|

市场调查报告书

商品编码

1881234

全球眼科器材市场(至2030年)依技术、产品类型(手术器材、诊断和监测器材)及最终用户划分Ophthalmic Equipment Market by Technology, Product Type (Surgical Devices, Diagnostic & Monitoring Devices ), End User - Global Forecast to 2030 |

||||||

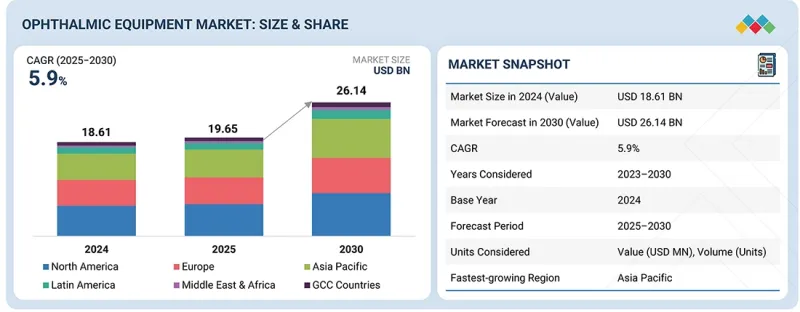

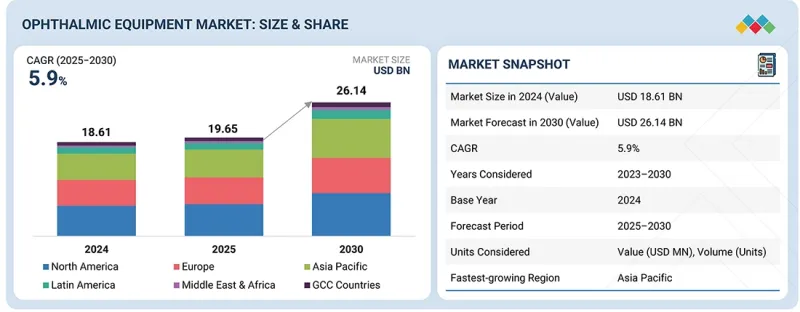

预计眼科设备市场将从 2025 年的 196.5 亿美元成长到 2030 年的 261.4 亿美元,预测期内复合年增长率为 5.9%。

| 调查范围 | |

|---|---|

| 调查期 | 2024-2033 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 单元 | 金额(美元) |

| 部分 | 技术、产品类型、最终用户、地区 |

| 目标区域 | 北美、欧洲、亚太地区、拉丁美洲、中东和非洲、海湾合作委员会国家 |

眼科器械市场的主要驱动力是白内障、青光眼和糖尿病视网膜病变等眼科疾病的日益普遍,以及全球人口老化。此外,OCT和眼底摄影机等先进诊断工具的日益普及、医疗保健成本的不断上涨以及开发中国家眼科医疗服务可及性的提高,也是推动市场成长的因素。

此外,微创和人工智慧眼科护理解决方案背后的技术创新也在推动其普及。然而,设备高成本和熟练专业人员短缺限制了市场扩张。

按产品类型划分,手术器械在市场上占据主导地位,这主要得益于全球大量的白内障、屈光矫正手术和青光眼手术。显微外科技术、超音波雷射和超音波乳化系统的进步提高了手术的精确度和效果,从而促进了手术器械的普及。此外,老年人口的成长和先进手术中心的扩张也推动了眼科手术器械的需求。

从终端用户来看,医院占最大份额。作为提供全面眼科护理的主要中心,医院提供诊断和手术服务。它们拥有先进的基础设施和技术精湛的眼科医生,因此比诊所更能吸引患者。此外,它们有能力投资购买用于复杂手术的精密眼科设备,这进一步巩固了它们在整体市场的主导地位。

北美地区凭藉其先进的医疗基础设施、创新诊断和手术技术的高普及率以及主要製造商的强大实力,占据了最大的市场份额。该地区受益于高额的医疗支出、有利的报销政策以及大量训练有素的眼科医生。此外,青光眼和老龄化黄斑部病变等老龄化性眼科疾病的日益普遍进一步推动了对医疗器材的需求,而持续的技术创新和早期应用则帮助该地区保持了其市场主导地位。

本报告调查了全球眼科设备市场,并提供了市场概况、影响市场成长的各种因素分析、技术和专利趋势、法律制度、案例研究、市场规模趋势和预测、按各个细分市场、地区/主要国家/地区进行的详细分析、竞争格局以及主要企业的概况。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章 市场概览

- 市场动态

- 司机

- 抑制因素

- 机会

- 任务

- 影响您业务的趋势/颠覆性因素

- 定价分析

- 价值链分析

- 供应链分析

- 生态系分析

- 投资和资金筹措方案

- 技术分析

- 产业趋势

- 专利分析

- 贸易分析

- 2025-2026 年重要会议与活动

- 案例研究分析

- 监管分析

- 波特五力分析

- 主要相关利益者和采购标准

- 未满足的需求/最终用户期望

- 2025年美国关税对眼科器械市场的影响

- 人工智慧对眼科设备市场的影响

- 邻近市场分析

第六章 眼科设备市场:依技术划分

- 非人工智慧相容设备

- 人工智慧设备

第七章 眼科设备市场:依产品分类

- 手术器械

- 白内障手术设备

- 玻璃体视网膜手术设备

- 屈光矫正手术设备

- 青光眼手术设备

- 眼科显微镜

- 眼科手术配件

- 诊断和监测设备

- 光学同调断层扫描设备

- 眼底摄影机

- 视野/视野分析设备

- 自动验光仪和角膜曲率计

- 超音波影像系统

- 其他超音波影像系统

- 眼压计

- 裂隙灯

- 光翼

- 波前像差仪

- 光学生物识别系统

- 眼底镜

- 焦度计

- 角膜地图仪系统

- 图表投影仪

- 镜面显微镜

- 检影镜

- 其他诊断和监测设备

第八章 依最终使用者分類的眼科设备市场

- 医院

- 专科诊所及门诊手术中心

- 其他的

第九章 眼科设备市场:依地区划分

- 北美洲

- 宏观经济展望

- 美国

- 加拿大

- 欧洲

- 宏观经济展望

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他的

- 亚太地区

- 宏观经济展望

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 其他的

- 拉丁美洲

- 宏观经济展望

- 巴西

- 墨西哥

- 阿根廷

- 其他的

- 中东和非洲

- 宏观经济展望

- 海湾合作委员会国家

- 宏观经济展望

第十章 竞争格局

- 概述

- 主要企业/主要企业的策略

- 收入分析

- 市占率分析

- 公司评估矩阵:主要企业

- 公司估值矩阵:Start-Ups/中小企业

- 估值和财务指标

- 品牌/产品对比

- 竞争场景

第十一章 公司简介

- 主要企业

- ALCON

- JOHNSON & JOHNSON

- CARL ZEISS MEDITEC AG

- BAUSCH HEALTH COMPANIES INC.

- HOYA CORPORATION

- ESSILORLUXOTTICA

- CANON

- GLAUKOS CORPORATION

- TOPCON CORPORATION

- NIDEK CO., LTD.

- STAAR SURGICAL

- HALMA PLC

- HAAG-STREIT

- SHANGHAI MEDIWORKS PRECISION INSTRUMENTS CO., LTD.

- VISIONIX

- 其他公司

- VISUNEX MEDICAL SYSTEMS

- COSTRUZIONE STRUMENTI OFTALMICI

- HAI LABORATORIES, INC.

- FORUS HEALTH

- ZIEMER OPHTHALMIC SYSTEMS AG

- CRYSTALVUE MEDICAL CORPORATION

- REMIDIO INNOVATIVE SOLUTIONS PVT. LTD.

- SUZHOU KANGJIE MEDICAL INC.

- LUMENIS

- OPHTEC BV

第十二章附录

The ophthalmic equipment market is projected to reach USD 26.14 billion by 2030 from USD 19.65 billion in 2025, at a CAGR of 5.9% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Technology, Product Type, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa, and GCC Countries |

The ophthalmic equipment market is mainly propelled by the increasing prevalence of eye conditions such as cataracts, glaucoma, and diabetic retinopathy, along with the aging global population. Rising use of advanced diagnostic tools like OCT and fundus cameras, higher healthcare expenditures, and broader access to eye care services in developing countries also drive market growth.

Additionally, innovations in technology that support minimally invasive and AI-based eye care solutions boost adoption. However, high equipment costs and a shortage of skilled professionals limit market expansion.

By product type, surgical devices dominate the ophthalmic equipment market because of the high volume of cataract, refractive, and glaucoma surgeries worldwide. Advances in microsurgical techniques, femtosecond lasers, and phacoemulsification systems have improved precision and outcomes, increasing their adoption. Additionally, the growing elderly population and the expanding availability of advanced surgical centers further boost demand for ophthalmic surgical devices.

By end user, hospitals hold the largest share in the ophthalmic equipment market because they serve as primary centers for comprehensive eye care, providing both diagnostic and surgical services. They have advanced infrastructure and skilled ophthalmologists, and they attract more patients than clinics. Additionally, hospitals' ability to invest in high-end ophthalmic equipment for complex procedures strengthens their dominance in the overall market.

North America holds the largest share of the ophthalmic equipment market because of its advanced healthcare infrastructure, high adoption of innovative diagnostic and surgical technologies, and a strong presence of leading manufacturers. The region benefits from significant healthcare spending, supportive reimbursement policies, and a large number of trained ophthalmologists. Additionally, the increasing prevalence of age-related eye diseases like glaucoma and macular degeneration further boosts equipment demand, while ongoing innovation and early technology adoption help sustain the market dominance.

A breakdown of the primary participants (supply-side) for the ophthalmic equipment market referred to in this report is provided below:

- By Company Type: Tier 1:34%, Tier 2: 38%, and Tier 3: 28%

- By Designation: C-level: 26%, Director Level: 35%, and Others: 39%

- By Region: North America: 17%, Europe: 39%, Asia Pacific: 28%, Latin America: 8%, Middle East & Africa: 3%, GCC Countries: 5%

Prominent players in the ophthalmic equipment market are Bausch Health Companies, Inc. (Canada), Alcon (US), Carl Zeiss Meditec AG (Germany), Johnson & Johnson Vision Care (US), HOYA Corporation (Japan), EssilorLuxottica (France), Canon Inc. (Japan), Glaukos Corporation (US), Nidek Co., Ltd. (Japan), Topcon Corporation (Japan), Staar Surgical (US), Haag-Streit (Switzerland), Visionix (France), Shanghai Mediworks Precision Instruments Co., Ltd. (China), Halma plc (UK), among others.

Research Coverage

The report assesses the ophthalmic equipment market and estimates its size and future growth potential across various segments, including technology, product type, end user, and region. It also provides a competitive analysis of the major players, featuring company profiles, product offerings, recent developments, and key market dynamics strategies.

Reasons to Buy the Report

The report will help market leaders and new entrants by providing data on approximate revenue figures for the overall market, the ophthalmic equipment sector, and its subsegments. It will assist stakeholders in understanding the competitive landscape and gaining insights to better position their businesses and develop effective go-to-market strategies. Additionally, the report helps stakeholders grasp the market pulse by offering data on key drivers, barriers, obstacles, and opportunities in the market.

This report provides insights into the following points:

- Analysis of key drivers (Increasing geriatric population, Rising prevalence of eye disorders, Technological advancements in ophthalmic devices, and Increased government initiatives to control visual impairment), restraints (High cost of ophthalmology devices, High cost and risk associated with eye surgeries and Rising adoption of refurbished ophthalmic devices), opportunities (Potential growth opportunities in emerging markets and Low adoption of phacoemulsification devices and premium IOLs in emerging markets), and challenges (Low accessibility to eye care in low-income countries, Lack of skilled professionals)

- Product Enhancement/Innovation: Comprehensive details about product launches and anticipated trends in the global ophthalmic equipment market

- Market Development: Thorough knowledge and analysis of the profitable rising markets by technology, product type, end user, and region

- Market Diversification: Comprehensive information about newly launched products, expanding markets, current advancements, and investments in the global ophthalmic equipment market

- Competitive Assessment: Thorough evaluation of the market shares, growth plans, offerings, and capacities of the major competitors in the global ophthalmic equipment market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 SEGMENTS COVERED & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY USED

- 1.5 STAKEHOLDERS

- 1.6 LIMITATIONS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 CAGR PROJECTIONS

- 2.2.2 TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.4 MARKET SHARE ESTIMATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 LIMITATIONS

- 2.6.1 METHODOLOGY-RELATED LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 OPHTHALMIC EQUIPMENT MARKET OVERVIEW

- 4.2 NORTH AMERICA: OPHTHALMIC EQUIPMENT MARKET, BY COUNTRY AND END USER (2024)

- 4.3 OPHTHALMIC EQUIPMENT MARKET: REGIONAL GROWTH OPPORTUNITIES

- 4.4 OPHTHALMIC EQUIPMENT MARKET, BY REGION (2025-2030)

- 4.5 OPHTHALMIC EQUIPMENT MARKET: DEVELOPED VS. DEVELOPING MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing geriatric population

- 5.2.1.2 Rising prevalence of eye disorders

- 5.2.1.2.1 Cataracts

- 5.2.1.2.2 Glaucoma

- 5.2.1.2.3 Obesity and diabetes

- 5.2.1.2.4 Age-related macular degeneration (AMD)

- 5.2.1.3 Technological advancements in ophthalmic devices

- 5.2.1.4 Increased government initiatives to control visual impairment

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost and risk associated with eye surgeries

- 5.2.2.2 High cost of ophthalmology devices

- 5.2.2.3 Rising adoption of refurbished ophthalmic devices

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Potential growth opportunities in emerging markets

- 5.2.3.2 Low adoption of phacoemulsification devices and premium IOLs in emerging markets

- 5.2.4 CHALLENGES

- 5.2.4.1 Low accessibility to eye care in low-income countries

- 5.2.4.2 Lack of skilled professionals

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE OF OPHTHLAMIC EQUIPMENT PRODUCTS, BY KEY PLAYER, 2024

- 5.4.2 AVERAGE SELLING PRICE TREND OF OPTICAL COHERENCE TOMOGRAPHY SYSTEMS, BY REGION, 2022-2024

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 INVESTMENT & FUNDING SCENARIO

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Robotics & image-guided surgical systems

- 5.9.1.2 Wearable and AR/VR-based vision systems

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Teleophthalmology and remote monitoring

- 5.9.2.2 Cloud connectivity and data integration

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Eye-tracking and motion compensation devices

- 5.9.3.2 Data management & EHR integration tools

- 5.9.1 KEY TECHNOLOGIES

- 5.10 INDUSTRY TRENDS

- 5.10.1 INNOVATIVE APPLICATION OF FEMTOSECOND LASER TECHNOLOGY

- 5.10.2 MINIMALLY INVASIVE GLAUCOMA SURGERY

- 5.11 PATENT ANALYSIS

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT DATA (HS CODE 901850)

- 5.12.2 EXPORT DATA (HS CODE 901850)

- 5.13 KEY CONFERENCES & EVENTS, 2025-2026

- 5.14 CASE STUDY ANALYSIS

- 5.14.1 CASE STUDY 1: ZEISS - AI INTEGRATION IN CIRRUS OCT SYSTEMS

- 5.14.2 CASE STUDY 2: INDIAN GOVERNMENT'S NPCB & USE OF FORUS HEALTH'S 3NETHRA

- 5.14.3 CASE STUDY 3: HEIDELBERG ENGINEERING - NHS UK OCT DEPLOYMENT

- 5.15 REGULATORY ANALYSIS

- 5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.2 REGULATORY LANDSCAPE

- 5.15.2.1 North America

- 5.15.2.1.1 US

- 5.15.2.1.2 Canada

- 5.15.2.2 Europe

- 5.15.2.2.1 Germany

- 5.15.2.2.2 France

- 5.15.2.2.3 UK

- 5.15.2.3 Asia Pacific

- 5.15.2.3.1 China

- 5.15.2.3.2 Japan

- 5.15.2.3.3 India

- 5.15.2.4 Latin America

- 5.15.2.4.1 Brazil

- 5.15.2.4.2 Mexico

- 5.15.2.5 Middle East & Africa

- 5.15.2.5.1 Saudi Arabia

- 5.15.2.5.2 UAE

- 5.15.2.5.3 South Africa

- 5.15.2.5.4 Nigeria

- 5.15.2.1 North America

- 5.16 PORTER'S FIVE FORCES ANALYSIS

- 5.16.1 THREAT OF NEW ENTRANTS

- 5.16.2 THREAT OF SUBSTITUTES

- 5.16.3 BARGAINING POWER OF BUYERS

- 5.16.4 BARGAINING POWER OF SUPPLIERS

- 5.16.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.17 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.17.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.17.2 BUYING CRITERIA

- 5.18 UNMET NEEDS/END-USER EXPECTATIONS

- 5.19 IMPACT OF 2025 US TARIFFS ON OPHTHALMIC EQUIPMENT MARKET

- 5.19.1 KEY TARIFF RATES

- 5.19.2 PRICE IMPACT ANALYSIS

- 5.19.3 KEY IMPACT ON COUNTRY/REGION

- 5.19.3.1 US

- 5.19.3.2 Europe

- 5.19.3.3 Asia Pacific

- 5.19.4 IMPACT ON END-USER INDUSTRIES

- 5.20 IMPACT OF ARTIFICIAL INTELLIGENCE ON OPHTHALMIC EQUIPMENT MARKET

- 5.21 ADJACENT MARKET ANALYSIS

6 OPHTHALMIC EQUIPMENT MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- 6.2 NON-AI-ENABLED EQUIPMENT

- 6.2.1 RISING SURGICAL VOLUMES AND AFFORDABILITY TO DRIVE NON-AI EQUIPMENT ADOPTION

- 6.3 AI-ENABLED EQUIPMENT

- 6.3.1 RISING DEMAND FOR PRECISION DIAGNOSTICS TO ACCELERATE AI-ENABLED EQUIPMENT ADOPTION

7 OPHTHALMIC EQUIPMENT MARKET, BY PRODUCT

- 7.1 INTRODUCTION

- 7.2 SURGICAL DEVICES

- 7.2.1 CATARACT SURGICAL DEVICES

- 7.2.1.1 Ophthalmic viscoelastic devices

- 7.2.1.1.1 Increasing number of cataract surgeries to support market growth

- 7.2.1.2 Phacoemulsification devices

- 7.2.1.2.1 Advancements in phacoemulsification devices to increase demand during forecast period

- 7.2.1.3 Cataract surgical lasers

- 7.2.1.3.1 Advantages such as high safety and accuracy to drive market growth

- 7.2.1.4 IOL injectors

- 7.2.1.4.1 Rising need for accurate implantation of IOLs to boost market growth

- 7.2.1.5 Intraocular lenses

- 7.2.1.5.1 Rising prevalence of cataracts globally to propel segment

- 7.2.1.1 Ophthalmic viscoelastic devices

- 7.2.2 VITREORETINAL SURGICAL DEVICES

- 7.2.2.1 Vitrectomy machines

- 7.2.2.1.1 Extensive usage of vitrectomy machines to correct retinal errors to boost market

- 7.2.2.2 Vitreoretinal packs

- 7.2.2.2.1 Increasing awareness about vitreoretinal surgery to increase utilization of vitreoretinal packs

- 7.2.2.3 Photocoagulation lasers

- 7.2.2.3.1 Rising prevalence of various eye diseases to drive market growth

- 7.2.2.4 Illumination devices

- 7.2.2.4.1 Growing use of portable, powerful illuminators for greater efficiency to fuel market growth

- 7.2.2.5 Vitrectomy probes

- 7.2.2.5.1 Advancements in vitrectomy probes to result in rapid cutting speed to remove vitreous bodies

- 7.2.2.6 Backflushes

- 7.2.2.6.1 Growing use of backflushes to prevent damage or complications to eye structure to propel growth

- 7.2.2.7 Chandeliers

- 7.2.2.7.1 Growing use of chandeliers for improved visualization of retina to aid growth

- 7.2.2.1 Vitrectomy machines

- 7.2.3 REFRACTIVE SURGICAL DEVICES

- 7.2.3.1 Femtosecond lasers

- 7.2.3.1.1 Rising preference for femtosecond lasers over microkeratomes to support market growth

- 7.2.3.2 Excimer lasers

- 7.2.3.2.1 Rising prevalence of myopia to drive market

- 7.2.3.3 Other refractive surgical devices

- 7.2.3.1 Femtosecond lasers

- 7.2.4 GLAUCOMA SURGICAL DEVICES

- 7.2.4.1 Microinvasive glaucoma surgery devices

- 7.2.4.1.1 Growing preference for microinvasive glaucoma surgery to drive adoption

- 7.2.4.2 Glaucoma drainage devices

- 7.2.4.2.1 Rising prevalence of glaucoma across globe to drives market growth

- 7.2.4.3 Glaucoma laser systems

- 7.2.4.3.1 Increasing prevalence of open-angle glaucoma to boost segment

- 7.2.4.1 Microinvasive glaucoma surgery devices

- 7.2.5 OPHTHALMIC MICROSCOPES

- 7.2.5.1 Increasing prevalence of eye diseases to drive demand

- 7.2.6 OPHTHALMIC SURGICAL ACCESSORIES

- 7.2.6.1 Surgical instruments & kits

- 7.2.6.1.1 Surgical instruments & kits to hold largest share of accessories market

- 7.2.6.2 Ophthalmic tips & handles

- 7.2.6.2.1 Wide range of tips and handles available to meet end-user demand

- 7.2.6.3 Ophthalmic scissors

- 7.2.6.3.1 Growing end-user preference for titanium scissors to boost market

- 7.2.6.4 Ophthalmic forceps

- 7.2.6.4.1 Wide use of forceps in ophthalmological surgeries to drive demand

- 7.2.6.5 Ophthalmic spatulas

- 7.2.6.5.1 China to be fastest-growing market for ophthalmic spatulas

- 7.2.6.6 Macular lenses

- 7.2.6.6.1 Rise in adoption of macular lenses for hands-free operation to support growth

- 7.2.6.7 Ophthalmic cannulas

- 7.2.6.7.1 Rising adoption of single-use cannulas to drive market growth

- 7.2.6.8 Other ophthalmic surgical accessories

- 7.2.6.1 Surgical instruments & kits

- 7.2.1 CATARACT SURGICAL DEVICES

- 7.3 DIAGNOSTIC & MONITORING DEVICES

- 7.3.1 OPTICAL COHERENCE TOMOGRAPHY SCANNERS

- 7.3.1.1 Spectral-domain OCT (SD-OCT)

- 7.3.1.1.1 Growing demand for high-resolution retinal imaging to accelerate spectral-domain OCT adoption

- 7.3.1.2 Swept-source OCT (SS-OCT)

- 7.3.1.2.1 Rising preference for deep tissue imaging and faster scanning to fuel swept-source OCT demand

- 7.3.1.3 Handheld OCT

- 7.3.1.3.1 Surging demand for portability and pediatric imaging to propel handheld OCT system adoption

- 7.3.1.1 Spectral-domain OCT (SD-OCT)

- 7.3.2 FUNDUS CAMERAS

- 7.3.2.1 Rising prevalence of age-related disorders to boost segment

- 7.3.3 PERIMETERS/VISUAL FIELD ANALYZERS

- 7.3.3.1 Increasing incidence of glaucoma and AMD to drive demand for perimeters

- 7.3.4 AUTOREFRACTORS & KERATOMETERS

- 7.3.4.1 Rising patient population with visual impairment to drive utilization

- 7.3.5 OPHTHALMIC ULTRASOUND IMAGING SYSTEMS

- 7.3.5.1 Ophthalmic A-scan ultrasound

- 7.3.5.1.1 Wide usage to measure length of eye in common eye disorders to boost market

- 7.3.5.2 Ophthalmic B-scan ultrasound

- 7.3.5.2.1 Growing use of B-scans to assess eye and orbit to determine eye disorders

- 7.3.5.3 Ophthalmic ultrasound biomicroscopes

- 7.3.5.3.1 Rising volume of refractive surgeries to fuel market growth

- 7.3.5.4 Ophthalmic pachymeters

- 7.3.5.4.1 Growing use of ophthalmic pachymeters to monitor condition of cornea to support growth

- 7.3.5.1 Ophthalmic A-scan ultrasound

- 7.3.6 OTHER OPHTHALMIC ULTRASOUND IMAGING SYSTEMS

- 7.3.7 TONOMETERS

- 7.3.7.1 Rising prevalence of glaucoma to boost demand

- 7.3.8 SLIT LAMPS

- 7.3.8.1 Rising prevalence of ocular conditions to drive market

- 7.3.9 PHOROPTERS

- 7.3.9.1 Phoropters aid in measurement of refractive errors

- 7.3.10 WAVEFRONT ABERROMETERS

- 7.3.10.1 Effectiveness in measuring refractive aberrations to drive demand

- 7.3.11 OPTICAL BIOMETRY SYSTEMS

- 7.3.11.1 Advantages of optical biometry systems to boost adoption in diagnostics

- 7.3.12 OPHTHALMOSCOPES

- 7.3.12.1 Increasing number of patients with glaucoma, diabetic retinopathy, and AMD to fuel market

- 7.3.13 LENSMETERS

- 7.3.13.1 Rising prevalence of myopia & hyperopia to fuel growth

- 7.3.14 CORNEAL TOPOGRAPHY SYSTEMS

- 7.3.14.1 Increasing number of LASIK procedures to drive demand

- 7.3.15 CHART PROJECTORS

- 7.3.15.1 Ability to provide practitioners access to multiple chart types in one device to boost demand

- 7.3.16 SPECULAR MICROSCOPES

- 7.3.16.1 Growing number of patients with diabetes to drive market

- 7.3.17 RETINOSCOPES

- 7.3.17.1 Rising prevalence of myopia across globe to boost market growth

- 7.3.18 OTHER DIAGNOSTIC & MONITORING DEVICES

- 7.3.1 OPTICAL COHERENCE TOMOGRAPHY SCANNERS

8 OPHTHALMIC EQUIPMENT MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 HOSPITALS

- 8.2.1 LARGE PATIENT POOL AND HIGH PURCHASING POWER OF HOSPITALS TO DRIVE GROWTH

- 8.3 SPECIALTY CLINICS & AMBULATORY SURGERY CENTERS

- 8.3.1 COST-EFFECTIVENESS OF AMBULATORY CARE TO ENHANCE END-USER INTEREST

- 8.4 OTHER END USERS

9 OPHTHALMIC EQUIPMENT MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 Rising geriatric population and increasing healthcare expenditure to drive market

- 9.2.3 CANADA

- 9.2.3.1 Rising awareness about eye care and increasing ocular diseases to drive market

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Increasing healthcare expenditure to boost market

- 9.3.3 UK

- 9.3.3.1 Rising prevalence of diabetes-related eye diseases to drive market

- 9.3.4 FRANCE

- 9.3.4.1 Growing number of eye surgeries to drive demand

- 9.3.5 ITALY

- 9.3.5.1 Increasing healthcare spending and growing geriatric population to propel market

- 9.3.6 SPAIN

- 9.3.6.1 Increasing ophthalmic surgical procedures to drive market

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 CHINA

- 9.4.2.1 Rising prevalence of cataracts to drive market

- 9.4.3 JAPAN

- 9.4.3.1 Strong manufacturing capabilities to propel market

- 9.4.4 INDIA

- 9.4.4.1 Increasing geriatric population and prevalence of eye disorders to support market

- 9.4.5 AUSTRALIA

- 9.4.5.1 Increased cataract surgeries to drive market

- 9.4.6 SOUTH KOREA

- 9.4.6.1 Growing focus on medical tourism to boost market

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 9.5.2 BRAZIL

- 9.5.2.1 Government support and initiatives to boost market

- 9.5.3 MEXICO

- 9.5.3.1 Growing incidence of eye disorders to drive market

- 9.5.4 ARGENTINA

- 9.5.4.1 Increasing healthcare expenditure and well-developed healthcare system to favor market

- 9.5.5 REST OF LATIN AMERICA

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 IMPROVING HEALTHCARE EXPENDITURE TO DRIVE MARKET

- 9.6.2 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 9.7 GCC COUNTRIES

- 9.7.1 RISING CATARACT PREVALENCE AND ADOPTION OF ADVANCED OPHTHALMIC TECHNOLOGIES TO DRIVE GROWTH

- 9.7.2 MACROECONOMIC OUTLOOK FOR GCC COUNTRIES

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGY/RIGHT TO WIN

- 10.3 REVENUE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Region footprint

- 10.5.5.3 Product footprint

- 10.5.5.4 End-user footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startups/SMEs

- 10.6.5.2 Competitive benchmarking of key startups/SMEs

- 10.7 COMPANY VALUATION & FINANCIAL METRICS

- 10.7.1 FINANCIAL METRICS

- 10.7.2 COMPANY VALUATION

- 10.8 BRAND/PRODUCT COMPARISON

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES & APPROVALS

- 10.9.2 DEALS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 ALCON

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.3.2 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses & competitive threats

- 11.1.2 JOHNSON & JOHNSON

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses & competitive threats

- 11.1.3 CARL ZEISS MEDITEC AG

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses & competitive threats

- 11.1.4 BAUSCH HEALTH COMPANIES INC.

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches

- 11.1.4.3.2 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses & competitive threats

- 11.1.5 HOYA CORPORATION

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.2.1 Deals

- 11.1.5.3 MnM view

- 11.1.5.3.1 Right to win

- 11.1.5.3.2 Strategic choices

- 11.1.5.3.3 Weaknesses & competitive threats

- 11.1.6 ESSILORLUXOTTICA

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Deals

- 11.1.7 CANON

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.8 GLAUKOS CORPORATION

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Product approvals

- 11.1.8.3.2 Deals

- 11.1.9 TOPCON CORPORATION

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Product launches

- 11.1.9.3.2 Deals

- 11.1.10 NIDEK CO., LTD.

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product launches

- 11.1.10.3.2 Deals

- 11.1.11 STAAR SURGICAL

- 11.1.11.1 Business overview

- 11.1.11.2 Products offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Product approvals

- 11.1.12 HALMA PLC

- 11.1.12.1 Business overview

- 11.1.12.2 Products offered

- 11.1.13 HAAG-STREIT

- 11.1.13.1 Business overview

- 11.1.13.2 Products offered

- 11.1.13.3 Recent developments

- 11.1.13.3.1 Product launches

- 11.1.13.3.2 Deals

- 11.1.14 SHANGHAI MEDIWORKS PRECISION INSTRUMENTS CO., LTD.

- 11.1.14.1 Business overview

- 11.1.14.2 Products offered

- 11.1.15 VISIONIX

- 11.1.15.1 Business overview

- 11.1.15.2 Products offered

- 11.1.15.3 Recent developments

- 11.1.15.3.1 Deals

- 11.1.1 ALCON

- 11.2 OTHER PLAYERS

- 11.2.1 VISUNEX MEDICAL SYSTEMS

- 11.2.2 COSTRUZIONE STRUMENTI OFTALMICI

- 11.2.3 HAI LABORATORIES, INC.

- 11.2.4 FORUS HEALTH

- 11.2.5 ZIEMER OPHTHALMIC SYSTEMS AG

- 11.2.6 CRYSTALVUE MEDICAL CORPORATION

- 11.2.7 REMIDIO INNOVATIVE SOLUTIONS PVT. LTD.

- 11.2.8 SUZHOU KANGJIE MEDICAL INC.

- 11.2.9 LUMENIS

- 11.2.10 OPHTEC BV

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

List of Tables

- TABLE 1 STANDARD CURRENCY CONVERSION RATES

- TABLE 2 RISK ASSESSMENT: OPHTHALMIC EQUIPMENT MARKET

- TABLE 3 INCREASE IN GERIATRIC POPULATION, 2000-2050

- TABLE 4 GLOBAL PREVALENCE OF EYE DISORDERS, BY TYPE, 2024 (IN MILLION)

- TABLE 5 NUMBER OF CATARACT SURGERIES, BY COUNTRY (2023 VS. 2024)

- TABLE 6 NUMBER OF GLAUCOMA PATIENTS, BY REGION AND TYPE, 2020 VS. 2040 (MILLION)

- TABLE 7 NUMBER OF PEOPLE WITH DIABETES, BY REGION, 2030 VS. 2045 (MILLION)

- TABLE 8 NUMBER OF PEOPLE WITH AGE-RELATED MACULAR DEGENERATION, BY REGION, 2020 VS. 2050 (MILLION)

- TABLE 9 PRICE OF OPHTHALMIC EQUIPMENT, BY TYPE (2022)

- TABLE 10 AVERAGE SELLING PRICE OF OPHTHALMIC EQUIPMENT PRODUCTS, BY KEY PLAYER, 2024 (USD)

- TABLE 11 AVERAGE SELLING PRICE TREND OF OPTICAL COHERENCE TOMOGRAPHY SYSTEMS, BY REGION, 2022-2024 (USD)

- TABLE 12 OPHTHALMIC EQUIPMENT MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 13 IMPORT DATA FOR HS CODE 901850-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 14 EXPORT DATA FOR HS CODE 901890-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 15 OPHTHALMIC EQUIPMENT MARKET: KEY CONFERENCES & EVENTS, 2025-2026

- TABLE 16 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 OPHTHALMIC EQUIPMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF OPHTHALMIC EQUIPMENT PRODUCTS

- TABLE 23 KEY BUYING CRITERIA FOR OPHTHALMIC EQUIPMENT PRODUCTS

- TABLE 24 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 25 KEY PRODUCT-RELATED TARIFFS EFFECTIVE FOR ECMO MACHINES

- TABLE 26 OPHTHALMIC EQUIPMENT MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 27 NON-AI-ENABLED EQUIPMENT OFFERED BY KEY PLAYERS

- TABLE 28 NON-AI-ENABLED OPHTHALMIC EQUIPMENT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 29 AI-ENABLED EQUIPMENT OFFERED BY KEY PLAYERS

- TABLE 30 AI-ENABLED OPHTHALMIC EQUIPMENT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 31 OPHTHALMIC EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 32 OPHTHALMIC EQUIPMENT MARKET FOR SURGICAL DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 33 OPHTHALMIC EQUIPMENT MARKET FOR SURGICAL DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 34 CATARACT SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 35 CATARACT SURGICAL DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 36 OPHTHALMIC VISCOELASTIC DEVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 37 OPHTHALMIC VISCOELASTIC DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 38 OPHTHALMIC VISCOELASTIC DEVICES MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 39 PHACOEMULSIFICATION OFFERED BY KEY MARKET PLAYERS

- TABLE 40 PHACOEMULSIFICATION DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 41 PHACOEMULSIFICATION DEVICES MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 42 CATARACT SURGICAL LASERS OFFERED BY KEY MARKET PLAYERS

- TABLE 43 CATARACT SURGICAL LASERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 44 CATARACT SURGICAL LASERS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 45 IOL INJECTORS OFFERED BY KEY PLAYERS

- TABLE 46 IOL INJECTORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 47 IOL INJECTORS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 48 INTRAOCULAR LENSES OFFERED BY KEY PLAYERS

- TABLE 49 INTRAOCULAR LENSES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 50 INTRAOCULAR LENSES MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 51 VITREORETINAL SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 52 VITREORETINAL SURGICAL DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 53 VITRECTOMY MACHINES OFFERED BY KEY MARKET PLAYERS

- TABLE 54 VITRECTOMY MACHINES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 55 VITRECTOMY MACHINES MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 56 VITREORETINAL PACKS OFFERED BY KEY MARKET PLAYERS

- TABLE 57 VITREORETINAL PACKS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 58 VITREORETINAL PACKS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 59 PHOTOCOAGULATION LASERS OFFERED BY KEY MARKET PLAYERS

- TABLE 60 PHOTOCOAGULATION LASERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 61 PHOTOCOAGULATION LASERS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 62 ILLUMINATION DEVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 63 ILLUMINATION DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 64 ILLUMINATION DEVICES MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 65 VITRECTOMY PROBES OFFERED BY KEY MARKET PLAYERS

- TABLE 66 VITRECTOMY PROBES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 67 VITRECTOMY PROBES MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 68 BACKFLUSHES OFFERED BY KEY MARKET PLAYERS

- TABLE 69 BACKFLUSHES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 70 BACKFLUSHES MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 71 CHANDELIERS OFFERED BY KEY MARKET PLAYERS

- TABLE 72 CHANDELIERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 73 CHANDELIERS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 74 REFRACTIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 75 REFRACTIVE SURGICAL DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 76 FEMTOSECOND LASERS OFFERED BY KEY MARKET PLAYERS

- TABLE 77 FEMTOSECOND LASERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 78 FEMTOSECOND LASERS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 79 EXCIMER LASERS OFFERED BY KEY MARKET PLAYERS

- TABLE 80 EXCIMER LASERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 81 EXCIMER LASERS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 82 OTHER REFRACTIVE SURGICAL DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 83 GLAUCOMA SURGICAL DEVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 84 GLAUCOMA SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 85 GLAUCOMA SURGICAL DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 86 MICROINVASIVE GLAUCOMA SURGERY DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 87 MICROINVASIVE GLAUCOMA SURGERY DEVICES MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 88 GLAUCOMA DRAINAGE DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 89 GLAUCOMA DRAINAGE DEVICES MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 90 GLAUCOMA LASER SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 91 GLAUCOMA LASER SYSTEMS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 92 OPHTHALMIC MICROSCOPES OFFERED BY KEY MARKET PLAYERS

- TABLE 93 OPHTHALMIC MICROSCOPES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 94 OPHTHALMIC SURGICAL ACCESSORIES OFFERED BY KEY MARKET PLAYERS

- TABLE 95 OPHTHALMIC SURGICAL ACCESSORIES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 96 OPHTHALMIC SURGICAL ACCESSORIES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 97 SURGICAL INSTRUMENTS & KITS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 98 OPHTHALMIC TIPS & HANDLES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 99 OPHTHALMIC SCISSORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 100 OPHTHALMIC FORCEPS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 101 OPHTHALMIC SPATULAS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 102 MACULAR LENSES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 103 OPHTHALMIC CANNULAS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 104 OTHER OPHTHALMIC SURGICAL ACCESSORIES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 105 OPHTHALMIC EQUIPMENT MARKET FOR DIAGNOSTIC & MONITORING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 106 OPHTHALMIC EQUIPMENT MARKET FOR DIAGNOSTIC & MONITORING DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 107 OCT SCANNERS OFFERED BY KEY MARKET PLAYERS

- TABLE 108 OPTICAL COHERENCE TOMOGRAPHY SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 109 OPTICAL COHERENCE TOMOGRAPHY SCANNERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 110 OPTICAL COHERENCE TOMOGRAPHY SCANNERS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 111 SPECTRAL-DOMAIN OCT (SD-OCT) SYSTEMS OFFERED BY KEY MARKET PLAYERS

- TABLE 112 SPECTRAL-DOMAIN OCT (SD-OCT) MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 113 SWEPT-SOURCE OCT (SS-OCT) SYSTEMS OFFERED BY KEY MARKET PLAYERS

- TABLE 114 SWEPT-SOURCE OCT (SS-OCT) MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 115 EXAMPLES OF HANDHELD OCT

- TABLE 116 HANDHELD OCT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 117 FUNDUS CAMERAS OFFERED BY KEY MARKET PLAYERS

- TABLE 118 FUNDUS CAMERAS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 119 FUNDUS CAMERAS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 120 PERIMETERS/VISUAL FIELD ANALYZERS OFFERED BY KEY MARKET PLAYERS

- TABLE 121 PERIMETERS/VISUAL FIELD ANALYZERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 122 PERIMETERS/VISUAL FIELD ANALYZERS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 123 AUTOREFRACTORS & KERATOMETERS OFFERED BY KEY MARKET PLAYERS

- TABLE 124 AUTOREFRACTORS & KERATOMETERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 125 AUTOREFRACTORS & KERATOMETERS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 126 OPHTHALMIC ULTRASOUND IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 127 OPHTHALMIC ULTRASOUND IMAGING SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 128 OPHTHALMIC ULTRASOUND IMAGING SYSTEMS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 129 OPHTHALMIC A-SCAN ULTRASOUND SYSTEMS OFFERED BY KEY MARKET PLAYERS

- TABLE 130 OPHTHALMIC A-SCAN ULTRASOUND MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 131 OPHTHALMIC B-SCAN ULTRASOUND SYSTEMS OFFERED BY KEY MARKET PLAYERS

- TABLE 132 OPHTHALMIC B-SCAN ULTRASOUND MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 133 OPHTHALMIC ULTRASOUND BIOMICROSCOPES OFFERED BY KEY MARKET PLAYERS

- TABLE 134 OPHTHALMIC ULTRASOUND BIOMICROSCOPES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 135 OPHTHALMIC PACHYMETERS OFFERED BY KEY MARKET PLAYERS

- TABLE 136 OPHTHALMIC PACHYMETERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 137 OTHER OPHTHALMIC ULTRASOUND IMAGING SYSTEMS OFFERED BY KEY MARKET PLAYERS

- TABLE 138 OTHER OPHTHALMIC ULTRASOUND IMAGING SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 139 TONOMETERS OFFERED BY KEY MARKET PLAYERS

- TABLE 140 TONOMETERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 141 TONOMETERS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 142 SLIT LAMPS OFFERED BY KEY MARKET PLAYERS

- TABLE 143 SLIT LAMPS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 144 SLIT LAMPS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 145 PHOROPTERS OFFERED BY KEY MARKET PLAYERS

- TABLE 146 PHOROPTERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 147 PHOROPTERS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 148 WAVEFRONT ABERROMETERS OFFERED BY KEY MARKET PLAYERS

- TABLE 149 WAVEFRONT ABERROMETERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 150 WAVEFRONT ABERROMETERS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 151 OPTICAL BIOMETRY SYSTEMS OFFERED BY KEY MARKET PLAYERS

- TABLE 152 OPTICAL BIOMETRY SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 153 OPTICAL BIOMETRY SYSTEMS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 154 OPHTHALMOSCOPES OFFERED BY KEY MARKET PLAYERS

- TABLE 155 OPHTHALMOSCOPES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 156 OPHTHALMOSCOPES MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 157 LENSMETERS OFFERED BY KEY MARKET PLAYERS

- TABLE 158 LENSMETERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 159 LENSMETERS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 160 CORNEAL TOPOGRAPHY SYSTEMS OFFERED BY KEY MARKET PLAYERS

- TABLE 161 CORNEAL TOPOGRAPHY SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 162 CORNEAL TOPOGRAPHY SYSTEMS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 163 CHART PROJECTORS OFFERED BY KEY MARKET PLAYERS

- TABLE 164 CHART PROJECTORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 165 CHART PROJECTORS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 166 SPECULAR MICROSCOPES OFFERED BY KEY MARKET PLAYERS

- TABLE 167 SPECULAR MICROSCOPES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 168 SPECULAR MICROSCOPES MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 169 RETINOSCOPES OFFERED BY KEY MARKET PLAYERS

- TABLE 170 RETINOSCOPES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 171 RETINOSCOPES MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 172 OTHER DIAGNOSTIC & MONITORING DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 173 OPHTHALMIC EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 174 OPHTHALMIC EQUIPMENT MARKET FOR HOSPITALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 175 OPHTHALMIC EQUIPMENT MARKET FOR SPECIALTY CLINICS & AMBULATORY SURGERY CENTERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 176 OPHTHALMIC EQUIPMENT MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 177 OPHTHALMIC EQUIPMENT MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 178 NORTH AMERICA: OPHTHALMIC EQUIPMENT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 179 NORTH AMERICA: OPHTHALMIC EQUIPMENT MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 180 NORTH AMERICA: OPHTHALMIC EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 181 NORTH AMERICA: OPHTHALMIC EQUIPMENT MARKET FOR DIAGNOSTIC & MONITORING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 182 NORTH AMERICA: OPTICAL COHERENCE TOMOGRAPHY SCANNERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 183 NORTH AMERICA: OPHTHALMIC ULTRASOUND IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 184 NORTH AMERICA: OPHTHALMIC EQUIPMENT MARKET FOR SURGICAL DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 185 NORTH AMERICA: CATARACT SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 186 NORTH AMERICA: GLAUCOMA SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 187 NORTH AMERICA: REFRACTIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 188 NORTH AMERICA: VITREORETINAL SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 189 NORTH AMERICA: OPHTHALMIC EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 190 US: OPHTHALMIC EQUIPMENT MARKET, VOLUME, 2023-2030 (UNITS)

- TABLE 191 US: OPHTHALMIC EQUIPMENT MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 192 US: OPHTHALMIC EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 193 US: OPHTHALMIC EQUIPMENT MARKET FOR DIAGNOSTIC & MONITORING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 194 US: OPTICAL COHERENCE TOMOGRAPHY SCANNERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 195 US: OPHTHALMIC ULTRASOUND IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 196 US: OPHTHALMIC EQUIPMENT MARKET FOR SURGICAL DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 197 US: CATARACT SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 198 US: GLAUCOMA SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 199 US: REFRACTIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 200 US: VITREORETINAL SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 201 US: OPHTHALMIC EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 202 CANADA: OPHTHALMIC EQUIPMENT MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 203 CANADA: OPHTHALMIC EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 204 CANADA: OPHTHALMIC EQUIPMENT MARKET FOR DIAGNOSTIC & MONITORING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 205 CANADA: OPTICAL COHERENCE TOMOGRAPHY SCANNERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 206 CANADA: OPHTHALMIC ULTRASOUND IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 207 CANADA: OPHTHALMIC EQUIPMENT MARKET FOR SURGICAL DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 208 CANADA: CATARACT SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 209 CANADA: GLAUCOMA SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 210 CANADA: REFRACTIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 211 CANADA: VITREORETINAL SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 212 CANADA: OPHTHALMIC EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 213 EUROPE: OPHTHALMIC EQUIPMENT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 214 EUROPE: OPHTHALMIC EQUIPMENT MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 215 EUROPE: OPHTHALMIC EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 216 EUROPE: OPHTHALMIC EQUIPMENT MARKET FOR DIAGNOSTIC & MONITORING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 217 EUROPE: OPTICAL COHERENCE TOMOGRAPHY SCANNERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 218 EUROPE: OPHTHALMIC ULTRASOUND IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 219 EUROPE: OPHTHALMIC EQUIPMENT MARKET FOR SURGICAL DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 220 EUROPE: CATARACT SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 221 EUROPE: GLAUCOMA SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 222 EUROPE: REFRACTIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 223 EUROPE: VITREORETINAL SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 224 EUROPE: OPHTHALMIC EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 225 GERMANY: OPHTHALMIC EQUIPMENT MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 226 GERMANY: OPHTHALMIC EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 227 GERMANY: OPHTHALMIC EQUIPMENT MARKET FOR DIAGNOSTIC & MONITORING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 228 GERMANY: OPTICAL COHERENCE TOMOGRAPHY SCANNERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 229 GERMANY: OPHTHALMIC ULTRASOUND IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 230 GERMANY: OPHTHALMIC EQUIPMENT MARKET FOR SURGICAL DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 231 GERMANY: CATARACT SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 232 GERMANY: GLAUCOMA SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 233 GERMANY: REFRACTIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 234 GERMANY: VITREORETINAL SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 235 GERMANY: OPHTHALMIC EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 236 UK: OPHTHALMIC EQUIPMENT MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 237 UK: OPHTHALMIC EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 238 UK: OPHTHALMIC EQUIPMENT MARKET FOR DIAGNOSTIC & MONITORING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 239 UK: OPTICAL COHERENCE TOMOGRAPHY SCANNERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 240 UK: OPHTHALMIC ULTRASOUND IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 241 UK: OPHTHALMIC EQUIPMENT MARKET FOR SURGICAL DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 242 UK: CATARACT SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 243 UK: GLAUCOMA SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 244 UK: REFRACTIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 245 UK: VITREORETINAL SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 246 UK: OPHTHALMIC EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 247 FRANCE: OPHTHALMIC EQUIPMENT MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 248 FRANCE: OPHTHALMIC EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 249 FRANCE: OPHTHALMIC EQUIPMENT MARKET FOR DIAGNOSTIC & MONITORING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 250 FRANCE: OPTICAL COHERENCE TOMOGRAPHY SCANNERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 251 FRANCE: OPHTHALMIC ULTRASOUND IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 252 FRANCE: OPHTHALMIC EQUIPMENT MARKET FOR SURGICAL DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 253 FRANCE: CATARACT SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 254 FRANCE: GLAUCOMA SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 255 FRANCE: REFRACTIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 256 FRANCE: VITREORETINAL SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 257 FRANCE: OPHTHALMIC EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 258 ITALY: OPHTHALMIC EQUIPMENT MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 259 ITALY: OPHTHALMIC EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 260 ITALY: OPHTHALMIC EQUIPMENT MARKET FOR DIAGNOSTIC & MONITORING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 261 ITALY: OPTICAL COHERENCE TOMOGRAPHY SCANNERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 262 ITALY: OPHTHALMIC ULTRASOUND IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 263 ITALY: OPHTHALMIC EQUIPMENT MARKET FOR SURGICAL DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 264 ITALY: CATARACT SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 265 ITALY: GLAUCOMA SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 266 ITALY: REFRACTIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 267 ITALY: VITREORETINAL SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 268 ITALY: OPHTHALMIC EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 269 SPAIN: OPHTHALMIC EQUIPMENT MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 270 SPAIN: OPHTHALMIC EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 271 SPAIN: OPHTHALMIC EQUIPMENT MARKET FOR DIAGNOSTIC & MONITORING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 272 SPAIN: OPTICAL COHERENCE TOMOGRAPHY SCANNERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 273 SPAIN: OPHTHALMIC ULTRASOUND IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 274 SPAIN: OPHTHALMIC EQUIPMENT MARKET FOR SURGICAL DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 275 SPAIN: CATARACT SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 276 SPAIN: GLAUCOMA SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 277 SPAIN: REFRACTIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 278 SPAIN: VITREORETINAL SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 279 SPAIN: OPHTHALMIC EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 280 REST OF EUROPE: OPHTHALMIC EQUIPMENT MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 281 REST OF EUROPE: OPHTHALMIC EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 282 REST OF EUROPE: OPHTHALMIC EQUIPMENT MARKET FOR DIAGNOSTIC & MONITORING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 283 REST OF EUROPE: OPTICAL COHERENCE TOMOGRAPHY SCANNERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 284 REST OF EUROPE: OPHTHALMIC ULTRASOUND IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 285 REST OF EUROPE: OPHTHALMIC EQUIPMENT MARKET FOR SURGICAL DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 286 REST OF EUROPE: CATARACT SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 287 REST OF EUROPE: GLAUCOMA SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 288 REST OF EUROPE: REFRACTIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 289 REST OF EUROPE: VITREORETINAL SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 290 REST OF EUROPE: OPHTHALMIC EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 291 ASIA PACIFIC: OPHTHALMIC EQUIPMENT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 292 ASIA PACIFIC: OPHTHALMIC EQUIPMENT MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 293 ASIA PACIFIC: OPHTHALMIC EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 294 ASIA PACIFIC: OPHTHALMIC EQUIPMENT MARKET FOR DIAGNOSTIC & MONITORING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 295 ASIA PACIFIC: OPTICAL COHERENCE TOMOGRAPHY SCANNERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 296 ASIA PACIFIC: OPHTHALMIC ULTRASOUND IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 297 ASIA PACIFIC: OPHTHALMIC EQUIPMENT MARKET FOR SURGICAL DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 298 ASIA PACIFIC: CATARACT SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 299 ASIA PACIFIC: GLAUCOMA SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 300 ASIA PACIFIC: REFRACTIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 301 ASIA PACIFIC: VITREORETINAL SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 302 ASIA PACIFIC: OPHTHALMIC EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 303 CHINA: OPHTHALMIC EQUIPMENT MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 304 CHINA: OPHTHALMIC EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 305 CHINA: OPHTHALMIC EQUIPMENT MARKET FOR DIAGNOSTIC & MONITORING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 306 CHINA: OPTICAL COHERENCE TOMOGRAPHY SCANNERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 307 CHINA: OPHTHALMIC ULTRASOUND IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 308 CHINA: OPHTHALMIC EQUIPMENT MARKET FOR SURGICAL DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 309 CHINA: CATARACT SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 310 CHINA: GLAUCOMA SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 311 CHINA: REFRACTIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 312 CHINA: VITREORETINAL SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 313 CHINA: OPHTHALMIC EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 314 JAPAN: OPHTHALMIC EQUIPMENT MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 315 JAPAN: OPHTHALMIC EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 316 JAPAN: OPHTHALMIC EQUIPMENT MARKET FOR DIAGNOSTIC & MONITORING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 317 JAPAN: OPTICAL COHERENCE TOMOGRAPHY SCANNERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 318 JAPAN: OPHTHALMIC ULTRASOUND IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 319 JAPAN: OPHTHALMIC EQUIPMENT MARKET FOR SURGICAL DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 320 JAPAN: CATARACT SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 321 JAPAN: GLAUCOMA SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 322 JAPAN: REFRACTIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 323 JAPAN: VITREORETINAL SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 324 JAPAN: OPHTHALMIC EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 325 INDIA: OPHTHALMIC EQUIPMENT MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 326 INDIA: OPHTHALMIC EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 327 INDIA: OPHTHALMIC EQUIPMENT MARKET FOR DIAGNOSTIC & MONITORING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 328 INDIA: OPTICAL COHERENCE TOMOGRAPHY SCANNERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 329 INDIA: OPHTHALMIC ULTRASOUND IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 330 INDIA: OPHTHALMIC EQUIPMENT MARKET FOR SURGICAL DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 331 INDIA: CATARACT SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 332 INDIA: GLAUCOMA SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 333 INDIA: REFRACTIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 334 INDIA: VITREORETINAL SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 335 INDIA: OPHTHALMIC EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 336 AUSTRALIA: OPHTHALMIC EQUIPMENT MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 337 AUSTRALIA: OPHTHALMIC EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 338 AUSTRALIA: OPHTHALMIC EQUIPMENT MARKET FOR DIAGNOSTIC & MONITORING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 339 AUSTRALIA: OPTICAL COHERENCE TOMOGRAPHY SCANNERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 340 AUSTRALIA: OPHTHALMIC ULTRASOUND IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 341 AUSTRALIA: OPHTHALMIC EQUIPMENT MARKET FOR SURGICAL DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 342 AUSTRALIA: CATARACT SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 343 AUSTRALIA: GLAUCOMA SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 344 AUSTRALIA: REFRACTIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 345 AUSTRALIA: VITREORETINAL SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 346 AUSTRALIA: OPHTHALMIC EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 347 SOUTH KOREA: OPHTHALMIC EQUIPMENT MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 348 SOUTH KOREA: OPHTHALMIC EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 349 SOUTH KOREA: OPHTHALMIC EQUIPMENT MARKET FOR DIAGNOSTIC & MONITORING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 350 SOUTH KOREA: OPTICAL COHERENCE TOMOGRAPHY SCANNERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 351 SOUTH KOREA: OPHTHALMIC ULTRASOUND IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 352 SOUTH KOREA: OPHTHALMIC EQUIPMENT MARKET FOR SURGICAL DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 353 SOUTH KOREA: CATARACT SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 354 SOUTH KOREA: GLAUCOMA SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 355 SOUTH KOREA: REFRACTIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 356 SOUTH KOREA: VITREORETINAL SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 357 SOUTH KOREA: OPHTHALMIC EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 358 REST OF ASIA PACIFIC: OPHTHALMIC EQUIPMENT MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 359 REST OF ASIA PACIFIC: OPHTHALMIC EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 360 REST OF ASIA PACIFIC: OPHTHALMIC EQUIPMENT MARKET FOR DIAGNOSTIC & MONITORING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 361 REST OF ASIA PACIFIC: OPTICAL COHERENCE TOMOGRAPHY SCANNERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 362 REST OF ASIA PACIFIC: OPHTHALMIC ULTRASOUND IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 363 REST OF ASIA PACIFIC: OPHTHALMIC EQUIPMENT MARKET FOR SURGICAL DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 364 REST OF ASIA PACIFIC: CATARACT SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 365 REST OF ASIA PACIFIC: GLAUCOMA SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 366 REST OF ASIA PACIFIC: REFRACTIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 367 REST OF ASIA PACIFIC: VITREORETINAL SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 368 REST OF ASIA PACIFIC: OPHTHALMIC EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 369 LATIN AMERICA: OPHTHALMIC EQUIPMENT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 370 LATIN AMERICA: OPHTHALMIC EQUIPMENT MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 371 LATIN AMERICA: OPHTHALMIC EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 372 LATIN AMERICA: OPHTHALMIC EQUIPMENT MARKET FOR DIAGNOSTIC & MONITORING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 373 LATIN AMERICA: OPTICAL COHERENCE TOMOGRAPHY SCANNERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 374 LATIN AMERICA: OPHTHALMIC ULTRASOUND IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 375 LATIN AMERICA: OPHTHALMIC EQUIPMENT MARKET FOR SURGICAL DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 376 LATIN AMERICA: CATARACT SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 377 LATIN AMERICA: GLAUCOMA SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 378 LATIN AMERICA: REFRACTIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 379 LATIN AMERICA: VITREORETINAL SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 380 LATIN AMERICA: OPHTHALMIC EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 381 BRAZIL: OPHTHALMIC EQUIPMENT MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 382 BRAZIL: OPHTHALMIC EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 383 BRAZIL: OPHTHALMIC EQUIPMENT MARKET FOR DIAGNOSTIC & MONITORING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 384 BRAZIL: OPTICAL COHERENCE TOMOGRAPHY SCANNERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 385 BRAZIL: OPHTHALMIC ULTRASOUND IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 386 BRAZIL: OPHTHALMIC EQUIPMENT MARKET FOR SURGICAL DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 387 BRAZIL: CATARACT SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 388 BRAZIL: GLAUCOMA SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 389 BRAZIL: REFRACTIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 390 BRAZIL: VITREORETINAL SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 391 BRAZIL: OPHTHALMIC EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 392 MEXICO: OPHTHALMIC EQUIPMENT MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 393 MEXICO: OPHTHALMIC EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 394 MEXICO: OPHTHALMIC EQUIPMENT MARKET FOR DIAGNOSTIC & MONITORING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 395 MEXICO: OPTICAL COHERENCE TOMOGRAPHY SCANNERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 396 MEXICO: OPHTHALMIC ULTRASOUND IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 397 MEXICO: OPHTHALMIC EQUIPMENT MARKET FOR SURGICAL DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 398 MEXICO: CATARACT SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 399 MEXICO: GLAUCOMA SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 400 MEXICO: REFRACTIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 401 MEXICO: VITREORETINAL SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 402 MEXICO: OPHTHALMIC EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 403 ARGENTINA: OPHTHALMIC EQUIPMENT MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 404 ARGENTINA: OPHTHALMIC EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 405 ARGENTINA: OPHTHALMIC EQUIPMENT MARKET FOR DIAGNOSTIC & MONITORING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 406 ARGENTINA: OPTICAL COHERENCE TOMOGRAPHY SCANNERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 407 ARGENTINA: OPHTHALMIC ULTRASOUND IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 408 ARGENTINA: OPHTHALMIC EQUIPMENT MARKET FOR SURGICAL DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 409 ARGENTINA: CATARACT SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 410 ARGENTINA: GLAUCOMA SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 411 ARGENTINA: REFRACTIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 412 ARGENTINA: VITREORETINAL SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 413 ARGENTINA: OPHTHALMIC EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 414 REST OF LATIN AMERICA: OPHTHALMIC EQUIPMENT MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 415 REST OF LATIN AMERICA: OPHTHALMIC EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 416 REST OF LATIN AMERICA: OPHTHALMIC EQUIPMENT MARKET FOR DIAGNOSTIC & MONITORING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 417 REST OF LATIN AMERICA: OPTICAL COHERENCE TOMOGRAPHY SCANNERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 418 REST OF LATIN AMERICA: OPHTHALMIC ULTRASOUND IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 419 REST OF LATIN AMERICA: OPHTHALMIC EQUIPMENT MARKET FOR SURGICAL DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 420 REST OF LATIN AMERICA: CATARACT SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 421 REST OF LATIN AMERICA: GLAUCOMA SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 422 REST OF LATIN AMERICA: REFRACTIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 423 REST OF LATIN AMERICA: VITREORETINAL SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 424 REST OF LATIN AMERICA: OPHTHALMIC EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 425 MIDDLE EAST & AFRICA: OPHTHALMIC EQUIPMENT MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 426 MIDDLE EAST & AFRICA: OPHTHALMIC EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 427 MIDDLE EAST & AFRICA: OPHTHALMIC EQUIPMENT MARKET FOR DIAGNOSTIC & MONITORING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 428 MIDDLE EAST & AFRICA: OPTICAL COHERENCE TOMOGRAPHY SCANNERS MARKET, BY TYPE,2023-2030 (USD MILLION)

- TABLE 429 MIDDLE EAST & AFRICA: OPHTHALMIC ULTRASOUND IMAGING SYSTEMS MARKET, BY TYPE,2023-2030 (USD MILLION)

- TABLE 430 MIDDLE EAST & AFRICA: OPHTHALMIC EQUIPMENT MARKET FOR SURGICAL DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 431 MIDDLE EAST & AFRICA: CATARACT SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 432 MIDDLE EAST & AFRICA: GLAUCOMA SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 433 MIDDLE EAST & AFRICA: REFRACTIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 434 MIDDLE EAST & AFRICA: VITREORETINAL SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 435 MIDDLE EAST & AFRICA: OPHTHALMIC EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 436 GCC COUNTRIES: OPHTHALMIC EQUIPMENT MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 437 GCC COUNTRIES: OPHTHALMIC EQUIPMENT MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 438 GCC COUNTRIES: OPHTHALMIC EQUIPMENT MARKET FOR DIAGNOSTIC & MONITORING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 439 GCC COUNTRIES: OPTICAL COHERENCE TOMOGRAPHY SCANNERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 440 GCC COUNTRIES: OPHTHALMIC ULTRASOUND IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 441 GCC COUNTRIES: OPHTHALMIC EQUIPMENT MARKET FOR SURGICAL DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 442 GCC COUNTRIES: CATARACT SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 443 GCC COUNTRIES: GLAUCOMA SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 444 GCC COUNTRIES: REFRACTIVE SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 445 GCC COUNTRIES: VITREORETINAL SURGICAL DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 446 GCC COUNTRIES: OPHTHALMIC EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 447 KEY DEVELOPMENTS IN OPHTHALMIC EQUIPMENT MARKET, JANUARY 2021-OCTOBER 2025

- TABLE 448 OPHTHALMIC EQUIPMENT MARKET: DEGREE OF COMPETITION

- TABLE 449 OPHTHALMIC EQUIPMENT MARKET: REGION FOOTPRINT

- TABLE 450 OPHTHALMIC EQUIPMENT MARKET: PRODUCT FOOTPRINT

- TABLE 451 OPHTHALMIC EQUIPMENT MARKET: END-USER FOOTPRINT

- TABLE 452 OPHTHALMIC EQUIPMENT MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 453 OPHTHALMIC EQUIPMENT MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 454 OPHTHALMIC EQUIPMENT MARKET: PRODUCT LAUNCHES & APPROVALS, JANUARY 2021-OCTOBER 2025

- TABLE 455 OPHTHALMIC EQUIPMENT MARKET: DEALS, JANUARY 2021-OCTOBER 2025

- TABLE 456 ALCON: COMPANY OVERVIEW

- TABLE 457 ALCON: PRODUCTS OFFERED

- TABLE 458 ALCON: PRODUCT LAUNCHES, JANUARY 2021-OCTOBER 2025

- TABLE 459 ALCON: DEALS, JANUARY 2021-OCTOBER 2025

- TABLE 460 JOHNSON & JOHNSON: COMPANY OVERVIEW

- TABLE 461 JOHNSON & JOHNSON: PRODUCTS OFFERED

- TABLE 462 JOHNSON & JOHNSON: PRODUCT LAUNCHES, JANUARY 2021-OCTOBER 2025

- TABLE 463 CARL ZEISS MEDITEC AG: COMPANY OVERVIEW

- TABLE 464 CARL ZEISS MEDITEC AG: PRODUCTS OFFERED

- TABLE 465 CARL ZEISS MEDITEC AG: PRODUCT LAUNCHES, JANUARY 2021-OCTOBER 2025

- TABLE 466 CARL ZEISS MEDITEC AG: DEALS, JANUARY 2021-OCTOBER 2025

- TABLE 467 BAUSCH HEALTH COMPANIES INC.: COMPANY OVERVIEW

- TABLE 468 BAUSCH HEALTH COMPANIES INC.: PRODUCTS OFFERED

- TABLE 469 BAUSCH HEALTH COMPANIES INC.: PRODUCT LAUNCHES, JANUARY 2021-OCTOBER 2025

- TABLE 470 BAUSCH HEALTH COMPANIES INC.: DEALS, JANUARY 2021-OCTOBER 2025

- TABLE 471 HOYA CORPORATION: COMPANY OVERVIEW

- TABLE 472 HOYA CORPORATION: PRODUCTS OFFERED

- TABLE 473 HOYA CORPORATION: DEALS, JANUARY 2021-OCTOBER 2025

- TABLE 474 ESSILORLUXOTTICA: COMPANY OVERVIEW

- TABLE 475 ESSILORLUXOTTICA: PRODUCTS OFFERED

- TABLE 476 ESSILORLUXOTTICA: DEALS, JANUARY 2021-OCTOBER 2025

- TABLE 477 CANON: COMPANY OVERVIEW

- TABLE 478 CANON: PRODUCTS OFFERED

- TABLE 479 GLAUKOS CORPORATION: COMPANY OVERVIEW

- TABLE 480 GLAUKOS CORPORATION: PRODUCTS OFFERED

- TABLE 481 GLAUKOS CORPORATION: PRODUCT APPROVALS, JANUARY 2021-OCTOBER 2025

- TABLE 482 GLAUKOS CORPORATION: DEALS, JANUARY 2021-OCTOBER 2025

- TABLE 483 TOPCON CORPORATION: COMPANY OVERVIEW

- TABLE 484 TOPCON CORPORATION: PRODUCTS OFFERED

- TABLE 485 TOPCON CORPORATION: PRODUCT LAUNCHES, JANUARY 2021-OCTOBER 2025

- TABLE 486 TOPCON CORPORATION: DEALS, JANUARY 2021-OCTOBER 2025

- TABLE 487 NIDEK CO., LTD.: COMPANY OVERVIEW

- TABLE 488 NIDEK CO., LTD.: PRODUCTS OFFERED

- TABLE 489 NIDEK CO., LTD.: PRODUCT LAUNCHES, JANUARY 2021-OCTOBER 2025

- TABLE 490 NIDEK CO., LTD.: DEALS, JANUARY 2021-OCTOBER 2025

- TABLE 491 STAAR SURGICAL: COMPANY OVERVIEW

- TABLE 492 STAAR SURGICAL: PRODUCTS OFFERED

- TABLE 493 STAAR SURGICAL: PRODUCT APPROVALS, JANUARY 2021-OCTOBER 2025

- TABLE 494 HALMA PLC: COMPANY OVERVIEW

- TABLE 495 HALMA PLC: PRODUCTS OFFERED

- TABLE 496 HAAG-STREIT: COMPANY OVERVIEW

- TABLE 497 HAAG-STREIT: PRODUCTS OFFERED

- TABLE 498 HAAG-STREIT: PRODUCT LAUNCHES, JANUARY 2021-OCTOBER 2025

- TABLE 499 HAAG-STREIT: DEALS, JANUARY 2021-OCTOBER 2025

- TABLE 500 SHANGHAI MEDIWORKS PRECISION INSTRUMENTS CO., LTD.: COMPANY OVERVIEW

- TABLE 501 SHANGHAI MEDIWORKS PRECISION INSTRUMENTS CO., LTD.: PRODUCTS OFFERED

- TABLE 502 VISIONIX: COMPANY OVERVIEW

- TABLE 503 VISIONIX: PRODUCTS OFFERED

- TABLE 504 VISIONIX: DEALS, JANUARY 2021-JULY 2025

- TABLE 505 VISUNEX MEDICAL SYSTEMS: COMPANY OVERVIEW

- TABLE 506 COSTRUZIONE STRUMENTI OFTALMICI: COMPANY OVERVIEW

- TABLE 507 HAI LABORATORIES, INC.: COMPANY OVERVIEW

- TABLE 508 FORUS HEALTH: COMPANY OVERVIEW

- TABLE 509 ZIEMER OPHTHALMIC SYSTEMS AG: COMPANY OVERVIEW

- TABLE 510 CRYSTALVUE MEDICAL CORPORATION: COMPANY OVERVIEW

- TABLE 511 REMIDIO INNOVATIVE SOLUTIONS PVT. LTD.: COMPANY OVERVIEW

- TABLE 512 SUZHOU KANGJIE MEDICAL INC.: COMPANY OVERVIEW

- TABLE 513 LUMENIS: COMPANY OVERVIEW

- TABLE 514 OPHTEC BV: COMPANY OVERVIEW

List of Figures

- FIGURE 1 OPHTHALMIC EQUIPMENT MARKET SEGMENTATION & REGIONAL SCOPE

- FIGURE 2 YEARS CONSIDERED

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 PRIMARY SOURCES

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE PARTICIPANTS

- FIGURE 7 MARKET SIZE APPROACH: REVENUE SHARE ANALYSIS

- FIGURE 8 REVENUE SHARE ANALYSIS ILLUSTRATION: ALCON INC.

- FIGURE 9 SUPPLY-SIDE MARKET SIZE ESTIMATION: OPHTHALMIC EQUIPMENT MARKET (2024)

- FIGURE 10 BOTTOM-UP APPROACH: SURGICAL DEVICES COMPANY REVENUE ESTIMATION APPROACH

- FIGURE 11 BOTTOM-UP APPROACH: DIAGNOSTIC & MONITORING DEVICES COMPANY REVENUE ESTIMATION APPROACH

- FIGURE 12 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN OPHTHALMIC EQUIPMENT MARKET (2025-2030): IMPACT ON GROWTH & CAGR

- FIGURE 14 DATA TRIANGULATION METHODOLOGY

- FIGURE 15 OPHTHALMIC EQUIPMENT MARKET, BY TECHNOLOGY, 2025 VS. 2030 (USD MILLION)

- FIGURE 16 OPHTHALMIC EQUIPMENT MARKET, BY PRODUCT, 2025 VS. 2030 (USD MILLION)

- FIGURE 17 OPHTHALMIC EQUIPMENT MARKET FOR SURGICAL DEVICES, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 18 OPHTHALMIC EQUIPMENT MARKET FOR DIAGNOSTIC & MONITORING DEVICES, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 19 OPHTHALMIC EQUIPMENT MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 20 REGIONAL SNAPSHOT OF OPHTHALMIC EQUIPMENT MARKET

- FIGURE 21 RISING PREVALENCE OF EYE DISEASES TO DRIVE MARKET GROWTH

- FIGURE 22 HOSPITALS DOMINATED NORTH AMERICAN OPHTHALMIC EQUIPMENT MARKET IN 2024

- FIGURE 23 INDIA TO REGISTER HIGHEST GROWTH RATE FROM 2025 TO 2030

- FIGURE 24 NORTH AMERICA TO LEAD MARKET UNTIL 2030

- FIGURE 25 DEVELOPING MARKETS TO REGISTER FASTER GROWTH DURING FORECAST PERIOD

- FIGURE 26 OPHTHALMIC EQUIPMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 27 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 28 AVERAGE SELLING PRICE TREND OF OPTICAL COHERENCE TOMOGRAPHY SYSTEMS, BY REGION, 2022-2024

- FIGURE 29 OPHTHALMIC EQUIPMENT MARKET: VALUE CHAIN ANALYSIS

- FIGURE 30 OPHTHALMIC EQUIPMENT MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 31 OPHTHALMIC EQUIPMENT MARKET: ECOSYSTEM ANALYSIS

- FIGURE 32 OPHTHALMIC EQUIPMENT MARKET: INVESTMENT & FUNDING SCENARIO, 2019-2023

- FIGURE 33 OPHTHALMIC EQUIPMENT MARKET: VALUE OF INVESTOR DEALS, BY KEY PLAYER, 2019-2023

- FIGURE 34 OPHTHALMIC EQUIPMENT MARKET: NUMBER OF INVESTOR DEALS, BY KEY PLAYER, 2019-2023 (USD MILLION)

- FIGURE 35 OPHTHALMIC EQUIPMENT MARKET: PATENT ANALYSIS, JANUARY 2015-OCTOBER 2025

- FIGURE 36 OPHTHALMIC EQUIPMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 37 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS OF OPHTHALMIC EQUIPMENT PRODUCTS

- FIGURE 38 KEY BUYING CRITERIA FOR OPHTHALMIC EQUIPMENT PRODUCTS

- FIGURE 39 OPHTHALMIC EQUIPMENT MARKET: IMPACT OF AI/GEN AI

- FIGURE 40 OPHTHALMIC EQUIPMENT MARKET: ADJACENT MARKETS

- FIGURE 41 OPHTHALMIC EQUIPMENT MARKET: REGIONAL GROWTH OPPORTUNITIES

- FIGURE 42 NORTH AMERICA: OPHTHALMIC EQUIPMENT MARKET SNAPSHOT

- FIGURE 43 ASIA PACIFIC: OPHTHALMIC EQUIPMENT MARKET SNAPSHOT

- FIGURE 44 REVENUE ANALYSIS OF TOP PLAYERS IN OPHTHALMIC EQUIPMENT MARKET, 2020-2024 (USD MILLION)