|

市场调查报告书

商品编码

1892787

眼科抗VEGF疗法市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Ophthalmic Anti-VEGF Therapeutics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

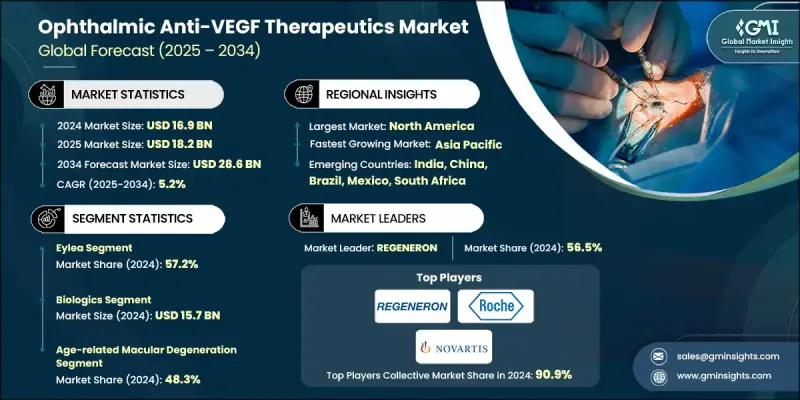

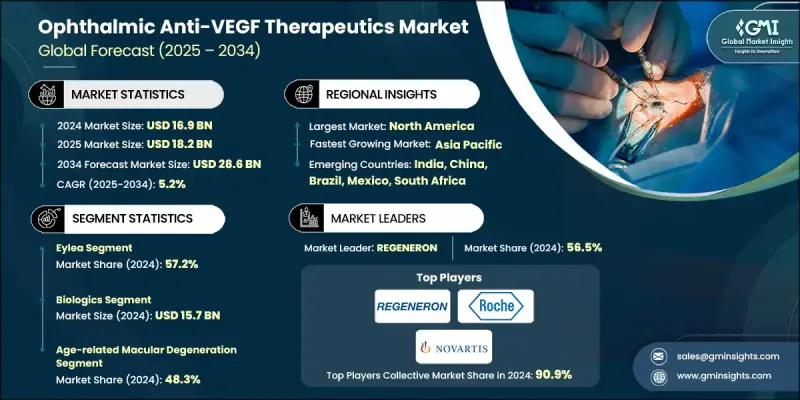

2024 年全球眼科抗 VEGF 治疗市值为 169 亿美元,预计到 2034 年将以 5.2% 的复合年增长率增长至 286 亿美元。

视网膜疾病的增加、全球糖尿病盛行率的上升、人口老化的持续加剧以及专业眼科机构的快速发展推动了市场扩张。抗VEGF药物透过阻断VEGF活性发挥作用,VEGF活性会导致视网膜异常血管形成,因此这类疗法对于治疗老年黄斑部病变(AMD)、糖尿病黄斑水肿(DME)和视网膜静脉阻塞(RVO)等疾病至关重要。糖尿病视网膜病变、糖尿病相关性黄斑部併发症和老年视力退化病例的不断增加,持续扩大了治疗范围。同时,持续的研究工作正在研发出具有更长效期、更高安全性和多通路靶向能力的改良分子。这些创新正在重塑治疗模式,拓展一线治疗方案的选择,优化转换策略,并支持更长的给药间隔。随着治疗领域的多元化,高端药物类别凭藉其卓越的临床疗效以及在老化和糖尿病人群中的持续需求,仍然保持着商业可行性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 169亿美元 |

| 预测值 | 286亿美元 |

| 复合年增长率 | 5.2% |

2024年,Eylea市占率达到57.2%,这得益于其强劲的临床疗效、可靠的安全性以及高剂量配方带来的更长给药週期。全球糖尿病患者人数的快速成长进一步推动了Eylea在糖尿病视网膜疾病领域的广泛应用,持续的长期使用和高年度治疗量也促进了该药物的长期应用。

2024年,年龄相关性黄斑部病变(AMD)市场占全球市场份额的48.3%,预计到2034年将达到132亿美元。由于AMD主要影响老年人,老年人口快速成长的市场对AMD的治疗需求持续上升。抗VEGF疗法仍是AMD治疗的基石,因此在全球老化人口中,AMD治疗市场持续成长。

2024年,北美眼科抗VEGF疗法市占率达到64.8%,这主要得益于该地区庞大的AMD、DME和糖尿病视网膜病变患者族群。该地区拥有完善的临床基础设施、丰富的专家资源以及高效的供应和管理系统,这些优势有助于患者坚持治疗。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 眼疾发生率不断上升

- 人口老化加剧

- 药物研发中的技术进步

- 人们对及时治疗眼科疾病的意识日益增强。

- 产业陷阱与挑战

- 治疗费用高昂

- 副作用和安全问题

- 市场机会

- 生物相似药和低成本替代药物扩大了患者的可及性。

- 随着医疗保健覆盖范围的扩大,业务拓展至新兴市场。

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 技术格局

- 当前技术趋势

- 新兴技术

- 未来市场趋势

- 管道分析

- 2024年定价分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 竞争定位矩阵

- 主要市场参与者的竞争分析

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依抗 VEGF 疗法划分,2021-2034 年

- 艾莉娅

- 瓦比斯莫

- 卢森蒂斯

- 其他抗 VEGF 疗法

第六章:市场估算与预测:依药物类型划分,2021-2034年

- 生物製剂

- 生物相似药

第七章:市场估算与预测:依指示剂划分,2021-2034年

- 老年性黄斑部病变

- 糖尿病视网膜病变

- 黄斑水肿

- 视网膜静脉阻塞

- 近视性脉络膜新生血管

第八章:市场估算与预测:依地区划分,2021-2034年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- AMGEN

- Astellas

- Biocon Biologics

- Biogen

- CELLTRION

- Intas Pharmaceuticals

- KANGHONG PHARMACEUTICALS

- LUPIN

- NOVARTIS

- REGENERON

- Reliance Life Sciences

- Roche

- SANDOZ

- STADA

- teva

The Global Ophthalmic Anti-VEGF Therapeutics Market was valued at USD 16.9 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 28.6 billion by 2034.

Market expansion is driven by the rise in retinal disorders, the global increase in diabetes, continued population aging, and the rapid establishment of specialized ophthalmic facilities. Anti-VEGF drugs work by blocking VEGF activity, which contributes to abnormal blood vessel formation in the retina, making these therapies essential for conditions such as age-related macular degeneration (AMD), diabetic macular edema (DME), and retinal vein occlusion (RVO). Increasing cases of diabetic retinopathy, diabetes-related macular complications, and age-related visual degeneration continue to widen the treatment pool. At the same time, continual research efforts are delivering improved molecules with longer durability, enhanced safety, and multi-pathway targeting capabilities. These innovations are reshaping treatment patterns by expanding options for first-line therapies, optimizing switching strategies, and supporting longer dosing intervals. As the therapeutic landscape diversifies, premium drug categories remain commercially viable due to clinical performance and sustained demand across aging and diabetic populations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $16.9 Billion |

| Forecast Value | $28.6 Billion |

| CAGR | 5.2% |

The Eylea segment held a 57.2% share in 2024, supported by strong clinical outcomes, reliable safety, and longer dosing cycles enabled by its higher-dose formulation. Its broad adoption in diabetic retinal diseases is reinforced by the fast-growing global diabetic population, which consistently drives long-term utilization and high annual treatment volumes.

The age-related macular degeneration segment accounted for a 48.3% share in 2024 and is expected to reach USD 13.2 billion through 2034. As AMD primarily affects older adults, markets with rapidly expanding senior populations continue to see rising therapy demand. Anti-VEGF treatment remains the cornerstone of AMD care, resulting in steady growth across aging demographics worldwide.

North America Ophthalmic Anti-VEGF Therapeutics Market held a 64.8% share in 2024, supported by a large patient base with AMD, DME, and diabetic retinopathy. The region benefits from robust clinical infrastructure, extensive specialist availability, and highly efficient supply and administration systems that facilitate ongoing treatment adherence.

Major companies participating in the Global Ophthalmic Anti-VEGF Therapeutics Market include AMGEN, Astellas, Biocon Biologics, Biogen, CELLTRION, Intas Pharmaceuticals, KANGHONG PHARMACEUTICALS, LUPIN, NOVARTIS, REGENERON, Reliance Life Sciences, Roche, SANDOZ, STADA, and Teva. Companies operating in the Ophthalmic Anti-VEGF Therapeutics Market are adopting several strategic approaches to strengthen their position. Many are investing heavily in next-generation molecules with extended durability to reduce injection burden and improve patient outcomes. Firms are expanding clinical trials across multiple retinal conditions to broaden therapeutic indications and secure a larger market share. Partnerships, co-development agreements, and biosimilar expansion strategies are helping companies reach new geographies and diversify product portfolios. Manufacturers are also prioritizing real-world evidence programs to reinforce clinical value and support reimbursement negotiations.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Anti-VEGF therapies trends

- 2.2.3 Drug type trends

- 2.2.4 Indication trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of eye diseases

- 3.2.1.2 Rise in aging population

- 3.2.1.3 Technological advancements in drug development

- 3.2.1.4 Growing awareness towards timely treatment of ophthalmic disorders

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of treatment

- 3.2.2.2 Side effects and safety concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Biosimilars and lower-cost alternatives expanding access

- 3.2.3.2 Expansion into emerging markets with growing healthcare access

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pipeline analysis

- 3.8 Pricing analysis, 2024

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Anti-VEGF Therapies, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Eylea

- 5.3 Vabysmo

- 5.4 Lucentis

- 5.5 Other anti-VEGF therapies

Chapter 6 Market Estimates and Forecast, By Drug Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Biologics

- 6.3 Biosimilars

Chapter 7 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Age-related macular degeneration

- 7.3 Diabetic retinopathy

- 7.4 Macular edema

- 7.5 Retinal vein occlusion

- 7.6 Myopic choroidal neovascularization

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AMGEN

- 9.2 Astellas

- 9.3 Biocon Biologics

- 9.4 Biogen

- 9.5 CELLTRION

- 9.6 Intas Pharmaceuticals

- 9.7 KANGHONG PHARMACEUTICALS

- 9.8 LUPIN

- 9.9 NOVARTIS

- 9.10 REGENERON

- 9.11 Reliance Life Sciences

- 9.12 Roche

- 9.13 SANDOZ

- 9.14 STADA

- 9.15 teva