|

市场调查报告书

商品编码

1913292

安全存取服务边缘 (SASE) 市场机会、成长驱动因素、产业趋势分析与预测 (2026-2035)Secure Access Service Edge Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

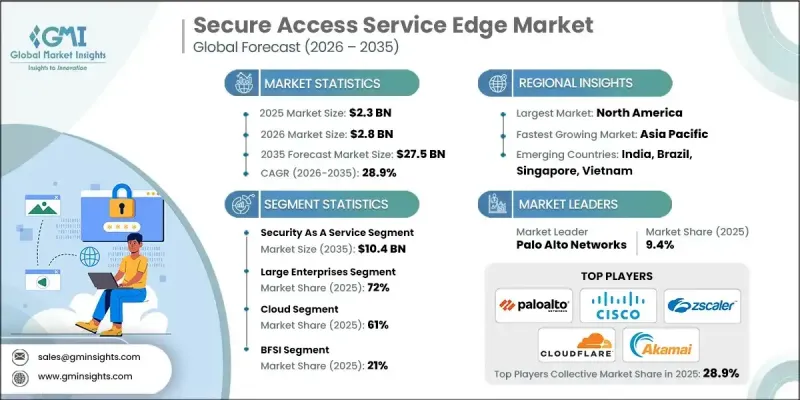

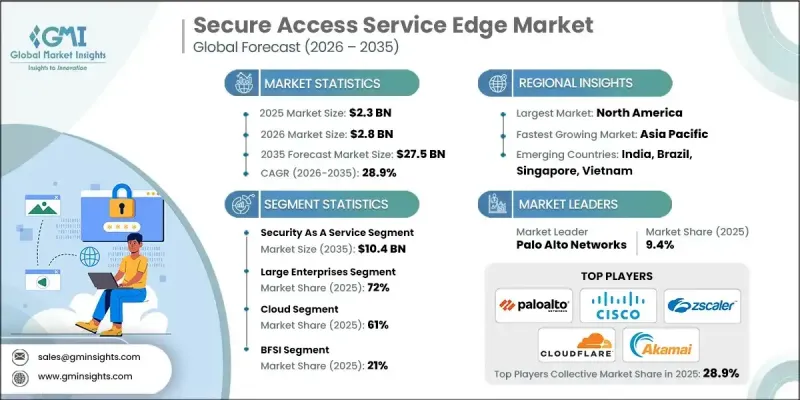

全球安全存取服务边缘市场预计到 2025 年将达到 23 亿美元,到 2035 年将达到 275 亿美元,年复合成长率为 28.9%。

各行各业的组织都在加速向云端交付应用程式转型,重新定义企业网路和安全的设计方式。随着对云端託管软体的依赖日益增强,企业正在摒弃传统的基于边界的防御策略,转而采用以云端为中心的SASE架构,以提供统一的连接和安全性。企业越来越需要为使用者和设备提供一致的保护和最佳化的效能,无论其身处何地。这种需求正在推动集中管理、策略驱动的SASE平台的普及,这些平台在支援安全全球存取的同时,也能维持营运的柔软性。分散式办公、云端迁移以及对可扩展基础架构的需求正在重塑企业安全策略。为了支持不断发展的业务运营和实现长期的数位转型目标,各组织正在优先考虑简化管理、加强基于身分的控制以及采用统一的网路和安全模型。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 23亿美元 |

| 预测金额 | 275亿美元 |

| 复合年增长率 | 28.9% |

分散的安全工具的广泛使用增加了营运复杂性和成本,促使企业将网路和安全整合到一个统一的平台上。采用统一的SASE解决方案可以帮助企业实现IT环境现代化,减少供应商分散,并简化管理。随着零信任原则的兴起,SASE框架内的统一身分和存取控制有助于限制未经授权的存取活动,并降低基于凭证的风险。

预计到2025年,安全即服务(Security as a Service)将占据52%的市场份额,到2035年市场规模将达到104亿美元。企业越来越依赖云端原生保全服务来取代传统模式,在强化防护的同时,也支援混合云和云端优先的营运模式。这些服务内建的高阶分析和自动化功能提高了威胁侦测和回应的效率。

预计到2025年,大型企业将占据72%的市场份额,到2035年将成长至183亿美元。这些企业采用SASE是为了应对复杂的全球营运、严格的安全要求以及超过两年的漫长引进週期。高可用性、扩充性、可自订策略和强大的服务保障仍然是推动其采用的关键因素。

预计到2025年,美国安全存取服务边缘市场规模将达到7.534亿美元。美国企业正根据国家零信任计划,快速对其安全框架进行现代化改造,以支援远距办公、云端扩展和日益增长的网路风险。市场对能够提升分散式团队效能、可扩展性和使用者体验的云端原生平台的需求持续成长。

目录

第一章调查方法

第二章执行摘要

第三章业界考察

- 产业生态系分析

- 供应商情况

- 利润率分析

- 成本结构

- 每个阶段的附加价值

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 云端运算和SaaS的快速普及

- 扩大远距和混合办公模式

- 网路安全威胁日益加剧,攻击手段也日益复杂。

- 降低安全复杂性和供应商分散性的必要性

- 加速零信任安全框架

- 产业潜在风险与挑战

- 与传统基础设施整合的挑战

- 对资料隐私和供应商锁定问题的担忧

- 市场机会

- 拓展至中小企业及中阶市场领域

- 对人工智慧驱动的威胁侦测的需求日益增长

- 边缘运算应用的日益普及

- 多重云端和混合云端现代化倡议

- 成长潜力分析

- 监管环境

- 北美洲

- 美国- 加州消费者隐私法案

- 加拿大—个人资讯保护与电子文件法

- 欧洲

- 英国- 资料保护法

- 德国——联邦资料保护法

- 法国——数位共和国法案

- 义大利—个人资料保护法

- 西班牙—资料保护与数位权利组织法

- 亚太地区

- 中国 - 个人资讯保护法

- 日本—个人资讯保护法

- 印度—数位个人资料保护法

- 拉丁美洲

- 巴西——通用资料保护法

- 墨西哥—关于保护私人实体所持有个人资料的联邦法律

- 阿根廷—个人资料保护法

- 中东和非洲

- 阿拉伯联合大公国—个人资料保护法

- 南非—个人资讯保护法

- 沙乌地阿拉伯—个人资料保护法

- 北美洲

- 波特分析

- PESTEL 分析

- 科技与创新趋势

- 当前技术趋势

- 新兴技术

- 成本細項分析

- 开发成本结构

- 研发成本分析

- 行销和销售费用

- 专利分析

- 案例研究

- 永续性和环境方面

- 永续努力

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 未来市场展望与机会

第四章 竞争情势

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 主要市场公司的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 重大进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 企业扩张计画和资金筹措

第五章 市场估算与预测:依产品类型划分(2021-2034 年)

- 网路即服务

- 安全即服务

第六章 市场估算与预测:依部署模式划分(2021-2034 年)

- 云

- 本地部署

第七章 市场估计与预测:依公司规模划分(2021-2034 年)

- 大公司

- 小型企业

第八章 依最终用途分類的市场估算与预测(2022-2035 年)

- BFSI

- 资讯科技/通讯

- 零售

- 卫生保健

- 政府

- 製造业

- 能源与公共产业

- 教育

- 其他的

第九章 各地区市场估算与预测(2022-2035 年)

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧国家

- 葡萄牙

- 克罗埃西亚

- 比荷卢经济联盟

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 新加坡

- 泰国

- 印尼

- 越南

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 哥伦比亚

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

第十章:公司简介

- 全球公司

- Cisco

- Palo Alto Networks

- Fortinet

- Zscaler

- Cloudflare

- Akamai

- Broadcom VMware

- Juniper Networks

- Aruba Networks HPE

- Verizon

- AT&T Cybersecurity

- Check Point Software Technologies

- IBM Security

- McAfee Enterprise Trellix

- BT Group British Telecom

- 本地公司

- SonicWall

- Forcepoint

- Barracuda Networks

- WatchGuard Technologies

- Sophos

- Sangfor Technologies

- Cyberoam

- SecPod

- T-Systems

- 新创公司/颠覆者

- Netskope

- Cato Networks

- Versa Networks

- Aryaka

- Perimeter 81

- Tailscale

- Axis Security

The Global Secure Access Service Edge Market was valued at USD 2.3 billion in 2025 and is estimated to grow at a CAGR of 28.9% to reach USD 27.5 billion by 2035.

Organizations across industries are accelerating the shift toward cloud-delivered applications, which is redefining how enterprise networks and security are designed. As reliance on cloud-hosted software grows, companies are moving away from legacy perimeter-based defenses and adopting cloud-centric SASE architectures that deliver unified connectivity and security. Enterprises increasingly require consistent protection and optimized performance for users and devices regardless of location. This demand is driving adoption of centrally managed, policy-driven SASE platforms that support secure global access while maintaining operational flexibility. Distributed workforces, cloud migration, and the need for scalable infrastructure are reshaping enterprise security strategies. Organizations are prioritizing simplified management, stronger identity-based controls, and integrated networking and security models to support evolving business operations and long-term digital transformation goals.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $2.3 Billion |

| Forecast Value | $27.5 Billion |

| CAGR | 28.9% |

The growing use of fragmented security tools has increased operational complexity and cost, prompting organizations to consolidate networking and security into integrated platforms. Unified SASE deployments allow enterprises to modernize IT environments, reduce vendor sprawl, and streamline management. As zero-trust principles gain traction, integrated identity verification and access control within SASE frameworks help limit unauthorized movement and reduce credential-based risks.

The security delivered as a service accounted for 52% share in 2025 and is forecast to reach USD 10.4 billion by 2035. Enterprises are increasingly relying on cloud-native security services to replace traditional models, improving protection while supporting hybrid and cloud-first operations. Advanced analytics and automation embedded within these services enhance threat detection and response efficiency.

The large enterprises represented held 72% share in 2025 and is projected to generate USD 18.3 billion by 2035. These organizations adopt SASE to address complex global operations, strict security requirements, and long deployment cycles that often extend beyond two years. High availability, scalability, customizable policies, and strong service guarantees remain key adoption drivers.

United States Secure Access Service Edge Market reached USD 753.4 million in 2025. U.S.-based organizations are rapidly modernizing security frameworks to support remote work, cloud expansion, and rising cyber risks, while aligning with national zero-trust initiatives. Demand continues to rise for cloud-native platforms that improve performance, scalability, and user experience for distributed teams.

Leading companies operating in the Global Secure Access Service Edge Market include Cisco, Zscaler, Fortinet, Palo Alto Networks, Akamai, Broadcom, Netskope, Cloudflare, and Forcepoint. Companies in the Global Secure Access Service Edge Market strengthen their market position by expanding cloud-native portfolios and emphasizing integrated security and networking capabilities. Providers focus on platform consolidation to reduce complexity for enterprise customers while improving visibility and control. Continuous investment in automation, analytics, and intelligent threat mitigation enhances operational efficiency and security outcomes. Strategic partnerships and ecosystem development enable broader service integration and faster deployment. Vendors also prioritize scalability, uptime assurance, and flexible pricing models to attract large enterprises and mid-sized organizations alike.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Offering

- 2.2.3 Deployment model

- 2.2.4 Organization size

- 2.2.5 End Use

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook & strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Rapid cloud and SaaS adoption

- 3.2.1.3 Expansion of remote and hybrid workforces

- 3.2.1.4 Rising cybersecurity threats and attack sophistication

- 3.2.1.5 Need to reduce security complexity and vendor sprawl

- 3.2.1.6 Acceleration of zero-trust security frameworks

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Integration challenges with legacy infrastructure

- 3.2.2.2 Concerns over data privacy and vendor lock-in

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into SMB and mid-market segments

- 3.2.3.2 Growing demand for AI-driven threat detection

- 3.2.3.3 Increasing adoption of edge computing applications

- 3.2.3.4 Multi-cloud and hybrid-cloud modernization initiatives

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S. - California Consumer Privacy Act

- 3.4.1.2 Canada - Personal Information Protection and Electronic Documents Act

- 3.4.2 Europe

- 3.4.2.1 UK - Data Protection Act

- 3.4.2.2 Germany - Federal Data Protection Act

- 3.4.2.3 France - Digital Republic Act

- 3.4.2.4 Italy - Personal Data Protection Code

- 3.4.2.5 Spain - Organic Law on Data Protection and Digital Rights

- 3.4.3 Asia Pacific

- 3.4.3.1 China - Personal Information Protection Law

- 3.4.3.2 Japan - Act on the Protection of Personal Information

- 3.4.3.3 India - Digital Personal Data Protection Act

- 3.4.4 Latin America

- 3.4.4.1 Brazil - General Data Protection Law

- 3.4.4.2 Mexico - Federal Law on Protection of Personal Data Held by Private Parties

- 3.4.4.3 Argentina - Personal Data Protection Law

- 3.4.5 Middle East & Africa

- 3.4.5.1 UAE - Personal Data Protection Law

- 3.4.5.2 South Africa - Protection of Personal Information Act

- 3.4.5.3 Saudi Arabia - Personal Data Protection Law

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.8.1 Development cost structure

- 3.8.2 R&D cost analysis

- 3.8.3 Marketing & sales costs

- 3.9 Patent analysis

- 3.10 Case study

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly Initiatives

- 3.12 Future market outlook & opportunities

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Offering, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Network as a Service

- 5.3 Security as a Service

Chapter 6 Market Estimates & Forecast, By Deployment model, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Cloud

- 6.3 On-premises

Chapter 7 Market Estimates & Forecast, By Organization size, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Large Enterprises

- 7.3 SMEs

Chapter 8 Market Estimates & Forecast, By End Use, 2022-2035 (USD Mn)

- 8.1 Key trends

- 8.2 BFSI

- 8.3 IT & Telecom

- 8.4 Retail

- 8.5 Healthcare

- 8.6 Government

- 8.7 Manufacturing

- 8.8 Energy & utilities

- 8.9 Education

- 8.10 Others

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035 (USD Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.3.8 Portugal

- 9.3.9 Croatia

- 9.3.10 Benelux

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Singapore

- 9.4.7 Thailand

- 9.4.8 Indonesia

- 9.4.9 Vietnam

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Colombia

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Turkey

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Cisco

- 10.1.2 Palo Alto Networks

- 10.1.3 Fortinet

- 10.1.4 Zscaler

- 10.1.5 Cloudflare

- 10.1.6 Akamai

- 10.1.7 Broadcom VMware

- 10.1.8 Juniper Networks

- 10.1.9 Aruba Networks HPE

- 10.1.10 Verizon

- 10.1.11 AT&T Cybersecurity

- 10.1.12 Check Point Software Technologies

- 10.1.13 IBM Security

- 10.1.14 McAfee Enterprise Trellix

- 10.1.15 BT Group British Telecom

- 10.2 Regional Players

- 10.2.1 SonicWall

- 10.2.2 Forcepoint

- 10.2.3 Barracuda Networks

- 10.2.4 WatchGuard Technologies

- 10.2.5 Sophos

- 10.2.6 Sangfor Technologies

- 10.2.7 Cyberoam

- 10.2.8 SecPod

- 10.2.9 T-Systems

- 10.3 Emerging / Disruptor Players

- 10.3.1 Netskope

- 10.3.2 Cato Networks

- 10.3.3 Versa Networks

- 10.3.4 Aryaka

- 10.3.5 Perimeter 81

- 10.3.6 Tailscale

- 10.3.7 Axis Security