|

市场调查报告书

商品编码

1892760

尼古丁袋市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Nicotine Pouches Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

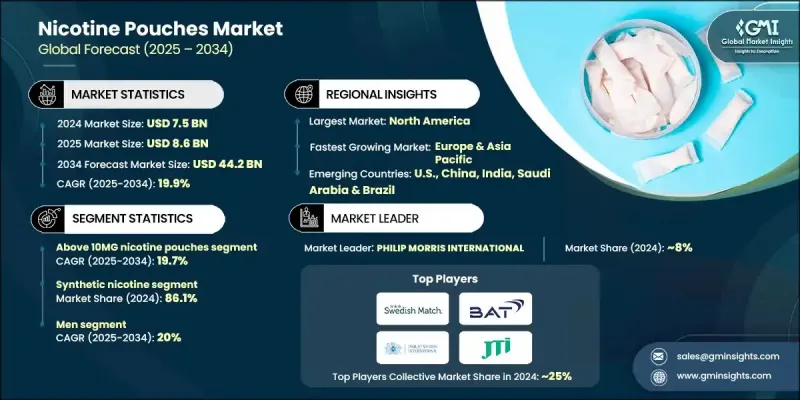

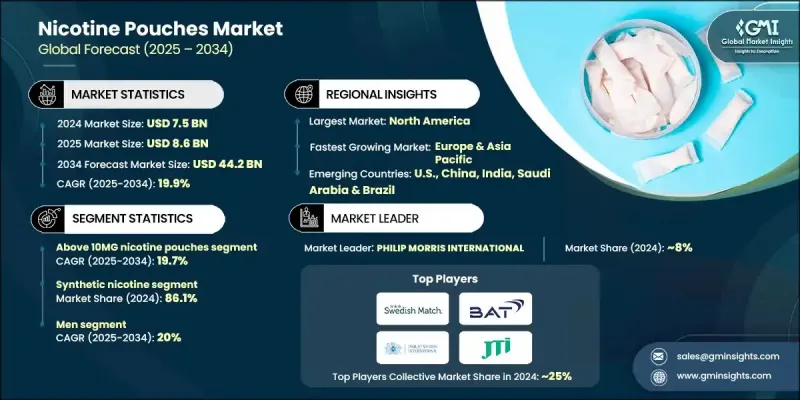

2024 年全球尼古丁袋市场价值为 75 亿美元,预计到 2034 年将以 19.9% 的复合年增长率增长至 442 亿美元。

随着消费者越来越多地寻求传统吸烟方式的替代品,尼古丁袋正日益受到欢迎。随着人们健康意识的提高以及对肺癌和心臟病等吸烟相关疾病的日益关注,许多成年使用者开始使用尼古丁袋来满足烟瘾,同时避免燃烧带来的有害影响。这些产品提供了一种隐密的选择,符合无烟工作场所的规定,因此被广泛接受。政府的措施、反吸烟运动以及更严格的烟草法规也在推动人们转向减害替代品。与香烟或嚼烟相比,尼古丁袋的便利性、隐藏性以及较低的风险认知使其极具吸引力。口味创新、高浓度版本和缓释技术进一步强化了这一趋势,提升了使用者体验,并促进了不同消费群体对尼古丁袋的接受度。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 75亿美元 |

| 预测值 | 442亿美元 |

| 复合年增长率 | 19.9% |

2024年,10毫克尼古丁袋市场规模达到24亿美元,预计到2034年将以19.7%的复合年增长率成长。高浓度尼古丁袋能为从吸烟或其他无烟烟草产品过渡到尼古丁袋的消费者提供更强烈的尼古丁刺激。其隐密的设计和与无烟环境的兼容性提高了消费者的接受度,而口味和输送方式的创新则进一步提升了消费者的满意度。

2024年,男性消费者群体占据了67.9%的市场份额,预计2025年至2034年将以20%的复合年增长率成长。男性吸烟率较高,且偏好高浓度尼古丁和浓郁口味,这使得他们成为尼古丁袋的主要消费群体。这些产品能够完美融入禁烟的工作场所和社交环境,提供便利、隐密且令人满意的体验。

美国尼古丁袋市场在2024年创造了20亿美元的收入,预计从2025年到2034年将以21.1%的复合年增长率成长。由于健康意识的提高和严格的禁烟政策,吸烟率下降,催生了庞大的无烟替代品消费群体。尼古丁袋提供了一个隐密、便利且符合法规的解决方案,满足了这项需求。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 传统烟草产品的无烟替代品越来越受欢迎。

- 健康意识提高。

- 口味多样,强度各异

- 产业陷阱与挑战

- 监管方面的不确定性

- 对青少年收养和公共卫生的担忧

- 成长驱动因素

- 成长潜力分析

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按类型

- 监管环境

- 标准和合规要求

- 区域监理框架

- 认证标准

- 贸易统计

- 主要进口国

- 主要出口国

- 波特的分析

- PESTEL 分析

- 消费者行为分析

- 购买模式

- 偏好分析

- 消费者行为的区域差异

- 电子商务对购买决策的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依口味类型划分,2021-2034年

- 调味

- 薄荷

- 水果

- 草药

- 其他成分(冬青油、咖啡、甜味剂等)

- 无味

第六章:市场估算与预测:依类型划分,2021-2034年

- 湿袋

- 干袋

第七章:市场估计与预测:依尼古丁含量划分,2021-2034年

- 最高 5 毫克

- 5毫克 - 10毫克

- 10毫克以上

第八章:市场估算与预测:依产品形式划分,2021-2034年

- 小型的

- 苗条的

- 常规的

- 麦克西

第九章:市场估算与预测:依类别划分,2021-2034年

- 无烟环境

- 合成尼古丁

第十章:市场估计与预测:依价格划分,2021-2034年

- 低的

- 中等的

- 高的

第十一章:市场估计与预测:依消费群体划分,2021-2034年

- 男人

- 女性

第十二章:市场估算与预测:依配销通路划分,2021-2034年

- 在线的

- 电子商务

- 公司网站

- 离线

- 电子烟专卖店

- 其他零售店

第十三章:市场估计与预测:依地区划分,2021-2034年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 印尼

- 马来西亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 沙乌地阿拉伯

- 阿联酋

- 南非

第十四章:公司简介

- Moxy

- Black Buffalo

- Lyft

- White Fox

- Nordic Spirit

- Dryft

- Killa

- ZERO

- Rogue

- VELO

- On!

- ZYN

- UPROAR

The Global Nicotine Pouches Market was valued at USD 7.5 billion in 2024 and is estimated to grow at a CAGR of 19.9% to reach USD 44.2 billion by 2034.

Nicotine pouches are gaining popularity as consumers increasingly seek alternatives to traditional smoking. With heightened health awareness and rising concerns over smoking-related diseases such as lung cancer and heart disease, many adult users are turning to nicotine pouches to satisfy their cravings without exposure to the harmful effects of combustion. These products offer a discreet option that aligns with smoke-free workplace regulations, contributing to their widespread acceptance. Government initiatives, anti-smoking campaigns, and stricter tobacco regulations are also driving the shift toward harm-reduction alternatives. The convenience, discreet nature, and perception of reduced risk compared to cigarettes or chewing tobacco make nicotine pouches particularly appealing. This trend is further reinforced by flavor innovations, high-strength variants, and extended-release technologies that enhance the user experience and promote adoption across diverse consumer segments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.5 billion |

| Forecast Value | $44.2 billion |

| CAGR | 19.9% |

The above 10MG nicotine pouch segment generated USD 2.4 billion in 2024 and is expected to grow at a CAGR of 19.7% through 2034. High-strength pouches provide a more intense nicotine hit for consumers transitioning from smoking or other smokeless tobacco products. Their discreet design and compatibility with smoke-free environments increase adoption, while innovations in flavor and delivery further enhance satisfaction.

The male consumers segment held a 67.9% share in 2024 and is projected to grow at a CAGR of 20% from 2025 to 2034. Higher smoking prevalence among men and a preference for stronger nicotine and bold flavors make them the primary adopters of nicotine pouches. These products fit seamlessly into workplaces and social environments where smoking is restricted, offering a convenient, discreet, and satisfying experience.

U.S. Nicotine Pouches Market generated USD 2 billion in 2024 and is anticipated to grow at a CAGR of 21.1% from 2025 to 2034. Declining cigarette smoking rates, driven by increased health awareness and strict anti-smoking policies, have created a large consumer base seeking smoke-free alternatives. Nicotine pouches fulfill this demand by providing a discreet, convenient, and regulation-compliant solution.

Key players in the Global Nicotine Pouches Market include UPROAR, Moxy, Nordic Spirit, Lyft, Rogue, ZYN, Black Buffalo, On!, ZERO, VELO, White Fox, Dryft, and Killa. Companies in the Nicotine Pouches Market are adopting several strategies to strengthen their market presence and foothold. They are investing heavily in research and development to introduce innovative flavors, extended-release technologies, and high-nicotine variants. Marketing campaigns target health-conscious consumers and emphasize the discreet, smoke-free nature of pouches. Firms are expanding their distribution networks across retail, e-commerce, and specialty stores to increase accessibility. Strategic collaborations with regulatory bodies and participation in anti-smoking initiatives enhance credibility and consumer trust. Additionally, companies focus on packaging innovations, subscription models, and loyalty programs to retain customers, drive repeat purchases, and reinforce brand loyalty in a highly competitive market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Flavour type

- 2.2.3 Type

- 2.2.4 Nicotine content

- 2.2.5 Format

- 2.2.6 Category

- 2.2.7 Price

- 2.2.8 Consumer group

- 2.2.9 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Smoke-free alternatives to traditional tobacco products gain traction.

- 3.2.1.2 Heightened health awareness.

- 3.2.1.3 Diverse flavors and varying strengths

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Uncertainty in regulations

- 3.2.2.2 Concerns over youth adoption & public health

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Flavour Type, 2021 - 2034, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Flavored

- 5.2.1 Mint

- 5.2.2 Fruit

- 5.2.3 Herbal

- 5.2.4 Others (wintergreen, coffee, sweeteners, etc.)

- 5.3 Non-Flavored

Chapter 6 Market Estimates & Forecast, By Type, 2021 - 2034, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Moist pouches

- 6.3 Dry pouches

Chapter 7 Market Estimates & Forecast, By Nicotine Content, 2021 - 2034, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Up to 5 MG

- 7.3 5MG - 10MG

- 7.4 Above 10MG

Chapter 8 Market Estimates & Forecast, By Format, 2021 - 2034, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Mini

- 8.3 Slim

- 8.4 Regular

- 8.5 Maxi

Chapter 9 Market Estimates & Forecast, By Category, 2021 - 2034, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Tobacco-free

- 9.3 Synthetic nicotine

Chapter 10 Market Estimates & Forecast, By Price, 2021 - 2034, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 Low

- 10.3 Medium

- 10.4 High

Chapter 11 Market Estimates & Forecast, By Consumer Group, 2021 - 2034, (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 Men

- 11.3 Women

Chapter 12 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Million Units)

- 12.1 Key trends

- 12.2 Online

- 12.2.1 E-Commerce

- 12.2.2 Company website

- 12.3 Offline

- 12.3.1 Specialty vape shops

- 12.3.2 Other retail stores

Chapter 13 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Million Units)

- 13.1 Key trends

- 13.2 North America

- 13.2.1 U.S.

- 13.2.2 Canada

- 13.3 Europe

- 13.3.1 Germany

- 13.3.2 UK

- 13.3.3 France

- 13.3.4 Italy

- 13.3.5 Spain

- 13.4 Asia Pacific

- 13.4.1 China

- 13.4.2 India

- 13.4.3 Japan

- 13.4.4 South Korea

- 13.4.5 Australia

- 13.4.6 Indonesia

- 13.4.7 Malaysia

- 13.5 Latin America

- 13.5.1 Brazil

- 13.5.2 Mexico

- 13.5.3 Argentina

- 13.6 MEA

- 13.6.1 Saudi Arabia

- 13.6.2 UAE

- 13.6.3 South Africa

Chapter 14 Company Profiles

- 14.1 Moxy

- 14.2 Black Buffalo

- 14.3 Lyft

- 14.4 White Fox

- 14.5 Nordic Spirit

- 14.6 Dryft

- 14.7 Killa

- 14.8 ZERO

- 14.9 Rogue

- 14.10 VELO

- 14.11 On!

- 14.12 ZYN

- 14.13 UPROAR