|

市场调查报告书

商品编码

1479761

等离子蚀刻:市场分析与策略问题Plasma Etching: Market Analysis and Strategic Issues |

||||||

半导体等离子体蚀刻是半导体製造的关键工艺,受到多种因素的推动,这些因素反映了行业不断变化的需求、技术进步和市场动态。

随着对摩尔定律的不断追求以及对更小、更强大的半导体装置的需求,不断需要减小特征尺寸并增加装置密度。 等离子蚀刻可以实现奈米级的精确图案转移,从而有助于製造高精度和先进的半导体结构。

半导体装置正在演变成日益复杂的架构,例如 FinFET、3D NAND 快闪记忆体和多层互连,并且需要先进的蚀刻技术来实现所需的装置形状和功能。 等离子蚀刻提供了对复杂的多层、多维装置结构进行图案化所需的灵活性和控制。

随着半导体材料变得更加多样化,化合物半导体装置变得越来越流行,对能够有效蚀刻各种材料同时保持高选择性和均匀性的等离子体蚀刻製程的需求不断增长。 透过开发专门的蚀刻化学物质和製程配方,可以精确控製材料去除率和侧壁轮廓,以确保最佳的装置性能和可靠性。

5G 无线通讯、人工智慧 (AI)、物联网 (IoT) 和自动驾驶汽车等新应用和技术的激增正在推动对具有特定性能特征和功能的半导体装置的需求。 等离子蚀刻可以客製化和优化装置结构,以满足这些应用的要求,开闢新的市场机会并促进半导体製造的创新。

半导体产业竞争激烈,製造商争夺市场占有率、技术领先地位和创新。 在激烈的市场竞争的推动下,等离子蚀刻设备、材料和製程技术的不断进步正在突破蚀刻能力和性能的极限,以满足不断变化的客户需求并获得竞争优势。

随着技术的快速进步和市场需求的不断增加,半导体等离子体蚀刻领域正在经历前所未有的演变和创新。 设备製造商、材料供应商和半导体公司不断突破等离子蚀刻技术的极限,以满足半导体装置日益增长的复杂性和性能要求。 从提高製程均匀性和生产率到扩大可蚀刻的材料和装置结构的范围,半导体等离子体蚀刻产业处于技术创新的前沿,推动着电子产业的进步和塑造未来。

本报告考察了等离子蚀刻市场,深入研究了等离子蚀刻技术的复杂性,并探讨了其基本原理、关键应用以及塑造产业的新兴趋势。 它还包括对市场动态、技术创新和竞争格局的详细分析。

目录

第一章简介

第 2 章执行摘要

第三章技术问题与趋势

- 简介

- 处理问题

- 等离子剥离

- 安全性问题

第四章市场预测

第 5 章策略问题:使用者

- 评估使用者需求

- 供应商基准

- 成本分析

- 使用者与供应商的协同作用

第 6 章策略问题:供应商

- 衝突

- 与客户互动

- 1 级无尘室的设备相容性

- 占地面积和可维护性

- 细悬浮微粒的产生

- 自动化

- 蚀刻工具

Driving Forces

Semiconductor plasma etching, a critical process in semiconductor manufacturing, is driven by a multitude of factors that reflect the evolving demands of the industry, technological advancements, and market dynamics. These driving forces encompass various aspects of semiconductor fabrication and the broader semiconductor ecosystem:

Device Scaling and Miniaturization: With the relentless pursuit of Moore's Law and the demand for smaller, more powerful semiconductor devices, there is a continuous need to shrink feature sizes and increase device density. Plasma etching enables precise pattern transfer at nanometer scales, facilitating the fabrication of advanced semiconductor structures with high precision and accuracy.

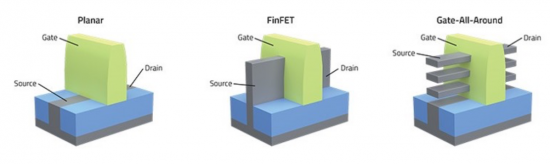

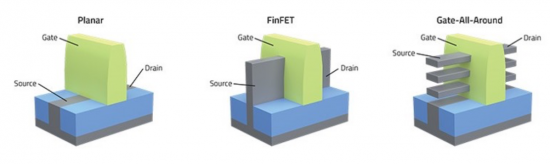

Complex Device Architectures: The evolution of semiconductor devices towards increasingly complex architectures, such as FinFETs, 3D NAND flash memory, and multi-layer interconnects, necessitates advanced etching techniques to achieve the desired device geometries and functionality. Plasma etching offers the flexibility and control required to pattern intricate device structures with multiple layers and dimensions.

Material Compatibility and Selectivity: As semiconductor materials diversify and compound semiconductor devices gain prominence, there is a growing need for plasma etching processes that can effectively etch a wide range of materials while maintaining high selectivity and uniformity. The development of specialized etching chemistries and process recipes enables precise control over material removal rates and sidewall profiles, ensuring optimal device performance and reliability.

Yield Enhancement and Process Control: Semiconductor manufacturers place a premium on yield enhancement and process control to minimize defects, improve device performance, and optimize production efficiency. Plasma etching plays a critical role in achieving these objectives by enabling precise pattern transfer with minimal variability, thereby reducing defect density, enhancing device uniformity, and maximizing wafer yields.

Emerging Applications and Technologies: The proliferation of emerging applications and technologies, such as 5G wireless communication, artificial intelligence (AI), Internet of Things (IoT), and autonomous vehicles, drives demand for semiconductor devices with specific performance characteristics and functionality. Plasma etching enables the customization and optimization of device structures to meet the requirements of these applications, opening up new market opportunities and driving innovation in semiconductor manufacturing.

Market Competition and Technological Innovation: The semiconductor industry is highly competitive, with manufacturers vying for market share, technological leadership, and innovation. Continuous advancements in plasma etching equipment, materials, and process technologies are driven by intense market competition, pushing the boundaries of etching capabilities and performance to meet evolving customer demands and gain competitive advantage.

Trends

Technological trends in semiconductor plasma etching are continuously evolving to address the growing demands of the semiconductor industry for higher performance, increased functionality, and enhanced manufacturability. Several key trends are driving innovation in plasma etching technologies:

Sub-Nanometer Feature Control: With the ongoing push towards smaller feature sizes and higher device densities, there is a critical need for plasma etching techniques capable of achieving sub-nanometer feature control. Advanced plasma sources, such as inductively coupled plasma (ICP) and electron cyclotron resonance (ECR), enable precise control over ion energy and flux, facilitating the etching of ultrafine features with sub-nanometer accuracy.

Selective Etching and Material Compatibility: As semiconductor devices incorporate a wider range of materials, including compound semiconductors, dielectrics, and metals, there is a growing demand for plasma etching processes that offer high selectivity and compatibility with diverse materials. Selective etching chemistries and process recipes enable the precise removal of target materials while minimizing damage to underlying layers and interfaces, ensuring optimal device performance and reliability.

Anisotropic Etching and Sidewall Control: Anisotropic etching, which produces vertical sidewalls with minimal sidewall roughness, is essential for fabricating advanced semiconductor structures with precise dimensions and profiles. Advanced plasma etching techniques, such as reactive ion etching (RIE) and deep reactive ion etching (DRIE), enable precise sidewall control and profile customization, facilitating the fabrication of complex device architectures, such as FinFETs, nanowires, and 3D memory structures.

Damage-Free Etching and Low-K Dielectric Preservation: With the increasing use of low-k dielectric materials in semiconductor devices to minimize signal delay and crosstalk, there is a growing emphasis on damage-free etching techniques that preserve the integrity of these sensitive materials. Plasma etching processes, such as downstream plasma etching and cryogenic etching, offer reduced ion energy and temperature, minimizing damage to low-k dielectrics and preserving their electrical properties.

Etch-Depth Uniformity and Across-Wafer Variability: Achieving uniform etch depths and minimizing across-wafer variability are critical for ensuring consistent device performance and yield in semiconductor manufacturing. Advanced plasma etching systems incorporate real-time process monitoring and control capabilities, such as optical emission spectroscopy (OES) and endpoint detection, to achieve precise etch-depth uniformity and minimize variations across the wafer, enhancing process repeatability and yield.

High-Aspect-Ratio Etching and Through-Silicon Via (TSV) Fabrication: The increasing demand for high-aspect-ratio structures, such as through-silicon vias (TSVs) and microelectromechanical systems (MEMS), requires plasma etching techniques capable of etching deep, narrow features with high aspect ratios. Deep silicon etching (DSE) and Bosch process-based etching enable the fabrication of TSVs and MEMS devices with precise control over sidewall profiles, aspect ratios, and etch depths, facilitating the integration of 3D device architectures and heterogeneous integration.

The Need for This Report

The semiconductor industry stands at the forefront of technological innovation, driving progress across various sectors from consumer electronics to healthcare and automotive. At the heart of semiconductor manufacturing lies the intricate process of plasma etching, a critical step in device fabrication that defines the intricate features and structures of modern semiconductor devices. As the demand for smaller, faster, and more energy-efficient electronic devices continues to soar, the importance of semiconductor plasma etching in enabling the production of advanced semiconductor devices cannot be overstated.

Plasma etching plays a pivotal role in the fabrication of semiconductor devices by selectively removing material layers from semiconductor substrates with unparalleled precision and control. By harnessing the unique properties of plasma—a highly ionized gas composed of charged particles—semiconductor manufacturers can achieve sub-micron feature sizes and complex device architectures essential for next-generation electronic applications. From logic and memory chips to advanced sensors and power devices, plasma etching technology underpins the development of a wide range of semiconductor products that drive innovation in virtually every aspect of modern life.

Against the backdrop of rapid technological advancements and growing market demands, the semiconductor plasma etching landscape is witnessing unprecedented evolution and innovation. Equipment manufacturers, materials suppliers, and semiconductor companies alike are continually pushing the boundaries of plasma etching technology to address the increasing complexity and performance requirements of semiconductor devices. From enhancing process uniformity and productivity to expanding the range of materials and device structures that can be etched, the semiconductor plasma etching industry is at the forefront of innovation, driving progress and shaping the future of electronics.

In this comprehensive report on semiconductor plasma etching, we delve into the intricacies of plasma etching technology, exploring its fundamental principles, key applications, and emerging trends shaping the industry. Through a detailed analysis of market dynamics, technological innovations, and competitive landscape, this report provides valuable insights and strategic intelligence for stakeholders across the semiconductor ecosystem. Whether you are a semiconductor equipment manufacturer, materials supplier, semiconductor company, or industry analyst, this report serves as a comprehensive guide to understanding the latest developments and opportunities in the dynamic field of semiconductor plasma etching.

About This Report

This 150-page report provides a comprehensive analysis of the semiconductor plasma etching market, including market size, growth drivers, challenges, and opportunities. Assessment of the competitive landscape, key players, market segmentation by product type, application, and geography.

Major segments are forecast with current and historic market shares are:

- Dielectric Etch

- Conductive Etch

- Plasma Strip

This report explores the wide range of applications of plasma etching in semiconductor manufacturing, including etching of silicon, compound semiconductors, dielectrics, metals, and other materials. Specific applications in logic devices, memory devices, sensors, power devices, and other semiconductor products.

Insights into the future outlook for semiconductor plasma etching technology, including emerging applications, market trends, and growth opportunities are detailed.

Table of Contents

Chapter 1. Introduction

- 1.1. The Need For This Report

Chapter 2. Executive Summary

- 2.1. Summary of Technical Issues

- 2.2. Summary of User Issues

- 2.3. Summary of Supplier Issues

- 2.4. Summary of Market Forecasts

Chapter 3. Technical Issues and Trends

- 3.1. Introduction

- 3.2. Processing Issues

- 3.2.1. Chlorine Versus Fluorine Processes

- 3.2.2. Multilevel Structures

- 3.2.3. New Materials

- 3.2.4. GaAs Processing

- 3.3. Plasma Stripping

- 3.3.1. Photoresist Stripping

- 3.3.2. Low-K Removal

- 3.4. Safety Issues

- 3.4.1. System Design Considerations

- 3.4.2. Gas Handling

- 3.4.3. Reactor Cleaning

Chapter 4. Market Forecast

- 4.1. Influence of Technology Trends on the Equipment Market

- 4.2. Market Forecast Assumptions

- 4.3. Market Forecast

Chapter 5. Strategic Issues: Users

- 5.1. Evaluating User Needs

- 5.1.1. Device Architecture

- 5.1.2. Wafer Starts and Throughput Requirements

- 5.1.3. Wafer Size

- 5.2. Benchmarking a Vendor

- 5.2.1. Pricing

- 5.2.2. Vendor Commitment and Attitudes

- 5.2.3. Vendor Capabilities

- 5.2.4. System Capabilities

- 5.3. Cost Analysis

- 5.3.1. Equipment Price

- 5.3.2. Installation Costs

- 5.3.3. Maintenance Costs

- 5.3.4. Sustaining Costs

- 5.3.5. Hidden Costs

- 5.4. User - Supplier Synergy

- 5.4.1. Feedback During Equipment Evaluation

- 5.4.2. Feedback During Device Production

Chapter 6. Strategic Issues: Suppliers

- 6.1. Competition

- 6.2. Customer Interaction

- 6.2.1. Customer Support

- 6.2.2. Cleanroom Needs in the Applications Lab

- 6.3. Equipment Compatibility in Class 1 Cleanrooms

- 6.3.1. Footprint Versus Serviceability

- 6.3.2. Particulate Generation

- 6.3.3. Automation

- 6.3.4. Etch Tools

List of Figures

- 3.1. Various Enhanced Designs (a) Helicon, (b) Multiple ECR, (c) Helical Resonator

- 3.2. Schematic of Inductively Coupled Plasma Source

- 3.3. Schematic of the HRe Source

- 3.4. Schematic of the Dipole Magnet Source

- 3.5. Schematic of Chemical Downstream Etch

- 3.6. Silicon Trench Structure

- 3.7. fin/STI Etch Requirements

- 3.8. FinFET Gate Etch Requirements

- 3.9. Dual Damascene Dielectric Etch Approaches

- 4.1. Trends in Minimum Feature Size for Dynamic RAMS

- 4.2. Market Shares for Dry Etch Equipment

- 4.3. Market Shares for Strip Equipment

- 4.4. Distribution of Etch Sales by Type

- 4.5. Distribution of Etch Sales by Device

- 4.6. Geographical Distribution of Equipment Purchases

- 5.1. Typical First Year Single Wafer System Cost Analysis

- 6.1. Relationship Between Device Yield and Particles

- 6.2. Sources of Particles

- 6.3. Relationship Between Die Yield and Chip Size

List of Tables

- 3.1. Silicon Wafer Usage

- 3.2. Plasma Source Comparison

- 3.3. Typical Process Specifications

- 4.1. Worldwide Dry Etch Market Shares

- 4.2. Worldwide Dry Strip Market Shares

- 4.3. Worldwide Market Forecast of Plasma Etching Systems

- 4.4. Distribution of Etch Sales by Device by Vendor

- 4.5. Number of Layers To Be Etched

- 5.1. Levels of Integration of Dynamic Rams

- 5.2. Interconnect Levels of Logic Devices

- 6.1. Etch Process Specifications