|

市场调查报告书

商品编码

1692533

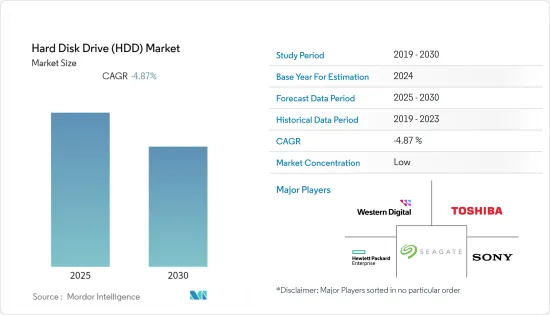

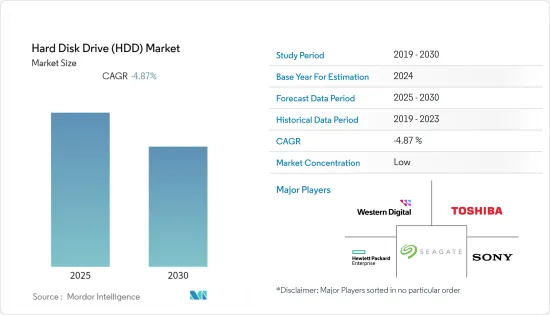

硬碟机 (HDD) - 市场占有率分析、产业趋势与统计资料、成长预测(2025-2030 年)Hard Disk Drive (HDD) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预计预测期内硬碟市场将会萎缩。

硬碟机 (HDD) 是电脑和其他电子设备中使用的资料储存设备。硬碟机由一个或多个涂有磁性材质的磁碟或磁碟片组成。 HDD 是非挥发性储存设备,即使电源关闭也能保留资料。

关键亮点

- 电子设备日益渗透到消费者的日常生活中,推动了对硬碟的需求。此外,家用电子电器产业技术趋势的近期变化预计将进一步推动市场成长。智慧连接技术和设备的采用正在推动对储存各种类型资料的储存驱动器的需求。

- 各国正在采取倡议加强製造地并减少对进口的依赖,预计将进一步促进市场成长。例如,2023年8月,印度突然限制个人电脑(包括笔记型电脑和平板电脑)的进口,以促进国内电子产品製造业的发展。此外,多家印度公司正在探索笔记型电脑的生产。例如,最近Reliance Jio宣布推出一款新型笔记型电脑。同样,总部位于新德里的新兴企业Primebook 生产的笔记型电脑主要针对印度学生。

- 此外,消费产业是硬碟(HDD)的主要采用者之一。随着家用电子电器产品的日益智慧化,HDD作为记录、储存媒体被越来越多地安装到许多家用电子电器产品中。

- 除了智慧型手机和个人电脑等传统应用领域外,HDD 的应用领域正迅速扩展到其他家用电子电器,如监视摄影机系统、游戏机、独立可携式储存设备等。 HDD 可以储存大量视讯影像,这对于连续录製的监视摄影机来说非常重要。

- 但随着需求从 HDD 转向 SSD(企业工作负载如资料库首先迁移,客户端设备迁移到笔记型电脑和平板电脑),SSD 容量不断增加,而价格多年来不断下降。由于耐用性、可靠性、高速、节能、重量轻以及实用的尺寸和外形等优势,SSD 的需求正在快速增长,并正在取代 HDD 的市场份额。

硬碟(HDD)市场趋势

储存容量需求的不断增长推动了市场

- 消费性电子产业正在不断发展壮大。该领域出现了多种新产品和新发展,这也导致数据消费的显着增长。据爱立信称,预计到 2022 年全球智慧型手机用户数量将超过 64 亿,到 2028 年将超过 75 亿。

- 此外,爱立信预计,到 2023 年底,全球每部智慧型手机的每月平均使用量将超过 20GB。由于影片是主要的数据消耗者,预计这将推动对数据中心的需求。

- 受疫情影响,出于公共卫生考虑,全球多个国家颁布了在家工作政策,刺激了对在家工作基础设施的需求。因此,包括政府机构在内的各级组织预测了一系列潜在影响,包括对虚拟服务的需求增加、公民对这些服务如何提供的期望不断提高、政府员工队伍可能进行长期重组,以及对自适应和动态监管模式交付的要求。

- 随着 5G 技术推动行动用户数量的增加,对可扩展和适应性基础设施的需求不断增长,这将推动云端产业的发展。 5G 更快的速度和更低的延迟推动了资料创建和消费的增加,需要使用混合云端解决方案来在私有云和公有云环境中提供足够的储存、处理和应用程式交付。

- 企业迅速采用云端运算解决方案来应对突然转向远端工作以及对可扩展和强大基础设施的需求。随着企业寻求将公共云端服务的优势与私有或内部设施的控制和安全性结合起来,混合云端变得越来越有吸引力。根据 Flexera Software 的《2023 年云端状况》报告,72% 的企业受访者表示他们的公司将使用混合云端。

- 主要企业的私有云端、混合云端和多重云端运算公司 Nutanix 发布了第三份企业云指数报告,衡量企业对私有云端、混合云端和公共云端采用的兴趣。调查显示,70%的受访者表示,新冠疫情让他们公司的IT更具策略意识,显示该产业已现代化。

美国占有很大的市场占有率

- 行动装置和网路连接硬碟越来越多地用于在硬碟上储存作业系统、应用程式和其他数据,这对市场产生了影响。它们主要用于许多电子设备和消费产品。硬碟主要用于储存和搜寻数位资讯(包括电脑资料),由具有磁写头的可程式设计旋转磁碟组成。

- 资料中心是您业务的一部分。资料中心用于储存、管理、备份和还原商业应用程式和生产力应用程式(如电子商务交易)的资料。美国资料中心数量的增加可能会对市场产生正面影响。例如,根据Cloudscene的预测,到2023年,美国将成为全球资料中心位置最多的国家,资料中心数量将达到5,375个。其次是德国(522 家)和英国(517 家)。

- 此外,电力是大多数主要市场面临的一个主要问题。资料中心营运商优先考虑电力供应,而不是根据地点、连通性、供水、土地价格等因素来选择市场。据高纬环球称,美国北维吉尼亚正在建造的资料中心容量在2022年下半年达到了965MW。资料中心容量的增加将推动更多资料的输入和输出,从而刺激低成本HDD的成长。

- 南方电信是东南部领先的通讯服务供应商之一,该公司宣布扩建位于乔治乔治亚科特兰大道 350 号的资料中心。 H5 Centres 是一家资料中心营运商和主机託管服务公司,将负责部署最先进的光纤网络,旨在改善客户的连接性。预计该网路将具有高品质和高可靠性。这将为阿拉巴马州、乔治亚、佛罗里达州和密西西比州的客户带来巨大的利益。

- 此外,Meta Platforms(Facebook)拥有并经营美国最大的资料中心,位于奥勒冈州普赖恩维尔,占地 460 万平方英尺。预计用户数量的增加将支持市场成长。

硬碟(HDD)市场概览

硬碟机 (HDD) 市场竞争激烈,许多老字型大小企业都在推动 HDD 技术的进步,以应对新兴储存技术带来的挑战。为了巩固其地位,这些供应商正在积极推行併购等策略,以增强技术力和市场覆盖范围。主要参与企业包括希捷科技控股有限公司、西部数据公司、东芝公司、惠普企业发展有限公司和索尼公司。

- 2023年10月,西部数据将开始计画分离其HDD和快闪记忆体业务。预计此次策略分离将使两家公司能够掌握自身的成长前景、加强主导地位并透过清晰的资本结构更有效地运作。

- 2023年6月,希捷公布了热辅助磁记录(HAMR)技术蓝图,透露了拥有10个磁碟和20个磁头的32TB HAMR硬碟的细节。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 评估主要宏观经济趋势的影响

第五章市场动态

- 市场驱动因素

- 储存空间需求不断增加

- 市场限制

- 替代储存设备/技术的开发

第六章市场区隔

- 按外形尺寸

- 2.5英寸

- 3.5英寸,其他

- 按应用

- 移动的

- 消费者

- 桌面

- 企业

- 近线

- 其他的

- 按地区

- 美国

- 中国

- 台湾

- 韩国

- 日本

- 东南亚

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 供应商市场占有率分析

- 主要HDD厂商差异化因素及策略分析

- 公司简介

- Seagate Technology Holdings PLC

- Western Digital Corporation

- Toshiba Corporation

- Hewlett Packard Enterprise Development LP

- Sony Corporation

- Transcend Information Inc.

- Schneider Electric

- Lenovo Group Limited

- ADATA Technology Co. Ltd

- Buffalo Americas Inc.

第八章:市场的未来

The Hard Disk Drive Market is expected to decline during the forecast period.

Hard disk drives (HDDs) are data storage devices used in computers and other electronic devices. They consist of one or more magnetic disks or platters coated with a magnetic material. HDDs provide non-volatile storage, retaining data even when powered off.

Key Highlights

- The increasing penetration of electronic gadgets in the day-to-day lives of consumers is driving the demand for HDDs. Additionally, the recent shift in the technological trends of the consumer electronics industry is expected to support the market's growth further, as the adoption of intelligent, connected technologies/devices is driving the demand for storage drives for storing various types of data.

- Various countries are taking initiatives to boost their manufacturing hub and reduce reliance on imports, which is further expected to drive market growth. For instance, in August 2023, India abruptly restricted the import of personal computers, including laptops and tablets, to boost local electronics manufacturing. Also, various Indian companies are seeking to manufacture their laptops. For instance, recently, Reliance Jio announced the launch of a new laptop model. Similarly, Primebook, a start-up based in New Delhi, is producing a laptop aimed at students in India.

- Furthermore, the consumer industry is among the significant adaptors of hard disk drives (HDDs). With consumer appliances becoming smarter every day, these devices are increasingly mounted in a multitude of consumer electronics appliances as recording/storage media.

- Apart from their traditional application areas in smartphones and PCs, HDD applications are fast expanding across other consumer electronic devices, such as surveillance camera systems, gaming consoles, and standalone portable storage devices. HDDs can store a large amount of video footage, which is important for surveillance cameras that record continuously.

- However, over the years, SSD capacities have increased with a decline in prices as the demand has shifted from HDD to SSD from enterprise workloads, such as databases, the first to transition, and client devices, following as users shifted to laptops and tablets. Owing to benefits such as durability, reliability, faster speeds, energy efficiency, lower weight, and practical size/form factors, the SSD demand is growing at a rapid rate, which is eating the HDD market share.

Hard Disk Drive (HDD) Market Trends

Increasing Need for Storage Space to Drive the Market

- The consumer electronics industry is constantly evolving and proliferating. The sector has witnessed several new products and developments, which have led to massive growth in data consumption as well. According to Ericsson, global smartphone subscriptions stood at just over 6.4 billion in 2022 and are expected to cross over 7.5 billion by 2028; such development is expected to propel the demand for storage solutions further.

- Further, the monthly global average usage per smartphone is expected to exceed 20 GB by the end of 2023, according to Ericsson; this is expected to push the demand for data centers as the main data consumption is in the form of video.

- As a result of the pandemic, several nations throughout the world legislated work-from-home policies, citing public health concerns that spurred the demand for working-from-home infrastructure. As a result, organizations at all levels, including government bodies, anticipated a wide range of potential impacts, including growing demand for virtual services, coupled with rising citizen expectations about how these services should be delivered, the longer-term possibility of reshaping the government workforce, and the requirement to provide adaptive and dynamic regulatory models.

- The increased requirement for scalable and adaptable infrastructure pushes the cloud industry as mobile subscriptions increase, owing to 5G technology. Because of 5G's faster speeds and reduced latency, there is an increase in data creation and consumption, necessitating the use of hybrid cloud solutions for adequate storage, processing, and application delivery across both private and public cloud environments.

- Businesses rapidly adopted cloud computing solutions in response to the abrupt transition to remote work and the requirement for scalable and robust infrastructure. As enterprises attempted to blend the advantages of public cloud services with the management and security of private or on-premises facilities, hybrid cloud gained attraction. According to Flexera Software's State of Cloud 2023, 72% of corporate respondents claimed a hybrid cloud would be used in their firm.

- The third annual Enterprise Cloud Index Report, which gauges enterprises' aspirations for adopting private, hybrid, and public clouds, was released by Nutanix, a key player in private, hybrid, and multi-cloud computing. It shows that the industry has modernized itself, with 70% of respondents noting that COVID-19 has made IT in their firms more strategically perceived.

United States to Hold Significant Market Share

- The market will be impacted due to the increasing utilization of portable devices and network-attached hard drives for storing operating systems, applications, and other data on hard disks. These are mainly used in many electronic and consumer products. They are primarily used for storing and retrieving digital information, including computer data, and consist of a re-programmable rotating magnetic disk with a magnetic writing head.

- Data centers are part of the business. They are used to store, manage, back up, and recover data for business applications and productivity applications like e-commerce transactions. The growth in the number of data centers in the United States will positively impact the market. For instance, according to Cloudscene, In 2023, the United States accounted for the most significant number of data center locations globally, with 5,375 data centers. Germany followed with 522 data center locations, and the United Kingdom with 517 data center locations.

- Additionally, power is a major issue in most of the major markets. Data center operators prioritize power availability rather than choosing markets based on geography, connectivity, water supply, and land prices. According to Cushman & Wakefield, the data center under construction in the United States in the Northern Virginia data centers reached 965 MW in the second half of 2022. If the capacity of data centers increases, the data flow in and out of the system increases, thereby fueling the growth of low-cost HDDs.

- Southern Telecom, one of the leading providers of communication services in the Southeast, has announced the expansion of its Atlanta, Georgia, data center to its new location of 350 Courtland Street. H5 Centers, the data center operator, and colocation services will be responsible for implementing the latest fiber optic network designed to provide customers with improved connectivity. This network is expected to be of high quality and reliability. It will significantly benefit customers in the Alabama and Georgia regions and those in Florida and Mississippi.

- Furthermore, Meta Platforms (Facebook) owns and operates the United States' most significant data center, encompassing a 4.6 million square feet area in Prineville, Oregon. Growth in the number of users is expected to support market growth.

Hard Disk Drive (HDD) Market Overview

The hard disk drive (HDD) market is fiercely competitive, with numerous well-established players driving advancements in HDD technology to counter challenges posed by emerging storage technologies. To fortify their positions, these vendors are actively engaging in strategies like mergers and acquisitions to bolster their technical capabilities and market reach. Among the key players are Seagate Technology Holdings plc, Western Digital Corporation, Toshiba Corporation, Hewlett Packard Enterprise Development LP, and Sony Corporation.

- In October 2023 - Western Digital will launch a plan to divide its HDD and Flash businesses, aiming to amplify each division's potential for pioneering technology and product development. This strategic separation is anticipated to empower both entities to seize unique growth prospects, reinforce their leading positions, and operate more efficiently through distinct capital structures.

- In June 2023- Seagate unveiled insights into its roadmap for heat-assisted magnetic recording (HAMR) technology, teasing details about its inaugural HAMR hard drive with a 32TB capacity based on 10 disks and 20 heads.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 An Assessment of the Impact of Key Macroeconomic Trends

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Need for Storage Space

- 5.2 Market Restraints

- 5.2.1 Development of Alternative Storage Devices/Technologies

6 MARKET SEGMENTATION

- 6.1 By Form Factor

- 6.1.1 2.5 inch

- 6.1.2 3.5 inch and Others

- 6.2 By Application

- 6.2.1 Mobile

- 6.2.2 Consumer

- 6.2.3 Desktop

- 6.2.4 Enterprise

- 6.2.5 Nearline

- 6.2.6 Other Applications

- 6.3 By Geography

- 6.3.1 United States

- 6.3.2 China

- 6.3.3 Taiwan

- 6.3.4 South Korea

- 6.3.5 Japan

- 6.3.6 Southeast Asia

- 6.3.7 Australia and New Zealand

- 6.3.8 Latin America

- 6.3.9 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Vendor Market Share Analysis

- 7.2 Analysis of Key Differentiators and Strategies of Major HDD Manufacturers

- 7.3 Company Profiles

- 7.3.1 Seagate Technology Holdings PLC

- 7.3.2 Western Digital Corporation

- 7.3.3 Toshiba Corporation

- 7.3.4 Hewlett Packard Enterprise Development LP

- 7.3.5 Sony Corporation

- 7.3.6 Transcend Information Inc.

- 7.3.7 Schneider Electric

- 7.3.8 Lenovo Group Limited

- 7.3.9 ADATA Technology Co. Ltd

- 7.3.10 Buffalo Americas Inc.