|

市场调查报告书

商品编码

1630293

电浆蚀刻设备:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Plasma Etching Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

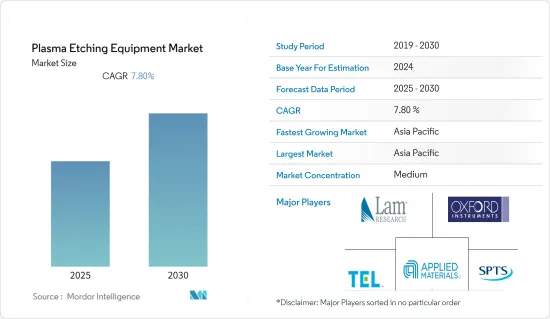

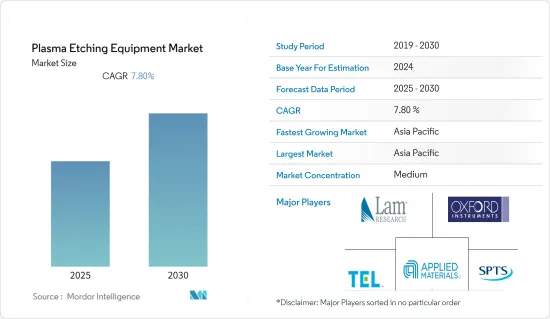

电浆蚀刻设备市场预计在预测期内复合年增长率为7.8%

主要亮点

- 电浆蚀刻是一种复杂且多功能的技术,可让您创建各种设备。如今,半导体製造商正在从传统的湿蚀刻转向等电浆蚀刻系统,因为等离子蚀刻系统的化学品消费量较低并且适合自动化和单晶圆製造。对更小、更节能和更高性能的电子设备的需求不断增长,推动了对更小型半导体积体电路 (IC) 的需求。微型化 IC 需要具有小几何形状的先进电路製造工艺,这需要精确的图案转移。

- 电浆蚀刻广泛应用于半导体和电子机械系统产业。例如,在印刷电路基板(PCB) 製造中,等向性蚀刻用于在加工后和电镀前对电路进行等离子清洗。异向性蚀刻用于在晶圆上形成电路图案。这种异向性电浆蚀刻是高能量的,称为反应离子蚀刻(RIE)。

- 此外,物联网应用领域正在发生的大规模技术升级,为世界各地的各种消费者提供技术先进的智慧设备,也加速了对先进半导体的需求,从而增加了市场成长的预期。随着物联网应用的成长,智慧型设备的数量不断增加,半导体的小型化不断进步,等电浆蚀刻的需求不断增加。

- 智慧型手机和其他需要半导体 IC 的应用是推动家用电子电器、汽车和其他产业等电浆蚀刻整体需求的其他因素,无线技术 (5G) 和人工智慧等技术的进步也对趋势产生重大影响。此外,物联网(IoT)设备的增加预计将迫使半导体产业投资这些设备以实现智慧产品。 SEMI硅製造商集团(SMG)在硅晶圆产业季度回顾中透露,2021年第三季全球硅晶圆出货量成长3.3%至36.49亿平方英寸,创产业新高。 2021年第三季硅片出货量年增16.4%至31.35亿平方吋。

- 然而,这种设备的成本通常比湿式化学蚀刻设备高。此外,湿式化学蚀刻会快速消耗抗蚀剂,导致与湿式化学蚀刻设备相比选择性较低。这些都是阻碍市场成长的主要挑战。

- COVID-19 大流行导致半导体製造设备行业的多种产品停止生产,并在全球大多数地区继续实施封锁。封锁措施减少了家用电子电器的需求,也影响了全球半导体产业。全球汽车需求和出口出货量的持续下降对半导体市场产生了负面影响,目前对半导体製造设备的需求放缓。然而,一旦工业活动恢復到大流行前的水平,需求预计将逐渐增强。

电浆蚀刻设备市场趋势

消费性电子领域推动需求

- 电气和电子产业包括航太产品、灯具和发光二极体)、电视、家用电子电器产品(例如电子医疗设备、微电子元件和家用电子电器软体)以及汽车诊断(OBD)、汽车触控萤幕、摄影机、导航系统和其他电气和电子元件。推动半导体产业成长的另一个重要因素是家用电子电器领域的扩张。

- COVID-19 大流行迫使世界各地的人们在家工作、学习和度过空閒时间,从而增加了对家用电子电器产品的需求。然而,由于全球晶片短缺和供应链瓶颈,许多电子设备仍然供不应求。与前一年相比,2020年全球电气和电子产业没有成长。随着与 COVID-19 相关的担忧得到解决,该行业预计将在 2021 年实现增长,并预计在 2022 年实现增长。德国电气和数位产业协会 ZVEI 预计,2021 年至 2022 年全球整体该产业预计将成长 6%。

- 印度等新兴国家自2013年以来资料通讯通讯资费已降低95%,导致智慧型手机用户数量快速成长。据 ASSOCHAM 称,印度智慧型手机用户预计将从 2017 年的 4.68 亿增加一倍,到 2022 年增加至约 8.59 亿,复合年增长率为 12.9%。智慧型手机普及率的显着数量增长预计将创造智慧型手机产业对半导体的需求。此外,根据印度品牌资产基金会的数据,到 2025 年,印度的家用电子电器产业预计将翻一番,达到 211.8 亿美元。

- 世界各国政府正在增加投资并制定支持性法规来满足一些国内需求,为所研究的市场成长创造良好的市场情景。

- 此外,消费性电子产业不断增长的需求也促使半导体製造商扩大生产设施。例如,2021年10月,台积电(TSMC)宣布计画在日本新建一座半专业工厂,以满足当地客户的需求。当该工厂于 2024 年下半年投入运作时,它将成为日本最先进的逻辑工厂。人们相信这种扩张将为所研究的市场创造成长机会。

亚太地区预计将经历显着成长

- 亚太地区是电浆蚀刻设备的重要市场之一。其主要原因包括主要半导体製造商的存在、许多最终用户行业对先进技术的需求不断增加、家用电子电器产业的高成长以及政府对该地区半导体产业的支持措施。

- 此外,对智慧和行动装置的需求不断增长预计将推动对小型积体电路(IC)的需求,预计这将在预测期内迅速增加电浆蚀刻设备市场的需求。根据GSMA的数据,中国自己的行动电话率位居全球最高。 2020年有12.2亿人,但预计2026年这一数字将达到12.6亿,约占总人口的85%。

- 该地区许多国家的政府都支持半导体产业。例如,中国不断推出措施支持半导体产业国产化。 「中国製造2025」为半导体设备生产国产化提供了清晰的蓝图。根据SEMI统计,近年来中国已有不少新的12吋晶圆厂计划宣布、启动建设或处于推出阶段,包括厦门联华电子、南京台积电、合肥PSC、成都格罗方德、武汉和南京都有长江存储。

- 同样,在印度政府宣布多项 PLI 计划后,多家半导体製造公司正在增加投资,在印度建立製造工厂。例如,2022年8月,总部位于泰米尔纳德邦的半导体晶片製造商Polymatech宣布投资10亿美元扩大其製造设施。

电浆蚀刻设备产业概况

电浆蚀刻设备市场竞争激烈。现有参与企业已迅速渗透市场,供应商之间的竞争非常激烈。主要参与企业包括应用材料公司、泛林研究公司和东京电子有限公司。

- 利用尖端等电浆技术,我们拥有SiC/GaN功率元件、高频滤波器、GaAs VCSEL、CMOS影像感测器、Micro OLED/LED和先进封装等化合物半导体装置的全面生产能力。

- 2022年3月-干式蚀刻设备製造商APTC宣布正在开发300mm氧化物蚀刻设备,并将于2023年提供示范文。 APTC 首先提供了用等离子体源蚀刻多晶硅的设备。因此,该公司致力于进一步扩大其在干蚀刻设备市场的影响力。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 半导体产业的成长

- 对小型节能电子设备的需求不断增长

- 市场限制因素

- 随着电路变得更小,复杂性也随之增加

第六章 市场细分

- 按类型

- 反应离子蚀刻 (RIE)

- 感应耦合电浆蚀刻 (ICP)

- 深反应离子蚀刻(DRIE)

- 其他的

- 按用途

- 工业用途

- 医疗用途

- 消费性电子产品

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 其他的

第七章 竞争格局

- 公司简介

- SPTS Technologies(KLA company)

- Applied Materials Inc.

- Lam Research Corporation

- Oxford Instruments PLC

- Tokyo Electron Limited

- Plasma Etch Inc.

- Plasma-Therm LLC

- Thierry Corporation

- Samco Inc.

- Advanced Micro-Fabrication Equipment Inc.

- Sentech Instruments GmbH

- GigaLane Co. Ltd

第八章投资分析

第九章 市场未来展望

简介目录

Product Code: 67027

The Plasma Etching Equipment Market is expected to register a CAGR of 7.8% during the forecast period.

Key Highlights

- Plasma etching is a sophisticated, versatile technology that creates a wide range of devices. Today, semiconductor manufacturers are switching to the plasma etch system from traditional wet etching, as it consumes fewer chemicals and is more suitable for automation and single wafer manufacturing. Increasing demand for compact, energy-efficient electronic devices having improved performance is boosting the need for developing miniature semiconductor integrated circuits (ICs). For miniaturizing IC, the course has to undergo an advanced circuit fabrication process with small geometries and thus requires precise pattern transfer.

- Plasma etching is used extensively in the semiconductor and microelectromechanical systems industries. For instance, in manufacturing printed circuit boards (PCBs), isotropic etching is used to plasma clean circuits after machining and before electroplating. Anisotropic etching is used to form circuit patterns in wafers. This anisotropic plasma etching is highly energetic and called reactive ion etching (RIE).

- Moreover, massive technological upgradation taking place in the IoT application to offer technologically advanced intelligent devices to different consumers across the globe is also predicted to accelerate the demand for advanced semiconductors, thereby positively affecting the market's growth. With the growth in IoT applications, smart devices are increasing, giving rise to miniature semiconductors, thus raising the demand for plasma etching.

- Smartphones and other applications that require semiconductor ICs are other factors driving the overall demand for plasma etching in consumer electronics, automotive, and other industries, as technology advancements like wireless technologies (5G) and artificial intelligence have significantly impacted the trend of these sectors. Also, the increasing number of Internet of Things (IoT) devices is expected to force the semiconductor industry to invest in this equipment to attain intelligent products. The SEMI Silicon Manufacturers Group (SMG) revealed in its quarterly review of the silicon wafer industry that worldwide silicon wafer shipments grew 3.3% to 3,649 million square inches in the third quarter of 2021, which was a new industry high. Shipments of silicon wafers in the third quarter of 2021 increased by 16.4% over the same quarter the previous year, to 3,135 million square inches.

- However, this equipment is often costlier than wet-chemical etching equipment. Also, due to faster consumption of resists due to wet chemical etching, the selectivity offered by this equipment is reduced compared to wet-chemical etching equipment. These are some of the primary factors challenging the growth of the market.

- The COVID-19 pandemic halted the manufacturing of several items in the semiconductor production equipment industry, owing to continued lockdown in most regions across the world. Lockdown measures reduced demand for consumer electronic gadgets, which had a global impact on the semiconductor sector. The continued decline in worldwide demand and export shipments for automobiles provided a negative impact on the semiconductor market, which is currently slowing the demand for semiconductor manufacturing equipment. However, the demand is expected to gain traction gradually with the industrial activities returning back to the pre-pandemic level.

Plasma Etching Equipment Market Trends

Consumer Electronics Segment to Drive the Demand

- The electrical and electronics industry includes a wide range of products, including aerospace products, lamps and light fixtures, including light-emitting diodes, consumer electronics, such as television sets, electrical household appliances, electronic medical equipment, microelectronic components, and automotive software, and electrical and electronic components, like on-board diagnostics (OBD), in-car touch screens, cameras, and navigation systems. Another key factor driving the semiconductor industry's growth is the expanding consumer electronics sector.

- People worldwide were forced to work, learn, and spend their free time at home due to the COVID-19 pandemic, which increased the demand for consumer electronics. Many electrical devices, however, are still in low supply due to a global lack of chips and supply chain bottlenecks. Compared to the previous year, the global electrical and electronics sector did not grow in 2020. The industry was predicted to grow in 2021 and is expected to grow in 2022, as the concerns linked to COVID-19 are being increasingly addressed. According to ZVEI, a German association of the electrical and digital sector, the industry was predicted to grow by 6% globally between 2021 and 2022.

- Emerging economies, such as India, have witnessed a reduction in data costs by 95% since 2013, resulting in tremendous growth in smartphone users. According to ASSOCHAM, smartphone users in India were expected to double from 468 million users in 2017 to approximately 859 million by 2022, at a CAGR of 12.9%. Such significant volume growth in smartphone adoption is expected to create a demand for semiconductors in the smartphone industry. Moreover, the appliances and consumer electronics industry is expected to double, to reach USD 21.18 billion by 2025, in India, according to the Indian Brand Equity Foundation.

- Increasing investment and supportive regulations being framed by governments worldwide to meet some portion of their local demand are creating a good market scenario for the studied market growth.

- Furthermore, the growing demand from the consumer electronics industry is also encouraging semiconductor manufacturers to expand their production facilities. For instance, in October 2021, Taiwan Semiconductor Manufacturing Company Ltd (TSMC) announced its plans to build a new semi-specialist factory in Japan to meet the needs of local customers. The factory will be the most advanced logic factory in Japan when it operates in the second half of 2024. Such expansions will create opportunities for the studied market to grow.

Asia-Pacific is Expected to Witness Significant Growth

- Asia-Pacific is one of the prominent markets for plasma etching equipment, primarily attributed to the presence of some of the leading semiconductor manufacturers, growing demand for advanced technologies across numerous end-user industries, high consumer electronics industry growth, and supporting government policies for the semiconductor industry in the region.

- Growing demand for smart and portable devices is also anticipated to boost the demand for miniature integrated circuits (ICs), which is expected to rapidly fuel the need for the plasma etching equipment market over the forecast period. According to GSMA, China's unique mobile subscriber rate is among the highest in the world. While it was 1.22 billion in 2020, it is estimated to reach 1.26 billion in 2026, approximately 85% of the total population.

- The governments in many countries across the region are supporting the semiconductor industry. For instance, China has continuously introduced policies to support the localization of the semiconductor industry. The "Made in China 2025" initiative has provided a clear roadmap for the localization of semiconductor equipment production. According to SEMI, in recent years, many new 12-inch fab projects have been announced, started construction, or are in the ramp-up stage in China, including UMC in Xiamen, TSMC in Nanjing, PSC in Hefei, GLOBALFOUNDRIES in Chengdu, as well as YMTC in Wuhan and Nanjing.

- Similarly, several semiconductor manufacturing companies are increasing their investment to establish manufacturing facilities in India after the government announced several PLI schemes. For instance, in August 2022, Polymatech, a Tamil Nadu based semiconductor chip manufacturer, announced an investment worth USD 1 billion to expand its manufacturing facilities.

Plasma Etching Equipment Industry Overview

The plasma etching equipment market is competitive. There is enormous competition among the vendors owing to the intense market penetration of some existing players in the market expected to grow further. Some major players include Applied Materials Inc., Lam Research Corporation, and Tokyo Electron Ltd., among others.

- March 2022 - Samco, an etching, deposition, and surface treatment processing equipment manufacturer, introduced the new plasma etching cluster tool 'Cluster H.' By leveraging its cutting-edge plasma technology, Cluster H provides the full-scale production capabilities for compound semiconductor devices such as SiC/GaN power devices, high-frequency filters, GaAs VCSELs, CMOS image sensors, micro-OLED/LED, and advanced packaging.

- March 2022 - APTC, a dry etching equipment maker, announced that it is developing a 300mm oxide etching equipment to offer for a demo text in 2023. APTC offered etching equipment that uses a plasma source to etch polysilicon first. With this, the company focuses on further expanding its presence in the dry etching equipment market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth of the Semiconductor Industry

- 5.1.2 Rising Demand for Compact and Energy Efficient Electronic Devices

- 5.2 Market Restraints

- 5.2.1 Growing Complexities Related to Miniaturized Structures of Circuits

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Reactive Ion Etching (RIE)

- 6.1.2 Inductively Coupled Plasma Etching (ICP)

- 6.1.3 Deep Reactive Ion Etching (DRIE)

- 6.1.4 Other Types

- 6.2 By Application

- 6.2.1 Industrial Applications

- 6.2.2 Medical Applications

- 6.2.3 Consumer Electronics

- 6.2.4 Other Applications

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 SPTS Technologies (KLA company)

- 7.1.2 Applied Materials Inc.

- 7.1.3 Lam Research Corporation

- 7.1.4 Oxford Instruments PLC

- 7.1.5 Tokyo Electron Limited

- 7.1.6 Plasma Etch Inc.

- 7.1.7 Plasma-Therm LLC

- 7.1.8 Thierry Corporation

- 7.1.9 Samco Inc.

- 7.1.10 Advanced Micro-Fabrication Equipment Inc.

- 7.1.11 Sentech Instruments GmbH

- 7.1.12 GigaLane Co. Ltd

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET

02-2729-4219

+886-2-2729-4219