|

市场调查报告书

商品编码

1892807

汽车储存半导体市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Automotive Memory Semiconductors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

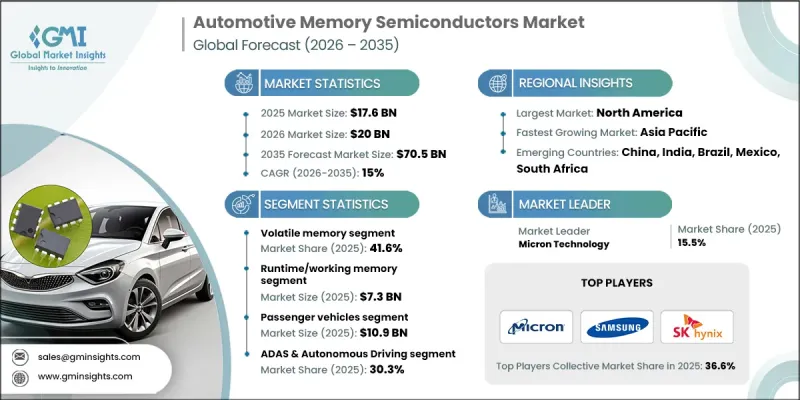

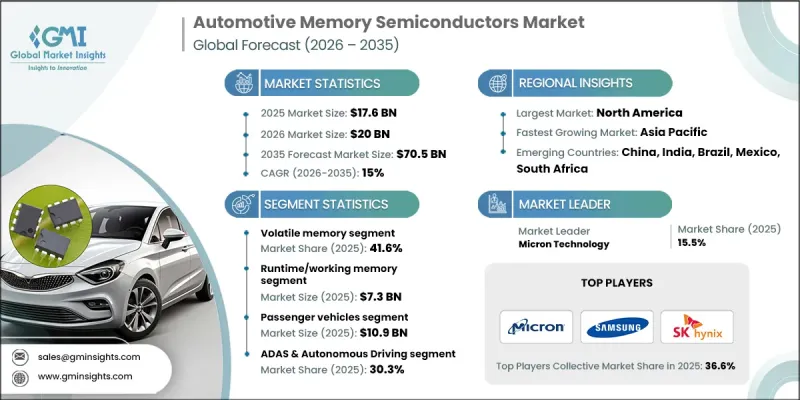

2025 年全球汽车储存半导体市场价值为 176 亿美元,预计到 2035 年将以 15% 的复合年增长率增长至 705 亿美元。

受对精密汽车电子产品需求不断增长、电动汽车产量持续增加以及互联出行系统快速发展的推动,汽车行业正经历强劲的增长势头。这些组件在高级驾驶辅助功能、车载娱乐平台和不断发展的自动驾驶功能中正变得至关重要。对智慧感测器和高速资料处理的日益依赖,推动了下一代汽车对能够支援即时工作负载的记忆体的需求。随着自动化规模的扩大,车辆需要容量更大、延迟更低、耐久性更强的记忆体架构。这种转变促使製造商开发符合严格安全性和可靠性标准的汽车级组件。向电动车和混合动力车的加速转型也创造了巨大的机会,因为电动车依赖复杂的电子控制单元和电池管理系统,而这些系统又依赖高性能记忆体来持续监控安全性、效率和系统运作状况。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 176亿美元 |

| 预测值 | 705亿美元 |

| 复合年增长率 | 15% |

到2025年,挥发性记忆体市场占有率将达到41.6%。其重要性源自于其在现代车辆中处理即时操作和短期资料载入的核心作用。 DRAM作为主要的挥发性记忆体,能够实现车辆感测器、资讯娱乐控制器、能源管理单元和其他关键模组之间的快速互动。其速度快、响应灵敏且功耗低,使其成为智慧互联汽车平台的基础。

预计到2025年,运行时记忆体或工作记忆体市场规模将达73亿美元。该市场占据主导地位,因为它承担着与电子控制单元、连接系统、电池监控模组和先进安全技术之间的即时资料通讯相关的最苛刻的处理任务。 DRAM凭藉其高效能和稳定性,继续作为运行时记忆体的支柱。电动车、自动驾驶系统和整合连接功能的日益普及,也持续推动该领域的强劲需求。

预计到2025年,北美汽车储存半导体市场将占据27.5%的份额。该地区正经历着显着的成长,这主要得益于电动车和自动驾驶汽车技术的广泛应用以及智慧汽车平台的强劲成长。先进的半导体工程技术、强大的大规模生产能力以及储存技术供应商不断增加的投资,共同推动了市场的扩张。此外,政府对电动车和下一代汽车创新的政策支持也进一步加速了市场成长。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 高级驾驶辅助系统(ADAS)和自动驾驶技术的日益普及

- 汽车电气化(电动车和混合动力车)的日益普及

- 资讯娱乐系统与连网汽车系统的集成

- 汽车级记忆体技术的进步

- 车联网(V2X)通讯的扩展

- 产业陷阱与挑战

- 汽车级半导体的高製造成本和认证成本

- 快速的技术演进

- 市场机会

- 软体定义车辆(SDV)的出现

- 车辆中的边缘人工智慧和机器学习

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 历史价格分析(2022-2024)

- 价格趋势驱动因素

- 区域价格差异

- 价格预测(2026-2035)

- 定价策略

- 新兴商业模式

- 合规要求

- 永续性措施

- 永续材料评估

- 碳足迹分析

- 循环经济实施

- 永续性认证和标准

- 永续性投资报酬率分析

- 全球消费者情绪分析

- 专利分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 市场集中度分析

- 按地区

- 对主要参与者进行竞争基准分析

- 财务绩效比较

- 收入

- 利润率

- 研发

- 产品组合比较

- 产品范围广度

- 科技

- 创新

- 地理位置比较

- 全球足迹分析

- 服务网路覆盖

- 按地区分類的市场渗透率

- 竞争定位矩阵

- 领导人

- 挑战者

- 追踪者

- 小众玩家

- 战略展望矩阵

- 财务绩效比较

- 2022-2025 年主要发展动态

- 併购

- 伙伴关係与合作

- 技术进步

- 扩张和投资策略

- 永续发展倡议

- 数位转型计划

- 新兴/新创企业竞争对手格局

第五章:市场估计与预测:依技术划分,2022-2035年

- 挥发性记忆体

- DRAM

- SRAM

- 非挥发性记忆体(NVM)

- NOR Flash

- NAND快闪记忆体

- EEPROM/NVRAM

- 新兴/先进内存

- MRAM

- 框架

- ReRAM/PCM

- 汽车管理记忆体解决方案

第六章:市场估算与预测:依职能角色划分,2022-2035年

- 运行时/工作内存

- 程式码储存

- 资料储存

第七章:市场估价与预测:依车辆类型划分,2022-2035年

- 搭乘用车

- 轻型商用车

- 重型商用车辆

第八章:市场估算与预测:依应用领域划分,2022-2035年

- 高级驾驶辅助系统与自动驾驶

- 资讯娱乐系统和数位座舱

- 动力系统和电池管理

- 车身、底盘和安全电子设备

- 仪錶板及显示系统

- 其他的

第九章:市场估计与预测:依地区划分,2021-2034年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- Everspin Technologies

- GigaDevice Semiconductor

- Infineon Technologies

- Integrated Silicon Solution (ISSI)

- Kingston Technology

- Kioxia Holdings

- Macronix International

- Micron Technology

- Powerchip Technology

- Renesas Electronics

- Samsung Electronics

- SK hynix

- Swissbit

- Transcend Information

- Western Digital

The Global Automotive Memory Semiconductors Market was valued at USD 17.6 billion in 2025 and is estimated to grow at a CAGR of 15% to reach USD 70.5 billion by 2035.

The industry is experiencing strong momentum driven by rising demand for sophisticated automotive electronics, increasing production of electric vehicles, and the rapid emergence of connected mobility systems. These components are becoming essential in advanced driver-assistance features, in-vehicle entertainment platforms, and evolving autonomous functions. Growing reliance on intelligent sensors and high-speed data processing fuels the need for memory capable of supporting real-time workloads in next-generation vehicles. As automation scales, vehicles require memory architectures that deliver higher capacity, reduced latency, and long-term durability. This shift encourages manufacturers to develop automotive-grade components built to meet rigorous safety and reliability criteria. The accelerating transition toward EVs and hybrid models is also creating significant opportunities, as electrified vehicles depend on complex electronic control units and battery management systems that rely on high-performance memory for continuous monitoring of safety, efficiency, and system behavior.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $17.6 Billion |

| Forecast Value | $70.5 Billion |

| CAGR | 15% |

The volatile memory segment accounted for 41.6% share in 2025. Its prominence stems from its central function in handling real-time operations and short-term data loads within modern vehicles. DRAM, the primary volatile memory, enables rapid interaction between vehicle sensors, infotainment controllers, energy-management units, and other mission-critical modules. Its speed, responsiveness, and optimized power usage make it fundamental to intelligent, connected vehicle platforms.

The runtime or working memory segment reached USD 7.3 billion in 2025. This segment dominates because it performs the most demanding processing tasks tied to immediate data communication across electronic control units, connectivity systems, battery oversight modules, and advanced safety technologies. DRAM continues to serve as the backbone of runtime memory due to its high performance and stability. Expanding use of EVs, automated driving systems, and integrated connectivity features continues to support strong demand in this category.

North America Automotive Memory Semiconductors Market held a 27.5% share in 2025. The region is witnessing substantial progress fueled by the widespread adoption of electric and automated vehicle technologies and strong uptake of intelligent car platforms. A combination of advanced semiconductor engineering, large-scale manufacturing strength, and increased investment from memory technology providers is reinforcing market expansion. Policy support for electric mobility and next-generation automotive innovation further accelerates growth.

Key companies active in the Global Automotive Memory Semiconductors Market include Everspin Technologies, Infineon Technologies, Kingston Technology, GigaDevice Semiconductor, Kioxia Holdings, Macronix International, Micron Technology, Integrated Silicon Solution (ISSI), Renesas Electronics, Powerchip Technology, SK hynix, Swissbit, Samsung Electronics, Western Digital, and Transcend Information. Key strategies used by companies in the Global Automotive Memory Semiconductors Market center on enhancing performance capabilities, expanding product durability, and strengthening partnerships across the automotive ecosystem. Many firms are investing in advanced fabrication technologies to boost endurance, reduce latency, and support high-bandwidth applications required by automated and electric vehicles. Companies are also prioritizing automotive-grade qualification standards to improve reliability under extreme conditions. Collaborations with OEMs and Tier-1 suppliers are expanding to ensure seamless integration of memory solutions into complex vehicle architectures. Additionally, businesses are diversifying memory portfolios, optimizing power efficiency, and scaling production capacity to meet rising global demand while improving their competitive position.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry snapshot

- 2.2 Key market trends

- 2.2.1 Technologies trends

- 2.2.2 Functional Role trends

- 2.2.3 Vehicle Type trends

- 2.2.4 Application trends

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising adoption of Advanced Driver Assistance Systems (ADAS) and autonomous driving

- 3.2.1.2 Growing vehicle electrification (EVs and HEVs)

- 3.2.1.3 Integration of infotainment and connected car systems

- 3.2.1.4 Advancements in automotive-grade memory

- 3.2.1.5 Expansion of vehicle-to-everything (V2X) communication

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High manufacturing and qualification costs of automotive-grade semiconductors

- 3.2.2.2 Rapid technology evolution

- 3.2.3 Market opportunities

- 3.2.4 Emergence of Software-Defined Vehicles (SDVs)

- 3.2.5 Edge AI and Machine Learning in Vehicles

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 Historical price analysis (2022-2024)

- 3.8.2 Price trend drivers

- 3.8.3 Regional price variations

- 3.8.4 Price forecast (2026-2035)

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Sustainability measures

- 3.12.1 Sustainable materials assessment

- 3.12.2 Carbon footprint analysis

- 3.12.3 Circular economy implementation

- 3.12.4 Sustainability certifications and standards

- 3.12.5 Sustainability roi analysis

- 3.13 Global consumer sentiment analysis

- 3.14 Patent analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market Concentration Analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2022-2025

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Technologies, 2022 - 2035 (USD Million)

- 5.1 Key trends

- 5.2 Volatile Memory

- 5.2.1 DRAM

- 5.2.2 SRAM

- 5.3 Non-Volatile Memory (NVM)

- 5.4 NOR Flash

- 5.5 NAND Flash

- 5.6 EEPROM / NVRAM

- 5.7 Emerging / Advanced Memory

- 5.8 MRAM

- 5.9 FRAM

- 5.10 ReRAM / PCM

- 5.11 Automotive Managed Memory Solutions

Chapter 6 Market Estimates and Forecast, By Functional Role, 2022 - 2035 (USD Million)

- 6.1 Key trends

- 6.2 Runtime / Working Memory

- 6.3 Code Storage

- 6.4 Data Storage

Chapter 7 Market Estimates and Forecast, By Vehicle Type, 2022 - 2035 (USD Million)

- 7.1 Key trends

- 7.2 Passenger Vehicles

- 7.3 Light Commercial Vehicles

- 7.4 Heavy Commercial Vehicles

Chapter 8 Market Estimates and Forecast, By Application, 2022 - 2035 (USD Million)

- 8.1 Key trends

- 8.2 ADAS & Autonomous Driving

- 8.3 Infotainment & Digital Cockpit

- 8.4 Powertrain & Battery Management

- 8.5 Body, Chassis & Safety Electronics

- 8.6 Instrument Cluster & Display Systems

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Everspin Technologies

- 10.2 GigaDevice Semiconductor

- 10.3 Infineon Technologies

- 10.4 Integrated Silicon Solution (ISSI)

- 10.5 Kingston Technology

- 10.6 Kioxia Holdings

- 10.7 Macronix International

- 10.8 Micron Technology

- 10.9 Powerchip Technology

- 10.10 Renesas Electronics

- 10.11 Samsung Electronics

- 10.12 SK hynix

- 10.13 Swissbit

- 10.14 Transcend Information

- 10.15 Western Digital