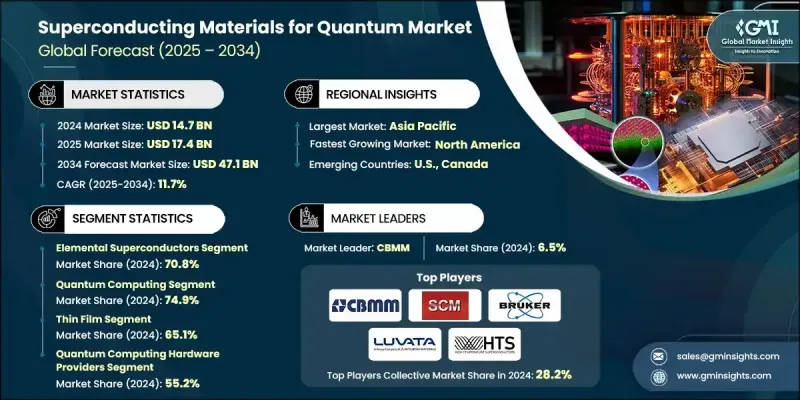

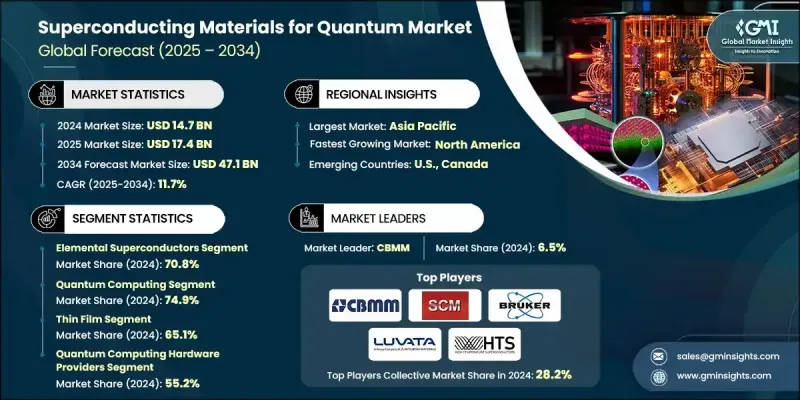

2024 年全球量子超导材料市场价值为 147 亿美元,预计到 2034 年将以 11.7% 的复合年增长率成长至 471 亿美元。

在量子运算、感测和通讯领域快速发展的推动下,超导材料正逐渐成为更广泛的量子技术领域的核心支柱。超导材料能够提供近乎零电阻,从而实现量子位元和量子电路的构建,这对于维持相干性和降低运行能耗至关重要。随着政府机构和私人投资者加快对量子研究的投入,以及製药、金融和网路安全等产业将量子解决方案融入长期策略,超导材料的发展势头日益强劲。可扩展量子处理器的需求持续成长,推动了超导元件的创新和商业化进程。除了计算领域,这些材料在成像系统、地质研究和环境监测等领域也越来越受欢迎。儘管高昂的成本和复杂的冷却要求仍然是主要障碍,尤其是对能够在低温下稳定运行的可靠材料的需求,但目前针对高温超导体的研究旨在降低运行成本并提高稳定性。预计这些技术的持续进步将在未来几年拓展市场机会。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 147亿美元 |

| 预测值 | 471亿美元 |

| 复合年增长率 | 11.7% |

2024年,元素超导体市占率占比达70.8%,预计到2034年将以11.7%的复合年增长率成长。这些材料,包括铌、铅和锡,仍然是加速器系统和诊断技术等科学和医疗应用的核心。它们的性能特征已被广泛认可,但由于需要极低的运行温度,冷却成本显着增加,限制了其成长。

2024年,量子计算领域占据74.9%的市场份额,预计2025年至2034年将以11.6%的复合年增长率成长。随着越来越多的企业寻求能够应对传统系统无法处理的复杂运算挑战的解决方案,量子运算的普及应用正在加速。这种不断增长的需求促使企业加大对先进硬体和软体的投资,量子技术在包括製药、物流和金融建模在内的各个领域的影响也日益增强。技术生态系统中的主要参与者将继续支持全球量子运算能力的扩展。

2024年,北美量子超导材料市场占31.8%的比重。该地区的领先地位得益于大量的公共和私人投资、广泛的研究项目以及强大的半导体和电子基础,这些都促进了产品的快速商业化。大量资金投入量子硬体研发,为该地区超导材料的应用和发展创造了有利环境。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 依产品类型

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依材料类型划分,2021-2034年

- 元素超导体

- 铌(Nb)

- 钽(Ta)

- 铝(Al)

- 超导合金和化合物

- 铌钛合金(Nb-Ti)

- 铌锡(Nb3Sn)

- 铌钽(Nb-Ta)

- 铌钛氮化物(NbTiN)

- 高温超导体(HTS)

- YBCO(钇钡铜氧化物)

- REBCO(稀土钡铜氧化物)

- BSCCO(铋锶钙铜氧化物)

第六章:市场估算与预测:依应用领域划分,2021-2034年

- 量子计算

- 量子感测

- 量子通讯与网络

第七章:市场估计与预测:依形式划分,2021-2034年

- 薄膜

- 桿和线

- 片材和箔材

- 粉末

- 其他的

第八章:市场估算与预测:依最终用途划分,2021-2034年

- 量子运算硬体供应商

- 国防与航太

- 医疗保健与生命科学

- 基础建设与地球物理

- 电信

- 科学研究机构

第九章:市场估计与预测:依地区划分,2021-2034年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十章:公司简介

- Alloy Hit

- Bruker EAS (BEST)

- CBMM

- Hitachi

- Goodfellow

- High Temperature Superconductors Inc. (HTSI)

- Luvata

- Marketech International

- Stanford Advanced Materials

- Super Conductor Materials Inc. (SCM)

The Global Superconducting Materials for Quantum Market was valued at USD 14.7 billion in 2024 and is estimated to grow at a CAGR of 11.7% to reach USD 47.1 billion by 2034.

This sector is becoming a core pillar of the broader quantum technology landscape, supported by rapid advancements in quantum computing, sensing, and communication. Superconducting materials enable the creation of qubits and quantum circuits by offering near-zero electrical resistance, which is essential for maintaining coherence and reducing operational energy loss. Momentum is building as government bodies and private investors accelerate funding for quantum research and as industries such as pharmaceuticals, finance, and cybersecurity integrate quantum solutions into long-term strategies. Demand for scalable quantum processors continues to rise, driving innovation and commercialization efforts in superconducting components. Beyond computing, these materials are gaining traction in imaging systems, geological studies, and environmental monitoring. Although high costs and complex cooling requirements remain key barriers, particularly the need for reliable materials that perform at low temperatures, ongoing research focused on high-temperature superconductors aims to lower operational expenses and enhance stability. Continued progress in these technologies is expected to expand market opportunities in the coming years.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14.7 Billion |

| Forecast Value | $47.1 Billion |

| CAGR | 11.7% |

The elemental superconductors segment accounted for a 70.8% share in 2024 and is projected to grow at an 11.7% CAGR through 2034. These materials, including niobium, lead, and tin, remain central to scientific and medical applications such as accelerator systems and diagnostic technologies. Their performance characteristics are widely established, yet their growth is tempered by the requirement for extremely low operating temperatures, which significantly increases cooling expenditure.

The quantum computing segment held a 74.9% share in 2024 and is set to grow at a CAGR of 11.6% from 2025 to 2034. Adoption is accelerating as more enterprises seek solutions capable of tackling complex computational challenges beyond the capabilities of traditional systems. This rising demand is inspiring larger investments in advanced hardware and software as quantum technology becomes more influential across sectors, including pharmaceuticals, logistics, and financial modeling. Major players in the technology ecosystem continue to support the scale-up of quantum computing capabilities worldwide.

North America Superconducting Materials for Quantum Market held a 31.8% share in 2024. The region's leadership is driven by substantial public and private investment, extensive research programs, and a strong semiconductor and electronics foundation that promotes rapid commercialization. Significant funding directed toward quantum hardware development is creating an environment conducive to the adoption and advancement of superconducting materials across the region.

Key companies active in the Global Superconducting Materials for Quantum Market include Alloy Hit, Bruker EAS (BEST), CBMM, Hitachi, Goodfellow, High Temperature Superconductors Inc., Luvata, Marketech International, Stanford Advanced Materials, and Super Conductor Materials Inc. (SCM). Companies competing in the Superconducting Materials for Quantum Market focus on several strategic initiatives to reinforce their standing. Many prioritize advancing material engineering to improve conductivity, stability, and performance at lower or more manageable temperatures, helping reduce cooling expenses. Firms are also strengthening partnerships with quantum hardware developers to integrate their materials more deeply into next-generation processors and sensing devices. Expanding production capabilities, enhancing quality control, and investing in precision fabrication technologies allow manufacturers to meet rising demand for highly reliable components.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material type

- 2.2.3 Application

- 2.2.4 Form

- 2.2.5 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By Product type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Material Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Elemental Superconductors

- 5.2.1 Niobium (Nb)

- 5.2.2 Tantalum (Ta)

- 5.2.3 Aluminum (Al)

- 5.3 Superconducting Alloys & Compounds

- 5.3.1 Niobium-Titanium (Nb-Ti)

- 5.3.2 Niobium-Tin (Nb3Sn)

- 5.3.3 Niobium-Tantalum (Nb-Ta)

- 5.3.4 Niobium Titanium Nitride (NbTiN)

- 5.4 High-Temperature Superconductors (HTS)

- 5.4.1 YBCO (Yttrium Barium Copper Oxide)

- 5.4.2 REBCO (Rare-Earth Barium Copper Oxide)

- 5.4.3 BSCCO (Bismuth Strontium Calcium Copper Oxide)

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Quantum computing

- 6.3 Quantum sensing

- 6.4 Quantum communication & networking

Chapter 7 Market Estimates and Forecast, By Form, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Thin films

- 7.3 Rods & wires

- 7.4 Sheets & foils

- 7.5 Powder

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By End Use, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Quantum computing hardware providers

- 8.3 Defense & aerospace

- 8.4 Healthcare & life sciences

- 8.5 Infrastructure & geophysics

- 8.6 Telecommunications

- 8.7 Scientific research institutions

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Alloy Hit

- 10.2 Bruker EAS (BEST)

- 10.3 CBMM

- 10.4 Hitachi

- 10.5 Goodfellow

- 10.6 High Temperature Superconductors Inc. (HTSI)

- 10.7 Luvata

- 10.8 Marketech International

- 10.9 Stanford Advanced Materials

- 10.10 Super Conductor Materials Inc. (SCM)