|

市场调查报告书

商品编码

1892903

汽车侧帘式气囊市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Automotive Curtain Airbags Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

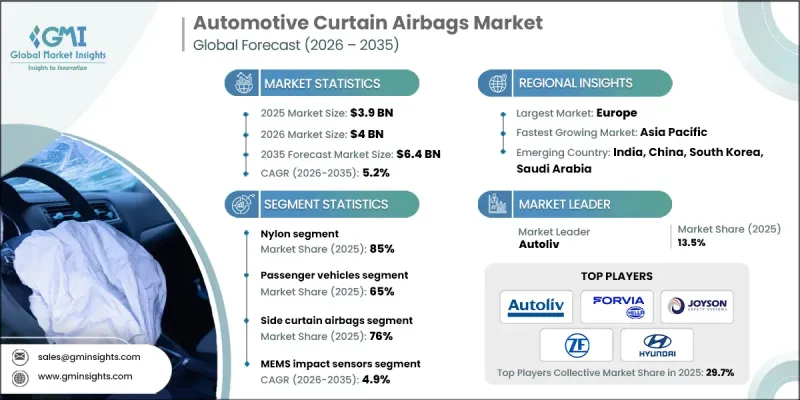

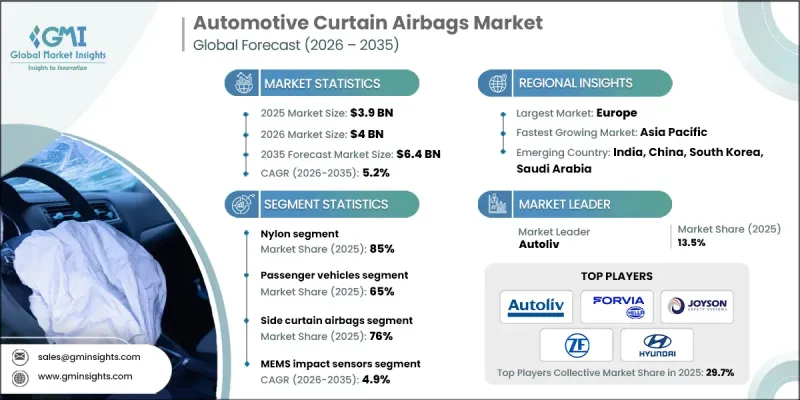

2025 年全球汽车侧帘式安全气囊市场价值为 39 亿美元,预计到 2035 年将以 5.2% 的复合年增长率增长至 64 亿美元。

SUV和跨界车销售的稳定成长是主要驱动力,因为更宽敞的座舱和更高的车顶线条增加了对头部保护系统的需求。汽车製造商正逐步将侧帘式气囊作为标准配置,使全球消费者都能以具竞争力的价格获得先进的安全解决方案。电动车滑板式平台的演进正在重塑车辆架构,影响感测器和安全系统的布局。这种转变使得侧帘式气囊能够更好地集成,促使供应商设计更轻巧、更紧凑的充气式气囊,并采用更先进的纺织材料,以便在日益狭小的座舱空间内提供强有力的保护。随着全球多个地区法规的日益严格,汽车製造商几乎必须在所有车型级别中提供侧面碰撞保护。消费者对车辆安全的日益关注也促使汽车製造商透过配备符合地区标准的先进被动安全系统来打造差异化产品线,从而吸引那些优先考虑全面乘员保护的消费者。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 39亿美元 |

| 预测值 | 64亿美元 |

| 复合年增长率 | 5.2% |

到2025年,尼龙材料市占率将达到85%,预计到2035年将以4.2%的复合年增长率成长。未来,尼龙-聚酯混纺织物、新一代尼龙配方以及生物基聚酰胺的研发有望在提升性能的同时,协助实现永续发展目标。纤维化学的进步正不断缩小尼龙与其他替代材料之间的性能差距。

2025年,乘用车细分市场占据65%的市场份额,预计2026年至2035年将以5.5%的复合年增长率成长。不同车型等级的应用模式有所不同:高阶车型普遍采用侧帘式气囊系统,而中阶车型则迅速普及。入门级市场仍面临成本限制,但随着监管要求的加强以及全球消费者对安全性的日益重视,整体应用率正在上升。

预计到2025年,美国汽车侧帘式气囊市场规模将达8.715亿美元。监管机构不断提高侧面碰撞和弹射保护测试的要求,鼓励製造商采用更先进的侧帘式气囊,这些气囊针对大型SUV和皮卡进行了最佳化。与早期设计相比,这些升级后的系统覆盖范围更广,翻滚保护性能更佳。

目录

第一章:方法论

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 越来越重视乘员安全合规性

- SUV和跨界车的普及率不断上升

- 自适应安全气囊系统的技术进步

- 新兴汽车产业中心的生产扩张

- 转向可持续材料

- 产业陷阱与挑战

- 高系统整合度和组件成本

- 新兴市场安全监管有限

- 市场机会

- 自动驾驶和半自动驾驶汽车的成长

- 售后市场更换和召回驱动的需求

- 拓展至商用车和车队领域

- 以永续发展为导向的采购转变

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 美国-FMVSS 214侧撞保护

- 加拿大 - CMVSS 214 侧碰撞保护

- 欧洲

- 德国-联合国第135号法规规定的桿侧碰撞保护

- 英国-联合国欧洲经济委员会第95号法规侧向衝击保护

- 法国-欧盟通用安全法规 2019/2144

- 义大利-联合国第21号法规室内配件安全

- 西班牙-欧盟法规 661/2009 通用车辆安全

- 亚太地区

- 中国GB 20071侧撞保护

- 印度-AIS-099 侧面碰撞法规

- 日本新车安全评鑑协会(JNCAP)侧面撞击安全性能测试规程

- 澳洲-ADR 72 侧面碰撞保护

- 韩国KMVSS侧撞保护

- 拉丁美洲

- 巴西-Contran 决议 518 侧面碰撞保护

- 墨西哥-NOM-194-SCFI车辆安全标准

- 阿根廷-IRAM-AITA 1-20 侧面碰撞标准

- 中东和非洲

- 南非-SANS 20079 侧撞保护

- 沙乌地阿拉伯-SASO 2915车辆安全法规

- 阿联酋-阿联酋.S 5010-5 车辆碰撞保护

- 土耳其-联合国欧洲经济委员会第95号法规侧面撞击保护

- 北美洲

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 目前技术

- 新兴技术

- 价格趋势

- 副产品

- 按地区

- 生产统计

- 生产中心

- 消费中心

- 进出口

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

- 未来市场展望及机会

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估算与预测:依类型划分,2022-2035年

- 侧帘式气囊

- 尼龙

- 聚酯纤维

- 前侧帘式气囊

- 尼龙

- 聚酯纤维

- 后排侧帘式气囊

- 尼龙

- 聚酯纤维

第六章:市场估算与预测:依材料划分,2022-2035年

- 尼龙

- 聚酯纤维

第七章:市场估算与预测:依感测器类型划分,2022-2035年

- MEMS衝击感测器

- 翻滚陀螺仪感应器

- 统一安全ECU

第八章:市场估算与预测:依车辆类型划分,2022-2035年

- 搭乘用车

- 掀背车

- 轿车

- SUV

- 商用车辆

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车辆(HCV)

第九章:市场估算与预测:依销售管道划分,2021-2034年

- OEM

- 售后市场

第十章:市场估计与预测:依地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧

- 葡萄牙

- 克罗埃西亚

- 比荷卢经济联盟

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 新加坡

- 泰国

- 印尼

- 越南

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

- 土耳其

第十一章:公司简介

- 全球参与者

- Autoliv

- ZF Friedrichshafen

- Joyson Safety Systems

- Continental

- Hyundai

- Toyoda Gosei

- Daicel

- Bosch Passive Safety Systems

- Magna International

- Denso

- Valeo

- Delphi Automotive / BorgWarner

- 区域玩家

- Forvia Hella

- Kolon Industries

- Nihon Plast

- Porcher Industries

- Toray Industries

- Sumitomo

- SEIREN

- Toyota Boshoku

- Ashimori Industry

- U-Shin

- 新兴及小众玩家

- Yanfeng Automotive Trim Systems

- Wuhu Ruili Automobile Airbag

- ARC Automotive

- Tata AutoComp Systems

- Ningbo Joyson Electronic

- Changzhou Changrui

The Global Automotive Curtain Airbags Market was valued at USD 3.9 billion in 2025 and is estimated to grow at a CAGR of 5.2% to reach USD 6.4 billion by 2035.

Steady growth in SUV and crossover sales is a major driver, as wider cabins and taller rooflines increase the need for head protection systems. Automakers are progressively equipping more vehicles with curtain airbags as standard features, making advanced safety solutions available at competitive pricing worldwide. The evolution of EV skateboard platforms is reshaping vehicle architecture, influencing how sensors and safety systems are positioned. This shift enables better integration of curtain airbags, prompting suppliers to engineer lighter, compact inflatable designs and improved textile materials capable of providing strong protection in increasingly constrained cabin spaces. With global regulations tightening across multiple regions, OEMs are required to deliver side-impact protection across nearly all vehicle classes. Rising consumer focus on vehicle safety is also pushing automakers to differentiate their lineups with advanced passive safety systems that comply with regional standards and appeal to buyers who prioritize comprehensive occupant protection.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $3.9 Billion |

| Forecast Value | $6.4 Billion |

| CAGR | 5.2% |

The nylon material segment accounted for an 85% share in 2025 and is projected to grow at a CAGR of 4.2% through 2035. Future developments in nylon-polyester hybrids, next-generation nylon formulations, and bio-based polyamides are expected to improve performance while addressing sustainability goals. Advancements in fiber chemistry continue to narrow the performance gap between nylon and alternative materials.

The passenger vehicle segment held a 65% share in 2025 and is anticipated to grow at a CAGR of 5.5% from 2026 to 2035. Adoption patterns vary depending on vehicle class: high-end models have widespread use of curtain airbag systems, while mid-range vehicles have seen rapid integration. Entry-level markets still face cost limitations, but overall adoption is rising as regulatory requirements strengthen and as safety becomes a higher priority among consumers worldwide.

US Automotive Curtain Airbags Market reached USD 871.5 million in 2025. Regulatory authorities have been expanding requirements for side-impact and ejection mitigation testing, encouraging manufacturers to adopt more advanced curtain airbags optimized for larger SUVs and pickup trucks. These updated systems offer broader coverage and better rollover performance than earlier designs.

Key companies operating in the Automotive Curtain Airbags Market include Autoliv, Continental, Hella, Hyundai, Joyson Safety Systems, Kolon Industries, Neaton Auto Products Manufacturing, Toyoda Gosei, and ZF Friedrichshafen. Companies within the Automotive Curtain Airbags Market are strengthening their competitive presence by advancing material technology, reducing system weight, and developing compact inflators that improve deployment efficiency. Many manufacturers are collaborating closely with automakers to design airbag systems tailored to new EV platforms and evolving vehicle geometries. Investments in improved textile engineering, enhanced sensor integration, and high-performance inflator mechanisms form a major part of ongoing R&D. Firms are also prioritizing compliance with global regulatory updates to secure broader OEM adoption. Expanding production capacity in strategic regions, focusing on cost-efficient manufacturing, and ensuring consistent quality control help companies maintain strong international footprints.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2022-2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Material

- 2.2.4 Sensor

- 2.2.5 Vehicle

- 2.2.6 Sales channel

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing emphasis on occupant safety compliance

- 3.2.1.2 Rising adoption of SUVs and crossovers

- 3.2.1.3 Technological advancements in adaptive airbag systems

- 3.2.1.4 Production expansion in emerging automotive hubs

- 3.2.1.5 Shift toward sustainable materials

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High system integration and component costs

- 3.2.2.2 Limited safety regulations in emerging markets

- 3.2.3 Market opportunities

- 3.2.3.1 Growth in autonomous and semi-autonomous vehicles

- 3.2.3.2 Aftermarket replacement and recall-driven demand

- 3.2.3.3 Expansion into commercial vehicles and fleets

- 3.2.3.4 Sustainability-driven procurement shifts

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 United States- FMVSS 214 side impact protection

- 3.4.1.2 Canada- CMVSS 214 side impact protection

- 3.4.2 Europe

- 3.4.2.1 Germany-UN regulation 135 pole side impact protection

- 3.4.2.2 United Kingdom-UNECE regulation 95 lateral impact protection

- 3.4.2.3 France-EU general safety regulation 2019/2144

- 3.4.2.4 Italy-UN regulation 21 interior fittings safety

- 3.4.2.5 Spain-EU regulation 661/2009 general vehicle safety

- 3.4.3 Asia Pacific

- 3.4.3.1 China-GB 20071 side impact protection

- 3.4.3.2 India-AIS-099 side impact regulation

- 3.4.3.3 Japan-JNCAP side impact crashworthiness protocol

- 3.4.3.4 Australia-ADR 72 side impact protection

- 3.4.3.5 South Korea-KMVSS side impact crash protection

- 3.4.4 Latin America

- 3.4.4.1 Brazil-Contran resolution 518 side impact protection

- 3.4.4.2 Mexico-NOM-194-SCFI vehicle safety standard

- 3.4.4.3 Argentina-IRAM-AITA 1-20 side impact standard

- 3.4.5 Middle East & Africa

- 3.4.5.1 South Africa-SANS 20079 side impact protection

- 3.4.5.2 Saudi Arabia-SASO 2915 vehicle safety regulation

- 3.4.5.3 UAE-UAE.S 5010-5 vehicle crash protection

- 3.4.5.4 Turkey-UNECE regulation 95 side impact protection

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technology

- 3.7.2 Emerging technology

- 3.8 Price trends

- 3.8.1 By Product

- 3.8.2 By region

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Future market outlook & opportunities

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Type, 2022 - 2035 ($Mn, Units)

- 5.1 Key trends

- 5.2 Side curtain airbags

- 5.2.1 Nylon

- 5.2.2 Polyester

- 5.3 Front curtain airbags

- 5.3.1 Nylon

- 5.3.2 Polyester

- 5.4 Rear curtain airbags

- 5.4.1 Nylon

- 5.4.2 Polyester

Chapter 6 Market Estimates & Forecast, By Material, 2022 - 2035 ($Mn, Units)

- 6.1 Key trends

- 6.2 Nylon

- 6.3 Polyester

Chapter 7 Market Estimates & Forecast, By Sensor, 2022 - 2035 ($Mn, Units)

- 7.1 Key trends

- 7.2 MEMS Impact Sensors

- 7.3 Rollover Gyro Sensors

- 7.4 Unified Safety ECUs

Chapter 8 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Mn, Units)

- 8.1 Key trends

- 8.2 Passenger vehicles

- 8.2.1 Hatchback

- 8.2.2 Sedan

- 8.2.3 SUVs

- 8.3 Commercial vehicles

- 8.3.1 Light commercial vehicles (LCVs)

- 8.3.2 Medium commercial vehicles (MCVs)

- 8.3.3 Heavy commercial vehicles (HCVs)

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.3.8 Portugal

- 10.3.9 Croatia

- 10.3.10 Benelux

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Singapore

- 10.4.7 Thailand

- 10.4.8 Indonesia

- 10.4.9 Vietnam

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Turkey

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Autoliv

- 11.1.2 ZF Friedrichshafen

- 11.1.3 Joyson Safety Systems

- 11.1.4 Continental

- 11.1.5 Hyundai

- 11.1.6 Toyoda Gosei

- 11.1.7 Daicel

- 11.1.8 Bosch Passive Safety Systems

- 11.1.9 Magna International

- 11.1.10 Denso

- 11.1.11 Valeo

- 11.1.12 Delphi Automotive / BorgWarner

- 11.2 Regional Players

- 11.2.1 Forvia Hella

- 11.2.2 Kolon Industries

- 11.2.3 Nihon Plast

- 11.2.4 Porcher Industries

- 11.2.5 Toray Industries

- 11.2.6 Sumitomo

- 11.2.7 SEIREN

- 11.2.8 Toyota Boshoku

- 11.2.9 Ashimori Industry

- 11.2.10 U-Shin

- 11.3 Emerging & Niche Players

- 11.3.1 Yanfeng Automotive Trim Systems

- 11.3.2 Wuhu Ruili Automobile Airbag

- 11.3.3 ARC Automotive

- 11.3.4 Tata AutoComp Systems

- 11.3.5 Ningbo Joyson Electronic

- 11.3.6 Changzhou Changrui