|

市场调查报告书

商品编码

1913398

汽车轮胎充气机市场:市场机会、成长驱动因素、产业趋势分析及预测(2026-2035)Automotive Tire Inflator Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

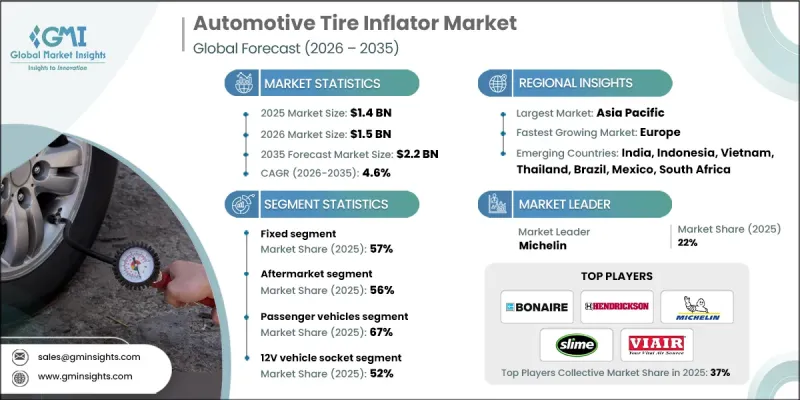

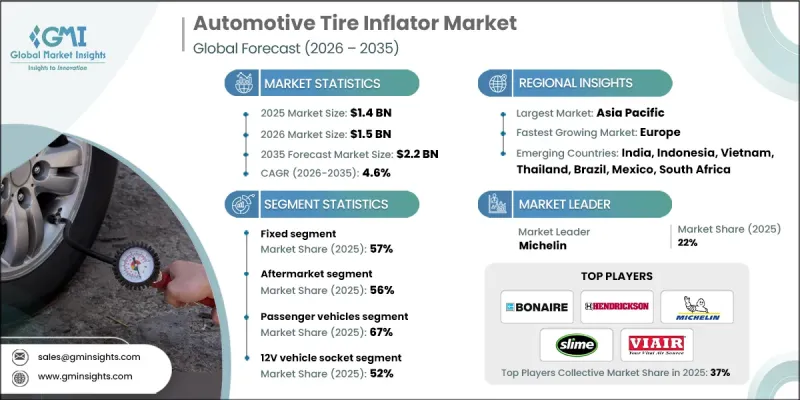

全球汽车轮胎充气机市场预计到 2025 年将达到 14 亿美元,到 2035 年将达到 22 亿美元,年复合成长率为 4.6%。

汽车轮胎充气装置在维持适当的轮胎气压方面发挥着至关重要的作用,这直接关係到车辆的效率、行驶安全性和整体性能。该市场涵盖固定式和便携式解决方案,可透过车辆电源插座、可充电电池系统或直接电源连接供电。产品种类繁多,从基本的充气装置到具有自动压力调节和监控功能的携带式控制系统,应有尽有。技术进步正在重塑市场格局,数位化介面、自动断电功能和智慧压力控制等技术的进步提高了易用性和精度。成长趋势反映了成熟市场(以替换需求为主导)与新兴市场(车辆保有量不断增长,持续创造新机会)之间的对比。不断变化的消费者期望、日益严格的安全标准以及零售通路的数位化程度不断提高,都在影响消费者的购买行为。这些因素共同作用,持续重塑全球汽车生态系统中的产品创新、可近性和普及性。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测期 | 2026-2035 |

| 初始市场规模 | 14亿美元 |

| 市场规模预测 | 22亿美元 |

| 复合年增长率 | 4.6% |

预计到2025年,固定式充气机市占率将达57%,2026年至2035年复合年增长率将达4.2%。这些系统专为连续、高强度使用而设计,通常安装在专业和工业环境中。其性能稳定,不受功率限制,并且能够承受严苛的运行要求,这些优势使其在市场上占据主导地位。

预计到2025年,售后市场将占据56%的市场份额,并在2035年之前以4.8%的最高复合年增长率成长。消费者对替换件和产品升级的强劲需求,以及线上销售管道的拓展,持续推动市场成长。此细分市场满足了用户对更高功能性、更强便携性或多辆车用充气帮浦的需求。

预计到2025年,中国汽车轮胎充气机市场将占全球38%的份额,市场规模达5.417亿美元。新兴经济体汽车保有量的成长、消费者在汽车配件上的支出增加、零售网路的扩张以及汽车保养意识的提高,都支撑了中国在该地区主导地位。

目录

第一章:分析方法和范围

第二章执行摘要

第三章业界考察

- 产业生态系分析

- 供应商情况

- 利润率分析

- 成本结构

- 每个阶段的附加价值

- 影响价值链的因素

- 中断

- 产业影响因素

- 司机

- 提高轮胎安全意识

- 对携带式和紧凑型解决方案的需求

- 冒险和越野活动的兴起

- 随着汽车拥有量的增加,对轮胎充气帮浦的需求也随之增加。

- 电子商务的发展提高了产品供应量和市场覆盖范围。

- 产业潜在风险与挑战

- 先进型号的初始成本较高

- 替代轮胎维修解决方案的竞争格局

- 市场机会

- 对智慧数位轮胎充气泵的需求日益增长

- 无线和可充电充气帮浦越来越受欢迎

- 新兴市场汽车销售上升

- 适用于没有备胎的车辆的原厂配套产品

- 拓展电子商务和直接面向销售管道

- 司机

- 成长潜力分析

- 监管环境

- 波特五力分析

- PESTEL 分析

- 科技与创新趋势

- 当前技术趋势

- 新兴技术

- 生产统计

- 生产基地

- 消费基础

- 进出口

- 定价分析

- 按地区

- 副产品

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 永续努力

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

- 未来展望与投资机会

第四章 竞争情势

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 主要企业的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 主要趋势

- 企业合併(M&A)

- 商业伙伴关係与合作

- 新产品发布

- 企业扩张计画和资金筹措

第五章 按产品分類的市场估算与预测(2022-2035 年)

- 固定式

- 携带式的

第六章 依车辆类型分類的市场估计与预测(2022-2035 年)

- 搭乘用车

- 掀背车

- 轿车

- SUV

- 商用车辆

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车(HCV)

- 摩托车

- 电动车

- 越野车(ATV/UTV)

第七章 按销售管道分類的市场估算与预测(2022-2035 年)

- OEM

- 固定式

- 携带式的

- 售后市场

- 固定式

- 携带式的

第八章 按应用领域分類的市场估算与预测(2022-2035 年)

- 家用

- 商业的

- 工业的

第九章 按组件分類的市场估计和预测(2022-2035 年)

- ECU

- 压缩机

- 压力感测器

- 其他的

第十章 依能源类型分類的市场估算与预测(2022-2035 年)

- 12V汽车插座

- 可充电电池(锂离子电池)

- 直流电源

- 其他的

第十一章 各地区市场估计与预测(2022-2035 年)

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧国家

- 比荷卢经济联盟国家

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 新加坡

- 泰国

- 印尼

- 越南

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 哥伦比亚

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

第十二章:公司简介

- 国际公司

- Berkshire Hathaway

- BLACK+DECKER

- CRAFTSMAN

- ITW Global Tire Repair

- Marmon Holdings

- MAT Industries

- Michelin

- Slime

- STEMCO Products

- VIAIR

- 本地公司

- Airtec

- BONAIRE Industries

- Coido

- Guangzhou Meitun Electronic Commerce

- Hendrickson USA

- Kensun

- Nova Gas Techniques

- Pressure Systems International

- PressureGuard

- TIRETEK

- 新兴企业

- Alpha Catalyst Consulting

- Alto Ride

- Kstar New Energy

- Stealth Electric Outboards

- TEMO

The Global Automotive Tire Inflator Market was valued at USD 1.4 billion in 2025 and is estimated to grow at a CAGR of 4.6% to reach USD 2.2 billion by 2035.

Automotive tire inflators play an essential role in maintaining correct tire pressure, which directly supports vehicle efficiency, driving safety, and overall performance. The market includes both stationary and portable solutions designed to operate through vehicle power outlets, rechargeable battery systems, or direct electrical connections. Product offerings range from basic air inflation units to digitally controlled systems equipped with automated pressure regulation and monitoring capabilities. Technological progress has reshaped the market, with digital interfaces, automated shut-off functions, and intelligent pressure control improving usability and accuracy. Growth trends reflect a contrast between mature markets, where replacement demand is dominant, and developing regions, where rising vehicle ownership continues to create new opportunities. Shifting consumer expectations, tighter safety standards, and the increasing digitization of retail channels are influencing purchasing behavior. Together, these factors continue to redefine product innovation, accessibility, and adoption across global automotive ecosystems.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.4 Billion |

| Forecast Value | $2.2 Billion |

| CAGR | 4.6% |

The fixed inflator segment accounted for 57% share in 2025 and is projected to grow at a CAGR of 4.2% from 2026 to 2035. These systems are designed for continuous, high-capacity usage and are commonly installed in professional and industrial environments. Their ability to deliver consistent performance without power limitations and withstand heavy operational demands supports their leading market position.

The aftermarket segment held 56% share in 2025 and is expected to grow at the fastest CAGR of 4.8% through 2035. Strong consumer demand for replacement units and product upgrades, combined with the expansion of online sales channels, continues to drive growth. This segment serves users seeking improved functionality, portability, or additional inflators for multiple vehicles.

China Automotive Tire Inflator Market held a 38% share in 2025, generating USD 541.7 million. Regional leadership is supported by rising vehicle ownership, increasing consumer spending on automotive accessories, expanding retail networks, and growing awareness of vehicle care across emerging economies.

Key companies active in the Global Automotive Tire Inflator Market include Michelin, VIAIR, Slime, ITW Global Tire Repair, Kensun, Marmon Holdings, BONAIRE Industries, Hendrickson USA, TIRETEK, and Guangzhou Meitun Electronic Commerce. Companies operating in the Global Automotive Tire Inflator Market strengthen their competitive position through continuous product innovation and portfolio expansion. Manufacturers focus on integrating digital controls, smart sensors, and automated features to improve accuracy and ease of use. Expanding presence across online and offline distribution channels helps brands reach a wider customer base. Strategic pricing across basic and premium product lines supports diverse consumer needs. Firms also emphasize product durability and compliance with safety standards to build long-term trust. Partnerships with automotive retailers and investments in brand visibility further enhance market penetration.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Vehicles

- 2.2.4 Application

- 2.2.5 Power Source

- 2.2.6 Component

- 2.2.7 Sales Channel

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Rising awareness about tire safety

- 3.2.1.3 Demand for portable and compact solutions

- 3.2.1.4 Rise in adventure and off-road activities

- 3.2.1.5 Rising vehicle ownership is increasing demand for tire inflators

- 3.2.1.6 Growth of e-commerce is improving product availability and market reach

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial cost of advanced models

- 3.2.2.2 Competition of alternative tire repair solutions

- 3.2.3 Market opportunities

- 3.2.3.1 Rising demand for smart and digital tire inflators

- 3.2.3.2 Growing adoption of cordless and rechargeable inflators

- 3.2.3.3 Increasing vehicle sales in emerging markets

- 3.2.3.4 OEM fitment in vehicles without spare tires

- 3.2.3.5 Expansion of e-commerce and direct-to-consumer channels

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Production statistics

- 3.8.1 Production hubs

- 3.8.2 Consumption hubs

- 3.8.3 Export and import

- 3.9 Pricing analysis

- 3.9.1 By region

- 3.9.2 By product

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Future outlook & investment opportunities

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2022 - 2035 ($Bn, Units)

- 5.1 Key trends

- 5.2 Fixed

- 5.3 Portable

Chapter 6 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger vehicles

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUVS

- 6.3 Commercial vehicles

- 6.3.1 Light commercial vehicles (LCV)

- 6.3.2 Medium commercial vehicles (MCV)

- 6.3.3 Heavy commercial vehicles (HCV)

- 6.4 Two-wheelers

- 6.5 Electric vehicles

- 6.6 Off-Road Vehicles (ATV/UTV)

Chapter 7 Market Estimates & Forecast, By Sales Channel, 2022 - 2035 ($Bn, Units)

- 7.1 Key trends

- 7.2 OEM

- 7.2.1 Fixed

- 7.2.2 Portable

- 7.3 Aftermarket

- 7.3.1 Fixed

- 7.3.2 Portable

Chapter 8 Market Estimates & Forecast, By Application, 2022 - 2035 ($Bn, Units)

- 8.1 Key trends

- 8.2 Household

- 8.3 Commercial

- 8.4 Industrial

Chapter 9 Market Estimates & Forecast, By Component, 2022 - 2035 ($Bn, Units)

- 9.1 Key trends

- 9.2 ECU

- 9.3 Compressor

- 9.4 Pressure sensor

- 9.5 Others

Chapter 10 Market Estimates & Forecast, By Power Source, 2022 - 2035 ($Bn, Units)

- 10.1 Key trends

- 10.2 12V Vehicle Socket

- 10.3 Rechargeable Battery (Li-ion)

- 10.4 Direct AC Power

- 10.5 Other

Chapter 11 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.3.8 Benelux

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Singapore

- 11.4.7 Thailand

- 11.4.8 Indonesia

- 11.4.9 Vietnam

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Colombia

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Global Players

- 12.1.1 Berkshire Hathaway

- 12.1.2 BLACK+DECKER

- 12.1.3 CRAFTSMAN

- 12.1.4 ITW Global Tire Repair

- 12.1.5 Marmon Holdings

- 12.1.6 MAT Industries

- 12.1.7 Michelin

- 12.1.8 Slime

- 12.1.9 STEMCO Products

- 12.1.10 VIAIR

- 12.2 Regional Players

- 12.2.1 Airtec

- 12.2.2 BONAIRE Industries

- 12.2.3 Coido

- 12.2.4 Guangzhou Meitun Electronic Commerce

- 12.2.5 Hendrickson USA

- 12.2.6 Kensun

- 12.2.7 Nova Gas Techniques

- 12.2.8 Pressure Systems International

- 12.2.9 PressureGuard

- 12.2.10 TIRETEK

- 12.3 Emerging Players

- 12.3.1 Alpha Catalyst Consulting

- 12.3.2 Alto Ride

- 12.3.3 Kstar New Energy

- 12.3.4 Stealth Electric Outboards

- 12.3.5 TEMO