|

市场调查报告书

商品编码

1478711

硬碟机 (HDD) 和固态硬碟 (SSD) 产业:市场分析与加工趋势The Hard Disk Drive (HDD) and Solid State Drive (SSD) Industries: Market Analysis and Processing Trends |

||||||

由于数位内容、云端运算和大数据分析的出现,对资料储存的需求不断增加,数位储存格局正在经历重大变革。这项转变的核心是两项关键技术:硬碟 (HDD) 和固态硬碟 (SSD),每项技术在塑造储存的未来方面都发挥着关键作用。

HDD 产业在提供经济高效的储存解决方案方面有着悠久的历史,为了满足更高容量储存和能源效率的需求,HDD 产业不断发展。儘管面临来自 SSD 的竞争压力,但 HDD 由于其每 GB 成本和容量优势,在资料中心、企业储存和消费产品中仍然至关重要。

相反,在对性能、耐用性和能源效率的不断追求的推动下,SSD行业正在经历前所未有的增长。由于没有移动部件,SSD 比 HDD 提供卓越的速度、更低的功耗和更高的耐用性,使其成为行动装置、高效能运算和伺服器应用程式的首选。

本报告对硬碟 (HDD) 和固态硬碟 (SSD) 市场进行了全面研究,全面回顾了数位储存产业的现状、新兴趋势和未来前景,以及这是该产业的市场机会和未来前景的总结。

目录

第一章磁碟机市场基础设施□□

第二章硬碟产业

- 硬碟的趋势

- 硬碟外型尺寸

- 硬碟市场分析

- 竞争结构

第三章固态硬碟产业

- 固态硬碟 (SSD) 的趋势

- 固态硬碟市场分析

- 3D NAND 预测

- SSD容量预测

第四章录音头

- 薄膜读写头

- 趋势

- 录音头市场预测

第 5 章加工趋势与市场

- 头部加工

- 图案化磁性介质

- 离散轨道媒体市场分析

- NAND 处理

- 3D ReRAM 课题

第六章媒体市场

- 产业趋势

- 媒体简介

- 媒体市场供应商占有率

Introduction

The digital storage landscape is undergoing a significant transformation, driven by the insatiable demand for data storage, fueled by the proliferation of digital content, cloud computing, and the advent of big data analytics. At the heart of this transformation are two critical technologies: Hard Disk Drives (HDDs) and Solid State Drives (SSDs), each playing a pivotal role in shaping the future of storage. This report provides an in-depth market analysis of the HDD and SSD industries, offering insights into the current trends, challenges, and advancements that are influencing the processing and manufacturing techniques within these sectors.

The HDD industry, with its long history of providing cost-effective storage solutions, continues to evolve in response to the demands for higher storage capacity and energy efficiency. Despite the competitive pressures from SSDs, HDDs remain integral in data centers, enterprise storage, and consumer products due to their advantages in cost-per-gigabyte and capacity. This report examines the technological advancements in areal density, energy-assisted magnetic recording technologies such as MAMR (Microwave-Assisted Magnetic Recording) and HAMR (Heat Assisted Magnetic Recording), and innovations in platter materials and design that are key to the future growth and sustainability of HDDs.

Conversely, the SSD industry, driven by the relentless pursuit of performance, durability, and energy efficiency, is witnessing unprecedented growth. SSDs, with their lack of moving parts, offer superior speed, lower power consumption, and greater durability over HDDs, making them the preferred choice for mobile devices, high-performance computing, and server applications.

Through a comprehensive analysis of both the HDD and SSD markets, this report aims to provide stakeholders with a thorough understanding of the current state, emerging trends, and future outlook of the digital storage industry. It is designed to equip manufacturers, technology developers, enterprise users, and investors with the critical insights needed to navigate the complexities of the storage market, capitalize on opportunities, and anticipate the challenges ahead in this rapidly evolving sector.

Trends in HDD and SSD

In the realm of Hard Disk Drives (HDDs) and Solid State Drives (SSDs), the landscape is continually evolving to meet the ever-increasing demands for data storage, characterized by a relentless pursuit of higher capacity, speed, and reliability. HDD manufacturers are pushing the limits of storage capacity through advanced technologies such as Shingled Magnetic Recording (SMR) and Heat-Assisted Magnetic Recording (HAMR), aiming to satisfy the burgeoning storage requirements of enterprises and cloud services. Alongside, energy-assisted recording methods are being explored to break through the physical limitations of conventional magnetic recording, enabling denser data storage.

On the SSD front, the narrative is about the reduction in cost per gigabyte alongside a surge in storage capacities, thanks to advancements in NAND flash technology. This trend is making high-capacity SSDs more attainable, encouraging their adoption over HDDs for primary storage roles. The SSD arena is also witnessing the rise of Quad-Level Cell (QLC) NAND technology, which packs more data into each cell, making SSDs a more compelling option for large-scale storage needs.

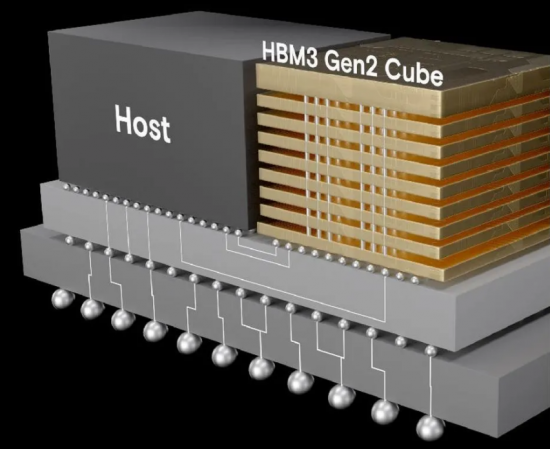

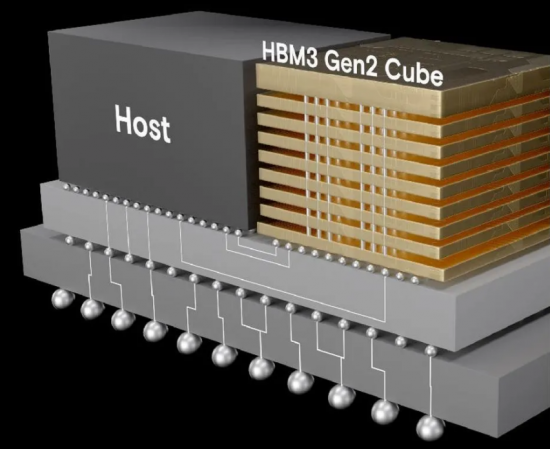

A significant highlight in the storage technology sphere is the advancement and integration of High Bandwidth Memory 3 (HBM3), which is setting new benchmarks in memory performance. HBM3, the latest iteration in the series, offers unprecedented data transfer speeds and bandwidth, markedly enhancing the performance of high-end computing systems. Its application is particularly notable in environments requiring rapid processing and analysis of vast data volumes, such as advanced AI algorithms and large-scale scientific computations.

The convergence of these technologies-HDDs evolving with smarter and denser recording techniques, SSDs becoming more accessible and capable, and the integration of cutting-edge solutions like HBM3-paints a picture of a storage industry that is not just about more space but about delivering faster, more efficient, and smarter data management and access solutions. This holistic advancement in storage technology underscores a future where data storage is not merely a repository but a critical component of computational efficiency and innovation.

Table of Contents

Chapter 1. The Disk Drive Market Infrastructure

Chapter 2. The Hard Disk Drive Industry

- 2.1. Hard Disk Drive Trends

- 2.2. Hard Disk Form Factors

- 2.3. Hard Disk Drive Market Analysis

- 2.3.1. Desktop PCs

- 2.3.2. Portable PCs

- 2.3.3. Enterprise

- 2.3.4. Consumer Electronics

- 2.4. Competitive Structure

- 2.4.1. HDD Market Share

Chapter 3. The Solid State Drive Industry

- 3.1. Solid-State Drives (SSD) Trends

- 3.2. Solid-State Drives Market Analysis

- 3.2.1. Client SSD Trends and Forecast

- 3.2.2. Enterprise SSD Trends and Forecast

- 3.2.3. Hybrid Hard Drives (HHD) Forecast

- 3.3 3D NAND Forecast

- 3.3.1. Comparison of 3D-NAND Structures

- 3.4. SSD Capacity Forecast

Chapter 4. Recording Heads

- 4.1. Thin Film Read/Write Heads

- 4.1.1. Thin Film (TF) Heads

- 4.1.2. Magnetoresistive (MR/AMR) Heads

- 4.1.3. Giant Magnetoresistive (GMR) Heads

- 4.1.4. Colossal Magnetoresistive (CMR) Heads

- 4.1.5. Current-Perpendicular-To-Place (CPP) Heads

- 4.1.6. Ballistic Magnetoresistance (BMR) Heads

- 4.2. Trends

- 4.3. Recording Head Market Forecast

Chapter 5. Processing Trends And Markets

- 5.1. Head Processing

- 5.1.1. Head Fabrication - CMP, Deposition, Lithography

- 5.1.1.1. CMP Challenges

- Ceria Slurry For Glass Disk Market

- Oxide Slurry For Metal Disk Market

- Oxide Slurry For Thin Film Head Market

- 5.1.1.2. Lithography Challenges

- 5.1.1.1. CMP Challenges

- 5.1.1. Head Fabrication - CMP, Deposition, Lithography

- 5.2. Patterned Magnetic Media

- 5.2.1. Conventional Media

- 5.2.2. Patterned Media

- 5.3. Market Analysis Of Discrete Track Media

- 5.3.1. The Perpendicular Recording Movement

- 5.3.2. Cost of Ownership (CoO) Analysis

- 5.4. NAND Processing

- 5.4.1. 2D NAND Processing

- 5.4.2. 3D NAND Processing

- 5.4.2.1. Etch Challenges and Market Forecast

- 5.4.2.2. Deposition Challenges and Market Forecast

- 5.5 3D ReRAM Challenges

Chapter 6. The Media Market

- 6.1. Industry Trends

- 6.2. Media Profiles

- 6.3. Media Market Supplier Shares

List Of Figures

- 1.1. Hard Disk Drive Infrastructure

- 2.1. Hard Disk Drive Roadmap

- 2.2. Decrease In Average Price Of Storage

- 2.3. Heads Per Drive

- 2.4. Increase In Areal Density

- 2.5. HDD Market Forecast By Form Factor

- 2.6. HDD Market Percentages By Form Factor

- 2.7 1.8. inch HDD Market Forecast

- 2.8. Platter Forecast

- 2.9. Ratio of Platter to HDDs

- 2.10. Forecast of Desktop Computers

- 2.11. Forecast of Portable Computers

- 3.1. Revenues For HDD and NAND

- 3.2. Change In Memory Cost For HDD and NAND

- 3.3. Growth Of SSD For Consumer Applications

- 3.4. Growth Of SSD For Enterprise Applications

- 3.5. Forecast Of SSDS HDDS And Hybrid SSDS

- 3.6. Western Digital's Thin Hybrid SSD

- 3.7. Process Steps For Samsung's 3D NAND

- 3.8. Technology Challenges for Planar NAND Manufacturing

- 4.1. Detailed Structure Diagram Of A GMR Head Assembly

- 4.2 (A) CIP Recording Head Structure (B) CPP Head Structure

- 4.3. Evolution Of Slider/Air Bearing Surface

- 4.4. Evolution Of HDD Recording Head Formats

- 4.5. Market Forecast Of Recording Head Consumption

- 4.6. Heads Per Drive Forecast

- 4.7. Market Share Of Head Suppliers

- 5.1. Thin Film Head Structure

- 5.2. Critical Features In Thin Film Head Structure

- 5.3. Spin Valve Head Structure

- 5.4. Cross-Sectional View TFH Stacks

- 5.5. Cross-Sectional View Of A TFH Design

- 5.6. CMP Slurry System For TFH Wafer Polishing

- 5.7. Total Slurry Consumption For HDD Forecast

- 5.8. Critical Lithography Trends In Thin Film Heads

- 5.9. Conventional Multigrain Media

- 5.10. Patterned Media

- 5.11a. Fabrication Of Patterned Media

- 5.11b. Fabrication Of Patterned Media

- 5.12. Nanoimprint Lithography Fabrication Of DTR Media

- 5.13. Magnetic Materials For DTR

- 5.14. Example Of A Thin Film Stack For DTR

- 5.15. Nanoimprint Lithography Process

- 5.16. DTR Film Deposition Alternatives

- 5.17. Ion Beam Etching Processes

- 5.18. Planarization By Etchback

- 5.19. Industry Wafer Capacity Additions

- 5.20. Building Blocks Of NAND Memory

- 5.21. Capped Cell Structured Memory

- 5.22 3D NAND Cell String

- 5.23 3D NAND Staircase Vias

- 5.24. Different 3D NAND Architectures

- 5.25. Steps In Making A Vertical String (BICS)

- 5.26. Steps In Making A Vertical String (TCAT)

- 5.27. Emerging Non-Volatile Memory Comparison

- 6.1. HDD Media Structure

- 6.2. Market Shares Of Media Suppliers

- 6.3. Market Shares Of Independent Media Suppliers

List of Tables

- 2.1. HDD Shipments by Form Factor

- 2.2. HDD Shipments by Application

- 2.3. Consumer Electronics HDD Shipments by Application

- 2.4. HDD Supplier Market Shares -Total Market

- 3.1. Advantages of SSD over HDD

- 3.2. Storage Memory Growth

- 3.3. Interface forecast for Client SSD

- 3.4. Comparison Between Consumer And Enterprise SSD

- 3.5. NAND Capitalization Scenario For HDD Replacement

- 5.1. Slurry and Abrasive Suppliers And Products

- 5.2. Worldwide Ceria Slurry For Glass Media Market

- 5.3. Worldwide Oxide Slurry For Metal Market

- 5.4. Worldwide Oxide Slurry For Thin Film Heads

- 5.5. Cost Of Ownership Assumptions

- 5.6. Cost Of Ownership Analysis

- 5.7. Cost Of Ownership Analysis