|

市场调查报告书

商品编码

1892790

分离机械市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Separation Machinery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

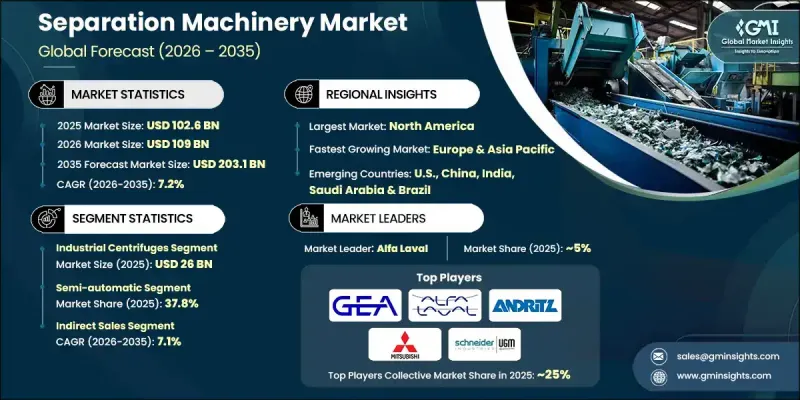

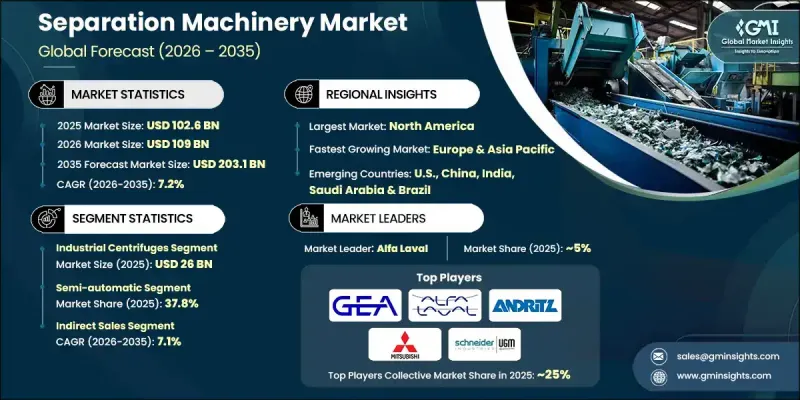

2025年全球分离机械市场价值为1,026亿美元,预计到2035年将以7.2%的复合年增长率成长至2,031亿美元。

市场成长主要得益于製药、化工、食品饮料、石油天然气和采矿等行业的工业活动不断扩张。随着各行业规模的扩大,对能够提升产品品质、实现资源回收并满足严格环保法规要求的更高效分离製程的需求日益增长。亚太、拉丁美洲和非洲的快速工业化进程正在推动对离心机、过滤器和膜分离器等先进设备的投资。包括智慧感测器、人工智慧驱动的製程优化和新一代膜过滤技术在内的技术创新,正在提升营运效率、降低能耗并提高可靠性。模组化设备设计与支援预测性维护的数位化监控系统正与工业4.0标准接轨。永续发展措施和日益增长的城市化正在为新兴市场的製造商创造新的机会。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 1026亿美元 |

| 预测值 | 2031亿美元 |

| 复合年增长率 | 7.2% |

2025年,工业离心机市场规模达260亿美元,预计2026年至2035年将以7.7%的复合年增长率成长。由于其精度高、处理能力强、性能卓越,这些系统在多个行业中用于固液分离,发挥至关重要的作用。製药和生物技术产业对高纯度产品的需求不断增长,以及废水管理和回收日益严格的环境法规,正在推动先进离心机技术的广泛应用。

到2025年,间接销售通路的市占率将达到61.9%,预计到2035年将以7.1%的复合年增长率成长。间接通路提供捆绑式解决方案、融资方案和强大的区域网络,使中小企业更容易获得设备。这些经销商和通路合作伙伴作为策略盟友,提供整合服务,促进更快的市场渗透,同时确保对客户需求的快速回应。

2025年美国分离机械市场规模达211亿美元,预计2026年至2035年将以7.9%的复合年增长率成长。製药、化学、食品饮料、石油天然气和水处理等行业的快速工业化推动了对先进分离系统的需求。政府在永续发展、脱碳以及零液体排放(ZLD)、全氟烷基和多氟烷基物质(PFAS)去除和废水回收利用等方面的倡议,加速了节能环保分离技术的应用。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 各领域的快速工业化

- 分离技术的创新

- 新兴市场需求不断成长

- 产业陷阱与挑战

- 高昂的初始投资成本

- 日益严格的环境法规

- 成长驱动因素

- 成长潜力分析

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 监管环境

- 标准和合规要求

- 区域监理框架

- 认证标准

- 贸易统计

- 主要进口国

- 主要出口国

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品类型划分,2022-2035年

- 工业离心机

- 磁选机

- 膜分离器

- 阶段分隔器

- 工业过滤器和筛子

- 蒸发器

- 其他(蒸馏塔、洗涤器)

第六章:市场估算与预测:依技术划分,2022-2035年

- 机械分离

- 膜分离

- 静电分离

第七章:市场估算与预测:依营运模式划分,2022-2035年

- 自动的

- 半自动

- 手动的

第八章:市场估算与预测:依速度划分,2022-2035年

- 低转速(低于 1000 转/分)

- 中转速(1000 - 5000 转/分)

- 高转速(5000 - 15000 转/分)

第九章:市场估算与预测:依应用领域划分,2022-2035年

- 生命科学

- 水和废水

- 运输

- 暖通空调及环境

- 工业加工

- 其他的

第十章:市场估价与预测:依配销通路划分,2022-2035年

- 直销

- 间接销售

第十一章:市场估计与预测:按地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 印尼

- 马来西亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 沙乌地阿拉伯

- 阿联酋

- 南非

第十二章:公司简介

- ACS Manufacturing

- Alfa Laval

- ANDRITZ

- CECO Environmental

- Ferrum

- Forsbergs

- GEA Group

- Gruppo Pieralisi

- Hiller Separation & Process

- Industriefabrik Schneider

- Mitsubishi Kakoki Kaisha

- Parkson Corporation

- Rotex

- Russell Finex

- SWECO

The Global Separation Machinery Market was valued at USD 102.6 billion in 2025 and is estimated to grow at a CAGR of 7.2% to reach USD 203.1 billion by 2035.

The market growth is driven by expanding industrial activity across sectors such as pharmaceuticals, chemicals, food and beverage, oil and gas, and mining. As industries scale up, there is an increasing demand for more efficient separation processes that improve product quality, enable resource recovery, and meet stringent environmental regulations. Rapid industrialization in the Asia Pacific, Latin America, and Africa is fueling investments in advanced machinery such as centrifuges, filters, and membranes. Technological innovations, including smart sensors, AI-driven process optimization, and next-generation membrane filtration, are enhancing operational efficiency, reducing energy consumption, and improving reliability. Modular equipment designs and digital monitoring systems supporting predictive maintenance are aligning with Industry 4.0 standards. Sustainability initiatives and rising urbanization are opening new opportunities for manufacturers in emerging markets.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $102.6 Billion |

| Forecast Value | $203.1 Billion |

| CAGR | 7.2% |

The industrial centrifuges segment accounted for USD 26 billion in 2025 and is expected to grow at a CAGR of 7.7% from 2026 to 2035. These systems are essential in separating solids from liquids across multiple industries due to their precision, high capacity, and superior performance. The rising demand for high-purity outputs in pharmaceuticals and biotechnology, along with stricter environmental regulations on wastewater management and recycling, is driving widespread adoption of advanced centrifuge technologies.

The indirect sales channel held a 61.9% share in 2025 and is projected to grow at a CAGR of 7.1% through 2035. Indirect channels provide bundled solutions, financing options, and robust regional networks, making it easier for small and medium-sized enterprises to acquire equipment. These distributors and channel partners act as strategic allies, offering integrated services and facilitating faster market penetration while ensuring responsiveness to customer requirements.

U.S. Separation Machinery Market generated USD 21.1 billion in 2025 and is forecasted to grow at a CAGR of 7.9% from 2026 to 2035. Rapid industrialization across pharmaceuticals, chemicals, food and beverage, oil and gas, and water treatment drives demand for advanced separation systems. Government initiatives focused on sustainability, decarbonization, and regulatory mandates on zero liquid discharge (ZLD), PFAS removal, and wastewater recycling have accelerated the adoption of energy-efficient and environmentally friendly separation technologies.

Key players in the Global Separation Machinery Market include Alfa Laval, Parkson Corporation, ANDRITZ, Rotex, CECO Environmental, Mitsubishi Kakoki Kaisha, SWECO, ACS Manufacturing, Gruppo Pieralisi, Hiller Separation & Process, Industriefabrik Schneider, Ferrum, Russell Finex, and Forsbergs. Companies are reinforcing their Separation Machinery Market presence by investing in R&D for energy-efficient, high-capacity, and technologically advanced equipment. Strategic partnerships with distributors and channel partners help expand reach in emerging markets. Firms are adopting modular designs and digital systems for faster deployment and predictive maintenance capabilities. Sustainability-focused production processes, compliance with environmental regulations, and product customization enhance competitiveness.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Technology

- 2.2.4 Operation mode

- 2.2.5 Speed

- 2.2.6 Application

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid industrialization across various sectors

- 3.2.1.2 Innovations in separation technologies

- 3.2.1.3 Growing demand in emerging markets

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Increasingly stringent environmental regulations

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2022 - 2035, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Industrial centrifuges

- 5.3 Magnetic separators

- 5.4 Membrane separators

- 5.5 Stage separators

- 5.6 Industrial strainers & sieves

- 5.7 Evaporators

- 5.8 Others (distillation columns, scrubbers)

Chapter 6 Market Estimates & Forecast, By Technology, 2022 - 2035, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Mechanical separation

- 6.3 Membrane separation

- 6.4 Electrostatic separation

Chapter 7 Market Estimates & Forecast, By Operation Mode, 2022 - 2035, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Automatic

- 7.3 Semi-automatic

- 7.4 Manual

Chapter 8 Market Estimates & Forecast, By Speed, 2022 - 2035, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Low (Below 1000 RPM)

- 8.3 Medium (1000 - 5000 RPM)

- 8.4 High (5000 - 15000 RPM)

Chapter 9 Market Estimates & Forecast, By Application, 2022 - 2035, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Life sciences

- 9.3 Water & wastewater

- 9.4 Transportation

- 9.5 HVAC & environmental

- 9.6 Industrial processing

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.4.6 Indonesia

- 11.4.7 Malaysia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 Saudi Arabia

- 11.6.2 UAE

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 ACS Manufacturing

- 12.2 Alfa Laval

- 12.3 ANDRITZ

- 12.4 CECO Environmental

- 12.5 Ferrum

- 12.6 Forsbergs

- 12.7 GEA Group

- 12.8 Gruppo Pieralisi

- 12.9 Hiller Separation & Process

- 12.10 Industriefabrik Schneider

- 12.11 Mitsubishi Kakoki Kaisha

- 12.12 Parkson Corporation

- 12.13 Rotex

- 12.14 Russell Finex

- 12.15 SWECO