|

市场调查报告书

商品编码

1892912

单相重合器市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Single Phase Recloser Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

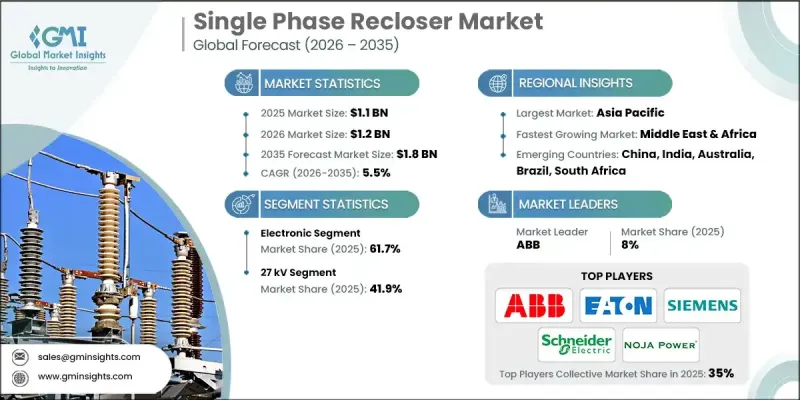

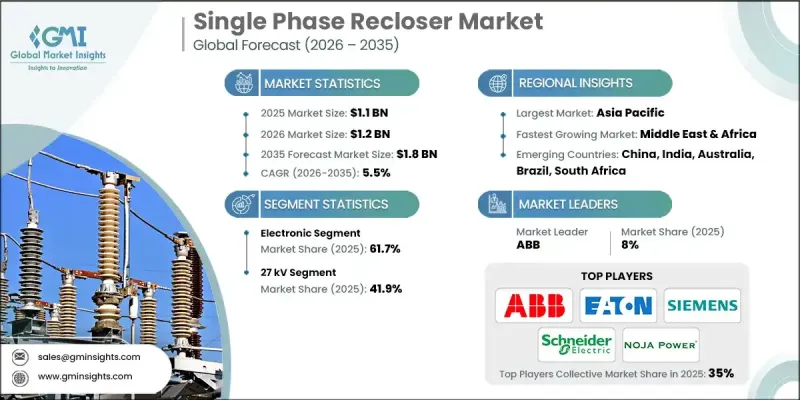

2025 年全球单相重合闸市场价值为 11 亿美元,预计到 2035 年将以 5.5% 的复合年增长率成长至 18 亿美元。

老旧配电网路的持续现代化改造仍然是推动单相重合器应用的关键因素。全球电力公司正在升级现有基础设施,以提高供电可靠性并缩短停电时间,尤其是在单相馈线广泛使用的农村和郊区。这些装置能够自动隔离故障区段并恢復供电,这对于经常遭受天气相关干扰的地区至关重要。随着全球电力产业向更智慧、更具韧性的电网结构转型,重合器正成为提升运作性能和维持稳定供电的必要组件。再生能源渗透率的不断提高也增加了电力流动的复杂性,从而增加了对先进保护设备的需求。自动化故障管理、快速復原能力以及与分散式能源的兼容性,增强了单相重合器在半城市和农村地区的实用性。发展中地区电气化进程的推进进一步支撑了这一需求,因为这些解决方案提供了一种经济高效的替代方案,可以取代部署成本更高的多相繫统,并帮助电力公司在向服务不足地区扩展服务的同时减少维护需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 11亿美元 |

| 预测值 | 18亿美元 |

| 复合年增长率 | 5.5% |

2025年,电子控制单相重合闸市占率达到61.7%,预计到2035年将以5.5%的复合年增长率成长。这些数位系统与智慧电网框架和物联网平台的整合日益增强,从而实现了更高级的监控、自动化和网路安全功能。它们与分析工具和远端控制功能的兼容性,使其成为采用现代电网架构的电力公司不可或缺的工具。

预计到 2035 年,15 kV 额定电压等级的电压等级将以 5% 的复合年增长率成长。非洲和亚太地区部分地区的电气化进程不断加快,持续推动对这些设备的需求,尤其是在农村地区,可靠性、简化的安装以及与现有馈线的兼容性是电力公司优先考虑的因素。

预计到2025年,美国单相重合闸市场将占据65%的份额,创造1.1亿美元的收入。美国和加拿大对电网自动化的大规模投资以及再生能源的扩张仍然是推动市场发展的关键因素。在联邦政府旨在提高电网韧性的资金支持下,该地区的公用事业公司正在优先考虑能够与SCADA、物联网和其他先进通讯系统整合的智慧设备。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 监管环境

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL 分析

- 新兴机会与趋势

- 数位化和物联网集成

- 新兴市场渗透

第四章:竞争格局

- 介绍

- 公司市占率分析

- 策略倡议

- 竞争性标竿分析

- 战略仪錶板

- 创新与技术格局

第五章:市场规模及预测:依控制方式划分,2022-2035年

- 电子的

- 油压

第六章:市场规模与预测:依中断类型划分,2022-2035年

- 油

- 真空

第七章:市场规模及预测:依电压等级划分,2022-2035年

- 15千伏

- 27千伏

- 38千伏

第八章:市场规模及预测:依地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 拉丁美洲

- 巴西

- 阿根廷

第九章:公司简介

- ABB

- ARTECHE

- Eaton Corporation

- ENSTO

- ENTEC Electric & Electronic

- G&W Electric

- Hubbell

- Hughes Power System

- L&R Electric Group

- NOJA Power Switchgear Pty Ltd

- Rockwill

- S&C Electric Company

- Schneider Electric

- Shinsung Industrial Electric

- Siemens

- Tavrida Electric

- Southern States LLC

- Joslyn Hi-Voltage

- Korea ENTEC

- Goto Electrical Co., Ltd.

- Cooper Power Systems

The Global Single Phase Recloser Market was valued at USD 1.1 billion in 2025 and is estimated to grow at a CAGR of 5.5% to reach USD 1.8 billion by 2035.

The ongoing modernization of aging power distribution networks remains a central factor fueling the adoption of single-phase reclosers. Utilities worldwide are upgrading existing infrastructure to enhance service reliability and shorten outage periods, especially in rural and suburban regions where single-phase feeders are widely used. These devices automatically isolate faulted sections and restore service, which is critical in areas that frequently experience weather-related disturbances. As the global power sector moves toward smarter and more resilient grid structures, reclosers are becoming a necessary component for improving operational performance and maintaining consistent electricity delivery. The growing penetration of renewable energy sources is also adding complexity to power flows, increasing the need for advanced protective equipment. Automated fault management, rapid restoration capabilities, and compatibility with distributed energy resources strengthen the utility of single-phase reclosers in semi-urban and rural areas. Expanding electrification efforts in developing regions further support demand, as these solutions offer a cost-effective alternative to deploying more expensive multi-phase systems and help utilities reduce maintenance needs while expanding into underserved areas.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.1 Billion |

| Forecast Value | $1.8 Billion |

| CAGR | 5.5% |

The electronically controlled single-phase reclosers segment accounted for a 61.7% share in 2025 and is forecasted to grow at a 5.5% CAGR through 2035. These digital systems increasingly integrate with smart grid frameworks and IoT platforms, enabling advanced forms of monitoring, automation, and cybersecurity. Their compatibility with analytics tools and remote-control functions makes them essential for utilities adopting modern grid architectures.

The 15 kV rating category is projected to grow at a CAGR of 5% by 2035. Rising electrification in parts of Africa and Asia-Pacific continues to boost demand for these devices, especially in rural applications where reliability, simplified installation, and compatibility with existing feeder lines are priorities for utilities.

U.S. Single Phase Recloser Market held a 65% share in 2025, generating USD 110 million. Large-scale investments in grid automation and the expansion of renewable power sources remain key drivers in both the U.S. and Canada. Utilities across the region are prioritizing smart devices capable of integrating with SCADA, IoT, and other advanced communication systems, supported by federal funding targeted at improving grid resilience.

Prominent companies active in the Global Single Phase Recloser Market include ABB, Eaton Corporation, ARTECHE, ENSTO, ENTEC Electric & Electronic, G&W Electric, Hubbell, NOJA Power Switchgear Pty Ltd, Rockwill, Schneider Electric, Siemens, Hughes Power System, S&C Electric Company, L&R Electric Group, Shinsung Industrial Electric, Tavrida Electric, Southern States LLC, Joslyn Hi-Voltage, Goto Electrical Co., Ltd., Korea ENTEC, and Cooper Power Systems. Key strategies adopted by leading companies in the Single Phase Recloser Market focus on improving digital intelligence, strengthening product durability, and enhancing interoperability with modern grid systems. Many manufacturers are prioritizing the development of advanced control platforms that support remote diagnostics, automated operations, and cybersecurity features. Companies are also investing in ruggedized designs suitable for harsh outdoor environments and expanding offerings that integrate seamlessly with smart grid technologies. Partnerships with utilities help accelerate product testing and deployment, while continuous updates to communication protocols ensure compatibility with SCADA, IoT, and DER management systems.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022 - 2035

- 2.1.1 Business trends

- 2.1.2 Control trends

- 2.1.3 Interruption trends

- 2.1.4 Voltage rating trends

- 2.1.5 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technology factors

- 3.6.5 environmental factors

- 3.6.6 Legal factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digitalization and IoT integration

- 3.7.2 Emerging market penetration

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2025

- 4.3 Strategic initiatives

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Control, 2022 - 2035 (USD Million, Units)

- 5.1 Key trends

- 5.2 Electronic

- 5.3 Hydraulic

Chapter 6 Market Size and Forecast, By Interruption, 2022 - 2035 (USD Million, Units)

- 6.1 Key trends

- 6.2 Oil

- 6.3 Vacuum

Chapter 7 Market Size and Forecast, By Voltage Rating, 2022 - 2035 (USD Million, Units)

- 7.1 Key trends

- 7.2 15 kV

- 7.3 27 kV

- 7.4 38 kV

Chapter 8 Market Size and Forecast, By Region, 2022 - 2035 (USD Million, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 France

- 8.3.3 UK

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 South Africa

- 8.5.3 UAE

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 ARTECHE

- 9.3 Eaton Corporation

- 9.4 ENSTO

- 9.5 ENTEC Electric & Electronic

- 9.6 G&W Electric

- 9.7 Hubbell

- 9.8 Hughes Power System

- 9.9 L&R Electric Group

- 9.10 NOJA Power Switchgear Pty Ltd

- 9.11 Rockwill

- 9.12 S&C Electric Company

- 9.13 Schneider Electric

- 9.14 Shinsung Industrial Electric

- 9.15 Siemens

- 9.16 Tavrida Electric

- 9.17 Southern States LLC

- 9.18 Joslyn Hi-Voltage

- 9.19 Korea ENTEC

- 9.20 Goto Electrical Co., Ltd.

- 9.21 Cooper Power Systems