|

市场调查报告书

商品编码

1892813

兽用缝合线市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Veterinary Sutures Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

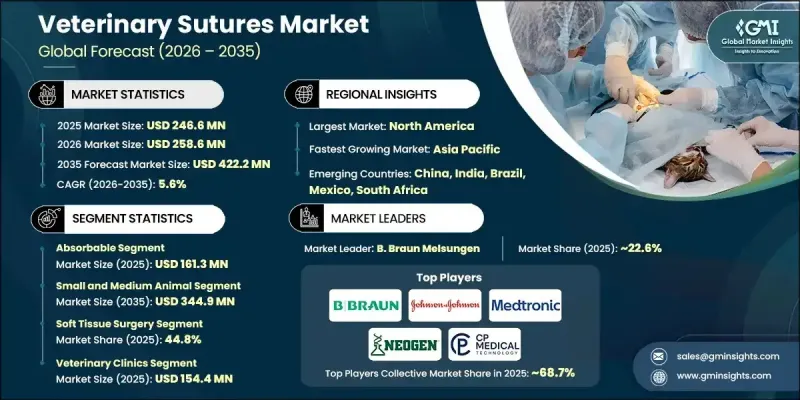

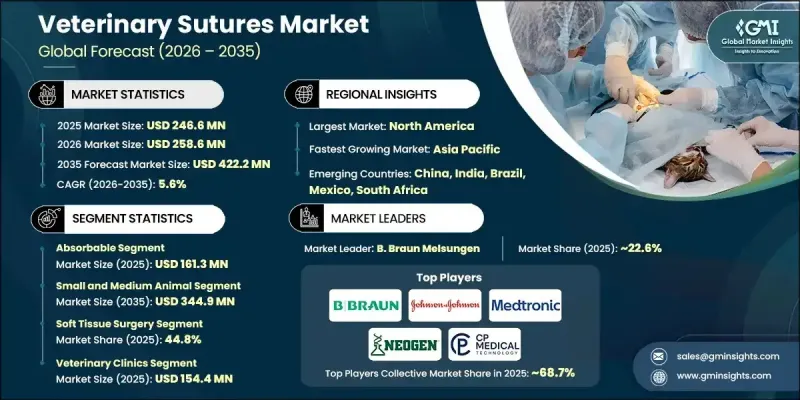

2025 年全球兽用缝线市场价值为 2.466 亿美元,预计到 2035 年将以 5.6% 的复合年增长率增长至 4.222 亿美元。

宠物数量的增长以及动物慢性病和生活方式相关疾病的日益普遍推动了市场的发展。随着宠物越来越被视为家庭成员,人们对包括外科手术在内的先进兽医护理的需求激增。兽用缝合线是兽医用于闭合伤口和固定手术切口的关键医疗工具,确保伤口癒合。缝合材料的创新降低了感染风险,促进了组织修復,从而改善了临床疗效,推动了市场的发展。已开发地区和新兴地区兽医医院和诊所的扩张提高了人们获得外科手术服务的便利性。缝合线分为可吸收型和不可吸收型,其设计兼顾了生物相容性、耐用性和安全性,适用于各种动物,确保有效的伤口管理和更快的康復。随着动物健康意识的提高,全球先进兽用缝线的应用持续成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 2.466亿美元 |

| 预测值 | 4.222亿美元 |

| 复合年增长率 | 5.6% |

可吸收缝线市占率高达65.4%,预计2025年市场规模将达1.613亿美元。可吸收缝合线,包括聚乙醇酸、聚乳酸等类型,因其无需拆线而备受青睐,减少了后续復诊的次数。它们在软组织手术、常规伤口缝合和内科手术中的广泛应用,使其占据市场主导地位,深受兽医和宠物主人的青睐。

预计2035年,中小动物市场规模将达到3.449亿美元。推动该市场成长的因素包括犬、猫及其他中小宠物数量的不断增加,以及宠物主人愿意投资先进的兽医护理。这些动物需要接受各种外科手术,从常规手术到复杂手术,因此对各种缝线的需求持续强劲。

预计2025年,北美兽用缝线市场将占据39.7%的最大份额。该地区市场成长的主要驱动力是庞大的宠物数量、较高的动物健康意识以及完善的兽医医疗基础设施。宠物保险的日益普及也促进了市场扩张,使宠物主人能够投入更多资金用于高品质的外科手术治疗。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 产业影响因素

- 成长驱动因素

- 宠物饲养和宠物拟人化趋势日益增长

- 发展中国家牲畜数量不断增加

- 缝合材料的进展

- 医疗保健支出不断增长

- 产业陷阱与挑战

- 高级缝合线成本高昂

- 新兴市场意识有限

- 市场机会

- 对微创和先进外科技术的需求不断增长

- 宠物保险的普及率不断提高

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 技术格局

- 当前技术趋势

- 新兴技术

- 全球动物族群统计数据

- 宠物数量统计数据

- 狗

- 猫

- 牲畜数量统计数据

- 宠物数量统计数据

- 未来市场趋势

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品类型划分,2022-2035年

- 可吸收缝线

- 聚乙醇酸缝线

- 聚乳酸缝线

- 其他可吸收缝合线

- 不可吸收缝线

- 尼龙缝线

- 聚酯缝线

- 其他不可吸收缝合线

第六章:市场估计与预测:依动物类型划分,2022-2035年

- 小型和中型动物

- 大型动物

第七章:市场估算与预测:依应用领域划分,2022-2035年

- 软组织手术

- 骨科手术

- 牙科手术

- 眼科手术

- 其他应用

第八章:市场估算与预测:依最终用途划分,2022-2035年

- 兽医诊所

- 兽医院

- 研究中心和学术界

第九章:市场估计与预测:依地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- AIP Medical

- B. Braun Melsungen

- Cencora

- CP Medical

- DemeTECH Corporation

- Dolphin Sutures

- Johnson & Johnson

- KATSAN

- Lotus Surgicals

- Medtronic

- Neogen Corporation

- Orion Sutures

- SMI

- Vetersut

- Vitrex medical

The Global Veterinary Sutures Market was valued at USD 246.6 million in 2025 and is estimated to grow at a CAGR of 5.6% to reach USD 422.2 million by 2035.

The market is driven by the rising pet population and the growing prevalence of chronic and lifestyle-related conditions among animals. With pets increasingly regarded as family members, demand for advanced veterinary care, including surgical procedures, has surged. Veterinary sutures are critical medical tools used by veterinarians to close wounds and secure surgical incisions, ensuring proper healing. The market benefits from innovations in suture materials that reduce infection risks and enhance tissue repair, improving clinical outcomes. Expansion of veterinary hospitals and clinics across both developed and emerging regions has improved access to surgical care. Sutures, available in absorbable and non-absorbable forms, are designed for biocompatibility, durability, and safety across species, ensuring effective wound management and faster recovery. As animal healthcare awareness grows, adoption of advanced veterinary sutures continues to rise globally.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $246.6 Million |

| Forecast Value | $422.2 Million |

| CAGR | 5.6% |

The absorbable sutures segment held a 65.4% share, valued at USD 161.3 million in 2025. Absorbable sutures, including polyglycolic acid, polyglactin, and other types, are favored for convenience since they do not require removal, reducing the need for follow-up visits. Their broad applicability across soft tissue surgeries, routine wound closures, and internal procedures contributes to their dominance, making them highly preferred by veterinarians and pet owners.

The small and medium animal segment is projected to reach USD 344.9 million by 2035. Growth in this segment is fueled by the increasing population of dogs, cats, and other small to medium pets, along with pet owners' willingness to invest in advanced veterinary care. These animals undergo a variety of surgical procedures, from routine operations to complex interventions, creating consistent demand for diverse suture types.

North America Veterinary Sutures Market held the largest share of 39.7% in 2025. Market growth in the region is driven by a substantial pet population, strong awareness of animal health, and a well-established veterinary care infrastructure. The rising adoption of pet insurance also supports market expansion by enabling owners to invest more in quality surgical care.

Key companies active in the Global Veterinary Sutures Market include B. Braun Melsungen, Vetersut, CP Medical, Medtronic, Orion Sutures, AIP Medical, Vitrex Medical, SMI, DemeTECH Corporation, Dolphin Sutures, Johnson & Johnson, Cencora, Lotus Surgicals, and KATSAN. Companies in the Veterinary Sutures Market are leveraging multiple strategies to strengthen their market presence. They are focusing on research and development to create advanced, biocompatible, and infection-resistant suture materials. Strategic collaborations with veterinary hospitals and clinics enhance product adoption. Expanding distribution networks across emerging and developed regions ensures wider reach and accessibility. Many firms are also adopting digital marketing and e-commerce platforms to target pet owners and veterinary professionals directly. In addition, companies are investing in training programs for veterinarians to promote optimal suture usage, while mergers, acquisitions, and partnerships are employed to increase market share and accelerate entry into new regions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Animal type trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing pet ownership and pet humanization trend

- 3.2.1.2 Rising livestock population in developing countries

- 3.2.1.3 Advancements in suture materials

- 3.2.1.4 Growing healthcare expenditure

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced sutures

- 3.2.2.2 Limited awareness in emerging markets

- 3.2.3 Market opportunities

- 3.2.3.1 Rising demand for minimally invasive and advanced surgical techniques

- 3.2.3.2 Growing adoption of pet insurance

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Global animal population statistics

- 3.6.1 Pet population statistics

- 3.6.1.1 Dogs

- 3.6.1.2 Cats

- 3.6.2 Livestock population statistics

- 3.6.1 Pet population statistics

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Absorbable sutures

- 5.2.1 Polyglycolic acid suture

- 5.2.2 Polyglactin suture

- 5.2.3 Other absorbable sutures

- 5.3 Non-absorbable sutures

- 5.3.1 Nylon suture

- 5.3.2 Polyester suture

- 5.3.3 Other non-absorbable sutures

Chapter 6 Market Estimates and Forecast, By Animal Type, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Small and medium animals

- 6.3 Large animals

Chapter 7 Market Estimates and Forecast, By Application, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Soft tissue surgery

- 7.3 Orthopedic surgery

- 7.4 Dental surgery

- 7.5 Ophthalmic surgery

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 Veterinary clinics

- 8.3 Veterinary hospitals

- 8.4 Research centers and academia

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AIP Medical

- 10.2 B. Braun Melsungen

- 10.3 Cencora

- 10.4 CP Medical

- 10.5 DemeTECH Corporation

- 10.6 Dolphin Sutures

- 10.7 Johnson & Johnson

- 10.8 KATSAN

- 10.9 Lotus Surgicals

- 10.10 Medtronic

- 10.11 Neogen Corporation

- 10.12 Orion Sutures

- 10.13 SMI

- 10.14 Vetersut

- 10.15 Vitrex medical