|

市场调查报告书

商品编码

1892711

钠离子电池材料市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Sodium Ion Battery Material Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

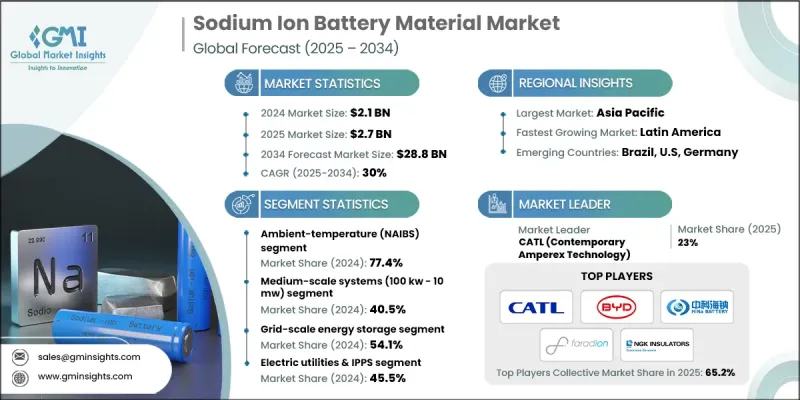

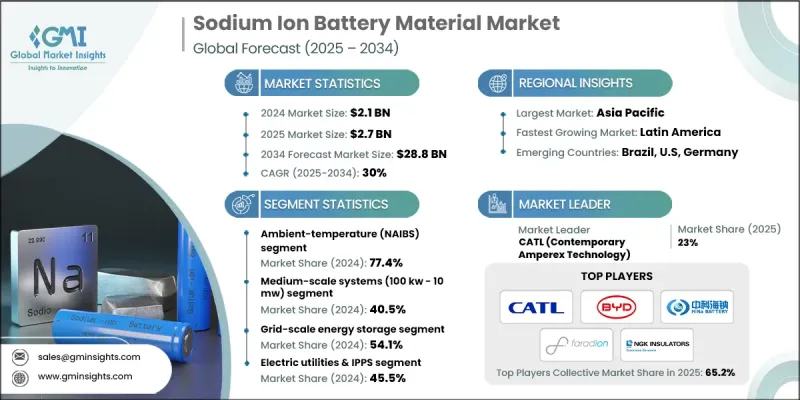

2024年全球钠离子电池材料市场价值为21亿美元,预计2034年将以30%的复合年增长率成长至288亿美元。

随着普鲁士蓝类似物(PBA)正极材料的创新和高倍率性能的提升,这项技术正超越早期研发阶段,迈向更广泛的商业化应用。能量密度提升至160-175 Wh/kg,加上多GWh级产能的扩张,正加速其在全球的普及。政府的支持性措施也鼓励对钠离子电池生产的投资,因为全球利害关係人的目标是减少对锂基材料的依赖。透过各种激励计划推动国内供应链的发展,进一步加强了产业基础设施。随着性能的提升和资本需求的降低,钠离子电池系统正越来越多地应用于电网级储能、备用电源网路、微电网和短途出行等领域。一些地区正在积极推进生产,以缓解关键矿物供应链的压力,而硬碳负极、电池组装工艺和回收设施的持续进步,也为该技术的大规模部署奠定了基础。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 21亿美元 |

| 预测值 | 288亿美元 |

| 复合年增长率 | 30% |

2024年,常温(NAIBS)系统市占率达到77.4%,预计到2034年将以29.4%的复合年增长率成长。其快速融入商业应用,加上有利的成本优势以及与固定式储存和短程行动应用的高度相容性,正在巩固其作为关键技术的地位。随着下一代PBA和层状氧化物材料的生产在多个工厂扩大规模,预计该市场将继续成长。

2024年,中型系统市场规模达到8.837亿美元,主要得益于商业和工业应用领域(包括备用电源网路、配电级能源和微电网环境)装机量的成长。中型系统具有良好的适应性和易于部署的特点,使其成为资料密集型环境、电信以及高需求充电解决方案的理想选择。

2024年,北美钠离子电池材料市占率达到21.3%,并随着大规模储能需求和再生能源装置容量扩张的增加而持续成长。该地区受益于有利的财政政策、采购要求以及关键原材料的供应,从而确保了稳定的供应。美国和加拿大的公用事业公司正在评估钠离子系统在长时储能、增强电网韧性和提高低温性能的应用。微电网和偏远地区电气化的发展也使北美成为钠离子电池商业部署的新兴热点地区。数据网路和通讯基础设施正在扩大钠离子技术的应用,以提升可靠性和电力稳定性。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 关键矿产独立性:消除对锂、钴和镍的依赖

- 成本竞争力:规模化生产成本比磷酸铁锂低20-30%。

- 寒冷气候性能:-40°C 下产能维持率 >90%,协助开拓北部市场

- 产业陷阱与挑战

- 能量密度较低:140-175 Wh/kg,限制了乘用电动车的普及。

- 标准与认证差距:缺乏钠离子特异性侦测规程

- 硬碳负极材料供应受限:国内产能有限

- 市场机会

- 美国公用事业规模电池新增装置容量22,255兆瓦(2023-2026年),主要面向固定式储能。

- 国防与军事应用:符合 BABA 标准的国内供应链

- 高循环寿命频率调节:>50,000 次循环,可实现 110 美元/千瓦/年的收入

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 依电池技术类型

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依电池技术类型划分,2021-2034年

- 室温钠离子电池

- 普鲁士蓝类似物(PBA)阴极

- 层状过渡金属氧化物阴极

- 多聚阴离子阴极

- 高温熔融

- 钠硫(NaS)电池

- 钠-金属卤化物(Na-NiCl2/ZEBRA)电池

- 中温钠电池(<200°C)

- 固态电池

- 陶瓷固体电解质

- 聚合物固态电解质

第六章:市场估计与预测:依产能规模划分,2021-2034年

- 小型(<100千瓦)

- 中型(100千瓦-10兆瓦)

- 大型(10兆瓦-100兆瓦)

- 超大型(>100兆瓦)

第七章:市场估计与预测:依应用领域划分,2021-2034年

- 电网级储能

- 频率调节及辅助服务

- 能源套利与削峰

- 再生能源併网与巩固

- 输配电升级延期

- 黑色启动与电网韧性

- 商业及工业仓储

- 资料中心和电信备用电源

- 工业削峰与需求响应

- 微电网和分散式发电支持

- 电动车快速充电基础设施

- 住宅储能

- 太阳能自用及备用

- 虚拟电厂(VPP)聚合

- 电动汽车应用

- 乘用电动车(纯电动车和插电式混合动力车)

- 两轮车和三轮车

- 商用巴士和重型卡车

- 电池更换系统

- 国防与军事

- 军用车辆和便携式电源

- 远端安装和关键基础设施

第八章:市场估算与预测:依最终用途划分,2021-2034年

- 电力公司和独立发电商

- 电信与资料中心

- 汽车原始设备製造商和电动汽车製造商

- 工业与製造业

- 再生能源开发商

- 政府与国防

第九章:市场估计与预测:依地区划分,2021-2034年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十章:公司简介

- Altris AB

- AMTE Power plc

- BYD

- CATL (Contemporary Amperex Technology Co., Ltd.)

- Hina Battery

- NGK Insulators

- Natron Energy, Inc.

- Reliance

- Tiamat Energy (Neogy)

- Xiamen Tob New Technology Co Ltd

The Global Sodium Ion Battery Material Market was valued at USD 2.1 billion in 2024 and is estimated to grow at a CAGR of 30% to reach USD 28.8 billion by 2034.

This technology is moving beyond early-stage development and progressing toward broader commercialization as innovations in prussian blue analog (PBA) cathodes and improved high-rate capabilities continue to gain traction. Energy density enhancements reaching 160-175 Wh/kg, combined with expanding multi-GWh manufacturing capacity, are accelerating worldwide adoption. Supportive government initiatives are also encouraging investment in sodium-ion production as global stakeholders aim to reduce dependence on lithium-based materials. The push toward domestic supply chains through various incentive programs is further strengthening industry infrastructure. As performance improves and capital requirements decline, sodium-ion systems are increasingly being incorporated into grid-scale storage, backup power networks, microgrids, and short-distance mobility applications. Several regions are promoting production to ease the pressure on critical mineral supply chains, while ongoing advancements in hard-carbon anodes, cell assembly processes, and recycling facilities position the technology for large-scale deployment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.1 Billion |

| Forecast Value | $28.8 Billion |

| CAGR | 30% |

The ambient-temperature (NAIBS) systems segment held 77.4% in 2024 and is projected to grow at a CAGR of 29.4% through 2034. Their rapid integration into commercial uses, combined with favorable cost profiles and strong compatibility with stationary storage and short-range mobility, is reinforcing their role as a key technology. Growth is expected to continue as production of next-generation PBA and layered-oxide materials is expanded across multiple facilities.

The medium-scale systems segment generated USD 883.7 million in 2024, supported by rising installations across commercial and industrial applications, including backup power networks, distribution-level energy resources, and microgrid environments. Their adaptability and straightforward deployment make them an appealing choice for data-intensive environments, telecommunications, and solutions that assist high-demand charging operations.

North America Sodium Ion Battery Material Market accounted for 21.3% share in 2024 and continues to gain momentum as demand for large-scale energy storage and renewable capacity expansion increases. The region benefits from supportive financial policies, procurement requirements, and access to essential raw materials, enabling consistent supply availability. Utilities across the U.S. and Canada are evaluating sodium-ion systems for long-duration storage, resilience enhancement, and effective cold-weather performance. Growing interest in microgrids and electrification of remote areas also positions North America as an emerging hotspot for commercial deployment. Data networks and communication infrastructure are expanding their use of sodium-ion technology to support reliability and power stability.

Key participants in the Sodium Ion Battery Material Market include Altris AB, AMTE Power plc, BYD, CATL (Contemporary Amperex Technology Co., Ltd.), Hina Battery, NGK Insulators, Natron Energy, Inc., Reliance, Tiamat Energy (Neogy), and Xiamen Tob New Technology Co. Ltd. Companies active in the Sodium Ion Battery Material Market are adopting several strategies to enhance their competitive edge and broaden their market reach. Many are rapidly scaling manufacturing capacity to support multi-GWh output, enabling cost reductions and improved supply stability. Firms are investing heavily in advanced anode and cathode material development to boost energy density, cycle life, and performance in extreme temperatures. Strategic collaborations with energy storage developers and mobility solution providers are strengthening integration across end-use sectors. Organizations are also focusing on regional production localization to benefit from policy incentives and reduce supply chain risks.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Battery Technology Type

- 2.2.3 Capacity Size

- 2.2.4 Application

- 2.2.5 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Critical Mineral Independence: Eliminating Lithium, Cobalt & Nickel Dependencies

- 3.2.1.2 Cost Competitiveness: 20-30% Lower Production Costs vs. LFP at Scale

- 3.2.1.3 Cold-Climate Performance: >90% Capacity Retention at -40°C Enabling Northern Markets

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lower Energy Density: 140-175 Wh/kg Limiting Passenger EV Adoption

- 3.2.2.2 Standards & Certification Gaps: Lack of Sodium-Ion-Specific Testing Protocols

- 3.2.2.3 Hard Carbon Anode Supply Constraints: Limited Domestic Production Capacity

- 3.2.3 Market opportunities

- 3.2.3.1 22,255 MW U.S. Utility-Scale Battery Additions (2023-2026) Targeting Stationary Storage

- 3.2.3.2 Defense & Military Applications: BABA-Compliant Domestic Supply Chains

- 3.2.3.3 High-Cycle-Life Frequency Regulation: >50,000 Cycles Enabling $110/kW-yr Revenue

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By Battery Technology Type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Battery Technology Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Ambient-Temperature NaIBs

- 5.2.1 Prussian Blue Analog (PBA) Cathodes

- 5.2.2 Layered Transition Metal Oxide Cathodes

- 5.2.3 Polyanion Cathodes

- 5.3 High-Temperature Molten

- 5.3.1 Sodium-Sulfur (NaS) Batteries

- 5.3.2 Sodium-Metal Halide (Na-NiCl2/ZEBRA) Batteries

- 5.3.3 Intermediate-Temperature Sodium Batteries (<200°C)

- 5.4 Solid State Battery

- 5.4.1 Ceramic Solid Electrolytes

- 5.4.2 Polymer Solid Electrolytes

Chapter 6 Market Estimates and Forecast, By Capacity Size, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Small-Scale (<100 kW)

- 6.3 Medium-Scale (100 kW - 10 MW)

- 6.4 Large-Scale (10 MW - 100 MW)

- 6.5 Extra-Large-Scale (>100 MW)

Chapter 7 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Grid-Scale Energy Storage

- 7.2.1 Frequency Regulation & Ancillary Services

- 7.2.2 Energy Arbitrage & Peak Shaving

- 7.2.3 Renewable Energy Integration & Firming

- 7.2.4 Transmission & Distribution Upgrade Deferral

- 7.2.5 Black Start & Grid Resilience

- 7.3 Commercial & Industrial Storage

- 7.3.1 Data Center & Telecom Backup Power

- 7.3.2 Industrial Peak Shaving & Demand Response

- 7.3.3 Microgrid & Distributed Generation Support

- 7.3.4 EV Fast Charging Infrastructure

- 7.4 Residential Energy Storage

- 7.4.1 Solar Self-Consumption & Backup

- 7.4.2 Virtual Power Plant (VPP) Aggregation

- 7.5 Electric Vehicle Applications

- 7.5.1 Passenger Electric Vehicles (BEVs & PHEVs)

- 7.5.2 Two-Wheelers & Three-Wheelers

- 7.5.3 Commercial Buses & Heavy-Duty Trucks

- 7.5.4 Battery Swapping Systems

- 7.6 Defense & Military

- 7.6.1 Military Vehicles & Portable Power

- 7.6.2 Remote Installations & Critical Infrastructure

Chapter 8 Market Estimates and Forecast, By End Use, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Electric Utilities & IPPs

- 8.3 Telecommunications & Data Centers

- 8.4 Automotive OEMs & EV Manufacturers

- 8.5 Industrial & Manufacturing

- 8.6 Renewable Energy Developers

- 8.7 Government & Defense

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Altris AB

- 10.2 AMTE Power plc

- 10.3 BYD

- 10.4 CATL (Contemporary Amperex Technology Co., Ltd.)

- 10.5 Hina Battery

- 10.6 NGK Insulators

- 10.7 Natron Energy, Inc.

- 10.8 Reliance

- 10.9 Tiamat Energy (Neogy)

- 10.10 Xiamen Tob New Technology Co Ltd