|

市场调查报告书

商品编码

1892864

STEM玩具市场机会、成长驱动因素、产业趋势分析及2025-2034年预测STEM Toys Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

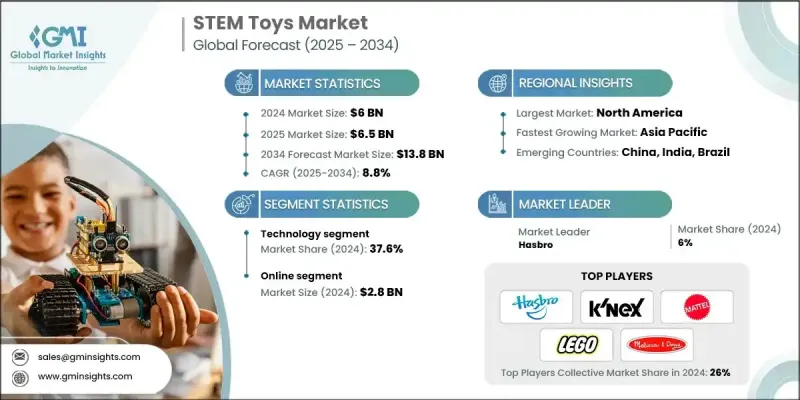

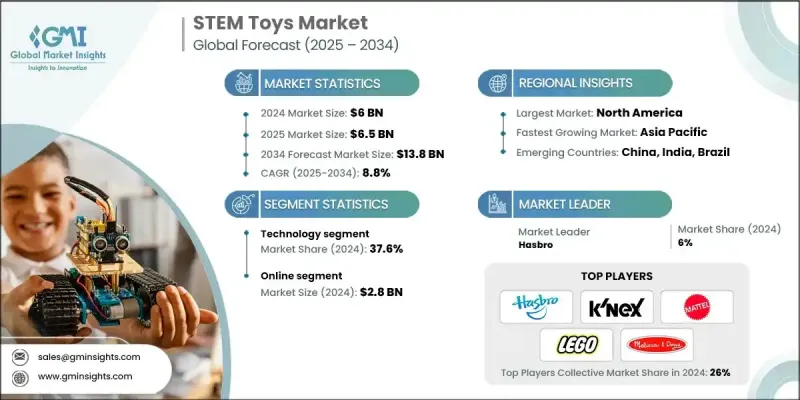

2024 年全球 STEM 玩具市场价值 60 亿美元,预计到 2034 年将以 8.8% 的复合年增长率增长至 138 亿美元。

市场扩张的驱动力在于家长和教育机构对能够培养儿童批判性思维、创造力和问题解决能力的玩具日益增长的兴趣。随着STEM(科学、技术、工程和数学)类产品在全球广泛认可,休閒玩具製造商正不断拓展产品线,将教育性和互动性玩具纳入其中。透过将传统游戏与STEM学习结合,企业可以兼顾娱乐和教育的双重目的,吸引那些既重视技能培养又注重娱乐的家长。将STEM玩具与其他热门儿童产品融合,也能提升产品感知价值,促使消费者做出明智的购买决策,并提高销售量。教育与娱乐的融合催生了对兼具学习和休閒功能的创新互动玩具的强劲市场需求,使得STEM玩具成为全球製造商关注的重点。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 60亿美元 |

| 预测值 | 138亿美元 |

| 复合年增长率 | 8.8% |

预计到2024年,科技类玩具将占37.6%的市占率。工程类玩具能让孩子积极创造、实验和解决问题,提供动手实作、多感官的学习体验。这些产品也能鼓励合作游戏,帮助孩子在完成搭建或工程挑战的同时,培养沟通和团队合作能力。

2024年,线上销售额达28亿美元。电子商务平台使製造商能够与客户保持直接联繫,提供个人化方案和一体化服务。线上管道还使企业能够收集宝贵的消费者洞察,改进售后支持,并透过服务合约和零件供应最大化客户终身价值。

美国STEM玩具市场占据84.5%的市场份额,预计到2024年将贡献18亿美元的市场规模。该地区完善的物流基础设施、高度的技术普及以及消费者对创新教育玩具的强劲需求,使其成为全球领先的市场之一。政府措施和教育计画持续推动STEM教育,进一步促进了市场成长。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 家长越来越重视早期教育

- 先进技术(人工智慧/机器学习/扩增实境)的集成

- 政府措施与课程衔接

- 产业陷阱与挑战

- 先进机器人和编程套件价格昂贵

- 来自萤幕数位娱乐的竞争

- 机会

- 新兴经济体尚未开发的市场

- 实体游戏与数位游戏的整合(STEAM)

- 成长驱动因素

- 成长潜力分析

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按类型

- 监管环境

- 标准和合规要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依类型划分,2021-2034年

- 科学

- 科技

- 工程

- 数学

第六章:市场估计与预测:依年龄组别划分,2021-2034年

- 0-3岁

- 3-8岁

- 8-12岁

- 12年以上

第七章:市场估计与预测:依配销通路划分,2021-2034年

- 在线的

- 离线

第八章:市场估算与预测:依地区划分,2021-2034年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- BanBao

- Bandai

- Gigotoys

- Goldlok Toys

- Guangdong Loongon

- Guangdong Qman Culture Communication

- Hasbro

- K'NEX

- LEGO Group

- Mattel

- Melissa and Doug

- ShanTou LianHuan Toys and Crafts

- Spin Master

- TAKARA TOMY

- Vtech

The Global STEM Toys Market was valued at USD 6 billion in 2024 and is estimated to grow at a CAGR of 8.8% to reach USD 13.8 billion by 2034.

The market expansion is driven by rising parental and educational interest in toys that develop children's critical thinking, creativity, and problem-solving skills. As STEM-based products gain global traction, recreational toy manufacturers are increasingly diversifying their portfolios to include educational and interactive toys. By combining traditional play with STEM learning, companies can cater to both fun and educational purposes, appealing to parents who prioritize skill-building alongside entertainment. Integrating STEM toys with other popular children's products also boosts perceived value, encourages informed purchasing decisions, and enhances sales volumes. This convergence of education and entertainment has created a strong market demand for innovative, engaging toys that provide both learning and leisure opportunities, making STEM toys a key focus for manufacturers worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6 Billion |

| Forecast Value | $13.8 Billion |

| CAGR | 8.8% |

The technology segment held a 37.6% share in 2024. Engineering-based toys allow children to actively create, experiment, and solve problems, providing hands-on, multi-sensory learning experiences. These products also encourage collaborative play, helping kids develop communication and teamwork skills while completing construction or engineering challenges.

The online sales segment generated USD 2.8 billion in 2024. E-commerce platforms allow manufacturers to maintain direct customer relationships, offer personalized packages, and provide integrated services. Online channels also enable companies to collect valuable consumer insights, improve after-sales support, and maximize customer lifetime value through service contracts and parts supply.

U.S. STEM Toys Market held 84.5% share, contributing USD 1.8 billion in 2024. The region's robust logistics infrastructure, high adoption of technology, and strong consumer demand for innovative educational toys have positioned it as a leading market globally. Government initiatives and educational programs continue to promote STEM learning, further supporting market growth.

Major players in the Global STEM Toys Market include BanBao, Bandai, Gigotoys, Goldlok Toys, Guangdong Loongon, Guangdong Qman Culture Communication, Hasbro, K'NEX, LEGO Group, Mattel, Melissa and Doug, ShanTou LianHuan Toys and Crafts, Spin Master, TAKARA TOMY, and VTech. STEM toy manufacturers focus on continuous innovation, designing interactive and technology-enabled toys that combine learning and entertainment. Companies invest in research and development to enhance product safety, educational value, and engagement. Strategic collaborations with educational institutions, after-school programs, and digital learning platforms help expand market reach. Firms also leverage online and omnichannel retail strategies to increase visibility, offer personalized customer experiences, and improve distribution efficiency. Marketing campaigns emphasizing skill development, creativity, and inclusivity help attract parents and educators.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Age group

- 2.2.4 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing parental emphasis on early education

- 3.2.1.2 Integration of advanced technology (AI/ML/AR)

- 3.2.1.3 Government initiatives and curriculum alignment

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost of advanced robotics and coding kits

- 3.2.2.2 Competition from screen-based digital entertainment

- 3.2.3 Opportunities

- 3.2.3.1 Untapped markets in emerging economies

- 3.2.3.2 Convergence of physical and digital play (STEAM)

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Science

- 5.3 Technology

- 5.4 Engineering

- 5.5 Mathematics

Chapter 6 Market Estimates and Forecast, By Age Group, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 0-3 years

- 6.3 3-8 years

- 6.4 8-12 years

- 6.5 12+ years

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Online

- 7.3 Offline

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 BanBao

- 9.2 Bandai

- 9.3 Gigotoys

- 9.4 Goldlok Toys

- 9.5 Guangdong Loongon

- 9.6 Guangdong Qman Culture Communication

- 9.7 Hasbro

- 9.8 K’NEX

- 9.9 LEGO Group

- 9.10 Mattel

- 9.11 Melissa and Doug

- 9.12 ShanTou LianHuan Toys and Crafts

- 9.13 Spin Master

- 9.14 TAKARA TOMY

- 9.15 Vtech