|

市场调查报告书

商品编码

1892858

动物饲料益生菌市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Animal Feed Probiotics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

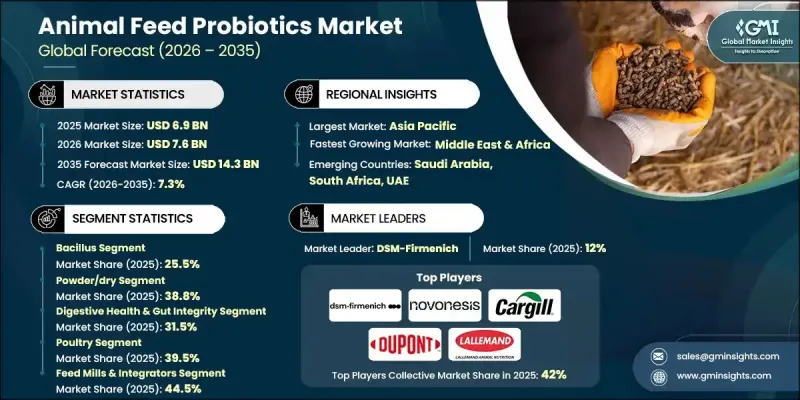

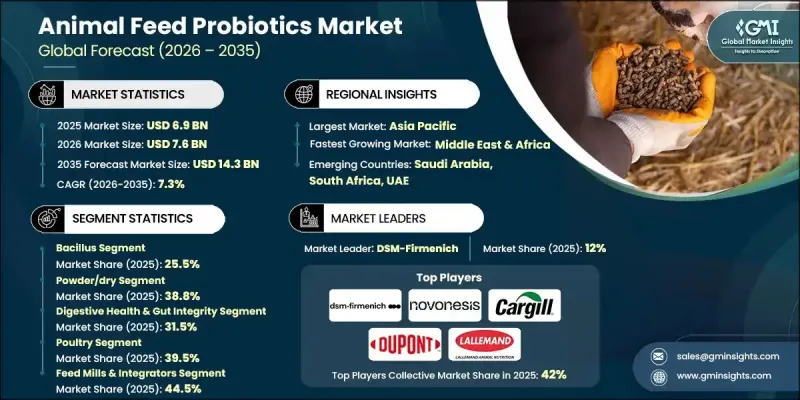

2025年全球动物饲料益生菌市场价值为69亿美元,预计到2035年将以7.3%的复合年增长率成长至143亿美元。

监管政策的转变限制了动物营养中抗生素的使用,鼓励生产者采用替代的健康管理方法,从而推动了益生菌市场的成长。饲料生产商越来越依赖以营养为基础的解决方案,以维持肠道平衡并提升动物的整体生产性能。益生菌已成为这一转变中不可或缺的一部分,它们作为一种专注于微生物组的成分,能够在不依赖具有重要药用价值的化合物的情况下改善动物健康状况。由于全球饲料生产规模庞大,即使是适度的采用也能产生显着的影响。在各种生产系统中观察到的持续性能提升,包括更高的生长效率、更低的疾病压力和更高的产品质量,进一步增强了市场对益生菌的接受度。这些益处使益生菌成为预防性动物健康策略的一部分,而非被动治疗模式。永续性的考量也进一步增强了市场需求,因为益生菌有助于提高营养物质的利用率,并有助于降低对环境的影响,从而帮助生产者履行气候承诺并满足不断变化的采购标准。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 69亿美元 |

| 预测值 | 143亿美元 |

| 复合年增长率 | 7.3% |

2025年,芽孢桿菌益生菌市占率达到25.5%,预计到2035年将以6.6%的复合年增长率成长。它们在高温加工和严苛的储存条件下仍能保持稳定,因此在商业饲料生产中广泛应用。这些特性使其成为在生产压力下维持消化平衡和酶活性的可靠解决方案。

2025年,粉末和干粉製剂市占率为38.8%,预计从2026年到2035年将以6.2%的复合年增长率成长。其易于操作、混合均匀、保质期长、成本效益高等优点,持续推动大规模饲料生产企业的采用。

预计2025年,北美动物饲料益生菌市占率将达到29%。先进的生产系统、严格的监管以及无抗生素饲餵方案的广泛应用,将持续推动市场扩张。该地区在精准营养和永续发展方面的领先地位,也促进了益生菌研发和应用领域的持续创新。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 科学支援的性能提升

- 管理和贸易要求

- 精准农业与稳定性技术

- 产业陷阱与挑战

- 菌株变异性和剂量

- 监理复杂性

- 市场机会

- 甲烷和营养管理

- 水产养殖与宠物营养。

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 依产品类型

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品类型划分,2022-2035年

- 芽孢桿菌

- 乳酸桿菌

- 酿酒酵母(酵母型)

- 双歧桿菌

- 肠球菌

- 后生元

- 链球菌

- 其他的

第六章:市场估算与预测:依产品类型划分,2022-2035年

- 粉末/干粉

- 微胶囊化

- 液体/可溶性

- 颗粒

- 其他的

第七章:市场估计与预测:依功能划分,2022-2035年

- 消化系统健康与肠道完整性

- 免疫支持与调节

- 促进生长和饲料效率

- 病原体控制与竞争性排斥

- 压力管理

- 其他的

第八章:市场估算与预测:依畜牧业划分,2022-2035年

- 家禽

- 肉鸡

- 层

- 育种者

- 其他的

- 猪

- 仔猪(断奶前和断奶后)

- 种植者

- 终结者

- 其他的

- 牛(反刍动物)

- 乳牛

- 肉牛

- 水产养殖

- 鲑鱼

- 鳟鱼

- 虾

- 鲤鱼

- 其他的

- 宠物食品

- 狗

- 猫

- 马科动物

- 其他的

第九章:市场估算与预测:依配销通路划分,2022-2035年

- 饲料厂和一体化企业

- 兽药经销商

- 直接销售(生产商对农场)

- 线上/电子商务

- 其他的

第十章:市场估计与预测:依最终用途划分,2022-2035年

- 商业/工业农场

- 小规模/后院作业

- 其他的

第十一章:市场估计与预测:按地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十二章:公司简介

- DSM-Firmenich

- Chr. Hansen (Novonesis)

- Cargill Animal Nutrition

- DuPont Nutrition & Biosciences (IFF)

- Lallemand Animal Nutrition

- Alltech

- Kemin Industries

- Evonik Industries

- Novus International

- Lesaffre Group

- Angel Yeast

- Biomin

- Nutreco

- MicroSynbiotiX

The Global Animal Feed Probiotics Market was valued at USD 6.9 billion in 2025 and is estimated to grow at a CAGR of 7.3% to reach USD 14.3 billion by 2035.

Growth is supported by regulatory shifts that limit the use of antibiotics in animal nutrition, encouraging producers to adopt alternative health management approaches. Feed manufacturers increasingly rely on nutrition-based solutions that support gut balance and overall animal performance. Probiotics have become an integral part of this transition as microbiome-focused ingredients that enhance health outcomes without relying on medically important compounds. Even modest adoption levels have a significant impact due to the sheer scale of global feed production. Market acceptance is reinforced by consistent performance improvements observed across production systems, including better growth efficiency, reduced disease pressure, and improved output quality. These benefits align probiotics with preventive animal health strategies rather than reactive treatment models. Sustainability considerations further strengthen demand, as probiotics support improved nutrient utilization and contribute to lower environmental impact, helping producers meet climate commitments and evolving sourcing standards.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $6.9 Billion |

| Forecast Value | $14.3 Billion |

| CAGR | 7.3% |

The bacillus-based probiotics segment held a 25.5% share in 2025 and is expected to grow at a CAGR of 6.6% through 2035. Their stability under high processing temperatures and challenging storage conditions supports widespread use in commercial feed manufacturing. These characteristics make them a reliable solution for maintaining digestive balance and enzyme activity under production stress.

The powder and dry formulations segment held 38.8% share in 2025 and is forecast to grow at a CAGR of 6.2% from 2026 to 2035. Their ease of handling, uniform blending, long shelf life, and cost efficiency continue to drive adoption across large-scale feed operations.

North America Animal Feed Probiotics Market captured 29% share in 2025. Advanced production systems, strong regulatory oversight, and widespread adoption of antibiotic-free feeding programs continue to support market expansion. Regional leadership in precision nutrition and sustainability initiatives encourages ongoing innovation in probiotic development and delivery.

Key companies operating in the Global Animal Feed Probiotics Market include Chr. Hansen (Novonesis), DSM-Firmenich, Alltech, Cargill Animal Nutrition, Lallemand Animal Nutrition, Evonik Industries, Kemin Industries, DuPont Nutrition & Biosciences (IFF), Nutreco, Novus International, Lesaffre Group, Angel Yeast, Biomin, and MicroSynbiotiX. Companies in the Animal Feed Probiotics Market pursue focused strategies to strengthen their competitive position. Investment in research and strain development remains a priority to enhance efficacy and stability. Manufacturers expand product portfolios to address evolving regulatory and sustainability requirements. Strategic partnerships with feed producers support wider market penetration and application expertise. Firms emphasize quality assurance and traceability to build customer trust. Geographic expansion into high-growth regions improves scale and distribution reach.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product Type

- 2.2.3 Form

- 2.2.4 Function

- 2.2.5 Livestock

- 2.2.6 Distribution Channel

- 2.2.7 End Use

- 2.3 TAM Analysis, 2025-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Science-backed performance gains

- 3.2.1.2 Stewardship and trade requirements

- 3.2.1.3 Precision farming & stability tech

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Strain variability & dosing

- 3.2.2.2 Regulatory complexity

- 3.2.3 Market opportunities

- 3.2.3.1 Methane and nutrient management

- 3.2.3.2 Aquaculture and pet nutrition.

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Bacillus

- 5.3 Lactobacilli

- 5.4 Saccharomyces (Yeast-Based)

- 5.5 Bifidobacterium

- 5.6 Enterococcus

- 5.7 Postbiotics

- 5.8 Streptococcus

- 5.9 Others

Chapter 6 Market Estimates and Forecast, By Form, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Powder/Dry

- 6.3 Microencapsulated

- 6.4 Liquid/Soluble

- 6.5 Granules

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Function, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Digestive health & gut integrity

- 7.3 Immune support & modulation

- 7.4 Growth promotion & feed efficiency

- 7.5 Pathogen control & competitive exclusion

- 7.6 Stress management

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Livestock, 2022-2035 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Poultry

- 8.2.1 Broilers

- 8.2.2 Layers

- 8.2.3 Breeders

- 8.2.4 Others

- 8.3 Swine

- 8.3.1 Piglets (pre-weaning & post-weaning)

- 8.3.2 Growers

- 8.3.3 Finishers

- 8.3.4 Others

- 8.4 Cattle (ruminants)

- 8.4.1 Dairy cattle

- 8.4.2 Beef cattle

- 8.5 Aquaculture

- 8.5.1 Salmon

- 8.5.2 Trout

- 8.5.3 Shrimp

- 8.5.4 Carp

- 8.5.5 Others

- 8.6 Pet food

- 8.6.1 Dogs

- 8.6.2 Cats

- 8.7 Equine

- 8.8 Others

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2022-2035 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Feed mills & integrators

- 9.3 Veterinary distributors

- 9.4 Direct sales (manufacturer to farm)

- 9.5 Online/e-commerce

- 9.6 Others

Chapter 10 Market Estimates and Forecast, By End Use, 2022-2035 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 Commercial/industrial farms

- 10.3 Small-scale/backyard operations

- 10.4 Others

Chapter 11 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Rest of Europe

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Rest of Asia Pacific

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Rest of Latin America

- 11.6 Middle East and Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

- 11.6.4 Rest of Middle East and Africa

Chapter 12 Company Profiles

- 12.1 DSM-Firmenich

- 12.2 Chr. Hansen (Novonesis)

- 12.3 Cargill Animal Nutrition

- 12.4 DuPont Nutrition & Biosciences (IFF)

- 12.5 Lallemand Animal Nutrition

- 12.6 Alltech

- 12.7 Kemin Industries

- 12.8 Evonik Industries

- 12.9 Novus International

- 12.10 Lesaffre Group

- 12.11 Angel Yeast

- 12.12 Biomin

- 12.13 Nutreco

- 12.14 MicroSynbiotiX