|

市场调查报告书

商品编码

1913461

硅烷市场机会、成长要素、产业趋势分析及2026年至2035年预测Silanes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

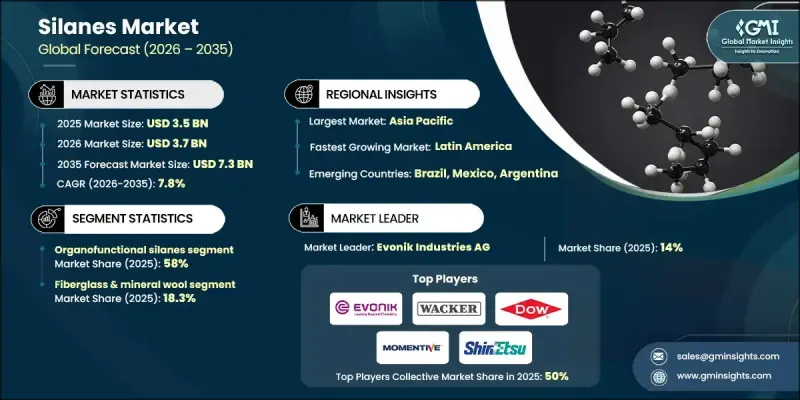

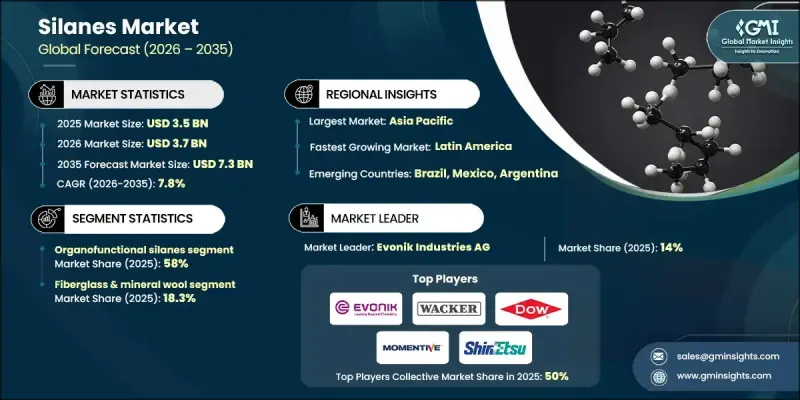

全球硅烷市场预计到 2025 年价值 35 亿美元,到 2035 年达到 73 亿美元,年复合成长率为 7.8%。

随着建筑、汽车和电子製造业活动的復苏,市场表现日益改善,推动了多个产业链对硅烷改质材料的需求成长。基础设施投资和工业生产的增加,推动了硅烷增强密封剂、涂料和增强复合材料在结构、运输和电气设备应用领域的广泛应用。减少排放的监管压力促使製造商开发低排放、低溶剂和无金属配方,加速了硅烷化学领域的创新。有机官能硅烷作为表面改质剂、黏合促进剂和尖端材料前驱物的应用日益广泛,进一步促进了市场成长。高性能电子元件和先进封装技术的产量增加也推动了市场需求,这些技术需要与精密製造环境相容的高纯度硅烷。同时,交通运输、可再生能源和工业复合材料领域的应用持续推动稳定的消费,因为製造商优先考虑材料的耐久性、黏合效率和长期性能。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 35亿美元 |

| 预测金额 | 73亿美元 |

| 复合年增长率 | 7.8% |

预计到 2025 年,有机官能硅烷市占率将达到 58%,到 2035 年将以 8% 的复合年增长率成长。虽然其他类型的硅烷继续作为硅基化学的重要中间体,但有机官能硅烷因其在涂料、电子产品和特种材料体系中的多功能性而越来越受到青睐。

2025年,玻璃纤维和矿物棉市场份额为18.3%,预计到2035年将以6.1%的复合年增长率成长。硅烷在提高隔热材料、涂料和复合材料应用中的黏合强度、防潮性和机械稳定性方面发挥着至关重要的作用。

预计到 2025 年,美国硅烷市场规模将达到 6.092 亿美元,主要得益于建筑材料、电子製造和复合材料应用领域的强劲需求,以及基础设施现代化和对高性能材料的持续投资。

目录

第一章调查方法和范围

第二章执行摘要

第三章业界考察

- 生态系分析

- 供应商情况

- 利润率

- 每个阶段的附加价值

- 影响价值链的因素

- 中断

- 产业影响因素

- 司机

- 扩大电子设备、半导体和显示器的生产

- 建筑和基础设施涂料市场的成长

- 增强塑胶和复合材料的使用日益增多

- 产业潜在风险与挑战

- 某些硅烷化合物引发的环境与健康问题

- 对上游工程氯硅烷和硅供应的依赖

- 市场机会

- 可再生能源、电缆和电网现代化

- 采用轻量化汽车和电动汽车零件

- 司机

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特五力分析

- PESTEL 分析

- 价格趋势

- 按地区

- 按类型

- 未来市场趋势

- 科技与创新趋势

- 当前技术趋势

- 新兴技术

- 专利状态

- 贸易统计(HS编码)

(註:贸易统计数据仅涵盖主要国家。)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续努力

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 考虑到碳足迹

第四章 竞争情势

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 企业矩阵分析

- 主要市场公司的竞争分析

- 竞争定位矩阵

- 重大进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 业务拓展计划

第五章 按类型分類的市场估算与预测,2022-2035年

- 卤代硅烷/氢化物官能化硅烷

- 氯硅烷

- 烷基硅烷

- 氢硅烷

- 有机官能硅烷

- 氨基硅烷

- 环氧硅烷

- 乙烯基硅烷

- 甲基丙烯酰氧基硅烷

- 硫硅烷

- 其他的

第六章 按应用领域分類的市场估算与预测,2022-2035年

- 玻璃纤维和矿物棉

- 油漆和涂料

- 聚烯化合物

- 黏合剂和密封剂

- 溶胶-凝胶法

- 填料和颜料

- 浇铸和浇铸树脂

- 硅酮

第七章 2022-2035年各地区市场估算与预测

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿拉伯聯合大公国

- 其他中东和非洲地区

第八章 公司简介

- Evonik Industries AG

- Wacker Chemie AG

- Momentive Performance Materials Inc.

- Dow Inc.

- Shin-Etsu Chemical Co., Ltd.

- Elkem ASA(Elkem Silicones)

- PCC SE

- Gelest, Inc.

- Nitrochemie AG

- Jiangxi Chenguang New Materials Co., Ltd.

- Nanjing Shuguang Chemical Group Co., Ltd.

- China National Bluestar(Group)Co., Ltd.

- Siltech Corporation

The Global Silanes Market was valued at USD 3.5 billion in 2025 and is estimated to grow at a CAGR of 7.8% to reach USD 7.3 billion by 2035.

Market performance is improving alongside the recovery of construction, automotive, and electronics manufacturing activities, which has strengthened demand for silane-modified materials across multiple industrial value chains. Rising investments in infrastructure and industrial output have increased the use of silane-enhanced sealants, coatings, and reinforced composites in structural, transportation, and electrical applications. Regulatory pressure to reduce emissions has encouraged manufacturers to develop low-emission, solvent-reduced, and metal-free formulations, accelerating innovation in silane chemistry. Growing adoption of organofunctional silanes as surface modifiers, adhesion promoters, and advanced material precursors is further supporting market expansion. Demand is also being reinforced by increased production of high-performance electronic components and advanced packaging technologies, which require high-purity silanes compatible with precision manufacturing environments. In parallel, applications in transportation, renewable energy, and industrial composites continue to drive consistent consumption as manufacturers prioritize durability, bonding efficiency, and long-term material performance.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $3.5 Billion |

| Forecast Value | $7.3 Billion |

| CAGR | 7.8% |

The organofunctional silanes segment accounted for 58% share in 2025 and is expected to grow at a CAGR of 8% through 2035. While other silane types continue to serve as essential intermediates in silicon-based chemistry, organofunctional grades are increasingly favored for their versatility across coatings, electronics, and specialty material systems.

The fiberglass and mineral wool segment held 18.3% share in 2025 and is forecast to expand at a CAGR of 6.1% by 2035. Silanes play a critical role in enhancing bonding strength, moisture resistance, and mechanical stability across insulation, coating, and composite applications.

U.S. Silanes Market reached USD 609.2 million in 2025, supported by strong demand from construction materials, electronics manufacturing, and composite applications, alongside continued investment in infrastructure modernization and high-performance materials.

Key companies operating in the Global Silanes Market include Dow Inc., Wacker Chemie AG, Shin-Etsu Chemical Co., Ltd., Evonik Industries AG, Elkem ASA, Momentive Performance Materials Inc., Gelest, Inc., Siltech Corporation, PCC SE, Nitrochemie AG, China National Bluestar (Group) Co., Ltd., Jiangxi Chenguang New Materials Co., Ltd., and Nanjing Shuguang Chemical Group Co., Ltd. Companies in the Silanes Market are strengthening their market position by investing in product innovation focused on low-emission and high-purity formulations. Strategic capacity expansions and process optimization are being used to ensure supply stability and cost efficiency. Many players are aligning their portfolios with regulatory requirements by developing environmentally compliant solutions. Collaboration with downstream manufacturers is helping accelerate application-specific customization and long-term supply agreements.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Application

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expanding electronics, semiconductors and displays production

- 3.2.1.2 Growth of construction and infrastructure coatings

- 3.2.1.3 Rising use of reinforced plastics and composites

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Environmental and health concerns around some silanes

- 3.2.2.2 Dependence on upstream chlorosilane, silicon supply

- 3.2.3 Market opportunities

- 3.2.3.1 Renewable energy, cable and grid modernization

- 3.2.3.2 Lightweight automotive and EV component adoption

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Type, 2022-2035 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Halosilanes / hydride functional silanes

- 5.2.1 Chlorosilanes

- 5.2.2 Alkylsilanes

- 5.2.3 Hydrosilanes

- 5.3 Organofunctional silanes

- 5.3.1 Amino silanes

- 5.3.2 Epoxy silanes

- 5.3.3 Vinyl silanes

- 5.3.4 Methacryloxy silanes

- 5.3.5 Sulfur silanes

- 5.3.6 Others

Chapter 6 Market Estimates and Forecast, By Application, 2022-2035 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Fiberglass & mineral wool

- 6.3 Paints & coatings

- 6.4 Polyolefin compounds

- 6.5 Adhesives & sealants

- 6.6 Sol-gel system

- 6.7 Fillers & pigments

- 6.8 Foundry & foundry resin

- 6.9 Silicones

Chapter 7 Market Estimates and Forecast, By Region, 2022-2035 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.5.4 Rest of Latin America

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

- 7.6.4 Rest of Middle East and Africa

Chapter 8 Company Profiles

- 8.1 Evonik Industries AG

- 8.2 Wacker Chemie AG

- 8.3 Momentive Performance Materials Inc.

- 8.4 Dow Inc.

- 8.5 Shin-Etsu Chemical Co., Ltd.

- 8.6 Elkem ASA (Elkem Silicones)

- 8.7 PCC SE

- 8.8 Gelest, Inc.

- 8.9 Nitrochemie AG

- 8.10 Jiangxi Chenguang New Materials Co., Ltd.

- 8.11 Nanjing Shuguang Chemical Group Co., Ltd.

- 8.12 China National Bluestar (Group) Co., Ltd.

- 8.13 Siltech Corporation