|

市场调查报告书

商品编码

1850984

运输管理系统:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Transportation Management System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

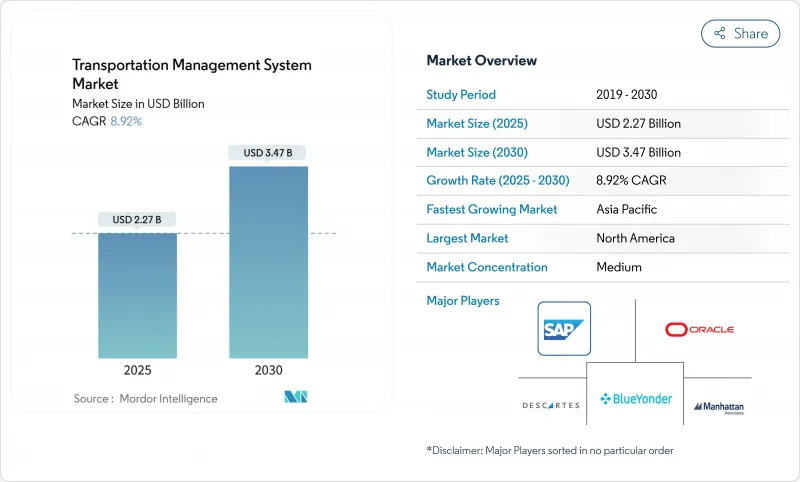

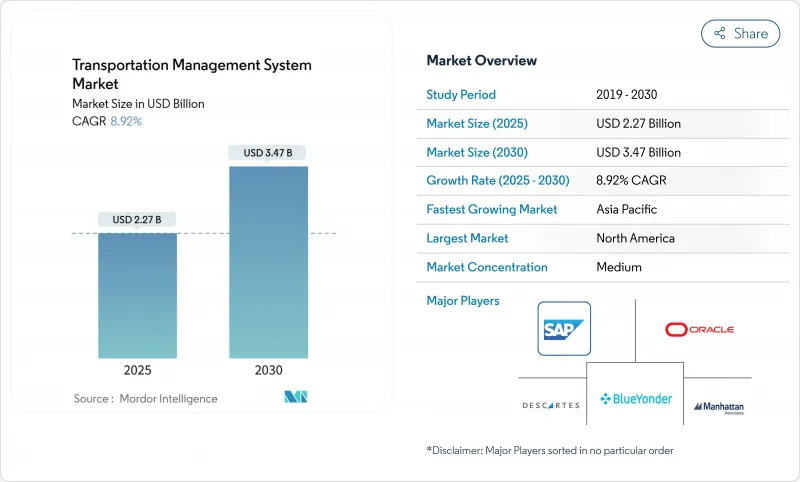

预计到 2025 年,运输管理系统市场规模将达到 22.7 亿美元,到 2030 年将达到 34.7 亿美元,预测期(2025-2030 年)复合年增长率为 8.92%。

这项加速发展源自于企业以扩充性的云端平台取代资本密集的本地部署工具,这些工具能够提供快速部署、更低的整体拥有成本以及对营运的即时可见性。强制使用电子记录设备 (ELD) 和温室气体排放报告的法规正在将合规数据转化为战略情报,而电子商务的成长则推动了对先进的末端物流和多式联运优化技术的需求。整合式货运市场使托运人能够即时获取现货运力,而人工智慧驱动的预计到达时间 (ETA) 引擎正在减少滞期费,并在永续性目标日益严格的同时提升供应链服务水准。

全球运输管理系统市场趋势与洞察

云端基础的运输管理系统实施可加速成本降低

云端技术的应用降低了硬体和IT开销,与旧有系统相比,整体拥有成本降低了30%。它能够跨设施即时同步运输数据,实现集中式视觉化和快速异常管理。微服务架构让托运人逐步启用模组,避免大规模部署的风险。供应商提供订阅定价模式,将技术成本与货运量相匹配,内建人工智慧提案符合永续性目标的低碳路线。这些因素使得云端成为新型运输管理系统市场推出的预设架构。

电子商务和全通路零售需要对最后一公里进行即时优化。

当日达和隔日达的期望正在将路线规划从静态转变为动态。现代运输管理系统 (TMS) 引擎每隔几分钟就会收集交通、天气和承运商运力数据,以便重新规划司机路线并自动发送客户提醒。最后一公里配送成本可能占总配送成本的 53%,而人工智慧驱动的优化正在帮助零售商转向整合订单编配平台,从而减轻这一负担。先进的地理围栏技术支援路边取货和门市配送,而预测预计到达时间 (ETA) 则提高了首次配送的成功率,从而提升了净推荐值 (NPS) 和收入留存率。

与传统ERP/WMS系统整合成本高

由于企业通常使用高度客製化的ERP和WMS平台,且缺乏现代化的API,TMS整合计划可能需要6到18个月的时间,成本在50万到500万美元之间。在资料迁移过程中常会发现格式不一致和业务逻辑过时的问题,需要进行大量的资料运作。平行系统会延长运作週期,而中介软体层级的增加也会提高授权费用。这些障碍会降低投资报酬率,并阻碍企业升级,尤其是在资本密集型製造业,因为这些产业的停机风险很高。

细分市场分析

到2024年,公路货运将占运输管理系统市场收入的58%。针对负载容量和零担负载容量的运输管理系统模组可最佳化线路定价、回程传输利用率和避免滞留。多式联运连接器可将货车通行与铁路装卸平台连接起来,进而提升网路灵活性。航空业的复合年增长率达到12.8%,反映了跨境电子商务小包裹和高价值货物的成长。人工智慧驱动的装载规划减少了货舱空间的閒置,而即时里程碑追踪则降低了主要枢纽机场的滞期费。随着预测分析技术的进步,货运站的舱位预订效率不断提高,托运人拥有了一种成本较高但可靠的选择,既能保证库存週转率,又能满足服务承诺。

随着低排放区法规日益严格,对行程可视性的要求也越来越高,以公路运输解决方案为主导的运输管理系统市场规模预计将会扩大。同时,空运优化平台正在整合天气分析和航班时刻调整功能,以降低服务中断的风险。虽然海运和铁路运输在大宗货物运输方面拥有稳定的用户群体,但供应商正在将货柜可视性数据与列车时刻表相结合,从而在单一的运输管理系统(TMS)驾驶座内实现真正的端到端编配。随着运输管理系统市场技术覆盖范围的扩大,这种转变确保了所有运输方式都能贡献差异化的价值。

到2024年,云端将占据运输管理系统市场63%的份额,年复合成长率高达14.92%,这主要得益于其快速的部署週期,通常只需八週即可完成。订阅模式将资本支出转化为营运支出,从而释放预算用于预测预计到达时间和自动化货物审核等高级模组。 API优先的设计能够轻鬆连接承运商入口网站、物联网信标和分析引擎,建构一个可扩展的生态系统,并随着使用者需求的发展而演进。虽然在资料保留要求严格的行业中,本地部署仍然不可或缺,但混合模式正在弥合这一差距,它将大量最佳化任务推送到云端,同时将敏感资料保护在防火墙之后。

云端运算的普及效应在小型货运公司中最为显着,他们现在无需购买硬体或组成专门的IT团队即可获得企业级优化服务,推动该细分市场以15%的复合年增长率成长。预计2025年至2030年间,中小企业的SaaS运输管理系统市场规模将翻倍,云端运算将巩固其在各地区作为预设部署模式的地位。

运输管理系统市场按运输方式(公路、铁路等)、部署类型(本地部署、云端、混合部署)、公司规模、最终用户行业(製造业、零售业、电子商务等)、组件、应用(订单管理、即时视觉化和追踪等)以及地区进行细分。市场预测以美元计价。

区域分析

到2024年,北美将占据运输管理系统市场收入的38%,这主要得益于云端物流套件的早期应用以及电子记录设备(ELD)强制令等法规的日益严格。美国托运人利用成熟的承运商网路和详尽的费率数据来制定优化方案。加拿大与美国的跨境贸易将推动对客製化工作流程的需求,而墨西哥将受益于近岸外包趋势,这将促使製造商快速实现运输路线的数位化。

亚太地区将引领成长,到2030年复合年增长率将达到13.9%,主要得益于中国、印度和东南亚电子商务交易量的快速成长。中国的小包裹网路则仰赖人工智慧路线排序系统,将城市前置作业时间缩短至两小时以内。印度製造商正在采用运输管理系统(TMS)来编配分散基础设施上的多式联运,并平衡成本和服务。日本的「社会5.0」蓝图正在推动对物联网物流的投资,将工厂感测器与承运商网路集成,进一步扩大运输管理系统市场。

由于严格的永续性指令和复杂的跨境贸易规则,欧洲占据了显着份额。德国出口商正在将二氧化碳计算器整合到其竞标系统中,法国零售商正在实施多模态管理系统(TMS)以减少拥堵费,英国脱欧后,英国托运人需要更高级的海关检查。中东和非洲地区由于港口扩建和自由贸易区的扩张,TMS 的使用量也在增加。同时,在南美洲,电子商务的成长和基础设施现代化正在为运输管理系统的市场渗透开闢新的途径。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 采用云端基础的TMS可加速服务成本降低

- 电子商务和全通路零售需要即时优化最后一公里配送。

- 电子记录设备(ELD)和更严格的温室气体报告法规推动货运数位化

- 货运市场的整合使得动态运力采购成为可能。

- 人工智慧驱动的预测预计到达时间工具可减少等待时间/服务等级协议罚款

- API优先的微服务为中小企业实作模组化TMS

- 市场限制

- 与传统ERP/WMS系统整合成本高昂

- 云端采用中的资料安全和隐私问题

- 缺乏内部资料科学人才来利用分析模组

- 营运商远端资讯处理标准碎片化阻碍了多模态的可视性

- 价值/供应链分析

- 监管环境

- 技术展望(人工智慧、物联网、5G、基于API的生态系统)

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 透过交通工具

- 路

- 铁路

- 空气

- 海路

- 透过部署

- 本地部署

- 云

- 杂交种

- 按公司规模

- 大公司

- 小型企业

- 微型企业

- 按最终用户行业划分

- 製造业

- 零售与电子商务

- 食品/饮料

- 医疗保健和製药

- 车

- 第三方物流和物流服务供应商

- 按组件

- 软体

- 服务

- 咨询

- 整合与实施

- 支援与维护

- 透过使用

- 订单管理

- 路线规划与最佳化

- 货物审核和付款

- 即时可见性和追踪

- 库存和仓库集成

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 亚太其他地区

- 中东和非洲

- 中东

- 以色列

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略性倡议(併购、资金筹措、伙伴关係)

- 市占率分析

- 公司简介

- SAP SE

- Oracle Corp.

- Blue Yonder(JDA)

- Descartes Systems Group

- Manhattan Associates

- MercuryGate International

- Trimble Transportation

- E2open

- Project44

- Transplace(Uber Freight)

- Infor Nexus

- Kinaxis Inc.

- CH Robinson

- BluJay Solutions(E2open)

- CargoSmart Ltd.

- 3Gtms Inc.

- Alpega Group

- Cloud Logistics by E2open

- Kuebix(Trimble)

- WiseTech Global(CargoWise TMS)

第七章 市场机会与未来展望

The Transportation Management System Market size is estimated at USD 2.27 billion in 2025, and is expected to reach USD 3.47 billion by 2030, at a CAGR of 8.92% during the forecast period (2025-2030).

The acceleration stems from enterprises replacing capital-heavy on-premises tools with scalable cloud platforms that deliver rapid deployment, lower total cost of ownership, and real-time operational visibility. Regulatory mandates for electronic logging devices (ELDs) and greenhouse-gas reporting are turning compliance data into strategic intelligence, while e-commerce growth amplifies demand for sophisticated last-mile and multimodal optimisation. Freight-marketplace integrations now let shippers secure spot capacity on the fly, and AI-driven ETA engines reduce detention penalties, lifting supply-chain service levels even as sustainability targets tighten.

Global Transportation Management System Market Trends and Insights

Cloud-based TMS adoption accelerates cost-to-serve savings

Cloud deployments cut hardware and IT overhead, trimming total cost of ownership by 30% compared with legacy systems. They synchronise shipment data across facilities in real time, yielding centralised visibility and rapid exception management. Microservices architecture lets shippers activate modules incrementally, avoiding the risk of big-bang rollouts. Vendors offer subscription pricing that aligns technology costs with freight volumes, while embedded AI suggests lower-carbon routes that align with sustainability targets. These factors position cloud as the default architecture for new transportation management system market implementations.

E-commerce & omnichannel retail demand real-time last-mile optimization

Same-day and next-day delivery expectations have moved route planning from static to dynamic. Modern TMS engines ingest traffic, weather, and carrier capacity data every few minutes, rerouting drivers and automating customer alerts. Last-mile costs can reach 53% of total shipping spend, and AI-enabled optimisation is cutting that burden for retailers that pivot to unified order orchestration platforms. Advanced geofencing supports curb side pickup and store-to-door fulfilment, while predictive ETAs boost first-attempt delivery success, raising NPS scores and revenue retention.

High integration cost with legacy ERP/WMS stacks

Enterprises often run heavily customised ERP and WMS platforms that lack modern APIs, pushing TMS integration projects to 6-18 months and budgets from USD 500,000 to USD 5 million. Data migration uncovers inconsistent formats and outdated business logic, requiring extensive cleansing. Parallel system runs prolong go-live cycles, and middleware layers add licence fees. These hurdles delay ROI and deter some organisations from upgrading, especially in capital-intensive manufacturing where downtime risks are high.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory push for ELD & greenhouse-gas reporting digitalizes freight

- Freight-marketplace convergence enables dynamic capacity procurement

- Data-security & privacy concerns for cloud deployments

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Road freight delivered 58% of transportation management system market revenue in 2024 thanks to its ubiquity in last-mile and regional haulage. TMS modules for truckload and less-than-truckload optimise lane pricing, back-haul filling, and detention avoidance. Intermodal connectors allow truck legs to synchronise with rail ramps, strengthening network agility. The airway segment, posting 12.8% CAGR, underscores the rise of e-commerce cross-border parcels and high-value cargo. AI-based load-planning cuts under-utilisation in belly space, and real-time milestone tracking mitigates dwell fees at major hubs. As predictive analytics refine slot booking at cargo terminals, shippers gain a premium-cost yet high-reliability option that balances inventory velocity with service promises.

The transportation management system market size attributed to road-based solutions is forecast to grow alongside regulatory pushes for lower emissions zones that require granular trip visibility. Conversely, air-cargo optimisation platforms integrate weather analytics and slot rescheduling features to contain service-disruption risk. While maritime and rail retain dedicated user bases for bulk moves, vendors are integrating container visibility data and train schedules to build true end-to-end orchestration inside a single TMS cockpit. These shifts ensure every mode contributes differentiated value as the transportation management system market widens its technological scope.

Cloud captured 63% transportation management system market share in 2024 and is on track for 14.92% CAGR on the back of rapid onboarding cycles that often conclude within eight weeks. Subscription pricing converts capex to opex, freeing budget for advanced modules such as predictive ETAs and automated freight audit. API-first design links easily with carrier portals, IoT beacons, and analytics engines, forming an extensible ecosystem that evolves with user needs. On-premise persists in sectors with strict data residency mandates, though hybrid footprints are bridging that gap by retaining sensitive data behind the firewall while pushing high-volume optimisation jobs to the cloud.

Cloud's democratisation effect is most visible among smaller shippers. SMEs can now procure enterprise-grade optimisation without hardware spend or specialist IT teams, driving 15% CAGR in the segment. The transportation management system market size for SME-focused SaaS is expected to double between 2025 and 2030, reinforcing cloud's status as the default deployment paradigm across regions.

Transportation Management System Market is Segmented by Mode of Transporation (Roadways, Railways and More), Deployment (On-Premise, Cloud and Hybrid), Enterprise Size, End-User Industry (Manufacturing, Retail and E-Commerce, and More), Component, Application (Order Management, Real-Time Visibility and Tracking and More), Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 38% of transportation management system market revenue in 2024, underpinned by early adoption of cloud logistics suites and regulatory catalysts like ELD mandates. United States shippers leverage mature carrier networks and detailed rate-base data to refine optimisation scenarios. Canada's cross-border trade with the US boosts demand for customs-ready workflows, while Mexico benefits from nearshoring trends that push manufacturers to digitise freight corridors quickly.

Asia-Pacific leads growth at 13.9% CAGR to 2030 as e-commerce volumes soar across China, India, and Southeast Asia. Chinese parcel networks rely on AI route sequencers that compress urban lead times to under two hours. Indian manufacturers adopt TMS to orchestrate multimodal moves across fragmented infrastructure, balancing cost and service. Japan's Society 5.0 blueprint spurs investments in IoT-rich logistics that integrate factory sensors with carrier networks, further enlarging the transportation management system market.

Europe commands a notable share owing to stringent sustainability directives and complex cross-border trade rules. German exporters integrate CO2 calculators into tendering engines, French retailers deploy multimodal TMS to cut congestion charges, and UK shippers post-Brexit need advanced customs screening. Middle East and Africa witness incremental uptake aligned with port expansions and free-trade zones, whereas South America's growing e-commerce and infrastructure modernisation open fresh lanes for transportation management system market penetration.

- SAP SE

- Oracle Corp.

- Blue Yonder (JDA)

- Descartes Systems Group

- Manhattan Associates

- MercuryGate International

- Trimble Transportation

- E2open

- Project44

- Transplace (Uber Freight)

- Infor Nexus

- Kinaxis Inc.

- C.H. Robinson

- BluJay Solutions (E2open)

- CargoSmart Ltd.

- 3Gtms Inc.

- Alpega Group

- Cloud Logistics by E2open

- Kuebix (Trimble)

- WiseTech Global (CargoWise TMS)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cloud-based TMS adoption accelerates cost-to-serve savings

- 4.2.2 E-commerce & omnichannel retail demand real-time, last-mile optimisation

- 4.2.3 Regulatory push for ELD & Green-house-gas reporting digitalises freight

- 4.2.4 Freight-marketplace convergence enables dynamic capacity procurement

- 4.2.5 AI-driven predictive ETA tools cut detention/SLA penalties

- 4.2.6 API-first micro-services unlock modular TMS for SMEs

- 4.3 Market Restraints

- 4.3.1 High integration cost with legacy ERP/WMS stacks

- 4.3.2 Data-security and privacy concerns for cloud deployments

- 4.3.3 Shortage of in-house data-science talent to exploit analytics modules

- 4.3.4 Fragmented carrier-telematics standards hinder multimodal visibility

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook (AI, IoT, 5G, API-based ecosystems)

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Mode of Transportation

- 5.1.1 Roadways

- 5.1.2 Railways

- 5.1.3 Airways

- 5.1.4 Maritime

- 5.2 By Deployment

- 5.2.1 On-premise

- 5.2.2 Cloud

- 5.2.3 Hybrid

- 5.3 By Enterprise Size

- 5.3.1 Large Enterprises

- 5.3.2 Small & Medium Enterprises

- 5.3.3 Micro Enterprises

- 5.4 By End-user Industry

- 5.4.1 Manufacturing

- 5.4.2 Retail and E-commerce

- 5.4.3 Food and Beverage

- 5.4.4 Healthcare and Pharmaceuticals

- 5.4.5 Automotive

- 5.4.6 3PL and Logistics Service Providers

- 5.5 By Component

- 5.5.1 Software

- 5.5.2 Services

- 5.5.2.1 Consulting

- 5.5.2.2 Integration and Implementation

- 5.5.2.3 Support and Maintenance

- 5.6 By Application

- 5.6.1 Order Management

- 5.6.2 Route Planning and Optimization

- 5.6.3 Freight Audit and Payment

- 5.6.4 Real-time Visibility and Tracking

- 5.6.5 Inventory and Warehouse Integration

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 United Kingdom

- 5.7.2.2 Germany

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 India

- 5.7.3.4 South Korea

- 5.7.3.5 Rest of Asia-Pacific

- 5.7.4 Middle East and Africa

- 5.7.4.1 Middle East

- 5.7.4.1.1 Israel

- 5.7.4.1.2 Saudi Arabia

- 5.7.4.1.3 United Arab Emirates

- 5.7.4.1.4 Turkey

- 5.7.4.1.5 Rest of Middle East

- 5.7.4.2 Africa

- 5.7.4.2.1 South Africa

- 5.7.4.2.2 Egypt

- 5.7.4.2.3 Rest of Africa

- 5.7.5 South America

- 5.7.5.1 Brazil

- 5.7.5.2 Argentina

- 5.7.5.3 Rest of South America

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, funding, partnerships)

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 SAP SE

- 6.4.2 Oracle Corp.

- 6.4.3 Blue Yonder (JDA)

- 6.4.4 Descartes Systems Group

- 6.4.5 Manhattan Associates

- 6.4.6 MercuryGate International

- 6.4.7 Trimble Transportation

- 6.4.8 E2open

- 6.4.9 Project44

- 6.4.10 Transplace (Uber Freight)

- 6.4.11 Infor Nexus

- 6.4.12 Kinaxis Inc.

- 6.4.13 C.H. Robinson

- 6.4.14 BluJay Solutions (E2open)

- 6.4.15 CargoSmart Ltd.

- 6.4.16 3Gtms Inc.

- 6.4.17 Alpega Group

- 6.4.18 Cloud Logistics by E2open

- 6.4.19 Kuebix (Trimble)

- 6.4.20 WiseTech Global (CargoWise TMS)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment