|

市场调查报告书

商品编码

1892887

人工智慧(AI)晶片组市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Artificial Intelligence (AI) Chipsets Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

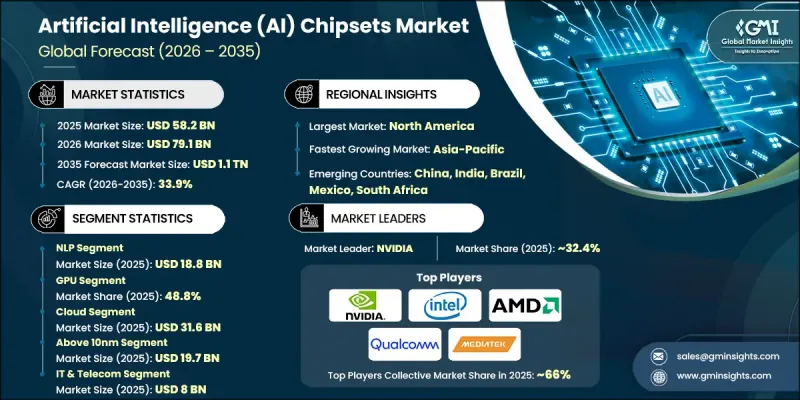

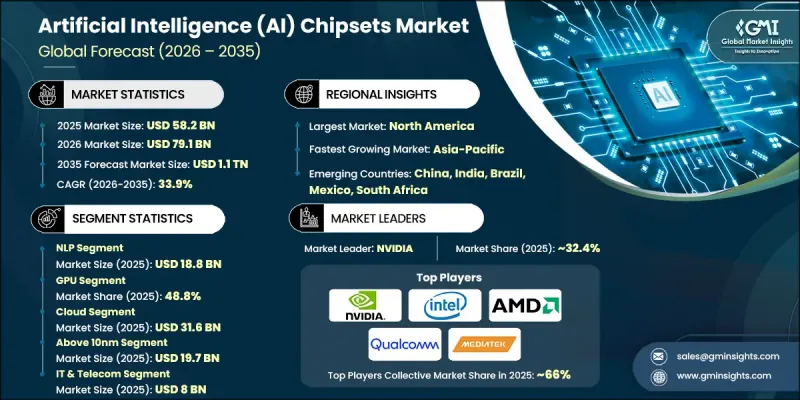

2025 年全球人工智慧 (AI) 晶片组市值为 582 亿美元,预计到 2035 年将以 33.9% 的复合年增长率增长至 1.1 兆美元。

人工智慧在医疗保健、汽车、消费性电子和资料中心等行业的日益整合推动了市场成长。对高效能运算、边缘人工智慧设备、人工智慧物联网应用和机器学习工作负载的需求不断增长,正推动全球人工智慧的普及。半导体技术的进步、节能处理器架构以及人工智慧优化晶片设计的改进正在改变市场格局,实现更快、更智慧的运算。各公司正致力于开发专用GPU、NPU和ASIC,以加速深度学习、神经网路和人工智慧处理,从而支援从自动驾驶汽车到预测分析等各种应用。这种向人工智慧专用架构的转变正在重塑各行业部署智慧系统的方式,同时优化能源效率和运作效能。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 582亿美元 |

| 预测值 | 1.1兆美元 |

| 复合年增长率 | 33.9% |

预计2025年,自然语言处理(NLP)领域市场规模将达到188亿美元。 NLP晶片组旨在加速基于语言的人工智慧应用,例如虚拟助理、聊天机器人、即时翻译和情绪分析,从而实现更快的模型训练和即时推理。企业、医疗保健、电子商务和智慧型设备等领域对NLP晶片组的需求日益增长,推动了市场对NLP晶片组的庞大需求。

由于GPU拥有卓越的平行处理能力、极高的运算效率以及处理复杂AI工作负载的能力,预计到2025年,GPU市场占有率将达到48.8%。 GPU能够加速机器学习、深度学习和神经网路的运算,使其成为机器人、云端运算、汽车和医疗保健等应用领域不可或缺的元件,从而巩固了其在AI晶片组中的主导地位。

预计到2025年,北美人工智慧(AI)晶片组市占率将达到31.6%。该地区市场扩张的驱动力包括:人工智慧技术的早期应用、对资料中心和云端运算的大力产业投资,以及边缘人工智慧和自主系统的日益普及。此外,主要人工智慧晶片组製造商的存在、政府的支持、研究计划以及对用于机器学习和即时分析的节能高效处理器的强劲需求,都进一步巩固了该地区市场的地位。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 产业影响因素

- 成长驱动因素

- 汽车产业需求不断成长

- 全球对智慧家庭和智慧城市的需求日益增长

- 人工智慧在智慧型手机和智慧型穿戴装置中的整合度日益提高

- 全球工业自动化不断发展

- 资料中心人工智慧推理硬体的成长

- 产业陷阱与挑战

- 高昂的开发和生产成本

- 散热和功耗问题

- 市场机会

- 生成式人工智慧和边缘人工智慧应用的扩展

- 医疗保健、金融和工业4.0领域的应用日益广泛

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 我们

- 加拿大

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 北美洲

- 技术格局

- 当前趋势

- 新兴技术

- 管道分析

- 未来市场趋势

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品划分,2022-2035年

- GPU

- 专用积体电路

- FPGA

- 中央处理器

第六章:市场估算与预测:依技术划分,2022-2035年

- 自然语言处理

- RPA

- 电脑视觉

- 网路安全

- 其他的

第七章:市场估算与预测:依加工类型划分,2022-2035年

- 边缘

- 云

第八章:市场估算与预测:依产业垂直领域划分,2022-2035年

- 消费性电子产品

- 智慧型手机和平板电脑

- 笔记型电脑和桌上型电脑

- 穿戴式装置

- AR/VR/MR 设备

- 智慧家庭设备

- 其他的

- 媒体与广告

- 金融服务业

- 资讯科技与电信

- 云端资料中心

- 边缘资料中心

- 网路安全与威胁侦测

- 人工智慧驱动的 5G/6G 无线存取网解决方案

- 其他的

- 零售

- 卫生保健

- 医学影像与诊断

- 药物发现与基因组学

- 穿戴式健康监测设备

- 医院自动化与工作流程管理

- 远距医疗和虚拟健康平台

- 其他的

- 汽车

- 高级驾驶辅助系统(ADAS)

- 自动驾驶汽车(AV 计算单元)

- 车载资讯娱乐系统(IVI)

- V2X通讯系统

- 其他的

- 其他的

第九章:市场估计与预测:依地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Alphabet Inc.

- AMD (Advanced Micro Devices)

- Analog Devices, Inc.

- Apple Inc.

- Arm Ltd.

- Blaize

- Graphcore

- Groq, Inc.

- Hailo

- Huawei Technologies Co., Ltd.

- IBM

- Imagination Technologies

- Infineon Technologies Inc

- Intel Corporation

- Kalray

- LG Electronics

- MediaTek Inc.

- Micron Technology Inc

- NVIDIA Corporation

- NXP Semiconductors

- Qualcomm Technologies, Inc

- ROHM Co., Ltd.

- Samsung Electronics Co., Ltd.

- STMicroelectronics

- Texas Instruments Incorporated

The Global Artificial Intelligence (AI) Chipsets Market was valued at USD 58.2 billion in 2025 and is estimated to grow at a CAGR of 33.9% to reach USD 1.1 trillion by 2035.

The market growth is fueled by the rising integration of AI across sectors such as healthcare, automotive, consumer electronics, and data centers. Increasing demand for high-performance computing, edge AI devices, AI-enabled IoT applications, and machine learning workloads is driving adoption worldwide. Advances in semiconductor technologies, energy-efficient processor architectures, and AI-optimized chip designs are transforming the market, enabling faster and more intelligent computations. Companies are focusing on developing specialized GPUs, NPUs, and ASICs to accelerate deep learning, neural networks, and AI processing, supporting applications from autonomous vehicles to predictive analytics. This shift toward AI-dedicated architectures is reshaping how industries deploy intelligent systems while optimizing energy efficiency and operational performance.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $58.2 Billion |

| Forecast Value | $1.1 Trillion |

| CAGR | 33.9% |

The natural language processing (NLP) segment generated USD 18.8 billion in 2025. NLP chipsets are designed to accelerate language-based AI applications, such as virtual assistants, chatbots, real-time translation, and sentiment analysis, enabling faster model training and real-time inference. Their adoption across enterprises, healthcare, e-commerce, and smart devices drives significant market demand.

The GPU segment accounted for a 48.8% share in 2025 due to its exceptional parallel processing capability, high computational efficiency, and ability to handle complex AI workloads. GPUs facilitate rapid machine learning, deep learning, and neural network computations, making them essential for applications in robotics, cloud computing, automotive, and healthcare, reinforcing their dominant position in AI chipsets.

North America Artificial Intelligence (AI) Chipsets Market held a 31.6% share in 2025. Market expansion in the region is driven by early adoption of AI technologies, strong industrial investment in data centers and cloud computing, and growing deployment of edge AI and autonomous systems. The presence of major AI chipset manufacturers, government support, research initiatives, and high demand for energy-efficient, high-performance processors for machine learning and real-time analytics further strengthen the regional market.

Key companies in the Artificial Intelligence (AI) Chipsets Market include Apple Inc., AMD (Advanced Micro Devices), Arm Ltd., NVIDIA Corporation, Intel Corporation, Qualcomm Technologies, Inc., MediaTek Inc., IBM, Hailo, Infineon Technologies Inc., Analog Devices, Inc., Micron Technology Inc., Samsung Electronics Co., Ltd., LG Electronics, ROHM Co., Ltd., STMicroelectronics, Graphcore, Kalray, Groq, Inc., Blaize, Imagination Technologies, NXP Semiconductors, and Alphabet Inc. Companies in the Artificial Intelligence (AI) Chipsets Market are employing multiple strategies to strengthen their market presence. They are heavily investing in research and development to create energy-efficient, high-performance GPUs, NPUs, and AI accelerators. Collaborations and strategic partnerships with cloud service providers, automotive OEMs, and industrial clients enhance adoption and integration across AI applications. Firms are launching specialized processors tailored for edge AI, NLP, and deep learning workloads to meet sector-specific needs.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional Trends

- 2.2.2 Product Trends

- 2.2.3 Technology Trends

- 2.2.4 Processing Type Trends

- 2.2.5 Node Size Trends

- 2.2.6 Industry Vertical Trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand from automotive industry

- 3.2.1.2 Increasing demand for smart homes & smart cities across the globe

- 3.2.1.3 Increasing integration of AI in smartphone & smart wearable devices

- 3.2.1.4 Growing industrial automation across the globe

- 3.2.1.5 Growth of AI inferencing hardware in data centers

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High development and production costs

- 3.2.2.2 Heat dissipation and power consumption issues

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of Generative AI and Edge AI Applications

- 3.2.3.2 Growing Adoption Across Healthcare, Finance, and Industry 4.0

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.4.1 North America

- 3.5 Technology landscape

- 3.5.1 Current trends

- 3.5.2 Emerging technologies

- 3.6 Pipeline analysis

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 Latin America

- 4.2.6 Middle East and Africa

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product, 2022-2035 (USD Million)

- 5.1 Key trends

- 5.2 GPU

- 5.3 ASIC

- 5.4 FPGA

- 5.5 CPU

Chapter 6 Market Estimates & Forecast, By Technology, 2022-2035 (USD Million)

- 6.1 Key trends

- 6.2 NLP

- 6.3 RPA

- 6.4 Computer Vision

- 6.5 Network Security

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Processing Type, 2022-2035 (USD Million)

- 7.1 Key trends

- 7.2 Edge

- 7.3 Cloud

Chapter 8 Market Estimates & Forecast, By Industry Vertical, 2022-2035 (USD Million)

- 8.1 Key trends

- 8.2 Consumer Electronics

- 8.2.1 Smartphones & Tablets

- 8.2.2 Laptops & PCs

- 8.2.3 Wearables

- 8.2.4 AR/VR/MR Devices

- 8.2.5 Smart Home Devices

- 8.2.6 Others

- 8.3 Media & Advertising

- 8.4 BFSI

- 8.5 IT & Telecom

- 8.5.1 Cloud Data Centers

- 8.5.2 Edge Data Centers

- 8.5.3 Cybersecurity & Threat Detection

- 8.5.4 AI-powered 5G/6G RAN Solutions

- 8.5.5 Others

- 8.6 Retail

- 8.7 Healthcare

- 8.7.1 Medical Imaging & Diagnostics

- 8.7.2 Drug Discovery & Genomics

- 8.7.3 Wearable Health Monitoring Devices

- 8.7.4 Hospital Automation & Workflow Management

- 8.7.5 Telemedicine & Virtual Health Platforms

- 8.7.6 Others

- 8.8 Automotive

- 8.8.1 Advanced Driver Assistance Systems (ADAS)

- 8.8.2 Autonomous Vehicles (AV Compute Units)

- 8.8.3 In-Vehicle Infotainment (IVI)

- 8.8.4 V2X Communication Systems

- 8.8.5 Others

- 8.9 Others

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2035 ($ USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Alphabet Inc.

- 10.2 AMD (Advanced Micro Devices)

- 10.3 Analog Devices, Inc.

- 10.4 Apple Inc.

- 10.5 Arm Ltd.

- 10.6 Blaize

- 10.7 Graphcore

- 10.8 Groq, Inc.

- 10.9 Hailo

- 10.10 Huawei Technologies Co., Ltd.

- 10.11 IBM

- 10.12 Imagination Technologies

- 10.13 Infineon Technologies Inc

- 10.14 Intel Corporation

- 10.15 Kalray

- 10.16 LG Electronics

- 10.17 MediaTek Inc.

- 10.18 Micron Technology Inc

- 10.19 NVIDIA Corporation

- 10.20 NXP Semiconductors

- 10.21 Qualcomm Technologies, Inc

- 10.22 ROHM Co., Ltd.

- 10.23 Samsung Electronics Co., Ltd.

- 10.24 STMicroelectronics

- 10.25 Texas Instruments Incorporated