|

市场调查报告书

商品编码

1913334

食品包埋市场机会、成长要素、产业趋势分析及预测(2026年至2035年)Food Encapsulation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

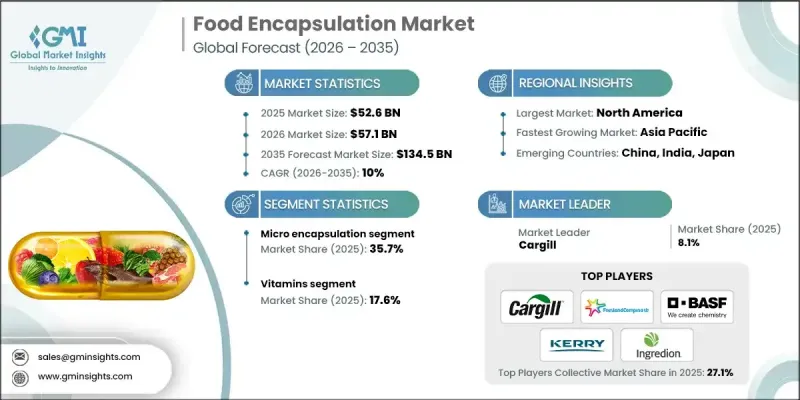

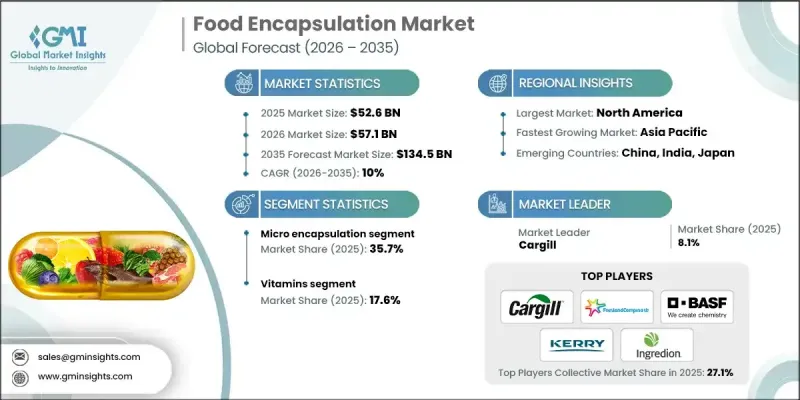

全球食品包埋市场预计到 2025 年将达到 526 亿美元,预计到 2035 年将达到 1,345 亿美元,年复合成长率为 10%。

市场成长主要得益于食品生产商致力于提升产品稳定性、感官品质和营养价值,从而推动了包埋技术在多个食品类别中的广泛应用。包埋技术正日益应用于改善食品的视觉吸引力、风味保持性和口感一致性,进而提升消费者对包装食品的接受度。甜味剂配方中包埋成分的日益普及,以及对成分创新和食品保藏研究的持续投入,都促进了包埋技术的广泛应用。消费者营养意识的不断提高,以及对强化食品和增值食品需求的成长,持续推动市场扩张。保护敏感和易挥发性食品成分的需求,推动了对先进包埋解决方案的需求。现代保藏技术的快速发展,进一步提升了成分保护效果和延长了保存期限。同时,缓释机制的进步,也为那些希望透过增强产品功能和健康益处来实现差异化生产的生产商创造了极具吸引力的成长机会。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 526亿美元 |

| 预测金额 | 1345亿美元 |

| 复合年增长率 | 10% |

由于保护性涂层技术在保护敏感成分方面的有效性以及其在各种食品配方中的适应性,微胶囊化领域在 2025 年将占据 35.7% 的市场份额。

到 2025 年,维生素细分市场将占 17.6% 的市场份额,这主要得益于人们对营养强化和维生素在维持长期健康和生理功能方面的作用日益增长的兴趣。

到 2025 年,北美食品封装市场将占据 36.6% 的市场份额,这得益于成熟的包装食品行业、丰富的封装材料供应以及先进保鲜技术的持续应用。

目录

第一章调查方法和范围

第二章执行摘要

第三章业界考察

- 生态系分析

- 供应商情况

- 利润率

- 每个阶段的附加价值

- 影响价值链的因素

- 中断

- 产业影响因素

- 司机

- 产业潜在风险与挑战

- 市场机会

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特五力分析

- PESTEL 分析

- 价格趋势

- 未来市场趋势

- 科技与创新趋势

- 当前技术趋势

- 新兴技术

- 专利状态

- 贸易统计(HS编码)

(註:贸易统计数据仅涵盖主要国家。)

- 主要进口国

- 主要出口国

第四章 竞争情势

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 企业矩阵分析

- 主要市场公司的竞争分析

- 竞争定位矩阵

- 重大进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 业务拓展计划

第五章 按类型分類的市场估算与预测,2022-2035年

- 微胶囊化

- 奈米封装

- 混合技术

- 大分子胶囊化

第六章 2022-2035年核心阶段市场估算与预测

- 维他命

- 脂溶性维生素

- 维生素A

- 维生素D

- 维生素E

- 维生素K

- 水溶性维生素

- 维生素B族

- 维生素C

- 脂溶性维生素

- 有机酸

- 柠檬酸

- 乳酸

- 富马酸

- 苹果酸

- 其他的

- 矿物

- 酵素

- 香精和香精

- 防腐剂

- 甜味剂

- 色素

- 益生元

- 益生菌

- 精油

- 其他的

第七章 按技术分類的市场估计与预测,2022-2035年

- 物理过程

- 喷

- 喷雾干燥

- 喷雾冷却

- 旋转圆盘

- 挤出法

- 流体化床技术

- 其他的

- 喷

- 化学和物理化学过程

第八章 按外壳材料的市场估算与预测,2022-2035年

- 多醣

- 蛋白质

- 脂质

- 乳化剂

- 其他的

第九章 2022-2035年各地区市场估算与预测

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿拉伯聯合大公国

- 其他中东和非洲地区

第十章:公司简介

- Cargill

- FrieslandCampina Kievit

- Royal DSM

- BASF SE

- Kerry Group

- Ingredion Incorporated

- Lycored Group

- International Flavours &Fragrances Inc.(IFF)

- Symrise AG

- Sensient Technologies Corporation

- Balchem Corporation

- Firmenich SA

- AVEKA Group

The Global Food Encapsulation Market was valued at USD 52.6 billion in 2025 and is estimated to grow at a CAGR of 10% to reach USD 134.5 billion by 2035.

Market growth is fueled by the widening use of encapsulation across multiple food categories, as manufacturers focus on enhancing product stability, sensory quality, and nutritional value. Encapsulation technologies are increasingly applied to improve visual appeal, flavor retention, and taste consistency, which supports stronger consumer acceptance of packaged foods. Rising utilization of encapsulated ingredients in sweetener formulations is contributing to broader adoption, supported by continuous investments in ingredient innovation and food preservation research. Growing consumer awareness regarding nutrition, combined with higher demand for fortified and value-added food products, continues to support market expansion. The need to safeguard sensitive and volatile food components has strengthened demand for advanced encapsulation solutions. Rapid adoption of modern preservation techniques is further improving ingredient protection and shelf-life performance. At the same time, advancements in controlled-release mechanisms are creating attractive growth opportunities for producers seeking to differentiate their offerings through functional performance and enhanced health benefits.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $52.6 Billion |

| Forecast Value | $134.5 Billion |

| CAGR | 10% |

The microencapsulation segment accounted for 35.7% share in 2025, supported by its effectiveness in protecting sensitive ingredients through protective coating methods and its adaptability across diverse food formulations.

The vitamins segment held 17.6% share in 2025, driven by rising interest in nutritional enrichment and the role of vitamins in supporting long-term health and physiological functions.

North America Food Encapsulation Market held 36.6% share in 2025, supported by a mature packaged food industry, strong availability of encapsulation materials, and ongoing adoption of advanced preservation technologies.

Key companies operating in the Global Food Encapsulation Market include Ingredion Incorporated, Kerry Group, Symrise AG, Balchem Corporation, Cargill, Sensient Technologies Corporation, International Flavours & Fragrances Inc. (IFF), FrieslandCampina Kievit, BASF SE, Lycored Group, AVEKA Group, Royal DSM, and Firmenich SA. Companies in the Global Food Encapsulation Market are reinforcing their market position by investing heavily in research and development to improve encapsulation efficiency, stability, and controlled-release performance. Strategic partnerships with food manufacturers allow suppliers to co-develop customized solutions tailored to specific formulation needs. Expansion of production capacities and geographic presence helps companies meet rising global demand while improving supply reliability. Firms are also focusing on clean-label and health-oriented innovations to align with evolving consumer preferences.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Core phase

- 2.2.4 Technology

- 2.2.5 Shell material

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Type, 2022-2035 (USD Billion & Tons)

- 5.1 Key trends

- 5.2 Micro encapsulation

- 5.3 Nano encapsulation

- 5.4 Hybrid technology

- 5.5 Macro encapsulation

Chapter 6 Market Estimates and Forecast, By Core Phase, 2022-2035 (USD Billion & Tons)

- 6.1 Key trends

- 6.2 Vitamins

- 6.2.1 Fat soluble vitamins

- 6.2.1.1 Vitamin A

- 6.2.1.2 Vitamin D

- 6.2.1.3 Vitamin E

- 6.2.1.4 Vitamin K

- 6.2.2 Water soluble vitamins

- 6.2.2.1 Vitamin B complex

- 6.2.2.2 Vitamin C

- 6.2.1 Fat soluble vitamins

- 6.3 Organic acids

- 6.3.1 Citric acid

- 6.3.2 Lactic acid

- 6.3.3 Fumaric acid

- 6.3.4 Malic acid

- 6.3.5 Others

- 6.4 Minerals

- 6.5 Enzymes

- 6.6 Flavors & essences

- 6.7 Preservatives

- 6.8 Sweeteners

- 6.9 Colors

- 6.10 Prebiotics

- 6.11 Probiotics

- 6.12 Essential oils

- 6.13 Others

Chapter 7 Market Estimates and Forecast, By Technology, 2022-2035 (USD Billion & Tons)

- 7.1 Key trends

- 7.2 Physical process

- 7.2.1 Atomization

- 7.2.1.1 Spray drying

- 7.2.1.2 Spray chilling

- 7.2.1.3 Spinning disk

- 7.2.2 Extrusion

- 7.2.3 Fluid bed technique

- 7.2.4 Others

- 7.2.1 Atomization

- 7.3 Chemical & physicochemical process

Chapter 8 Market Estimates and Forecast, By Shell Material, 2022-2035 (USD Billion & Tons)

- 8.1 Key trends

- 8.2 Polysaccharides

- 8.3 Proteins

- 8.4 Lipids

- 8.5 Emulsifiers

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion & Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Cargill

- 10.2 FrieslandCampina Kievit

- 10.3 Royal DSM

- 10.4 BASF SE

- 10.5 Kerry Group

- 10.6 Ingredion Incorporated

- 10.7 Lycored Group

- 10.8 International Flavours & Fragrances Inc. (IFF)

- 10.9 Symrise AG

- 10.10 Sensient Technologies Corporation

- 10.11 Balchem Corporation

- 10.12 Firmenich SA

- 10.13 AVEKA Group