|

市场调查报告书

商品编码

1892713

电池回收化学品市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Battery Recycling Chemicals Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

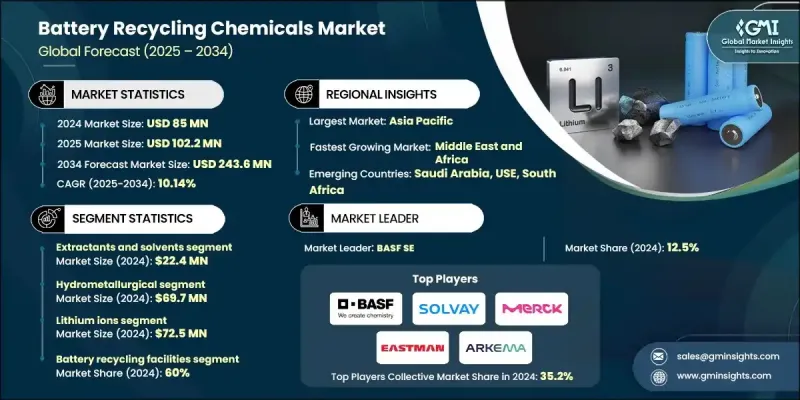

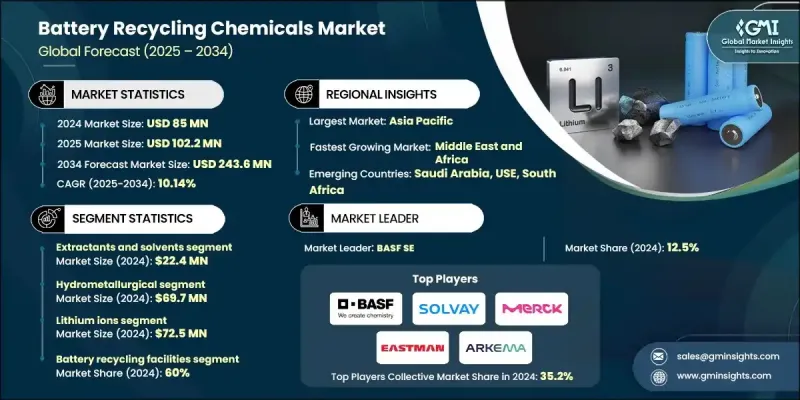

2024 年全球电池回收化学品市场价值为 8,500 万美元,预计到 2034 年将以 10.14% 的复合年增长率增长至 2.436 亿美元。

化学回收催化剂在将废弃聚合物和塑胶转化为其原始单体或其他高价值化合物的过程中发挥着至关重要的作用,它们透过引发分子水平的转化而非依赖物理加工来实现这一转化。这些催化剂透过提高反应性能、优化选择性和实现更永续的加工方式,为先进的循环经济方法提供了支持。随着废弃物管理策略转向能够恢復材料品质而非生产降级产品的解决方案,人们对电池回收化学品的兴趣日益浓厚。日益增长的环境压力、更严格的监管要求以及塑胶和电池产业对永续材料的更强需求,都在加速化学回收技术的应用。催化剂有助于降低破坏聚合物结构所需的能量,从而实现热解、水解和解聚等过程,取决于催化剂的组成。这种更广泛的转变凸显了化学回收技术在现代材料回收以及支援全球转型为更清洁、闭环资源系统的重要性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 8500万美元 |

| 预测值 | 2.436亿美元 |

| 复合年增长率 | 10.14% |

2024年,湿式冶金製程产业创造了6,970万美元的产值。该方法被广泛用于从废弃电池中提取金属,因为它能够精确控制分离和回收过程,从而稳定地提取有价元素。火法冶金方法依赖高温来简化电池材料混合物,但与水基处理相比,这些製程通常需要更多的能量。

到2024年,电池回收设施产业将占据60%的市场。随着各国优先考虑资源效率和低影响生产,金属精炼、化学加工、汽车製造和电子产品回收等产业持续成长。电动车、储能技术和电子设备的日益普及,使得从报废产品中回收关键材料的需求日益增长。回收和精炼方法有助于维持锂、钴和镍等关键资源的供应,同时减轻整体环境负担。

2024年,美国电池回收化学品市场规模达1,810万美元。在包括美国和加拿大在内的北美地区,随着各公司致力于透过先进的湿式冶金和化学方法回收关键金属,该行业正在蓬勃发展。电动车和电网储能係统的强劲成长推动了对可扩展、高效处理方法的需求,而持续的监管支持也吸引着对化学回收技术的投资。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 电动车和储能需求激增,推动供应激增

- 采用先进的回收技术

- 新兴电池化学领域的需求不断增长

- 产业陷阱与挑战

- 高昂的资本和营运成本

- 复杂多样的电池化学

- 市场机会

- 特种化学品创新

- 与循环经济倡议的融合

- 新兴市场的扩张

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依化学品类型

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依化学品类型划分,2021-2034年

- 浸出剂

- 还原剂/氧化剂

- 萃取剂和溶剂

- 沉淀剂

- 离子交换材料

- 高温灭菌添加剂

- 直接回收

- 其他的

第六章:市场估算与预测:依製程类型划分,2021-2034年

- 湿式冶金

- 火法冶金

- 直接和物理

- 生物浸出

- 混合工艺

第七章:市场估计与预测:依电池化学类型划分,2021-2034年

- 锂离子

- 铅酸

- 镍基

- 碱性及其他

第八章:市场估算与预测:依最终用途产业划分,2021-2034年

- 电池回收设施

- 金属精炼厂和冶炼厂

- 化学加工厂

- 汽车原厂设备製造商

- 电子产品回收商

- 工业电池回收商

第九章:市场估计与预测:依地区划分,2021-2034年

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十章:公司简介

- BASF SE

- Solvay SA

- Merck KGaA

- Eastman Chemical Company

- Arkema SA

- Umicore NV

- Redwood Materials Inc

- Ascend Elements Inc

- Fortum Corporation

- Guangdong Brunp Recycling Technology Co Ltd (GEM)

- Contemporary Amperex Technology Co Limited (CATL)

- Hydrovolt AS

- RecycLiCo Battery Materials Inc

- Cylib GmbH

- Glencore PLC

- Sibanye-Stillwater Limited

- Terrafame Oy

- American Battery Technology Company

- Aqua Metals Inc

- Neometals Ltd

- EnviroLeach Technologies Inc

- Battery Resourcers Inc

The Global Battery Recycling Chemicals Market was valued at USD 85 million in 2024 and is estimated to grow at a CAGR of 10.14% to reach USD 243.6 million by 2034.

Chemical recycling catalysts play a crucial role in converting waste polymers and plastics into their original monomers or other high-value compounds by triggering molecular-level transformations rather than relying on physical processing. These catalysts support advanced circular-economy approaches by improving reaction performance, optimizing selectivity, and enabling more sustainable processing. Interest in battery recycling chemicals is rising as waste-management strategies shift toward solutions that can restore material quality instead of producing downgraded outputs. Increasing environmental pressures, more aggressive regulatory requirements, and stronger demand for sustainable materials within the plastics and battery industries are accelerating adoption. Catalysts help reduce the energy needed to break polymer structures, enabling processes such as pyrolysis, hydrolysis, and depolymerization, depending on catalyst composition. This broader shift underscores how chemical recycling technologies are becoming essential in modern material recovery and in supporting the global transition toward cleaner, closed-loop resource systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $85 Million |

| Forecast Value | $243.6 Million |

| CAGR | 10.14% |

The hydrometallurgical processes segment generated USD 69.7 million in 2024. This approach is widely used to extract metals from spent batteries because it allows precise control over separation and recovery, yielding consistent results for valuable elements. Pyrometallurgical methods rely on high heat to simplify battery material mixtures, although these processes typically require more energy compared with aqueous-based treatments.

The battery recycling facilities segment held a 60% share in 2024. With countries prioritizing resource efficiency and low-impact production, sectors such as metal refining, chemical processing, automotive manufacturing, and electronics recycling continue to grow. Rising usage of electric vehicles, energy storage technologies, and electronic devices is increasing the need to reclaim essential materials from end-of-life products. Recycling and refining methods help maintain access to critical resources such as lithium, cobalt, and nickel while reducing overall environmental burden.

U.S. Battery Recycling Chemicals Market reached USD 18.1 million in 2024. In North America, which includes both the U.S. and Canada, the industry is expanding as companies work to recover key metals through advanced hydrometallurgical and chemical solutions. Strong growth in electric mobility and grid storage systems is driving the need for scalable, efficient treatments, and ongoing regulatory support for sustainable recycling continues to attract investment in chemical recovery technologies.

Major companies involved in the Global Battery Recycling Chemicals Market include BASF SE, Solvay SA, Merck KGaA, Eastman Chemical Company, Arkema SA, Umicore NV, Redwood Materials Inc, Ascend Elements Inc, Fortum Corporation, Guangdong Brunp Recycling Technology Co Ltd (GEM), Contemporary Amperex Technology Co Limited (CATL), Hydrovolt AS, RecycLiCo Battery Materials Inc, Cylib GmbH, Glencore PLC, Sibanye-Stillwater Limited, Terrafame Oy, American Battery Technology Company, Aqua Metals Inc, Neometals Ltd, EnviroLeach Technologies Inc, and Battery Resourcers Inc. Companies competing in the battery recycling chemicals sector are reinforcing their market presence by scaling hydrometallurgical capabilities, improving catalyst formulations, and expanding integrated recycling partnerships with battery manufacturers. Many firms are optimizing process efficiency by reducing reaction temperatures, improving metal-recovery yields, and adopting selective leaching and purification methods that deliver higher-quality outputs. Organizations are also forming regional alliances to secure feedstock, enhance supply-chain resilience, and ensure reliable access to end-of-life batteries. Increased investment in environmentally compliant technologies and low-emission processing systems remains a priority as regulatory expectations rise.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Chemicals type

- 2.2.2 Process type

- 2.2.3 Battery chemistry

- 2.2.4 End use industry

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Surge in EVs & energy-storage drives supply surge

- 3.2.1.2 Adoption of advanced recovery technologies

- 3.2.1.3 Rising demand from emerging battery chemistries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High capital and operational costs

- 3.2.2.2 Complex and diverse battery chemistries

- 3.2.3 Market opportunities

- 3.2.3.1 Innovation in specialized chemicals

- 3.2.3.2 Integration with circular economy initiatives

- 3.2.3.3 Expansion in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By chemicals type

- 3.9 Future market trends

- 3.10 Technology and innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent landscape

- 3.12 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Chemicals Type, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Leaching agents

- 5.3 Reductants/Oxidants

- 5.4 Extractants & solvents

- 5.5 Precipitating agents

- 5.6 Ion-exchange materials

- 5.7 Pyromet additives

- 5.8 Direct recycling

- 5.9 Others

Chapter 6 Market Estimates and Forecast, By Process Type, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Hydrometallurgical

- 6.3 Pyrometallurgical

- 6.4 Direct & physical

- 6.5 Bioleaching

- 6.6 Hybrid process

Chapter 7 Market Estimates and Forecast, By Battery Chemistry, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Lithium-Ion

- 7.3 Lead-Acid

- 7.4 Nickel-Based

- 7.5 Alkaline & Others

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Battery recycling facilities

- 8.3 Metal refineries & smelters

- 8.4 Chemical processing plants

- 8.5 Automotive OEMs

- 8.6 Electronics recyclers

- 8.7 Industrial battery recyclers

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 BASF SE

- 10.2 Solvay SA

- 10.3 Merck KGaA

- 10.4 Eastman Chemical Company

- 10.5 Arkema SA

- 10.6 Umicore NV

- 10.7 Redwood Materials Inc

- 10.8 Ascend Elements Inc

- 10.9 Fortum Corporation

- 10.10 Guangdong Brunp Recycling Technology Co Ltd (GEM)

- 10.11 Contemporary Amperex Technology Co Limited (CATL)

- 10.12 Hydrovolt AS

- 10.13 RecycLiCo Battery Materials Inc

- 10.14 Cylib GmbH

- 10.15 Glencore PLC

- 10.16 Sibanye-Stillwater Limited

- 10.17 Terrafame Oy

- 10.18 American Battery Technology Company

- 10.19 Aqua Metals Inc

- 10.20 Neometals Ltd

- 10.21 EnviroLeach Technologies Inc

- 10.22 Battery Resourcers Inc