|

市场调查报告书

商品编码

1844671

汽车扭力转换器:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Automotive Torque Converter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

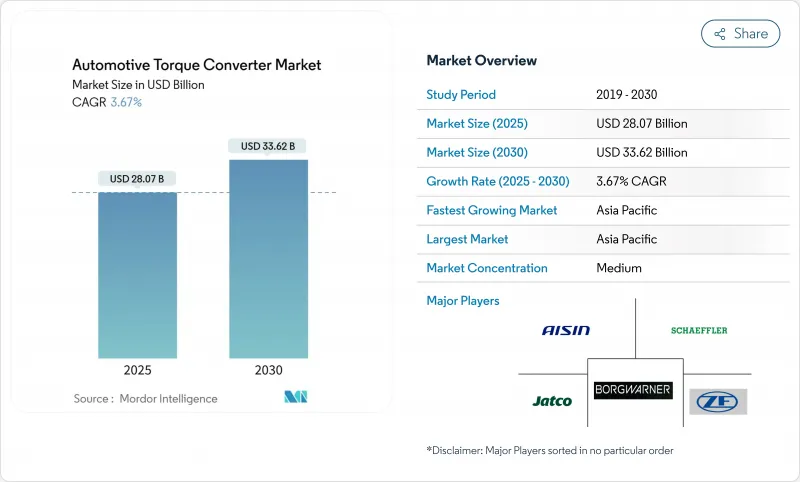

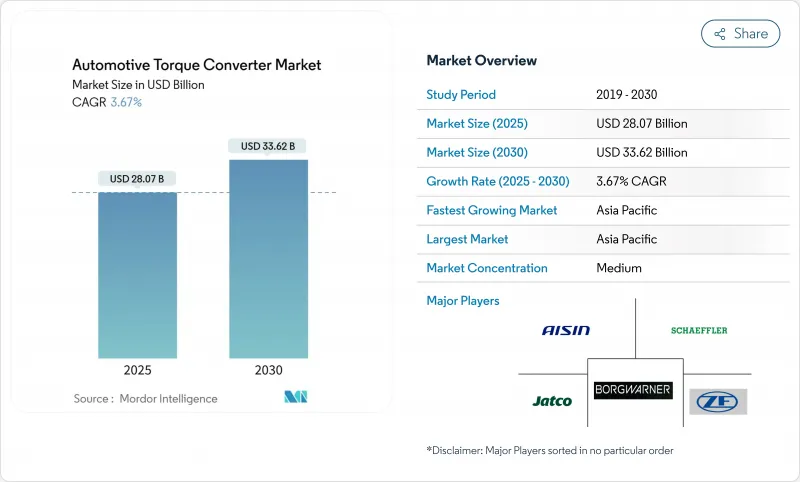

预计2025年汽车扭力转换器市场规模将达280.7亿美元,2030年将达336.2亿美元。

这是因为混合动力传动系统、多速自排变速箱和商用车产量的增加正在重塑需求模式。新兴经济体对自动变速箱的采用持续提升了基准产量,而已开发国家则正在投资混合动力专用的变速箱架构,以提高燃油经济性和排放气体性能。北美供应链的近岸外包、轻型商用车在疫情后持续扩张以及原始设备製造商对8速和10速变速箱的需求压力将进一步刺激市场。相反,纯电力传动系统以及DCT和CVT技术的日益普及削弱了某些乘用车细分市场的长期前景。铝和铜原料成本的波动进一步增加了零件利润率的不确定性。

全球汽车扭力转换器市场趋势与洞察

自排变速箱在新兴市场日益普及

在都市区拥塞加剧和可支配收入增加的推动下,自动变速箱在大型开发中国家的普及速度正在加快。中国的自动变速箱正在将数百万辆汽车从手排转换为自动挡。印度也出现了类似的势头,雷诺价格极具竞争力的 Kiger CVT 可在不到 1000 万美元的预算内提供完全自动驾驶选项,从而消除了长期以来对手排的偏好。艾里逊变速箱公司在清奈投资 1 亿美元进行扩建,旨在到 2027 年将产能翻一番,这表明供应商致力于满足这一需求浪潮。陕西法士特汽车传动集团等区域龙头企业正在利用其现有的製造地来扩大商用车和乘用车领域的订单。

混合动力和轻度混合动力汽车的繁荣推动了液力变矩器的需求

混合动力传动系统需要配备精密锁定机构的变矩器,以最大限度地减少滑移,并在引擎关闭时实现无缝扭矩混合。福特Ranger PHEV采用了全新的整合式布局,将电动马达和分离离合器置于变矩器前方,从而改善了锁定占空比。采埃孚(ZF)为BMWX5 xDrive40e设计的插电式混合动力变速箱以整合式马达取代了传统的变矩器,展示了液力耦合器原理在电气化系统中的演变,可将油耗降低高达70%。 Stellantis已在欧洲推出30款混合模式,每款车型均配备电动双离合器变速箱,可减少20%的二氧化碳排放量。随着混合动力车与纯电动车价格差距的缩小,汽车变速箱市场将受益于锁定部件的持续创新。

BEV动力传动系统无需扭力转换器

纯电动车采用电动机直接驱动,无需传统的变矩器。博格华纳为其Polestar SUV车型转向电动扭力向量控制模组,彰显了其目前在液压零件以外的多元化布局。然而,基础设施缺口和电池成本意味着混合动力汽车汽车和电动车在新兴市场占据主导地位,这种抑制效应在2030年及以后才会减弱。

細項分析

虽然混合动力专用自动变速箱预计年增率为10.62%,但到2024年,液压自排变速箱仍将占据汽车液压变速箱市场份额的40.23%。双结构设计意味着变矩器必须兼顾传统内燃机(引擎频繁重启考验锁定耐久性)和新型混合动力循环。像采埃孚(ZF)这样的原始设备製造商将电动马达整合到其8速变速箱中,并保留了纤薄的液压联轴器,以平稳地实现引擎嚙合併吸收扭矩峰值。虽然CVT正在成本受限的小型车中兴起,但自动手排变速箱仍仅供大型车辆使用,其优先考虑燃油经济性而非换檔品质。由于混合动力汽车在中价格分布的电气化产品中占据主导地位,即使纯液压装置的市场已趋于稳定,支援整合式电子离合器模组的变矩器在此期间的价值也可能有所提升。

混合动力变速箱的成长迫使供应商重新设计泵浦以减少寄生阻力,并开发可在低扭力条件下透过电力辅助运作的多模式锁定装置。变矩器壳体正在向高强度钢和复合铝过渡,以抵消快速离合器循环产生的热量。随着马达和引擎之间的扭矩传递加剧,软体整合变得至关重要。提供完整液压控制和硬体的一级供应商仍保持定价优势,而独立的变矩器製造商则面临利润压力。因此,汽车变速箱市场将青睐那些能够快速检验适用于全球平台的混合动力设计的公司。

乘用车将占据汽车液力变矩器销量的大部分,到 2024 年将占据 63.57% 的市场份额,而轻型商用车将以 8.28% 的复合年增长率增长最快。城市货运、食品配送和电子商务物流优先考虑自动变速箱,以减少驾驶员在走走停停的路线上的疲劳。车队管理者对总拥有成本的关注推动了对与 8 速变速箱搭配使用的液力变矩器的需求,这些变速箱承诺节省燃料而无需高昂的购买成本。在新兴市场,叫车服务也正在推动自动变速箱的发展,吸引不熟悉手排变速箱的年轻驾驶。相反,欧洲豪华乘用车买家越来越多地选择混合动力汽车和纯电动车,这些汽车可能没有传统的液力变矩器,造成了需求的微妙平衡。

重型商用车是最小的子类别,需要客製化的大容量变矩器来承受极端扭力和高热负荷。由于续航里程和功率密度的限制,矿山运输和市政除雪等应用一直难以全面电气化。艾里逊最新系列产品采用一檔锁定和双扭力避震器,可实现更平稳的启动并减少离合器磨损。儘管初始成本较高,但这些特性仍然吸引驾驶员放弃手排。因此,即使乘用车电气化进程加速,汽车变速箱市场仍受益于商用车市场的韧性。

区域分析

到2024年,亚太地区将占据汽车液力变矩器市场的38.76%,预计2030年将以每年7.27%的速度成长。像陕西法士特这样的本土龙头企业正在扩大其混合动力卡车的液力变矩器产品组合,而日本则透过加特可位于广州的百万级产能工厂供应尖端的CVT变速箱。在印度,艾里逊清奈工厂产能翻番,正在加速自动变速箱的普及,进一步巩固该地区的核心地位。具有成本竞争力的製造能力和深厚的供应链,使亚太地区成为成熟液压变速箱和新型混合动力变矩器的全球采购中心。

北美市场呈现喜忧参半的局面。基准自动变速箱的广泛采用使销量保持强劲,但电气化正将变矩器推向更专业的细分市场。商用车市场仍然强劲,因为都市区货运车队寻求比手排变速箱更可靠的升级,而像佩卡这样的原始设备製造商在其八速变速箱中整合了节油锁定功能。欧洲严格的二氧化碳排放法规正在加速向混合动力和纯电动车的转变。采埃孚为宝马车型提供的插电式混合动力装置体现了该地区在将电动马达整合到变速箱方面的领先地位,并以逐步发展的方式支持变矩器需求。这两个市场都表明,法规正在同时抑制和再形成汽车变速箱市场,而不是完全淘汰它。

南美、中东和非洲在自动变速箱普及方面落后,但随着都市化进程的深入,预计需求将迎头赶上。为避免进口关税而进行的本地组装正在兴起,Tiaong 正在探索合资企业,以提供成本敏感的产品。儘管道路燃油补贴仍然存在,但巴西和海湾地区的车队营运商越来越多地选择自动变速箱,以留住驾驶员并延长车辆运作。虽然这些地区目前规模较小,但它们补充了主流收益中心,并分散了变速箱供应商的地理风险。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 新兴市场自排变速箱采用率快速成长

- 混合动力和轻度混合动力车的繁荣推动了对锁定式变矩器的需求

- 原始设备製造商面临提高 8 速/10 速变速箱燃油经济性的压力

- 后疫情时代全球轻型商用车产量復苏

- 下一代高温自动变速箱油实现高失速扭矩

- NVH法规推动先进多阻尼转换器设计

- 市场限制

- BEV动力传动系统无需扭力转换器

- 小型轿车中DCT/CVT份额不断增加

- 铝和铜价格波动推高零件成本

- 电子离合器模组取代混合动力汽车中的转换器

- 价值/供应链分析

- 监管状况

- 技术展望

- 五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场规模及成长预测

- 按传动类型

- 自动手排变速箱(AMT)

- 双离合器变速箱(DCT)

- 无段变速箱(CVT)

- 液压自排变速箱(传统AT)

- 混合动力专用AT(电子扭力转换器)

- 按车辆类型

- 搭乘用车

- 轻型商用车

- 大型商用车

- 按组件

- 泵浦

- 涡轮

- 定子

- 锁定离合器

- 按杂交程度

- 仅限 ICE

- 48V轻度混合动力

- 全/强混合动力

- 插电式混合动力

- 按销售管道

- OEM

- 售后市场

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 埃及

- 奈及利亚

- 其他中东和非洲地区

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- Aisin Corporation

- BorgWarner Inc.

- ZF Friedrichshafen AG

- Schaeffler AG(LuK)

- Jatco Ltd.

- Allison Transmission Holdings

- Hyundai Transys Co., Ltd.

- Continental AG

- Valeo SA

- Punch Powertrain

- Exedy Corporation

- Kapec Co. Ltd.

- Precision Industries

- Sonnax Transmission Company

- Voith GmbH & Co. KGaA

- Subaru Corporation

- Robert Bosch GmbH

- General Motors(GM Powertrain)

第七章 市场机会与未来展望

The Automotive Torque Converter Market reached USD 28.07 billion in 2025 and is forecast to climb to USD 33.62 billion by 2030, translating into a steady 3.67% CAGR.

The measured headline pace belies a deep transition as hybrid powertrains, multi-speed automatics, and rising commercial-vehicle production reshape demand patterns. Automatic-transmission adoption in emerging economies keeps baseline volumes rising, while developed regions channel investment toward hybrid-dedicated converter architectures that improve fuel economy and emissions performance. Supply-chain near-shoring in North America, continued light-commercial expansion after the pandemic, and OEM pressure for eight- and ten-speed gearboxes add further momentum. Conversely, pure battery-electric drivetrains and the growing popularity of DCT and CVT technologies temper long-term outlooks in some passenger-car segments. Raw-material cost swings in aluminum and copper inject additional uncertainty into component margins.

Global Automotive Torque Converter Market Trends and Insights

Soaring Automatic-Transmission Penetration in Emerging Markets

Escalating urban congestion and rising disposable incomes sharply increase automatic-transmission uptake in large developing nations. China's automatic transmission is shifting millions of vehicles from manual to automatic transmission solutions. Similar momentum is visible in India, where Renault's competitively priced Kiger CVT places a fully automatic option within sub-10-lakh budgets, eroding the long-standing manual bias.Scale effects follow: as local volumes grow, unit costs fall, unlocking further penetration. Allison Transmission's USD 100 million expansion in Chennai aims to double output by 2027, demonstrating supplier commitment to this demand wave. Regional champions such as Shaanxi Fast Auto Drive Group leverage entrenched manufacturing bases to capture incremental orders across commercial and passenger segments.

Hybrid & Mild-Hybrid Boom Drives Lock-up Torque-Converter Demand

Hybrid powertrains require converters with refined lock-up mechanisms that minimise slip during engine-off phases and enable seamless torque blending. Ford's Ranger PHEV places an e-motor and separator clutch ahead of the converter, highlighting new integration layouts that increase lock-up duty cycles. ZF's plug-in hybrid transmission for BMW's X5 xDrive40e replaces conventional converters with integrated motors, yet still demonstrates how hydraulic coupling principles evolve in electrified systems, cutting fuel use by up to 70%. Stellantis already fields 30 European hybrid models, each deploying electrified dual-clutch transmissions that deliver a 20% CO2 cut. As hybrids bridge the affordability gap to full BEVs, the automotive torque converter market benefits from sustained lock-up component innovation.

BEV Drivetrains Eliminate Torque Converters

Pure electric vehicles use direct motor drive, sidelining traditional converters. BorgWarner's pivot to electric torque-vectoring modules for Polestar SUVs illustrates incumbent diversification away from hydraulic components. However, infrastructure gaps and battery costs keep hybrids and ICEs prevalent in emerging markets, softening the restraining effect until after 2030.

Other drivers and restraints analyzed in the detailed report include:

- OEM Pressure for 8-/10-Speed Fuel-Efficiency Upgrades

- Recovery of Global Light-Commercial Production Post-COVID

- Rising DCT/CVT Share in Compact Cars

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hybrid-dedicated automatics are forecast to grow 10.62% annually, while hydraulic automatics still held 40.23% of the automotive torque converter market share in 2024. The dual structure means converters must span legacy ICE duty and new hybrid cycles, where frequent engine restarts test lock-up durability. OEMs such as ZF embed electric motors into eight-speed boxes, retaining a slimmed hydraulic coupling that smooths engine engagement and absorbs torsional spikes. Automated manuals linger in specialised heavy-duty fleets because fuel efficiency outweighs shift quality, whereas CVTs gain ground in cost-constrained small cars. Over the period, converters supporting integrated e-clutch modules will capture incremental value even as pure hydraulic units plateau because hybrids dominate mid-price electrification offerings.

Hybrid transmission growth compels suppliers to redesign pumps for lower parasitic drag and develop multi-mode lock-ups that engage under electrically assisted low-torque conditions. Converter casings migrate toward high-strength steels and clad aluminium to manage added heat from rapid clutch cycling. Software integration becomes critical as torque hand-off between motor and engine intensifies. Tier-ones that provide complete hydraulic controls alongside hardware retain pricing power, while stand-alone converter makers face margin pressure. The automotive torque converter market therefore rewards firms able to validate hybrid-ready designs quickly for global platforms.

Passenger cars dominated revenue with a 63.57% of the automotive torque converter market share in 2024, yet light commercial vehicles are growing fastest at an 8.28% CAGR. Urban freight, food delivery, and e-commerce logistics prioritise automatic gearboxes that cut driver fatigue in stop-start routes. Fleet managers focus on total cost of ownership, boosting demand for converters paired with eight-speed boxes that promise fuel savings without steep acquisition costs. In emerging markets, ride-hailing services also push for automatic transmissions that appeal to younger drivers unfamiliar with manuals. Conversely, premium European passenger-car buyers increasingly choose hybrids or BEVs where traditional converters may be absent, creating a nuanced demand balance.

Heavy commercial vehicles, though the smallest subgroup, require bespoke high-capacity converters that withstand extreme torque and high thermal loads. Due to range and power density constraints, applications such as mining haulage or municipal snow removal are resistant to full electrification. Allison's latest series offers first-gear lock-up and twin torsional dampers, delivering smoother launches and reducing clutch wear. Such attributes encourage operators to shift from manuals despite higher upfront costs. The automotive torque converter market therefore benefits from commercial-segment resilience even as passenger-car electrification accelerates.

The Automotive Torque Converter Market Report is Segmented by Transmission Type (Automated Manual Transmission, Dual-Clutch Transmission, and More), Vehicle Type (Passenger Vehicle, Light Commercial Vehicles, and More), Component ( Pump, Turbine, and More), Hybridization Level ( ICE-Only, and More), Sales Channel (OEM, and Aftermarket) and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific held 38.76% of the automotive torque converter market revenue in 2024 and should grow 7.27% per year to 2030, supported by China's ascent as the top vehicle exporter and sustained commercial-vehicle demand. Local champions such as Shaanxi Fast Auto Drive Group broaden converter portfolios for hybrid trucks, while Japan supplies cutting-edge CVT output via JATCO's one million-unit Guangzhou plant. India's accelerating automatic-transmission uptake, highlighted by Allison's Chennai capacity doubling, further cements the region's central role. Cost-competitive manufacturing and deep supply chains make APAC the nexus of global sourcing for mature hydraulic and new hybrid converter designs.

North America presents a mixed landscape: high baseline automatic penetration keeps unit volumes solid, yet electrification pushes converters into more specialised niches. Commercial-vehicle segments remain robust as urban freight fleets seek reliability upgrades over manual gearboxes, and OEMs such as PACCAR integrate fuel-saving lock-up features across eight-speed boxes. Europe's stringent CO2 rules quicken the pivot toward hybrids and BEVs. ZF's plug-in hybrid units for BMW models exemplify the region's leadership in integrating electric motors inside transmissions, sustaining converter demand in progressively evolved forms. Both markets illustrate how regulation simultaneously restrains and reshapes the automotive torque converter market rather than eliminating it outright.

South America, the Middle East, and Africa trail on automatic-transmission penetration yet promise catch-up demand as urbanisation deepens. Local assembly to bypass import tariffs gains momentum, with tier-ones scouting joint ventures for cost-sensitive offerings. Fleet operators in Brazil and the Gulf increasingly choose automatic gearboxes for driver retention and uptime, even where road-fuel subsidies persist. Although small today, these regions complement mainstream revenue centres and diversify geographic risk for converter suppliers.

- Aisin Corporation

- BorgWarner Inc.

- ZF Friedrichshafen AG

- Schaeffler AG (LuK)

- Jatco Ltd.

- Allison Transmission Holdings

- Hyundai Transys Co., Ltd.

- Continental AG

- Valeo SA

- Punch Powertrain

- Exedy Corporation

- Kapec Co. Ltd.

- Precision Industries

- Sonnax Transmission Company

- Voith GmbH & Co. KGaA

- Subaru Corporation

- Robert Bosch GmbH

- General Motors (GM Powertrain)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Soaring Automatic-transmission Penetration In Emerging Markets

- 4.2.2 Hybrid And Mild-hybrid Boom Drives Lock-up Torque-converter Demand

- 4.2.3 OEM Pressure For 8-/10-speed Fuel-efficiency Upgrades

- 4.2.4 Recovery Of Global Light-commercial Production Post-covid

- 4.2.5 Next-gen High-temperature ATF Fluids Enable Higher Stall Torque

- 4.2.6 NVH Regulations Spur Advanced Multi-damping Converter Designs

- 4.3 Market Restraints

- 4.3.1 BEV Drivetrains Eliminate Torque Converters

- 4.3.2 Rising DCT/CVT Share In Compact Cars

- 4.3.3 Volatile Aluminum and Copper Prices Inflate BOM Cost

- 4.3.4 E-clutch Modules Replacing Converters In Dedicated Hybrids

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Transmission Type

- 5.1.1 Automated Manual Transmission (AMT)

- 5.1.2 Dual-Clutch Transmission (DCT)

- 5.1.3 Continuously Variable Transmission (CVT)

- 5.1.4 Hydraulic Automatic (Traditional AT)

- 5.1.5 Hybrid Dedicated AT (e-Torque Converter)

- 5.2 By Vehicle Type

- 5.2.1 Passenger Vehicles

- 5.2.2 Light Commercial Vehicles

- 5.2.3 Heavy Commercial Vehicles

- 5.3 By Component

- 5.3.1 Pump

- 5.3.2 Turbine

- 5.3.3 Stator

- 5.3.4 Lock-up Clutch

- 5.4 By Hybridization Level

- 5.4.1 ICE-Only

- 5.4.2 48-V Mild Hybrid

- 5.4.3 Full/Strong Hybrid

- 5.4.4 Plug-in Hybrid

- 5.5 By Sales Channel

- 5.5.1 OEM

- 5.5.2 Aftermarket

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Spain

- 5.6.3.5 Russia

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 South Africa

- 5.6.5.4 Egypt

- 5.6.5.5 Nigeria

- 5.6.5.6 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Aisin Corporation

- 6.4.2 BorgWarner Inc.

- 6.4.3 ZF Friedrichshafen AG

- 6.4.4 Schaeffler AG (LuK)

- 6.4.5 Jatco Ltd.

- 6.4.6 Allison Transmission Holdings

- 6.4.7 Hyundai Transys Co., Ltd.

- 6.4.8 Continental AG

- 6.4.9 Valeo SA

- 6.4.10 Punch Powertrain

- 6.4.11 Exedy Corporation

- 6.4.12 Kapec Co. Ltd.

- 6.4.13 Precision Industries

- 6.4.14 Sonnax Transmission Company

- 6.4.15 Voith GmbH & Co. KGaA

- 6.4.16 Subaru Corporation

- 6.4.17 Robert Bosch GmbH

- 6.4.18 General Motors (GM Powertrain)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment