|

市场调查报告书

商品编码

1892841

婴儿餵食用品市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Baby Feeding Accessories Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

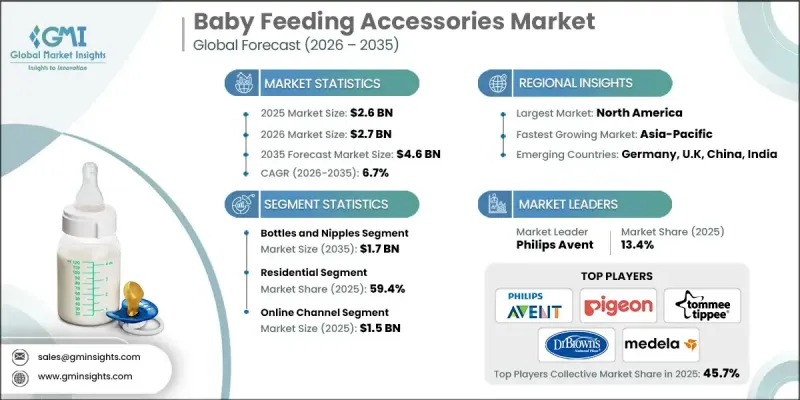

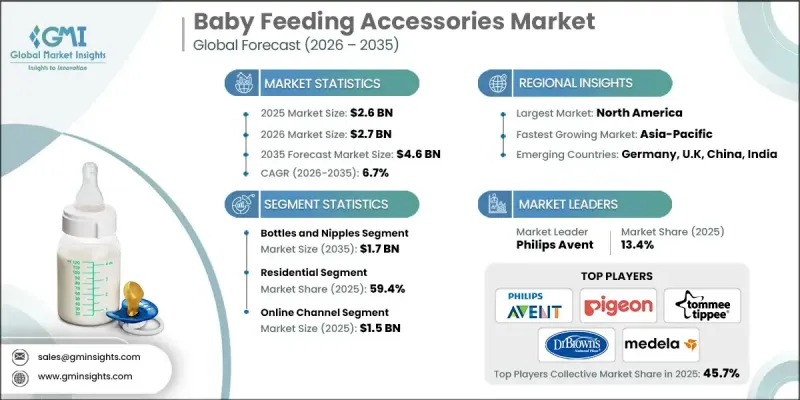

2025 年全球婴儿餵食用品市场价值为 26 亿美元,预计到 2035 年将以 6.7% 的复合年增长率增长至 46 亿美元。

随着全球父母越来越重视永续和健康的餵食方案,市场需求持续成长。政府为减少对一次性塑胶的依赖而推行的可持续发展倡议,推动了环保材料的普及,促使製造商设计采用耐用且环保材料製成的餵食配件。科技融合也在改变这个产业,智慧餵养设备在追求便利和精准餵养的数位化父母中越来越受欢迎。不断扩展的线上零售网络进一步提升了产品的可及性,使更多消费者能够找到适合婴幼儿不断变化的营养需求的餵食配件。人们对饮食相关需求的日益关注,也促使父母寻找能够支持有机食品选择、过敏原管理和配方奶粉冲调的专用餵食工具。随着家庭对婴幼儿健康和便利性的持续关注,市场有望持续发展。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 26亿美元 |

| 预测值 | 46亿美元 |

| 复合年增长率 | 6.7% |

2025年,奶瓶和奶嘴品类创造了10亿美元的市场规模,预计到2035年将成长至17亿美元。製造商不断改进产品设计,以支持那些需要兼顾母乳餵养和奶瓶餵养的父母,并融入符合人体工学的元素,帮助宝宝更顺畅地过渡到奶瓶餵养。许多品牌也致力于减少餵食过程中的不适感,透过采用先进的排气机制和改良的奶嘴结构,促进宝宝的消化健康。

到2025年,住宅终端用户市场将占据59.4%的份额。家庭购买力的提高,以及对婴幼儿营养日益增长的关注,推动了产品在家庭中的普及。婴儿餵食配件的技术进步也促进了消费者的参与,例如,连网的保温设备和配方奶粉冲调系统可以透过相容的行动应用程式提供更强大的控制和监控功能,使父母能够便捷地监督餵食过程。

2024年,美国婴儿餵食配件市占率达82.3%。可支配收入的增加、对婴儿健康指南的严格遵守以及严格的安全标准,持续推动消费者对高品质餵食解决方案的需求。监管机构对不含双酚A(BPA)的材料和先进餵食工具的重视,影响了市场的接受度,而高端品牌因其符合人体工学的设计和智慧技术而备受青睐。越来越多的职场父母进一步提升了消费者对高效省时的餵食配件的需求。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 不断提高的生活标准

- 增加可支配收入

- 都市化与双薪家庭

- 产业陷阱与挑战

- 价格敏感度

- 监理合规与安全标准

- 机会

- 环保永续产品

- 智慧互联餵食解决方案

- 成长驱动因素

- 成长潜力分析

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 依产品类型

- 按地区

- 监管环境

- 标准和合规要求

- 区域监理框架

- 认证标准

- 贸易统计(HS编码)

- 主要进口国

- 主要出口国

- 差距分析

- 风险评估与缓解

- 波特的分析

- PESTEL 分析

- 消费者行为分析

- 购买模式

- 偏好分析

- 消费者行为的区域差异

- 电子商务对购买决策的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品类型划分,2022-2035年

- 奶瓶和奶嘴

- 塑胶瓶

- 玻璃瓶

- 硅胶乳头

- 哺乳用品

- 婴儿餵食用具

- 婴儿汤匙和叉

- 婴儿碗

- 婴儿安抚奶嘴

- 盘子

- 其他(杯子、托盘等)

- 婴儿配方奶粉分配器

- 其他的

第六章:市场估算与预测:依材料分类,2022-2035年

- 金属

- 非金属

- 塑胶

- 硅酮

- 其他的

第七章:市场估计与预测:依年龄组别划分,2022-2035年

- 12个月以下

- 12个月至3岁

- 3年以上

第八章:市场估算与预测:依价格区间划分,2022-2035年

- 低价(低于 50 美元)

- 中价位(50至100美元)

- 高级/特级(100 美元以上)

第九章:市场估计与预测:依技术划分,2022-2035年

- 防胀气和通风系统

- 智慧/连网餵食配件

- 自消毒产品

- 温度监控与控制

- 传统产品

第十章:市场估计与预测:依标准划分,2022-2035年

- 经认证不含双酚A的产品

- 经认证不含邻苯二甲酸酯的产品

- FDA食品接触认证

- JPMA/婴儿安全联盟认证

第十一章:市场估计与预测:依永续性划分,2022-2035年

- 可生物降解材料

- 可回收产品

- 有机材料

- 碳中和及碳抵消产品

- 传统产品

第十二章:市场估算与预测:依最终用途划分,2022-2035年

- 住宅

- 商业的

- 日托

- 护理中心

- 其他的

第十三章:市场估计与预测:依配销通路划分,2022-2035年

- 线上零售

- 电子商务

- 公司自有网站

- 离线

- 超市/大型超市

- 专卖店

- 其他零售业态

第十四章:市场估算与预测:依地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十五章:公司简介

- Chicco

- Comotomo

- Dr. Brown's

- Evenflo

- Goodbaby International

- Lansinoh

- MAM Baby

- Medela

- Munchkin

- Nuby

- NUK

- Philips Avent

- Pigeon

- Playtex Baby

- Tommee Tippee

The Global Baby Feeding Accessories Market was valued at USD 2.6 billion in 2025 and is estimated to grow at a CAGR of 6.7% to reach USD 4.6 billion by 2035.

Demand continues to grow as parents worldwide increasingly prioritize sustainable and health-conscious feeding solutions. The shift toward eco-friendly materials, supported by government sustainability efforts aimed at reducing reliance on single-use plastics, is influencing manufacturers to design accessories made from durable and environmentally responsible materials. Technology integration is also transforming the sector, with smart feeding devices gaining traction among digitally connected parents who seek convenience and precision during feeding routines. Expanding online retail networks are further boosting product accessibility, enabling a broader range of consumers to explore feeding accessories tailored to infants' evolving nutritional needs. Rising awareness of diet-related requirements has also pushed parents to search for specialized feeding tools that can support organic choices, allergen management, and formula preparation. As households continue to emphasize infant wellness and convenience, the market is positioned for sustained advancement.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $2.6 Billion |

| Forecast Value | $4.6 Billion |

| CAGR | 6.7% |

The bottles and nipples category generated USD 1 billion in 2025 and is projected to increase to USD 1.7 billion by 2035. Manufacturers are continually enhancing design features to support parents who balance breastfeeding and bottle feeding, incorporating ergonomic elements that help create smoother feeding transitions. Many brands also focus on reducing discomfort during feeding by integrating advanced venting mechanisms and improved nipple structures designed to support healthy digestion.

The residential end-use segment accounted for a 59.4% share in 2025. Higher household spending power, coupled with rising attention to infant nutrition, has strengthened product adoption across homes. Technological progress in baby feeding accessories has also contributed to stronger engagement, as connected warming devices and formula preparation systems offer greater control and monitoring through compatible mobile applications, giving parents convenient oversight of feeding routines.

U.S. Baby Feeding Accessories Market held an 82.3% share in 2024. Elevated disposable incomes, strong adherence to infant health guidelines, and strict safety standards continue to drive consumer preference for high-quality feeding solutions. Regulatory emphasis on BPA-free materials and advanced feeding tools has influenced market adoption, while premium brands remain favored for their focus on ergonomic design and smart technology. The growing number of working parents has further accelerated interest in efficient and time-saving accessories.

Key companies active in the Global Baby Feeding Accessories Market include Chicco, Comotomo, Dr. Brown's, Evenflo, Goodbaby International, Lansinoh, MAM Baby, Medela, Munchkin, Nuby, NUK, Philips Avent, Pigeon, Playtex Baby, and Tommee Tippee. Leading manufacturers in the baby feeding accessories space are strengthening their market presence by prioritizing product innovation, sustainability, and digital connectivity. Many brands are expanding their portfolios with eco-friendly materials to meet the rising demand for environmentally responsible products. Companies are also integrating smart technology into feeding devices to appeal to tech-savvy parents seeking greater convenience and accuracy. Strong omnichannel distribution strategies, especially through e-commerce platforms, allow these companies to reach wider audiences with personalized product offerings. In addition, extensive investment in ergonomic design and safety-focused materials helps build consumer trust. Collaborations with healthcare professionals, along with consistent branding and targeted marketing campaigns, further reinforce their competitive advantage and enhance customer loyalty across global markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product Type

- 2.2.3 Material

- 2.2.4 Age Group

- 2.2.5 Price Range

- 2.2.6 Technology

- 2.2.7 Standards

- 2.2.8 Sustainability

- 2.2.9 End Use

- 2.2.10 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing lifestyle standards

- 3.2.1.2 Increasing disposable income

- 3.2.1.3 Urbanization & working parents

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Price sensitivity

- 3.2.2.2 Regulatory compliance & safety standards

- 3.2.3 Opportunities

- 3.2.3.1 Eco-friendly & sustainable products

- 3.2.3.2 Smart & connected feeding solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By product type

- 3.6.2 By region

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Gap analysis

- 3.10 Risk assessment and mitigation

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

- 3.13 Consumer behaviour analysis

- 3.13.1 Purchasing patterns

- 3.13.2 Preference analysis

- 3.13.3 Regional variations in consumer behaviour

- 3.13.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2022-2035 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Bottles and nipples

- 5.2.1 Plastic bottles

- 5.2.2 Glass bottles

- 5.2.3 Silicone nipples

- 5.3 Breastfeeding accessories

- 5.4 Baby feeding utensils

- 5.4.1 Baby spoons & forks

- 5.4.2 Baby bowls

- 5.4.3 Baby pacifiers

- 5.4.4 Plates

- 5.4.5 Others (cups, tray, etc.)

- 5.5 Baby formula dispensers

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Material, 2022-2035 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Metallic

- 6.3 Non-Metallic

- 6.3.1 Plastic

- 6.3.2 Silicone

- 6.3.3 Others

Chapter 7 Market Estimates & Forecast, By Age Group, 2022-2035 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Below 12 months

- 7.3 12 months to 3 years

- 7.4 Above 3 years

Chapter 8 Market Estimates & Forecast, By Price Range, 2022-2035 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Low (Below 50 USD)

- 8.3 Medium (50 to 100 USD)

- 8.4 High/Premium (Above 100 USD)

Chapter 9 Market Estimates & Forecast, By Technology, 2022-2035 (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Anti-colic & vented systems

- 9.3 Smart/connected feeding accessories

- 9.4 Self-sterilizing products

- 9.5 Temperature monitoring & control

- 9.6 Traditional products

Chapter 10 Market Estimates & Forecast, By Standards, 2022-2035 (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 BPA-free certified products

- 10.3 Phthalate-free certified products

- 10.4 FDA food contact approved

- 10.5 JPMA/baby safety alliance verified

Chapter 11 Market Estimates & Forecast, By Sustainability, 2022-2035 (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 Biodegradable materials

- 11.3 Recyclable products

- 11.4 Organic materials

- 11.5 Carbon-neutral & offset products

- 11.6 Conventional products

Chapter 12 Market Estimates & Forecast, By End Use, 2022-2035 (USD Billion) (Million Units)

- 12.1 Key trends

- 12.2 Residential

- 12.3 Commercial

- 12.3.1 Day care

- 12.3.2 Nursing centers

- 12.3.3 Others

Chapter 13 Market Estimates & Forecast, By Distribution Channel, 2022-2035 (USD Billion) (Million Units)

- 13.1 Key trends

- 13.2 Online retail

- 13.2.1 Ecommerce

- 13.2.2 Company owned website

- 13.3 Offline

- 13.3.1 Supermarket/hypermarket

- 13.3.2 Specialty stores

- 13.3.3 Other retail formats

Chapter 14 Market Estimates & Forecast, By Region, 2022-2035 (USD Billion) (Million Units)

- 14.1 Key trends

- 14.2 North America

- 14.2.1 U.S.

- 14.2.2 Canada

- 14.3 Europe

- 14.3.1 Germany

- 14.3.2 France

- 14.3.3 UK

- 14.3.4 Italy

- 14.3.5 Spain

- 14.4 Asia Pacific

- 14.4.1 China

- 14.4.2 India

- 14.4.3 Japan

- 14.4.4 South Korea

- 14.4.5 Australia

- 14.5 Latin America

- 14.5.1 Brazil

- 14.5.2 Mexico

- 14.5.3 Argentina

- 14.6 MEA

- 14.6.1 South Africa

- 14.6.2 Saudi Arabia

- 14.6.3 UAE

Chapter 15 Company Profiles

- 15.1 Chicco

- 15.2 Comotomo

- 15.3 Dr. Brown's

- 15.4 Evenflo

- 15.5 Goodbaby International

- 15.6 Lansinoh

- 15.7 MAM Baby

- 15.8 Medela

- 15.9 Munchkin

- 15.10 Nuby

- 15.11 NUK

- 15.12 Philips Avent

- 15.13 Pigeon

- 15.14 Playtex Baby

- 15.15 Tommee Tippee