|

市场调查报告书

商品编码

1913276

消费品市场可程式物质的机会、成长驱动因素、产业趋势分析及预测(2026-2035)Programmable Matter for Consumer Products Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

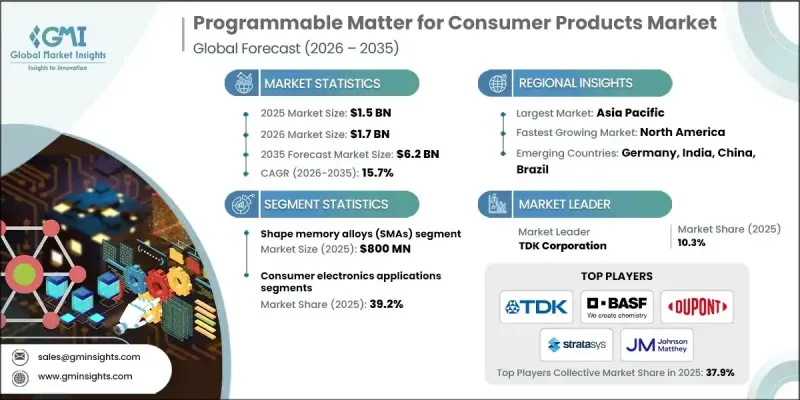

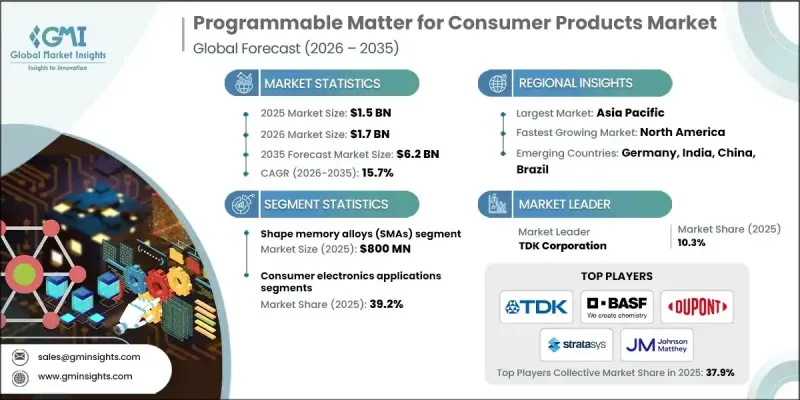

全球消费品可编程物质市场预计到 2025 年价值 15 亿美元,到 2035 年达到 62 亿美元,年复合成长率为 15.7%。

材料科学和响应技术的快速发展正在改变消费品的设计、製造和体验方式。国防、航太和公共研究机构的大量资金投入正在加速创新,并逐步将这些技术转化为消费应用。研究重点在于能够回应外部刺激的材料,使其具备自调节、适应性和功能转换等特性。随着先进製造能力的不断成熟,商业化门槛正在降低,规模化生产也变得越来越可行。消费者对智慧、适应性和个人化产品的兴趣日益浓厚,推动了这类产品在各个终端应用领域的普及。企业正在利用材料科学、电子学和数位系统之间的跨学科合作,开拓新的应用场景。技术转移框架在将创新成果从受控的研究环境推向消费市场方面发挥着至关重要的作用。资金、基础设施和消费者需求的整合,正使可程式材料成为下一代消费品领域的一股变革力量。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 15亿美元 |

| 预测金额 | 62亿美元 |

| 复合年增长率 | 15.7% |

形状记忆合金市场预计2025年将达到8亿美元。政府对智慧材料研究的长期公共投资正在推动製造技术的进步,并加速其大规模商业化应用。政府支持的研究机构不断拓展对热和机械刺激有反应的合金的应用范围,能源机构也认识到它们在支持环境高效技术方面的潜力。

到2025年,家用电器领域将占据39.2%的市场。学术界和产业界的持续研究正在推动可重编程材料的创新,从而使电子消费品具备自适应功能。智慧纺织品和可穿戴解决方案正越来越多地整合可编程材料,以提高性能、舒适度和用户互动。

预计到2025年,美国可程式物质消费品市场占有率将达到74.9%。强大的研发生态系统、早期技术应用以及对先进製造技术的持续投资巩固了其主导地位。材料科学、人工智慧和互联技术领域的积极研发活动将继续推动市场扩张。

目录

第一章调查方法和范围

第二章执行摘要

第三章业界考察

- 产业生态系分析

- 供应商情况

- 利润率

- 每个阶段的附加价值

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 对客製化和个人化的需求

- 材料科学和奈米技术的进展

- 与物联网和人工智慧的集成

- 产业潜在风险与挑战

- 高成本且製造流程复杂

- 能源消耗和控制系统

- 机会

- 下一代消费者介面

- 循环经济与产品寿命

- 成长驱动因素

- 成长潜力分析

- 未来市场趋势

- 科技与创新趋势

- 当前技术趋势

- 新兴技术

- 监管环境

- 标准和合规要求

- 区域法规结构

- 认证标准

- 差距分析

- 风险评估与缓解

- 波特分析

- PESTEL 分析

- 消费行为分析

- 购买模式

- 偏好分析

- 消费行为的区域差异

- 电子商务对购买决策的影响

第四章 竞争情势

- 介绍

- 公司市占率分析

- 按地区

- 企业矩阵分析

- 主要市场公司的竞争分析

- 竞争定位矩阵

- 重大进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 业务拓展计划

第五章 依技术类型分類的市场估算与预测(2022-2035 年)

- 形状记忆合金(SMA)

- 4D列印技术

- 智慧型自适应纺织品

- 电活性聚合物和材料

- 水凝胶和生物响应材料

- 相变材料(PCM)

第六章 市场估计与预测:依应用领域划分(2022-2035 年)

- 家用电器应用

- 整合到智慧型手机和行动装置中

- 穿戴式科技及配件

- 自适应显示技术

- 触觉介面系统

- 智慧纺织品和服装

- 适应性服装和时尚应用

- 运动表现监测设备

- 健康监测服装

- 互动娱乐纺织品

- 智慧家庭和家具

- 可重构家具系统

- 辅助设备

- 智慧表面技术

- 互动式介面集成

- 汽车消费功能

- 自适应内装系统

- 舒适性和空调控制应用

- 保健和健康产品

- 穿戴式健康监测设备

- 自适应医疗设备

- 治疗和復健系统

- 为老年人和身心障碍者提供辅助产品

- 食品/包装应用

- 4D列印食品

- 智慧包装技术

- 温度和新鲜度指标

第七章 市场估计与预测:按地区划分(2022-2035 年)

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

第八章 公司简介

- AiQ Smart Clothing

- ATI

- BASF

- Cambridge Mechatronics

- DuPont

- Fort Wayne Metals

- Gentherm

- Interactive Wear

- Johnson Matthey

- Ohmatex

- Parker Hannifin

- Schoeller Textil

- Sensoria

- Stratasys

- TDK

The Global Programmable Matter for Consumer Products Market was valued at USD 1.5 billion in 2025 and is estimated to grow at a CAGR of 15.7% to reach USD 6.2 billion by 2035.

Rapid progress in material science and responsive technologies reshapes how consumer products are designed, manufactured, and experienced. Significant funding from defense, aerospace, and public research institutions accelerates innovation and gradually shifts these technologies toward consumer-ready applications. Research initiatives focus on materials capable of responding to external stimuli, enabling properties such as self-adjustment, adaptability, and functional transformation. As advanced manufacturing capabilities continue to mature, commercialization barriers decline, and scalable production becomes increasingly viable. Consumer interest in intelligent, adaptive, and personalized products supports adoption across multiple end-use categories. Companies leverage cross-disciplinary collaboration between material science, electronics, and digital systems to unlock new use cases. Technology transfer frameworks play a critical role in moving innovations from controlled research environments into consumer markets. This convergence of funding, infrastructure, and consumer demand positions programmable matter as a transformative force within next-generation consumer products.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.5 Billion |

| Forecast Value | $6.2 Billion |

| CAGR | 15.7% |

The shape memory alloys segment generated USD 800 million in 2025. Long-term public investment in smart materials research supports advancements in manufacturing techniques and accelerates readiness for large-scale commercial deployment. Government-backed research institutions continue to expand applications for alloys that respond to thermal and mechanical stimuli, while energy-focused agencies recognize their potential to support environmentally efficient technologies.

The consumer electronics segment held 39.2% share in 2025. Ongoing academic and industrial research drives innovation in reprogrammable materials that enable adaptive functionality within electronic consumer goods. Smart textiles and wearable solutions increasingly integrate programmable matter to enhance performance, comfort, and user interaction.

U.S. Programmable Matter for Consumer Products Market held a 74.9% share in 2025. Strong research ecosystems, early technology adoption, and sustained investment in advanced manufacturing reinforce this leadership position. Robust development activity across materials science, artificial intelligence, and connected technologies continues to fuel market expansion.

Key companies operating in the Global Programmable Matter for Consumer Products Market include BASF, Stratasys, DuPont, TDK, Johnson Matthey, Parker Hannifin, Gentherm, ATI, Fort Wayne Metals, Cambridge Mechatronics, Sensoria, AiQ Smart Clothing, Ohmatex, Interactive Wear, and Schoeller Textil. Companies strengthen their position by prioritizing research-driven innovation, strategic partnerships, and scalable manufacturing capabilities. Many firms invest heavily in proprietary materials and process optimization to accelerate commercialization timelines. Collaboration with research institutions and technology developers supports access to emerging breakthroughs while reducing development risk. Businesses also focus on integrating programmable matter with digital platforms to enable smarter, connected consumer products. Expanding production capacity and improving material reliability help address cost and performance expectations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology

- 2.2.3 Application

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Demand for customization and personalization

- 3.2.1.2 Advances in material science and nanotechnology

- 3.2.1.3 Integration with IoT and AI

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost and manufacturing complexity

- 3.2.2.2 Energy consumption and control systems

- 3.2.3 Opportunities

- 3.2.3.1 Next-gen consumer interfaces

- 3.2.3.2 Circular economy and product longevity

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Regulatory landscape

- 3.6.1 Standards and compliance requirements

- 3.6.2 Regional regulatory frameworks

- 3.6.3 Certification standards

- 3.7 Gap analysis

- 3.8 Risk assessment and mitigation

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behaviour analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behaviour

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Technology Type, 2022-2035 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Shape memory alloys (SMAs)

- 5.3 4d printing technologies

- 5.4 Smart and adaptive textiles

- 5.5 Electroactive polymers and materials

- 5.6 Hydrogels and bio-responsive materials

- 5.7 Phase change materials (PCMS)

Chapter 6 Market Estimates & Forecast, By Application Type, 2022-2035 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Consumer Electronics Applications

- 6.2.1 Integration in smartphones and mobile devices integration

- 6.2.2 Wearable technology & accessories

- 6.2.3 Adaptive display technologies

- 6.2.4 Haptic interface systems

- 6.3 Smart textiles & apparel

- 6.3.1 Adaptive clothing & fashion applications

- 6.3.2 Sports & performance monitoring gear

- 6.3.3 Health monitoring garments

- 6.3.4 Interactive & entertainment textiles

- 6.4 Home automation & furniture

- 6.4.1 Reconfigurable furniture systems

- 6.4.2 Adaptive home appliances

- 6.4.3 Smart surface technologies

- 6.4.4 Interactive interface integration

- 6.5 Automotive consumer features

- 6.5.1 Adaptive interior systems

- 6.5.2 Comfort & climate control applications

- 6.6 Healthcare & wellness products

- 6.6.1 Wearable health monitoring devices

- 6.6.2 Adaptive medical equipment

- 6.6.3 Therapeutic & rehabilitation systems

- 6.6.4 Products for elderly & disability assistance

- 6.7 Food & packaging applications

- 6.7.1 4D printed food products

- 6.7.2 Smart packaging technologies

- 6.7.3 Temperature & freshness indicators

Chapter 7 Market Estimates & Forecast, By Region, 2022-2035 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 France

- 7.3.3 UK

- 7.3.4 Italy

- 7.3.5 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 AiQ Smart Clothing

- 8.2 ATI

- 8.3 BASF

- 8.4 Cambridge Mechatronics

- 8.5 DuPont

- 8.6 Fort Wayne Metals

- 8.7 Gentherm

- 8.8 Interactive Wear

- 8.9 Johnson Matthey

- 8.10 Ohmatex

- 8.11 Parker Hannifin

- 8.12 Schoeller Textil

- 8.13 Sensoria

- 8.14 Stratasys

- 8.15 TDK