|

市场调查报告书

商品编码

1892833

轻型卡车转向系统市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Light Duty Truck Steering System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

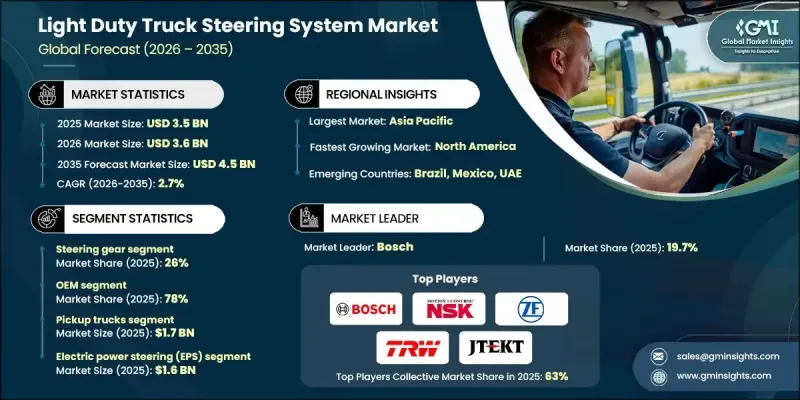

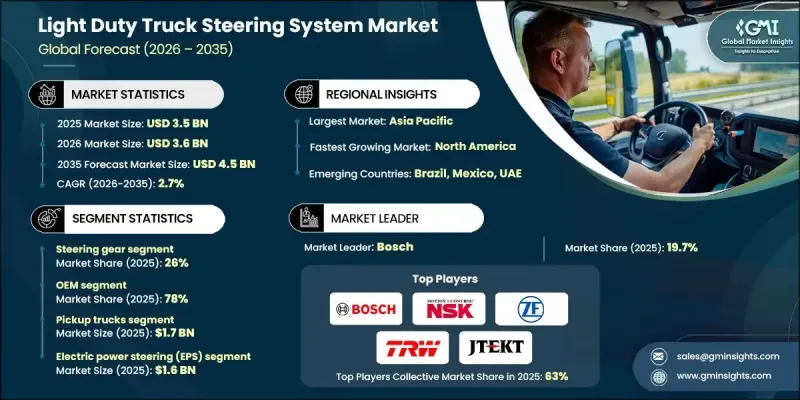

2025 年全球轻型卡车转向系统市场价值为 35 亿美元,预计到 2035 年将以 2.7% 的复合年增长率增长至 45 亿美元。

市场扩张的驱动力来自对更先进、更安全、更有效率的转向技术日益增长的需求,以及电动和混合动力轻型卡车的普及和商业物流业务的成长。车队营运商和个人买家都将驾驶员的舒适性、车辆操控性和安全性放在首位,因此,现代转向系统对于在各种路况和作业环境下实现可靠操控至关重要。电动辅助转向 (EPS)、液压动力转向系统、自适应转向模组以及轻量化高强度零件等创新技术正在改变这些卡车的功能。铝合金、高强度钢和耐腐蚀涂层等优质材料确保了转向解决方案的耐用性和持久性。城市物流、最后一公里配送服务、共享出行车队的扩张,以及对具备更佳操控性和安全性的卡车的需求,正在加速全球市场的普及。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 35亿美元 |

| 预测值 | 45亿美元 |

| 复合年增长率 | 2.7% |

转向器市场在2025年占据26%的市场份额,预计2026年至2035年将以2.2%的复合年增长率成长。转向器对于皮卡、厢型车和轻型商用卡车的精准操控、稳定性和机动性至关重要。它们坚固耐用,可相容于液压、电动和电液系统,并且在重载和多变负载条件下都能保持可靠性,因此成为原始设备製造商 (OEM) 和车队营运商的首选。

2025年, OEM)OEM达到78%,预计到2035年将以2.3%的复合年增长率成长。 OEM通路将转向系统整合到新卡车中,确保使用符合安全和性能标准的认证优质组件。这些系统具有无缝的车辆相容性、更高的驾驶舒适性、耐用性和精准性。 OEM安装因其可靠性以及与EPS(电动OEM系统)、ADAS(高级驾驶辅助系统)和车辆远端资讯处理等先进技术的兼容性而备受青睐。

中国轻型卡车转向系统市场占33%的市场份额,预计2025年市场规模将达到4.435亿美元。市场成长的主要驱动力包括皮卡和轻型商用车的强劲产量、对先进汽车技术的投资,以及EPS、线控转向和ADAS整合转向解决方案的广泛应用。政府对新能源汽车的支持和日益严格的安全法规也进一步推动了现代转向系统的应用。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 对先进转向技术的需求不断增长

- 轻型卡车车队的成长

- 注重驾驶员的舒适性和安全性

- 技术整合与材料创新

- 产业陷阱与挑战

- 高昂的系统成本

- 复杂的维护要求

- 市场机会

- 电动和混合动力轻型卡车的扩张

- 售后市场和改造解决方案

- ADAS与自动驾驶车辆集成

- 轻便节能的系统

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 副产品

- 生产统计

- 生产中心

- 消费中心

- 进出口

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 投资与融资分析

- OEM研发投资趋势

- 供应商资本支出分配

- 科技新创公司融资格局

- 最佳情况

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估算与预测:依组件划分,2022-2035年

- 转向器

- 转向柱

- 感测器和控制器

- 转向泵浦

- 拉桿

- 方向盘

- 其他的

第六章:市场估价与预测:依车辆类型划分,2022-2035年

- 皮卡车

- SUV 与跨界车

- 轻型商用车(LCV)

- 范斯

第七章:市场估计与预测:依技术划分,2022-2035年

- 电动辅助转向系统(EPS)

- 液压动力转向(HPS)

- 电液辅助转向(EHPS)

- 线控转向

第八章:市场估算与预测:依销售管道划分,2022-2035年

- OEM

- 售后市场

第九章:市场估计与预测:依地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 比利时

- 荷兰

- 瑞典

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 新加坡

- 韩国

- 越南

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- Global Player

- Bosch

- Denso

- Hyundai Mobis

- JTEKT

- Magna International

- Nexteer Automotive

- NSK

- Thyssenkrupp

- TRW Automotive

- ZF Friedrichshafen

- Regional Player

- Aisin Seiki

- Calsonic Kansei

- Hitachi Astemo

- JMC Steering

- Kongsberg Automotive

- Mando

- Mevotech

- Mubea

- Schaeffler

- KYB

- 新兴参与者

- Auto Steering Technologies

- Eberspacher Steering Solutions

- Neapco

- Protean Electric

- Servotronic Systems

The Global Light Duty Truck Steering System Market was valued at USD 3.5 billion in 2025 and is estimated to grow at a CAGR of 2.7% to reach USD 4.5 billion by 2035.

The market expansion is fueled by increasing demand for advanced, safer, and more efficient steering technologies, alongside the rising adoption of electric and hybrid light-duty trucks and the growth of commercial and logistics operations. Fleet operators and individual buyers are prioritizing driver comfort, vehicle maneuverability, and safety, making modern steering systems essential for reliable handling across diverse road conditions and operational settings. Innovations such as electric power steering (EPS), hydraulic-assisted systems, adaptive steering modules, and lightweight, high-strength components are transforming the functionality of these trucks. High-quality materials, including aluminum alloys, high-strength steel, and corrosion-resistant coatings, ensure durable, long-lasting steering solutions. Expanding urban logistics, last-mile delivery services, ride-sharing fleets, and demand for trucks with enhanced handling and safety features are accelerating market adoption globally.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $3.5 Billion |

| Forecast Value | $4.5 Billion |

| CAGR | 2.7% |

The steering gear segment held a 26% share in 2025 and is expected to grow at a CAGR of 2.2% from 2026 to 2035. Steering gears are critical for precise vehicle control, stability, and maneuverability across pickups, vans, and light commercial trucks. They offer robustness, compatibility with hydraulic, electric, and electro-hydraulic architectures, and reliability under heavy-duty and variable load conditions, making them a preferred choice for OEMs and fleet operators.

The OEM segment held 78% share in 2025 and is forecasted to grow at a CAGR of 2.3% through 2035. OEM channels integrate steering systems into new trucks, ensuring the use of certified, high-quality components that meet safety and performance standards. These systems offer seamless vehicle compatibility, enhanced driver comfort, durability, and precision. OEM installations are favored for their reliability and alignment with advanced technologies such as EPS, ADAS, and vehicle telematics.

China Light Duty Truck Steering System Market held a 33% share, generating USD 443.5 million in 2025. Growth is driven by strong production of pickups and light commercial vehicles, investments in advanced automotive technologies, and the adoption of EPS, steer-by-wire, and ADAS-integrated steering solutions. Government support for new energy vehicles and stricter safety regulations are further boosting the use of modern steering systems.

Key players operating in the Light Duty Truck Steering System Market include JTEKT, NSK, Thyssenkrupp, ZF Friedrichshafen, Bosch, Hyundai Mobis, Delphi Technologies, TRW Automotive, Denso, and KYB. Companies are focusing on technological innovation to enhance steering system performance, reliability, and fuel efficiency while integrating advanced features like EPS, ADAS, and steer-by-wire capabilities. Strategic partnerships with OEMs and logistics fleet operators enable the adoption of cutting-edge steering solutions in new vehicles and retrofit applications. Firms are investing in lightweight, durable materials to reduce vehicle weight and improve fuel economy. Expanding regional production and supply chain networks ensures timely delivery and cost optimization. Research and development efforts target improved system precision, longevity, and compatibility with hybrid and electric trucks. Companies are also leveraging digital platforms for predictive maintenance, diagnostics, and telematics integration, strengthening their market presence and building long-term relationships with customers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Vehicle

- 2.2.4 Technology

- 2.2.5 Sales channel

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for advanced steering technologies

- 3.2.1.2 Growth of light-duty truck fleets

- 3.2.1.3 Focus on driver comfort and safety

- 3.2.1.4 Technological integration and material innovations

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High system costs

- 3.2.2.2 Complex maintenance requirements

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of electric and hybrid light-duty trucks

- 3.2.3.2 Aftermarket and retrofit solutions

- 3.2.3.3 ADAS & autonomous vehicle integration

- 3.2.3.4 Lightweight & energy-efficient systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation Landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Investment & Funding Analysis

- 3.13.1 OEM R&D investment trends

- 3.13.2 Supplier capex allocation

- 3.13.3 Technology startup funding landscape

- 3.14 Best case scenarios

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2022 - 2035 ($ Bn, Units)

- 5.1 Key trends

- 5.2 Steering gear

- 5.3 Steering column

- 5.4 Sensors & controllers

- 5.5 Steering pumps

- 5.6 Tie rods

- 5.7 Steering wheel

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($ Bn, Units)

- 6.1 Key trends

- 6.2 Pickup trucks

- 6.3 SUVs & crossovers

- 6.4 Light commercial vehicles (LCV)

- 6.5 Vans

Chapter 7 Market Estimates & Forecast, By Technology, 2022 - 2035 ($ Bn, Units)

- 7.1 Key trends

- 7.2 Electric power steering (EPS)

- 7.3 Hydraulic power steering (HPS)

- 7.4 Electro-hydraulic power steering (EHPS)

- 7.5 Steer-by-wire

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2022 - 2035 ($ Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035 ($ Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Belgium

- 9.3.7 Netherlands

- 9.3.8 Sweden

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 Singapore

- 9.4.6 South Korea

- 9.4.7 Vietnam

- 9.4.8 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Global Player

- 10.1.1 Bosch

- 10.1.2 Denso

- 10.1.3 Hyundai Mobis

- 10.1.4 JTEKT

- 10.1.5 Magna International

- 10.1.6 Nexteer Automotive

- 10.1.7 NSK

- 10.1.8 Thyssenkrupp

- 10.1.9 TRW Automotive

- 10.1.10 ZF Friedrichshafen

- 10.2 Regional Player

- 10.2.1 Aisin Seiki

- 10.2.2 Calsonic Kansei

- 10.2.3 Hitachi Astemo

- 10.2.4 JMC Steering

- 10.2.5 Kongsberg Automotive

- 10.2.6 Mando

- 10.2.7 Mevotech

- 10.2.8 Mubea

- 10.2.9 Schaeffler

- 10.2.10 KYB

- 10.3 Emerging Players

- 10.3.1 Auto Steering Technologies

- 10.3.2 Eberspacher Steering Solutions

- 10.3.3 Neapco

- 10.3.4 Protean Electric

- 10.3.5 Servotronic Systems