|

市场调查报告书

商品编码

1913303

影片串流软体市场机会、成长要素、产业趋势分析及2026年至2035年预测Video Streaming Software Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

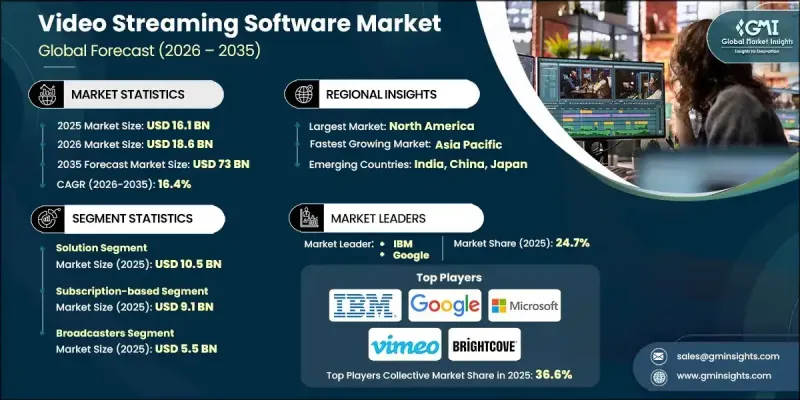

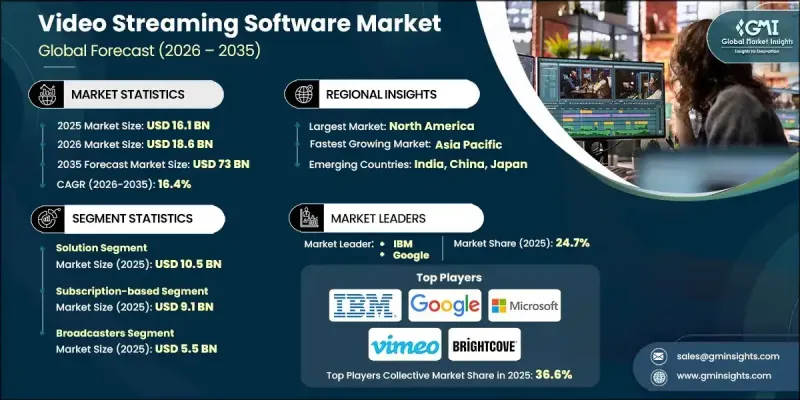

全球影片串流软体市场预计到 2025 年将达到 161 亿美元,到 2035 年将达到 730 亿美元,年复合成长率为 16.4%。

随着消费者越来越倾向于透过网路平台获取数位内容,对视讯串流软体的需求呈指数级增长。行动连线的普及、宽频基础设施的扩展以及连网装置的日益普及正在重塑用户观看影片内容的方式。用户现在期望能够即时存取高品质的点播串流内容,并能无缝适配多种网路和萤幕类型。从传统广播模式向网路观看方式的稳定转变,持续推动对先进串流软体解决方案的需求。个人化的观看体验、灵活的存取模式以及全球范围内不断增长的数位化普及率,都为市场的长期扩张提供了支撑。随着网路使用日益融入日常生活,影片串流软体仍是实现可扩展内容传送、提升用户参与度以及在全球市场提供客製化观看体验的核心技术。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 161亿美元 |

| 预测金额 | 730亿美元 |

| 复合年增长率 | 16.4% |

预计到2025年,解决方案市场规模将达到105亿美元。这个市场主导地位的驱动力在于对灵活平台日益增长的需求,这些平台能够实现高效的内容传送、效能优化和一致的观看品质。为了满足用户不断提高的期望,各公司持续投资强大的软体解决方案,以支援可扩展性、内容保护、自适应串流媒体和跨装置相容性。

预计到2025年,订阅服务市场规模将达到91亿美元。该市场成长的主要驱动力是消费者对不间断、按需存取以及个人化内容体验的强劲偏好。安全的收费系统、扩充性的订阅基础架构和客製化的内容传送模式对于持续普及仍然至关重要。

预计到2025年,美国影片串流软体市场规模将达51亿美元。消费者强大的购买力、数位平台的广泛普及以及对技术主导娱乐服务的强烈需求,共同支撑了这一市场成长。持续的创新和平台多元化将进一步促进市场成长。

目录

第一章调查方法和范围

第二章执行摘要

第三章业界考察

- 生态系分析

- 供应商情况

- 利润率

- 成本结构

- 每个阶段的附加价值

- 影响价值链的因素

- 中断

- 生态系分析

- 产业影响因素

- 司机

- Over-The-Top服务的需求不断增长

- 直播的兴起

- 行动和网路普及率不断提高。

- 影片压缩技术的进步

- 订阅模式的兴起

- 挑战与困难

- 服务品质和使用者体验

- 资料安全和隐私问题

- 市场机会

- 云端整合提供无缝扩充性

- 互动性增强了使用者参与度

- 司机

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特五力分析

- PESTEL 分析

- 科技与创新趋势

- 当前技术趋势

- 新兴技术

- 新兴经营模式

- 合规要求

- 永续性措施

- 消费者心理分析

- 专利和智慧财产权分析

- 地缘政治和贸易趋势

第四章 竞争情势

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 市场集中度分析

- 按地区

- 主要企业的竞争标竿分析

- 产品系列比较

- 产品线的广度

- 科技

- 创新

- 地理分布比较

- 全球扩张分析

- 服务网路覆盖

- 按地区分類的市场渗透率

- 竞争定位矩阵

- 领导企业

- 受让人

- 追踪者

- 小众玩家

- 战略展望矩阵

- 产品系列比较

- 2021-2024 年主要发展动态

- 併购

- 伙伴关係与合作

- 技术进步

- 扩张与投资策略

- 永续发展倡议

- 数位转型计划

- 新兴/Start-Ups竞赛的趋势

第五章 依产品类型分類的市场估算与预测,2022-2035年

- 解决方案

- 转码/编码

- 影片託管

- 影片内容管理

- 影片分析

- 视讯监控

- 其他的

- 服务

第六章 按分销类型分類的市场估算与预测,2022-2035年

- 直播

- 视讯点播串流媒体

第七章 依实施类型分類的市场估计与预测,2022-2035年

- 本地部署

- 基于云端的

第八章 依货币化模型分類的市场估算与预测,2022-2035年

- 订阅类型

- 基于广告

- 基于交易

9. 按交付管道分類的市场估算与预测,2022-2035 年

- 网路为基础的交付

- 行动应用交付

第十章 2022-2035年各产业市场估计与预测

- 广播公司

- 出版商

- 体育赛事/组织

- 监控与安防

- 活动/会议/演出

- 宗教组织

第十一章 2022-2035年各地区市场估计与预测

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿拉伯聯合大公国

第十二章:公司简介

- 主要企业

- Amazon Web Services Inc.(AWS Elemental)

- Microsoft

- IBM Corporation

- Akamai Technologies Inc.

- 按地区分類的主要企业

- 北美洲

- Brightcove Inc.

- JW Player Inc.

- Haivision Systems Inc.

- Vimeo.com, Inc.

- 欧洲

- Dacast

- Panopto Inc.

- Qumu Corporation

- MediaPlatform Inc.

- Asia-Pacific

- SproutVideo

- Vbrick Systems Inc.

- 北美洲

- 颠覆者/小众玩家

- Enghouse Interactive

- Wowza Media Systems LLC

- Kaltura Inc.

The Global Video Streaming Software Market was valued at USD 16.1 billion in 2025 and is estimated to grow at a CAGR of 16.4% to reach USD 73 billion by 2035.

Demand for video streaming software is rising sharply as consumers increasingly favor digital content delivered through internet-based platforms. Widespread mobile connectivity, expanding broadband infrastructure, and growing use of connected devices are reshaping how audiences consume video content. Users now expect instant access to high-quality, on-demand streaming that adapts seamlessly across multiple networks and screen types. The steady shift away from traditional broadcast models toward internet-based viewing alternatives continues to strengthen demand for advanced streaming software solutions. Growth in personalized viewing experiences, flexible access models, and global digital penetration supports long-term market expansion. As internet usage becomes more deeply embedded in daily life, video streaming software remains a core technology enabling scalable content delivery, enhanced user engagement, and customized viewing experiences across global markets.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $16.1 Billion |

| Forecast Value | $73 Billion |

| CAGR | 16.4% |

The solution segment reached USD 10.5 billion in 2025. This dominance is supported by increasing demand for flexible platforms that enable efficient content delivery, performance optimization, and consistent viewing quality. Businesses continue to invest in robust software solutions that support scalability, content protection, adaptive streaming, and compatibility across devices to meet rising user expectations.

The subscription-based offerings segment generated USD 9.1 billion in 2025. Growth in this segment is driven by strong consumer preference for uninterrupted, on-demand access combined with personalized content experiences. Secure billing systems, scalable subscription infrastructure, and tailored content delivery models remain critical for sustained adoption.

United States Video Streaming Software Market garnered USD 5.1 billion in 2025. Market strength is supported by high consumer spending power, widespread adoption of digital platforms, and strong engagement with technology-driven entertainment services. Continued innovation and platform diversity further reinforce market growth.

Key companies operating in the Global Video Streaming Software Market include Amazon Web Services Inc., Google, Microsoft, IBM Corporation, Akamai Technologies Inc., Brightcove Inc., Kaltura Inc., Vimeo.com, Inc., JW Player Inc., Wowza Media Systems LLC, Haivision Systems Inc., Panopto Inc., MediaPlatform Inc., Qumu Corporation, Vbrick Systems Inc., Dacast, Enghouse Interactive, and SproutVideo. Companies in the Global Video Streaming Software Market strengthen their competitive position through continuous platform innovation, scalability enhancement, and user experience optimization. Firms prioritize adaptive streaming technologies, data-driven personalization, and secure content management to meet evolving consumer expectations. Investment in cloud-based infrastructure improves performance and global reach, while flexible pricing and subscription models support customer retention.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Offering trends

- 2.2.2 Streaming type trends

- 2.2.3 Deployment mode trends

- 2.2.4 Monetization model trends

- 2.2.5 Delivery channel trends

- 2.2.6 Vertical trends

- 2.2.7 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry ecosystem analysis

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Increasing demand for over-the-top (OTT) services

- 3.3.1.2 The proliferation of live-streaming

- 3.3.1.3 Expansion of mobile and internet penetration

- 3.3.1.4 Advancements in video compression technologies

- 3.3.1.5 Rise of subscription-based models

- 3.3.2 Pitfalls and challenges

- 3.3.2.1 Quality of service and user experience

- 3.3.2.2 Data security and privacy concerns

- 3.3.3 Market opportunities

- 3.3.3.1 Cloud integration enables seamless scalability

- 3.3.3.2 Interactive features boost user engagement

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.5.4 Latin America

- 3.5.5 Middle East & Africa

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Technology and Innovation landscape

- 3.8.1 Current technological trends

- 3.8.2 Emerging technologies

- 3.9 Emerging Business Models

- 3.10 Compliance Requirements

- 3.11 Sustainability Measures

- 3.12 Consumer Sentiment Analysis

- 3.13 Patent and IP analysis

- 3.14 Geopolitical and trade dynamics

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Product portfolio comparison

- 4.3.1.1 Product range breadth

- 4.3.1.2 Technology

- 4.3.1.3 Innovation

- 4.3.2 Geographic presence comparison

- 4.3.2.1 Global footprint analysis

- 4.3.2.2 Service network coverage

- 4.3.2.3 Market penetration by region

- 4.3.3 Competitive positioning matrix

- 4.3.3.1 Leaders

- 4.3.3.2 Challengers

- 4.3.3.3 Followers

- 4.3.3.4 Niche players

- 4.3.4 Strategic outlook matrix

- 4.3.1 Product portfolio comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market estimates and forecast, By Offering, 2022 - 2035 (USD Billion)

- 5.1 Key trends

- 5.2 Solution

- 5.2.1 Transcoding & encoding

- 5.2.2 Video hosting

- 5.2.3 Video content management

- 5.2.4 Video analytics

- 5.2.5 Video security

- 5.2.6 Others

- 5.3 Service

Chapter 6 Market estimates and forecast, By Streaming Type, 2022 - 2035 (USD Billion)

- 6.1 Key trends

- 6.2 Live streaming

- 6.3 Video-on-demand streaming

Chapter 7 Market estimates and forecast, By Deployment Mode, 2022 - 2035 (USD Billion)

- 7.1 Key trends

- 7.2 On-premises

- 7.3 Cloud-based

Chapter 8 Market estimates and forecast, By Monetization Model, 2022 - 2035 (USD Billion)

- 8.1 Key trends

- 8.2 Subscription-based

- 8.3 Advertising-based

- 8.4 Transaction-based

Chapter 9 Market estimates and forecast, By Delivery Channel, 2022 - 2035 (USD Billion)

- 9.1 Key trends

- 9.2 Web-based delivery

- 9.3 Mobile app delivery

Chapter 10 Market estimates and forecast, By Vertical, 2022 - 2035 (USD Billion)

- 10.1 Key trends

- 10.2 Broadcasters

- 10.3 Publishers

- 10.4 Sports events/organizations

- 10.5 Surveillance/security

- 10.6 Events/conference/performances

- 10.7 Religious organizations

Chapter 11 Market estimates and forecast, By Region, 2022 - 2035 (USD Billion)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

Chapter 12 Company profiles

- 12.1 Global Key Players

- 12.1.1 Google

- 12.1.2 Amazon Web Services Inc. (AWS Elemental)

- 12.1.3 Microsoft

- 12.1.4 IBM Corporation

- 12.1.5 Akamai Technologies Inc.

- 12.2 Regional Key Players

- 12.2.1 North America

- 12.2.1.1 Brightcove Inc.

- 12.2.1.2 JW Player Inc.

- 12.2.1.3 Haivision Systems Inc.

- 12.2.1.4 Vimeo.com, Inc.

- 12.2.2 Europe

- 12.2.2.1 Dacast

- 12.2.2.2 Panopto Inc.

- 12.2.2.3 Qumu Corporation

- 12.2.2.4 MediaPlatform Inc.

- 12.2.3 Asia-Pacific

- 12.2.3.1 SproutVideo

- 12.2.3.2 Vbrick Systems Inc.

- 12.2.1 North America

- 12.3 Disruptors / Niche Players

- 12.3.1 Enghouse Interactive

- 12.3.2 Wowza Media Systems LLC

- 12.3.3 Kaltura Inc.