|

市场调查报告书

商品编码

1911833

中东智慧家庭市场:市场占有率分析、产业趋势与统计、成长预测(2026-2031年)Middle East Smart Home - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

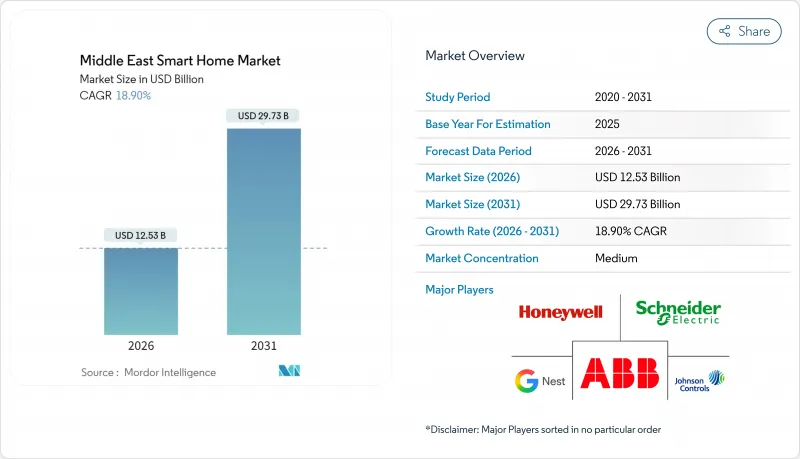

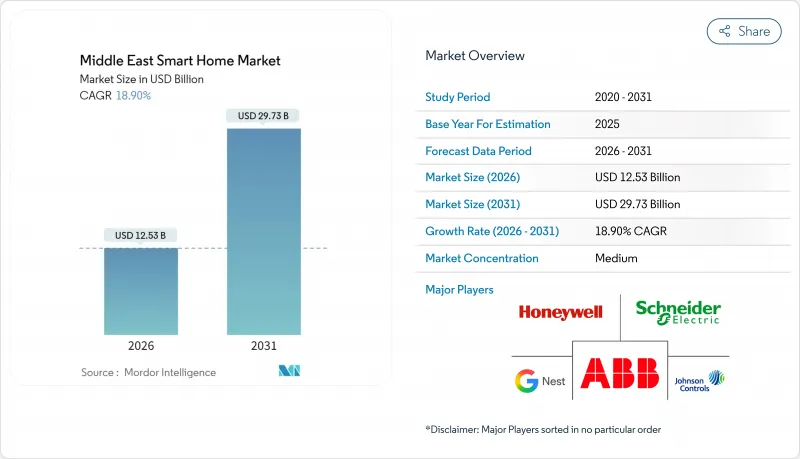

2025 年中东智慧家庭市场价值 105.4 亿美元,预计将从 2026 年的 125.3 亿美元成长到 2031 年的 297.3 亿美元,在预测期(2026-2031 年)内,预计复合年增长率为 18.90%。

加速推进的数位化政府项目、高端消费群体以及大规模智慧城市计划正在推动这一两位数的成长。沙乌地阿拉伯的「2030愿景」以及波湾合作理事会(GCC)其他国家类似的国家议程都强调永续城市发展,这使得供应商能够从长远角度看待住宅自动化需求。先进通讯服务的推广,特别是全国光纤和5G网路的覆盖,正在消除频宽限制,并建立更丰富的互联设备生态系统。沙乌地阿拉伯公民和外籍人士的高可支配收入支撑了高端产品的价格,而豪华房地产开发商也越来越多地将承包自动化解决方案打包出售,以使新计画脱颖而出。同时,以安全为先的产品定位引起了注重资产保护的家庭的共鸣,推动监控和门禁解决方案成为首选购买清单上的项目,并随着时间的推移促进生态系统的扩展。

中东智慧家庭市场趋势与洞察

政府的「2030年智慧城市愿景」计划

长期国家计画正将智慧家庭理念纳入强制性住宅规划要求。沙乌地阿拉伯的NEOM和阿联酋的智慧城区计画等旗舰计划,都拨出专案预算用于高频宽的最后一公里连线、本地物联网闸道和需求面管理平台等基础设施建设。这些公共投资透过标准化设备规格和安装指南,简化了供应商的进入流程,并透过增加采购量,推动了组件成本的快速下降。 2030愿景框架中的永续性目标明确认可节能住宅设计,使设备製造商能够将自动化产品作为合规工具而非奢侈品进行销售。政府支持的示范区所取得的示范效应,正在加速住宅智慧家庭的接受度,并巩固中东智慧家庭市场作为区域数位经济计画核心支柱的地位。

快速部署5G和光纤基础设施

沿岸地区的通讯业者已部署光纤网络,几乎涵盖了所有家庭,目前正逐步推出低延迟的5G室内应用场景。固定无线接入方案正在将覆盖范围扩展到先前讯号较弱的郊区度假屋。这使得系统整合商能够提案多房间监控系统和身临其境型多媒体解决方案,而无需考虑品质保证方面的限制。网路切片测试正在为安全和生命安全设备提供独立的虚拟通道,从而解决了风险规避型买家对可靠性的担忧。结合由网路服务供应商提供的Wi-Fi 6E路由器,消费者可以操作密集的设备群而不会感受到明显的延迟。随着连接性不再是限制阻碍因素,竞争差异化正在转向软体功能的深度、数据分析仪表板和用户体验设计,从而推动了中东智慧家庭市场对加值服务的需求。

网路安全和资料隐私问题

物联网相关安全漏洞的报告数量持续成长,提高了消费者的警觉性。沙乌地阿拉伯和阿联酋的联邦资料保护法都加强了使用者授权的审批流程,增加了供应商的合规成本。家庭用户越来越需要本地资料储存和多因素身份验证,这使得即插即用的便利提案难以实现。曾经仅用于商业建筑的企业级加密技术如今也开始应用于高端住宅,虽然延长了销售週期,但提高了平均售价。儘管对安全性的重视可能会限制短期销量,但也为值得信赖的品牌在中东智慧家庭市场获得更高的利润奠定了基础。

细分市场分析

到2025年,安防系统将占中东智慧家庭市场30.12%的份额,反映出该地区对资产保护和隐私的高度重视。市场需求主要集中在具备设备内建分析功能的智慧摄影机、可视门铃和生物识别锁上,这些产品符合当地居民对封闭式住宅的文化偏好。随着家庭用户在其网路中添加能源管理感测器,利用现有的基础设施投资,追加提升销售强劲。能源管理设备预计将以20.75%的复合年增长率(CAGR)实现最高增长,这主要得益于基于收费系统的投资回报率计算以及政府应对气候变迁的承诺。同时,控制和连接中心正从单一功能的网关向人工智慧辅助的整合引擎发展,为第三方家用电器开闢了交叉销售管道。娱乐套餐正受益于高清串流媒体的普及,但随着消费者更加重视安全功能,其收入份额正在下降。随着价格下降,中等收入的公寓居住者开始采用一体化入门套件,从而扩大了中东智慧家庭市场的潜在客户群。

第二梯队成长将来自高端品牌,这些品牌将健康感测器整合到产品中,用于监测室内空气品质并与暖通空调控制设备整合。健康与舒适的结合使高端度假屋产品脱颖而出,并提高了单价。 Matter框架带来的互通性进步消除了传统生态系统的壁垒,使住宅能够采用多品牌产品线,而无需担心未来产品过时。这些协同效应创造了具有韧性的产品组合,使供应商免受任何单一类别需求波动的影响,从而保持中东智慧家居市场的高速成长。

到2025年,Wi-Fi将在中东智慧家庭市场占据40.35%的份额,这主要得益于路由器的普及和简易的设定体验。网状网路扩展技术消除了沿岸地区常见的多层住宅中的通讯盲区,并支援无需额外中心即可安装摄影机和感测器。然而,Thread通讯协定预计将以20.56%的复合年增长率成长,这反映了全球范围内采用节能型网状网路(用于电池供电节点)的趋势。经Matter认证的Thread边界路由器将成为新型智慧音箱的标配,从而形成大规模的用户群,并在未来重塑设备连接方式。低功耗蓝牙(Bluetooth Low Energy)将在个人健康追踪器和携带式语音助理领域继续保持其独特地位,而Zigbee仍将是商业整合商现有建筑管理系统整合方案中的首选。 Z-Wave仍然受到频谱分配规则的限制,这使其难以进入大众市场零售领域。

目前,产业联盟正在推广韧体更新,以实现双通讯协定运行,从而缓解消费者在初始技术选择上的不确定性。这种整合将使零售商受益,因为他们可以减少库存的不同SKU数量,降低库存风险。随着具有确定性延迟保证的Wi-Fi 7的到来,8K安防视讯串流和身临其境型虚拟实境等高频宽应用将获得更佳的效能。因此,增强Wi-Fi骨干网路和Thread边缘设备的共存将引领中东智慧家庭市场迈向无缝的混合网路架构。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 政府2030年愿景智慧城市计划

- 快速部署5G和光纤基础设施

- 电费上涨推动能源管理技术的普及

- 房地产开发商提供智慧家庭捆绑解决方案

- 精通科技的外籍人士群体日益壮大

- 气候变迁要求优化暖通空调系统。

- 市场限制

- 网路安全和资料隐私问题

- 技术标准分散

- 熟练安装人员的生态系统有限

- 补贴降低了公用事业费率,从而降低了投资收益(ROI)。

- 产业价值链分析

- 监管环境

- 技术展望

- 宏观经济因素的影响

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 副产品

- 舒适度和照明

- 控制与连接

- 能源管理

- 家庭娱乐

- 安全

- 智慧家庭设备

- 透过连接技术

- Wi-Fi

- Bluetooth

- Zigbee

- Z-Wave

- 线

- 其他技术

- 按住宅类型

- 豪华别墅

- 高所得公寓

- 中等收入公寓

- 低收入住宅

- 按销售管道

- 直接面向消费者(线上)

- 零售店(实体店面)

- 建筑承包商

- 系统整合商

- 按国家/地区

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 卡达

- 土耳其

- 科威特

- 巴林

- 其他中东地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Schneider Electric SE

- Honeywell International Inc.

- ABB Ltd.

- Johnson Controls International plc

- Google LLC(Nest)

- Amazon.com Inc.(Ring LLC)

- Samsung Electronics Co. Ltd.

- Huawei Technologies Co. Ltd.

- Legrand SA

- Siemens AG

- LG Electronics Inc.

- Lutron Electronics Co. Inc.

- Bosch Security Systems GmbH

- Cisco Systems Inc.

- TP-Link Technologies Co. Ltd.

- Resideo Technologies Inc.

- Fibaro Group SA

- Aqara(Lumi United Technology Co. Ltd.)

- Dahua Technology Co. Ltd.

- Etisalat by e&

第七章 市场机会与未来展望

The Middle East smart home market was valued at USD 10.54 billion in 2025 and estimated to grow from USD 12.53 billion in 2026 to reach USD 29.73 billion by 2031, at a CAGR of 18.90% during the forecast period (2026-2031).

Accelerating digital-government programs, premium-focused consumer segments, and large-scale smart-city projects collectively underpin this double-digit expansion. Saudi Vision 2030 and comparable national agendas across the Gulf Cooperation Council emphasize sustainable urban development, giving vendors long-range visibility into residential automation demand. Advanced telecommunications rollouts, especially nationwide fiber and 5G coverage, remove bandwidth constraints and enable richer connected-device ecosystems. High disposable incomes among both nationals and expatriates support premium price points, while luxury real-estate developers increasingly bundle turnkey automation packages to differentiate new projects. Meanwhile, security-first product positioning resonates with households concerned about property protection, pushing surveillance and access-control solutions to the top of initial purchase lists and encouraging ecosystem expansion over time.

Middle East Smart Home Market Trends and Insights

Government Vision 2030 Smart-City Initiatives

Long-range national programs have hard-wired smart-home considerations into residential planning mandates. Flagship projects such as Saudi Arabia's NEOM and the UAE's smart-district blueprints allocate infrastructure budgets for high-bandwidth last-mile connectivity, on-premises IoT gateways, and demand-side management platforms. These public investments ease vendor entry by standardizing device specifications and installation guidelines while unlocking procurement volumes that quickly shift component costs downward. Sustainability targets inside Vision 2030 frameworks explicitly reward energy-efficient dwelling designs, allowing device makers to market automation not as a luxury but as a compliance aid. The demonstration effect of government-backed model neighborhoods accelerates homeowner awareness, reinforcing the Middle East smart home market as a core pillar of regional digital-economy plans.

Rapid Deployment of 5G and Fiber Infrastructure

Operators in the Gulf have achieved near-ubiquitous household fiber coverage and are now layering low-latency 5G for indoor use-cases. Fixed-wireless access options widen reach to suburban villas that previously suffered from signal drop-offs, letting integrators pitch multi-room surveillance and immersive multimedia without quality-of-service caveats. Network slicing pilots provide isolated virtual channels for security and life-safety devices, addressing reliability fears among risk-averse buyers. Combined with Wi-Fi-6E routers bundled by internet-service providers, consumers can run dense device clusters without perceivable lag. As connectivity ceases to be a limiting factor, competitive differentiation shifts toward software feature depth, data analytics dashboards, and user-experience design, reinforcing premium service willingness across the Middle East smart home market.

Cybersecurity and Data-Privacy Concerns

A steady rise in IoT-related breach headlines has elevated consumer caution. Federal data-protection statutes in both Saudi Arabia and the UAE impose stricter consent rules, heightening vendor compliance costs. Households increasingly request on-premises data storage and multi-factor authentication, complicating quick plug-and-play proposals. Enterprise-grade encryption, once aimed at commercial buildings, is now marketed for high-net-worth residences, lengthening sales cycles but also raising average selling prices. While the security narrative restrains short-term volumes, it simultaneously positions trusted brands to command higher margins within the Middle East smart home market.

Other drivers and restraints analyzed in the detailed report include:

- High Electricity Tariffs Driving Energy-Management Adoption

- Real-Estate Developers Bundling Smart-Home Solutions

- Fragmented Technology Standards

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Security systems captured 30.12% of the Middle East smart home market size in 2025, underscoring the region's priority on property protection and privacy safeguards. Demand centers on smart cameras with on-device analytics, video doorbells, and biometric locks that align with cultural preferences for gated living. Upsell momentum builds as households layer energy-management sensors onto the same network, leveraging sunk infrastructure costs. Energy-management devices exhibit the strongest 20.75% CAGR outlook, propelled by tariff-driven return-on-investment calculations and government climate commitments. Meanwhile, control and connectivity hubs evolve from single-purpose gateways into AI-assisted orchestration engines, opening cross-selling pathways for third-party appliances. Entertainment bundles ride high-definition streaming adoption, yet their revenue share lags because consumers often prioritize core safety features before discretionary upgrades. As price points descend, some middle-income apartment dwellers begin installing all-in-one starter kits, broadening addressable volume within the Middle East smart home market.

A second growth layer emerges from premium brands packaging wellness sensors that monitor indoor air quality and integrate with HVAC controllers. This convergence of health and comfort differentiates offerings in upscale villas, raising per-unit revenue. Interoperability progress under the Matter framework removes earlier ecosystem barriers, letting homeowners adopt multi-brand product stacks without fear of future obsolescence. The combined effect is a more resilient product mix that buffers vendors from single-category demand shocks and keeps the Middle East smart home market on its high-growth trajectory.

Wi-Fi supported 40.35% of the Middle East smart home market share in 2025, buoyed by near-universal router penetration and straightforward setup experiences. Mesh extensions eliminate dead zones in multi-story properties common across the Gulf, letting homeowners deploy cameras and sensors without additional hubs. Nevertheless, Thread protocol is projected to log a 20.56% CAGR, mirroring global momentum toward energy-efficient mesh networks for battery-powered nodes. Matter-certified Thread border routers ship as standard in new smart speakers, creating a large installed base that will redirect future device attach rates. Bluetooth Low Energy retains niche roles in personal health trackers and portable voice assistants, while Zigbee persists in commercial integrator portfolios for legacy building-management integrations. Z-Wave remains constrained by spectrum allocation rules that complicate mass-market retail.

Industry alliances now push firmware updates enabling dual-protocol operation, reducing consumer anxiety over early technology bets. This convergence benefits retailers who can stock fewer distinct SKUs, lowering inventory risk. As Wi-Fi 7 arrives with deterministic latency guarantees, high-bandwidth applications such as 8K security feeds and immersive virtual reality receive a performance boost. The coexistence of upgraded Wi-Fi backbones and Thread edge devices thus positions the Middle East smart home market for seamless hybrid networking architectures.

The Middle East Smart Home Market Report is Segmented by Product (Comfort and Lighting, Control and Connectivity, and More), Connectivity Technology (Wi-Fi, Bluetooth, and More), Residential Type (Luxury Villas, High-Income Apartments, and More), Sales Channel (Direct-To-Consumer, Retail, and More), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Schneider Electric SE

- Honeywell International Inc.

- ABB Ltd.

- Johnson Controls International plc

- Google LLC (Nest)

- Amazon.com Inc. (Ring LLC)

- Samsung Electronics Co. Ltd.

- Huawei Technologies Co. Ltd.

- Legrand SA

- Siemens AG

- LG Electronics Inc.

- Lutron Electronics Co. Inc.

- Bosch Security Systems GmbH

- Cisco Systems Inc.

- TP-Link Technologies Co. Ltd.

- Resideo Technologies Inc.

- Fibaro Group S.A.

- Aqara (Lumi United Technology Co. Ltd.)

- Dahua Technology Co. Ltd.

- Etisalat by e&

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government Vision 2030 smart-city initiatives

- 4.2.2 Rapid deployment of 5G and fibre infrastructure

- 4.2.3 High electricity tariffs driving energy-management adoption

- 4.2.4 Real-estate developers bundling smart-home solutions

- 4.2.5 Expatriate tech-savvy population growth

- 4.2.6 Climate-driven demand for HVAC optimisation

- 4.3 Market Restraints

- 4.3.1 Cybersecurity and data-privacy concerns

- 4.3.2 Fragmented technology standards

- 4.3.3 Limited skilled-installer ecosystem

- 4.3.4 Subsidised utility prices reducing ROI

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macroeconomic Factors

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Product

- 5.1.1 Comfort and Lighting

- 5.1.2 Control and Connectivity

- 5.1.3 Energy Management

- 5.1.4 Home Entertainment

- 5.1.5 Security

- 5.1.6 Smart Appliances

- 5.2 By Connectivity Technology

- 5.2.1 Wi-Fi

- 5.2.2 Bluetooth

- 5.2.3 Zigbee

- 5.2.4 Z-Wave

- 5.2.5 Thread

- 5.2.6 Other Technologies

- 5.3 By Residential Type

- 5.3.1 Luxury Villas

- 5.3.2 High-income Apartments

- 5.3.3 Middle-income Apartments

- 5.3.4 Low-income Housing

- 5.4 By Sales Channel

- 5.4.1 Direct-to-Consumer (Online)

- 5.4.2 Retail (Brick-and-Mortar)

- 5.4.3 Contractors and Installers

- 5.4.4 System Integrators

- 5.5 By Country

- 5.5.1 Saudi Arabia

- 5.5.2 United Arab Emirates

- 5.5.3 Qatar

- 5.5.4 Turkey

- 5.5.5 Kuwait

- 5.5.6 Bahrain

- 5.5.7 Rest of Middle East

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Schneider Electric SE

- 6.4.2 Honeywell International Inc.

- 6.4.3 ABB Ltd.

- 6.4.4 Johnson Controls International plc

- 6.4.5 Google LLC (Nest)

- 6.4.6 Amazon.com Inc. (Ring LLC)

- 6.4.7 Samsung Electronics Co. Ltd.

- 6.4.8 Huawei Technologies Co. Ltd.

- 6.4.9 Legrand SA

- 6.4.10 Siemens AG

- 6.4.11 LG Electronics Inc.

- 6.4.12 Lutron Electronics Co. Inc.

- 6.4.13 Bosch Security Systems GmbH

- 6.4.14 Cisco Systems Inc.

- 6.4.15 TP-Link Technologies Co. Ltd.

- 6.4.16 Resideo Technologies Inc.

- 6.4.17 Fibaro Group S.A.

- 6.4.18 Aqara (Lumi United Technology Co. Ltd.)

- 6.4.19 Dahua Technology Co. Ltd.

- 6.4.20 Etisalat by e&

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need assessment