|

市场调查报告书

商品编码

1892900

汽车液力变矩器市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Automotive Torque Converter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

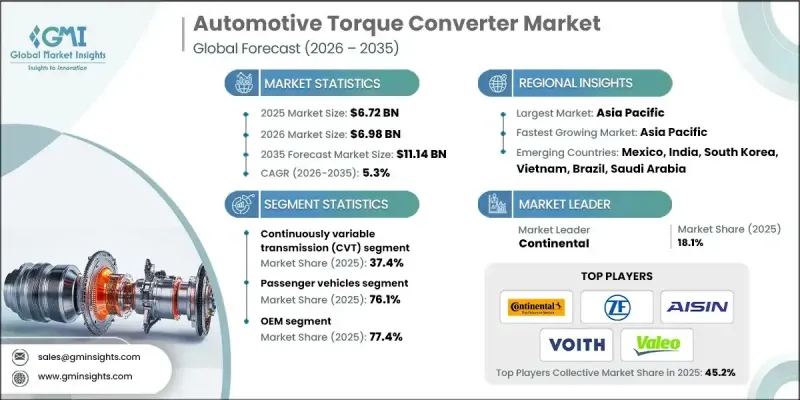

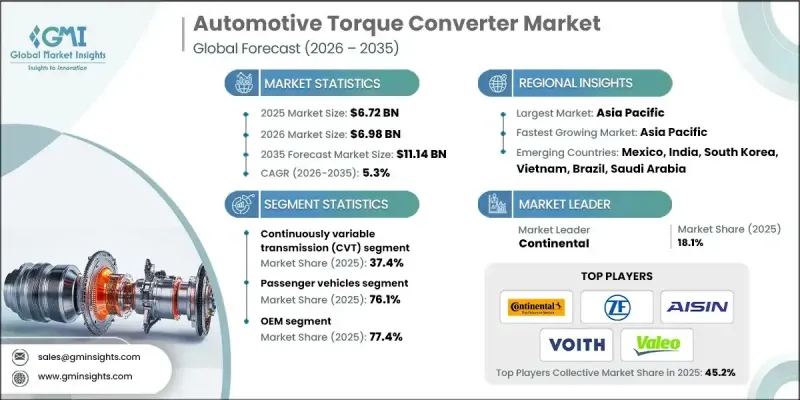

2025 年全球汽车扭力转换器市场价值为 67.2 亿美元,预计到 2035 年将以 5.3% 的复合年增长率成长至 111.4 亿美元。

自动变速箱的日益普及推动了市场成长,尤其是在城市地区,自动变速箱能够提供更平顺、更轻鬆的驾驶体验。液力变矩器透过以液压系统取代复杂的离合器和齿轮机构,使车辆无需离合器踏板即可行驶,从而改变了传统车辆的驾驶方式。消费者对乘用车和商用车自动变速箱的偏好不断增强,进一步推高了市场需求。与手排变速箱相比,液力变矩器还能提高燃油效率,这进一步促进了其普及。美国和英国等自动挡汽车渗透率高的市场,持续为新车生产和售后零件更换创造了巨大的机会。随着全球城市化进程的推进和混合动力汽车的普及,液力变矩器正成为实现车辆顺畅高效运作的关键部件。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 67.2亿美元 |

| 预测值 | 111.4亿美元 |

| 复合年增长率 | 5.3% |

由于其卓越的燃油效率和使引擎以最佳转速运转的能力,预计到2025年,无段变速箱(CVT)市场份额将达到37.4%。 CVT提供平顺、无缝的驾驶体验,在城市环境中越来越受欢迎。

预计到2025年,乘用车市场规模将达到51.1亿美元,反映出市场对自动变速箱汽车的强劲需求。混合动力汽车(HEV)的兴起以及製造商对先进自动变速箱技术的投入,正在推动该细分市场的成长。

美国汽车扭力转换器市场规模预计在2025年达到18.2亿美元,高于2024年的17.5亿美元。技术进步正促使美国汽车製造商采用更有效率的扭力转换器,以满足企业平均燃油经济性(CAFE)标准。虽然纯电动车通常不需要扭力转换器,但混合动力车和插电式混合动力车则依赖先进的紧凑型转换器来最大限度地提高效率和性能。

目录

第一章:方法论

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 全球自排变速箱普及率不断提高

- 乘用车产量成长

- 商用车和非公路用车成长

- 售后市场和服务市场成长

- 产业陷阱与挑战

- 电动车的普及降低了对自动变速箱的需求。

- 在价格敏感型市场中,手排变速箱更受欢迎

- 市场机会

- 混合动力汽车(HEV)细分市场成长

- 与原始设备製造商 (OEM) 就係统级最佳化开展合作

- 永续性与循环经济的融合

- 售后性能及赛车领域

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 美国:美国企业平均燃油经济性(CAFE)标准

- 加拿大:加拿大联邦轻型车辆标准

- 欧洲

- 德国:德国道路交通许可条例(StVZO)

- 法国:法国车辆类型认证框架

- 英国:英国车辆认证机构(VCA)

- 亚太地区

- 中国:中国第六期汽车排放标准

- 日本:日本汽车型式认证(JATA)法规

- 印度:Bharat Stage排放标准

- 拉丁美洲

- 巴西:巴西 PROCONVE 车辆排放计划

- 阿根廷:阿根廷国家汽车安全标准

- 墨西哥:墨西哥NOM车辆排放与安全标准

- 中东和非洲

- 阿联酋:阿联酋联邦车辆安全与排放法规

- 南非:南非国家道路交通法规

- 沙乌地阿拉伯:SASO燃油经济性和车辆安全标准

- 北美洲

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 副产品

- 生产统计

- 生产中心

- 消费中心

- 进出口

- 成本細項分析

- 製造成本结构

- 营运成本分析

- 基础设施成本分析

- 成本优化策略

- 专利分析

- 永续性和环境影响

- 液力变矩器生产的碳足迹

- 材料可回收性分析

- 环保生产方式

- 生命週期评估

- 最佳情况

- 未来展望与机会

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:依输电方式划分,2022-2035年

- 自动手排变速箱(AMT)

- 双离合器变速箱(DCT)

- 无段变速器(CVT)

- 其他的

第六章:市场估算与预测:依转换器划分,2022-2035年

- 单级

- 多阶段

- 锁

- 其他的

第七章:市场估价与预测:依车辆类型划分,2022-2035年

- 搭乘用车

- 掀背车

- 轿车

- SUV

- 商用车辆

- 低容量性状

- MCV

- C型肝炎

第八章:市场估算与预测:依销售管道划分,2022-2035年

- OEM

- 售后市场

第九章:市场估计与预测:依地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧

- 比荷卢经济联盟

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 新加坡

- 马来西亚

- 印尼

- 越南

- 泰国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 哥伦比亚

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- 全球公司

- ZF Friedrichshafen

- Schaeffler

- Valeo

- EXEDY

- Aisin

- BorgWarner

- Yutaka Giken

- Allison Transmission

- JATCO

- Punch Powertrain

- Voith

- Delphi Technologies

- 区域公司

- Zhejiang Torch Auto Parts

- Hubei Aviation Precision Machinery Technology

- Zhejiang Wanliyang

- Transtar Industries

- Florida Torque Converter

- RevMax Converters

- TCI Automotive

- 新兴公司

- Circle D Specialties

- Coan Engineering

- Hughes Performance

- Hays Performance (Holley)

- Sonnax Transmission Company

The Global Automotive Torque Converter Market was valued at USD 6.72 billion in 2025 and is estimated to grow at a CAGR of 5.3% to reach USD 11.14 billion by 2035.

Growth is driven by the rising adoption of automatic transmissions, which offer a smoother, easier driving experience, particularly in urban areas. Torque converters are transforming traditional vehicles by replacing complex clutch and gear mechanisms with hydraulic fluid-based systems, allowing vehicles to operate without a clutch pedal. Increasing consumer preference for automatic transmission in both passenger cars and commercial fleets is boosting market demand. Torque converters also enhance fuel efficiency compared to manual transmissions, which further encourages adoption. Markets with high penetration of automatic vehicles, including the U.S. and the U.K., continue to create significant opportunities for both new vehicle production and aftermarket component replacement. As global urbanization and hybrid vehicle adoption grow, torque converters are becoming essential for seamless and efficient vehicle operation.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $6.72 Billion |

| Forecast Value | $11.14 Billion |

| CAGR | 5.3% |

The continuously variable transmission (CVT) segment held a 37.4% share in 2025 due to its superior fuel efficiency and ability to allow engines to operate at optimal revolutions per minute. CVTs provide a smooth, seamless driving experience that is increasingly favored in city environments.

The passenger vehicle segment generated USD 5.11 billion in 2025, reflecting high demand for automatic transmission vehicles. The rise of hybrid electric vehicles (HEVs) and manufacturers' push for advanced automatic transmission technology is driving growth in this segment.

United States Automotive Torque Converter Market reached USD 1.82 billion in 2025, up from USD 1.75 billion in 2024. Technological advancements are encouraging U.S.-based OEMs to adopt more efficient torque converters that help meet Corporate Average Fuel Economy (CAFE) standards. While battery-electric vehicles often do not require torque converters, HEVs and plug-in hybrids rely on advanced, compact converters to maximize efficiency and performance.

Key players in the Automotive Torque Converter Market include Schaeffler Technologies, BorgWarner, Exedy, Aisin Seiki, Allison Transmission, Continental, Voith, ZF Friedrichshafen, Valeo, and Delphi Technologies. Companies are strengthening their Automotive Torque Converter Market positions by developing high-efficiency and compact torque converters suitable for hybrid and plug-in hybrid electric vehicles. Strategic R&D investments are focused on improving fuel economy, reducing emissions, and enhancing durability. Leading manufacturers are forming alliances with OEMs to integrate advanced torque converters into next-generation automatic transmissions and continuously variable transmissions (CVTs). Technological innovation, including hydraulic optimization and lightweight materials, is being used to improve performance while lowering costs. Market leaders are also expanding global production capabilities and establishing service and aftermarket networks to ensure long-term customer support.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Transmission

- 2.2.3 Converter

- 2.2.4 Vehicle

- 2.2.5 Sales Channel

- 2.3 TAM analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing global automatic transmission penetration

- 3.2.1.2 Growth in passenger vehicle production

- 3.2.1.3 Commercial vehicle & off-highway vehicle growth

- 3.2.1.4 Aftermarket & service market growth

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 EV adoption reducing automatic transmission demand

- 3.2.2.2 Manual transmission preference in price-sensitive markets

- 3.2.3 Market opportunities

- 3.2.3.1 Hybrid electric vehicle (HEV) segment growth

- 3.2.3.2 Partnerships with OEMs on system-level optimization

- 3.2.3.3 Sustainability & circular economy integration

- 3.2.3.4 Aftermarket performance & racing segments

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 United States: U.S. Corporate Average Fuel Economy (CAFE) Standards

- 3.4.1.2 Canada: Canada's federal light-duty vehicle standards

- 3.4.2 Europe

- 3.4.2.1 Germany: German Road Traffic Licensing Regulations (StVZO)

- 3.4.2.2 France: French Vehicle Type-Approval Framework

- 3.4.2.3 United Kingdom: UK Vehicle Certification Agency (VCA)

- 3.4.3 Asia Pacific

- 3.4.3.1 China: China VI Vehicle Emission Standards

- 3.4.3.2 Japan: Japan Automobile Type Approval (JATA) Regulations

- 3.4.3.3 India: Bharat Stage Emission Standards

- 3.4.4 Latin America

- 3.4.4.1 Brazil: Brazilian PROCONVE Vehicle Emission Program

- 3.4.4.2 Argentina: Argentina National Automotive Safety Standards

- 3.4.4.3 Mexico: Mexican NOM Vehicle Emission and Safety Standards

- 3.4.5 Middle East & Africa

- 3.4.5.1 UAE: UAE Federal Vehicle Safety & Emission Regulations

- 3.4.5.2 South Africa: South African National Road Traffic Regulations

- 3.4.5.3 Saudi Arabia: SASO Fuel Economy and Vehicle Safety Standards

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.10.1 Manufacturing cost structure

- 3.10.2 Operational cost analysis

- 3.10.3 Infrastructure cost analysis

- 3.10.4 Cost optimization strategies

- 3.11 Patent analysis

- 3.12 Sustainability and environmental impact

- 3.12.1 Carbon footprint of torque converter production

- 3.12.2 Material recyclability analysis

- 3.12.3 Eco-friendly manufacturing practices

- 3.12.4 Lifecycle assessment

- 3.13 Best case scenarios

- 3.14 Future outlook & opportunities

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Transmission, 2022 - 2035 ($Mn, Units)

- 5.1 Key trends

- 5.2 Automated manual transmission (AMT)

- 5.3 Dual- Clutch transmission (DCT)

- 5.4 Continuously variable transmission (CVT)

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Converter, 2022 - 2035 ($Mn, Units)

- 6.1 Key trends

- 6.2 Single-stage

- 6.3 Multi-stage

- 6.4 Lockup

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Mn, Units)

- 7.1 Key trends

- 7.2 Passenger Vehicles

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUVs

- 7.3 Commercial Vehicles

- 7.3.1 LCV

- 7.3.2 MCV

- 7.3.3 HCV

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2022 - 2035 ($Mn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.3.8 Benelux

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Singapore

- 9.4.7 Malaysia

- 9.4.8 Indonesia

- 9.4.9 Vietnam

- 9.4.10 Thailand

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Colombia

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global companies

- 10.1.1 ZF Friedrichshafen

- 10.1.2 Schaeffler

- 10.1.3 Valeo

- 10.1.4 EXEDY

- 10.1.5 Aisin

- 10.1.6 BorgWarner

- 10.1.7 Yutaka Giken

- 10.1.8 Allison Transmission

- 10.1.9 JATCO

- 10.1.10 Punch Powertrain

- 10.1.11 Voith

- 10.1.12 Delphi Technologies

- 10.2 Regional companies

- 10.2.1 Zhejiang Torch Auto Parts

- 10.2.2 Hubei Aviation Precision Machinery Technology

- 10.2.3 Zhejiang Wanliyang

- 10.2.4 Transtar Industries

- 10.2.5 Florida Torque Converter

- 10.2.6 RevMax Converters

- 10.2.7 TCI Automotive

- 10.3 Emerging companies

- 10.3.1 Circle D Specialties

- 10.3.2 Coan Engineering

- 10.3.3 Hughes Performance

- 10.3.4 Hays Performance (Holley)

- 10.3.5 Sonnax Transmission Company