|

市场调查报告书

商品编码

1892821

运输管理系统市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Transportation Management System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 -2035 |

||||||

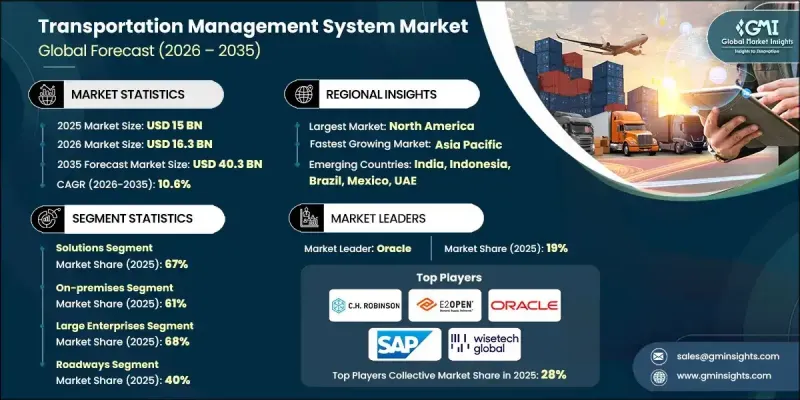

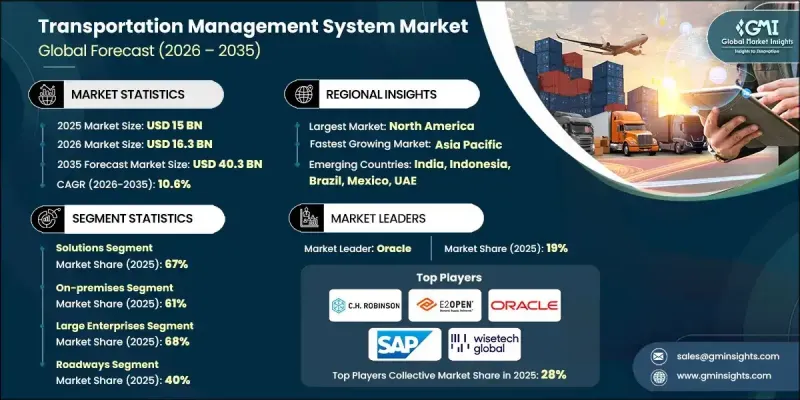

2025 年全球运输管理系统市场价值为 150 亿美元,预计到 2035 年将以 10.6% 的复合年增长率成长至 403 亿美元。

电子商务的快速成长显着增加了包裹和零担货运量,同时也缩短了交货预期,导致人工路线规划和问题解决成本更高、效率更低。随着云端原生平台降低前期投资并缩短部署週期,各种规模的企业都在转向运输管理系统 (TMS) 以简化营运。供应商正在利用微服务、更广泛的 API 存取和嵌入式人工智慧重新设计其平台,以改善预计到达时间 (ETA) 的预测、实现定价自动化并优化运力利用率。因此,TMS 平台现在被视为建立可靠、可扩展运输营运的关键工具,而不仅仅是降低成本的途径。随着全球供应链日益互联互通和多模式,企业需要能够协调承运商、实现文件数位化、支援合规性并增强跨境可视性的系统。 TMS 平台现在结合了 GPS资料、远端资讯处理和物联网讯号,提供即时追踪,从而增强物流团队和终端客户的透明度。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 150亿美元 |

| 预测值 | 403亿美元 |

| 复合年增长率 | 10.6% |

解决方案领域在2025年占据67%的市场份额,预计2025年至2035年间将以10%的复合年增长率成长。核心运输管理系统(TMS)平台负责管理计画、执行、路线规划、货运资源调配、发票处理、物流视觉化和分析。其自动化工作流程和提供即时洞察的能力推动了其强劲的市场普及。未来,人工智慧赋能的路线优化、预测分析和物联网增强的物流视觉化等新兴功能将进一步推动其成长。

到2025年,本地部署市场份额将达到61%,预计到2035年将以9.2%的复合年增长率成长。儘管由于客製化和资料控制方面的要求,本地部署解决方案仍保持着较高的收入份额,但随着企业采用模组化平台、更快的实施週期和基于使用量的定价模式,云端部署的成长速度仍在持续加快。混合架构正日益受到青睐,因为企业需要在满足监管要求的同时兼顾现代分析和工作流程自动化。

预计2025年,美国运输管理系统市场规模将达52亿美元。美国在采用人工智慧驱动的云端运输管理系统平台方面仍处于领先地位,这得益于其复杂的国内货运格局以及不断增长的服务品质提升压力。由于公路、货运、包裹和最后一公里配送等运输网路面临劳动力短缺和需求波动,预测规划工具、自动化和即时资料整合至关重要。

目录

第一章:方法论

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 电子商务和线上零售需求不断增长

- 供应链全球化

- 需要即时货运可见性

- 越来越重视成本优化

- 产业陷阱与挑战

- 初始实施成本高

- 资料安全和合规性挑战

- 市场机会

- 新兴市场的扩张

- 中小企业成长

- 车队电气化与绿色物流

- 与第三方物流和物流供应商建立合作关係

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- FMCSA电子记录设备(ELD)强制命令

- 服务时间(HOS)规定

- 美国交通部安全法规(CFR 第 300-399 部分)

- 欧洲

- 货运资料符合GDPR规定

- C-ITS(合作式智慧交通系统)

- 跨境运输法规

- 亚太地区

- 中国投资与标准

- 印度商品及服务税对物流的影响

- 东协跨境运输便利化

- 拉丁美洲

- 中东和非洲

- 北美洲

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 当前技术趋势

- 云端原生微服务架构

- 人工智慧与机器学习的融合

- 新兴技术

- 用于网路建模的数位孪生技术

- 自动驾驶汽车整合准备情况

- 当前技术趋势

- 定价分析

- SaaS订阅定价模式

- 永久授权定价

- 按交易量定价(每次出货)

- 基于使用者的定价模式

- 成本細項分析

- 专利分析

- TMS技术的美国专利商标局专利分类

- 主要专利持有者和创新领导者

- 新兴专利趋势(人工智慧、区块链、物联网)

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

- 用例

- 零售与电子商务应用案例经济学

- 医疗保健和製药应用案例经济学

- 食品饮料应用案例经济学

- 第三方物流和货运代理的应用案例经济学

- 功能采用率和利用率分析

- 核心功能采用率

- 进阶功能采用率

- 新兴功能采用率

- 各行业垂直领域的功能采用情况

- 迁移模式和转换趋势

- TMS迁移驱动因素

- 按部署类型分類的迁移模式

- 供应商转换趋势

- 迁移时间表及复杂性

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

- 对TMS新创公司的创投

- 物流技术领域的私募股权活动

- 政府基础设施投资(世界银行资讯科技服务报告)

- 主要供应商的企业研发支出

- 供应商选择标准

- 市场进入策略

第五章:市场估算与预测:依平台划分,2021-2034年

- 解决方案

- 出货计划

- 订单管理

- 审计与付款

- 分析与报告

- 路线规划与追踪

- 其他的

- 服务

- 咨询

- 实施与集成

- 支援与维护

第六章:市场估计与预测:依运输方式划分,2021-2034年

- 道路

- 铁路

- 航空

- 水道

第七章:市场估算与预测:依部署模式划分,2021-2034年

- 现场

- 云

第八章:市场估算与预测:依企业规模划分,2021-2034年

- 大型企业

- 中小企业

第九章:市场估计与预测:依产业垂直领域划分,2021-2034年

- 零售与电子商务

- 医疗保健与製药

- 分销与物流

- 製造业

- 政府

- 其他的

第十章:市场估计与预测:依地区划分,2021-2034年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧

- 俄罗斯

- 波兰

- 罗马尼亚

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 越南

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十一章:公司简介

- 全球公司

- Blue Yonder

- CH Robinson

- Descartes

- E2 open

- Infor

- Manhattan Associates

- Oracle

- SAP

- Trimble

- Wise Tech Global

- 区域玩家

- 11.2.1. Gtms

- Alpega

- Blujay Solutions

- CTSI-Global

- Korber

- Kuebix

- Logility

- MercuryGate

- Shippeo

- Transporeon

- 新兴玩家

- Arrive Logistics

- FourKites

- Loadsmart

- Locus

- Motive

- Parade

- project44

- Samsara

- Shipsy

- Transfix

The Global Transportation Management System Market was valued at USD 15 billion in 2025 and is estimated to grow at a CAGR of 10.6% to reach USD 40.3 billion by 2035.

Rapid growth in e-commerce has significantly increased parcel and LTL activity while shortening delivery expectations, making manual routing and issue resolution more expensive and less effective. As cloud-native platforms reduce upfront investment and shorten deployment timelines, organizations of all sizes are turning to Transportation Management Systems to streamline operations. Vendors are redesigning their platforms with microservices, broader API access, and embedded AI to improve predictive ETAs, automate pricing, and optimize capacity utilization. As a result, TMS platforms are now viewed as essential tools for building reliable, scalable transportation operations rather than solely an avenue for cost reduction. With global supply chains growing more interconnected and multimodal, businesses need systems that coordinate carriers, digitize documentation, support compliance, and enhance cross-border visibility. TMS platforms now combine GPS data, telematics, and IoT signals to offer real-time tracking, strengthening transparency for both logistics teams and end customers.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $15 Billion |

| Forecast Value | $40.3 Billion |

| CAGR | 10.6% |

The solutions segment held a 67% share in 2025 and is expected to grow at a CAGR of 10% from 2025 to 2035. Core TMS platforms manage planning, execution, routing, freight sourcing, invoicing, visibility, and analytics. Their ability to automate workflows and deliver real-time insights drives their strong adoption curve. Future growth will be supported by emerging capabilities such as AI-enabled route optimization, predictive analytics, and IoT-enhanced visibility.

The on-premises segment held a 61% share in 2025 and is projected to grow at a CAGR of 9.2% through 2035. While on-premises solutions maintain a larger revenue share due to customization and data control requirements, cloud deployments continue to grow more quickly as organizations adopt modular platforms, faster implementation cycles, and usage-based pricing models. Hybrid architectures are gaining traction as companies balance regulatory needs with modern analytics and workflow automation.

US Transportation Management System Market generated USD 5.2 billion in 2025. The country remains a leader in adopting AI-driven and cloud-based TMS platforms, supported by a complex domestic freight landscape and rising pressure to enhance service quality. Predictive planning tools, automation, and real-time data integration are essential as transportation networks across road, freight, parcel, and last-mile delivery face labor shortages and fluctuating demand.

Major players in the Global Transportation Management System Market include SAP, Oracle, CH Robinson, Trimble, Manhattan Associates, Blue Yonder, MercuryGate International, E2open, Descartes, and Wise Tech Global. Companies operating in the Transportation Management System Market strengthen their competitive position by investing heavily in AI automation, modular platform designs, and advanced analytics that enhance forecasting accuracy and shipment visibility. Many organizations expand through strategic integrations with telematics providers, freight platforms, and warehouse management systems, creating unified logistics ecosystems for their customers. Vendors also focus on cloud-native architectures that deliver continuous updates and scalable deployments, enabling clients to adopt new features without operational disruption. Customized solutions for different transportation modes, along with flexible pricing based on shipment volume or usage, help broaden customer reach. Partnerships with carriers and 3PLs further enhance network data quality, ensuring TMS platforms deliver more reliable insights and measurable efficiency gains.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Platform

- 2.2.3 Transportation mode

- 2.2.4 Deployment mode

- 2.2.5 Enterprise size

- 2.2.6 Industry vertical

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook

- 2.6 Strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising e-commerce and online retail demand

- 3.2.1.2 Globalization of supply chains

- 3.2.1.3 Need for real-time shipment visibility

- 3.2.1.4 Increasing focus on cost optimization

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial implementation cost

- 3.2.2.2 Data security and compliance challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in emerging markets

- 3.2.3.2 Growth in small and medium-sized enterprises (SMEs)

- 3.2.3.3 Fleet electrification and green logistics

- 3.2.3.4 Partnerships with 3PL and logistics providers

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 FMCSA Electronic Logging Device (ELD) mandate

- 3.4.1.2 Hours-of-Service (HOS) regulations

- 3.4.1.3 DOT safety regulations (CFR Parts 300-399)

- 3.4.2 Europe

- 3.4.2.1 GDPR compliance for shipment data

- 3.4.2.2 C-ITS (Cooperative Intelligent Transport Systems)

- 3.4.2.3 Cross-border transportation regulations

- 3.4.3 Asia Pacific

- 3.4.3.1 China ITS investment & standards

- 3.4.3.2 India GST impact on logistics

- 3.4.3.3 ASEAN cross-border transport facilitation

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.1.1 Cloud-native microservices architecture

- 3.7.1.2 Artificial Intelligence & Machine Learning integration

- 3.7.2 Emerging technologies

- 3.7.2.1 Digital twin technology for network modeling

- 3.7.2.2 Autonomous vehicle integration readiness

- 3.7.1 Current technological trends

- 3.8 Pricing analysis

- 3.8.1 SaaS subscription pricing models

- 3.8.2 Perpetual license pricing

- 3.8.3 Transaction-based pricing (per shipment)

- 3.8.4 User-based pricing models

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.10.1 USPTO patent classification for TMS technologies

- 3.10.2 Key patent holders & innovation leaders

- 3.10.3 Emerging patent trends (AI, Blockchain, IoT)

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.11.5 Carbon footprint considerations

- 3.12 Use cases

- 3.12.1 Retail & e-commerce use case economics

- 3.12.2 Healthcare & pharmaceuticals use case economics

- 3.12.3 Food & beverage use case economics

- 3.12.4. 3 PL & freight forwarders use case economics

- 3.13 Feature adoption rates & utilization analysis

- 3.13.1 Core feature adoption rates

- 3.13.2 Advanced feature adoption rates

- 3.13.3 Emerging feature adoption rates

- 3.13.4 Feature adoption by industry vertical

- 3.14 Migration patterns & switching trends

- 3.14.1 TMS migration drivers

- 3.14.2 Migration patterns by deployment type

- 3.14.3 Vendor switching trends

- 3.14.4 Migration timeline & complexity

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

- 4.6.4.1 Venture capital investment in TMS startups

- 4.6.4.2 Private equity activity in logistics technology

- 4.6.4.3 Government infrastructure investment (World Bank ITS report)

- 4.6.4.4 Corporate R&D spending by major vendors

- 4.7 Vendor selection criteria

- 4.8 Go-to-Market Strategies

Chapter 5 Market Estimates & Forecast, By Platform, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Solutions

- 5.2.1 Shipment planning

- 5.2.2 Order management

- 5.2.3 Audit & payments

- 5.2.4 Analytics & reporting

- 5.2.5 Routing & Tracking

- 5.2.6 Others

- 5.3 Services

- 5.3.1 Consulting

- 5.3.2 Implementation & integration

- 5.3.3 Support & maintenance

Chapter 6 Market Estimates & Forecast, By Transportation Mode, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Roadways

- 6.3 Railways

- 6.4 Airways

- 6.5 Waterways

Chapter 7 Market Estimates & Forecast, By Deployment model, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 On-premises

- 7.3 Cloud

Chapter 8 Market Estimates & Forecast, By Enterprise size, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Large enterprises

- 8.3 SMEs

Chapter 9 Market Estimates & Forecast, By Industry vertical, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 Retail & e-commerce

- 9.3 Healthcare & pharmaceuticals

- 9.4 Distribution & logistics

- 9.5 Manufacturing

- 9.6 Government

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.3.8 Poland

- 10.3.9 Romania

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Vietnam

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global companies

- 11.1.1 Blue Yonder

- 11.1.2 C.H. Robinson

- 11.1.3 Descartes

- 11.1.4. E2 open

- 11.1.5 Infor

- 11.1.6 Manhattan Associates

- 11.1.7 Oracle

- 11.1.8 SAP

- 11.1.9 Trimble

- 11.1.10 Wise Tech Global

- 11.2 Regional players

- 11.2.1. Gtms

- 11.2.2 Alpega

- 11.2.3 Blujay Solutions

- 11.2.4 CTSI-Global

- 11.2.5 Korber

- 11.2.6 Kuebix

- 11.2.7 Logility

- 11.2.8 MercuryGate

- 11.2.9 Shippeo

- 11.2.10 Transporeon

- 11.3 Emerging players

- 11.3.1 Arrive Logistics

- 11.3.2 FourKites

- 11.3.3 Loadsmart

- 11.3.4 Locus

- 11.3.5 Motive

- 11.3.6 Parade

- 11.3.7 project44

- 11.3.8 Samsara

- 11.3.9 Shipsy

- 11.3.10 Transfix