|

市场调查报告书

商品编码

1512799

物联网启动状态与资料库:2024 年IoT Start-Up Landscape and Database 2024 |

|||||||

该报告对超过3,330家物联网新创公司进行了分类,并总结了每家新创公司的基本资讯、物联网技术能力、资金状况、最终用户产业、大型新创公司的详细分析以及分析师的观点。

样本视图

样本视图

物联网新创公司资料库具有以下结构。

- 1. 一般资讯:公司名称、描述、类型、地点

- 2.物联网技术能力:物联网硬体、物联网连接、物联网中间件和软体基础设施、应用程式和服务等。

- 3. 细分领域重点:金融、农业、互联建筑、零售、企业/IT 基础设施和安全、健康与製药、能源/公用事业、移动、智慧城市、製造/工业、供应链、公共部门、政府与服务、其他业务促进因素(创投/投资者、顾问、孵化器等)。

- 4.详细资料:成立年份、LinkedIn、电子邮件、电话号码、创办人、员工人数、最近融资日期、最近融资金额、最近融资币种、融资总额、融资总额货币、投资者数量、前5 位投资者、融资类型、预期销售、收购数量

- 5. 大型新创公司:年收入超过100万美元,员工50人或以上,B轮或更高,是/否

目录

第一章 概要 引言

第二章 物联网启动状况

- 一)概述

- 活跃物联网新创企业累积数量

- 物联网新创公司:依成立年份划分

- 物联网新创公司的融资:依融资阶段

- 物联网新创公司的资金:依成立年份

- 物联网新创公司的平均资金金额:以成立年份

- 筹集最多资金的物联网新创公司

- 物联网新创公司收购数量:2021-2024

- 物联网新创公司将于 2023 年收购

- 近期物联网新创公司的 IPO(摘录)

- 最活跃的投资者

- 大型新创公司占比

- 大型新创公司比例:依成立年份划分

- 专注于人工智慧的物联网新创公司比例

- b) 技术深入研究

- 依技术类型划分的物联网新创公司占有率

- 依技术类型划分的物联网新创公司占有率:2016-2023

- 提供不同类型物联网硬体的物联网新创公司的百分比

- 提供各种类型的物联网中间件和软体的物联网新创公司的百分比

- 提供不同类型连接/服务的物联网新创公司的百分比

- 大型新创公司的占有率:依技术堆迭和技术类型划分

- c) 依地区深入研究

- 物联网新创企业全球分布

- 物联网新创公司和主要见解:依地区

- 新创公司百分比:依地区和成立年份划分

- 依地区划分的物联网新创公司的技术重点

- 依地区深入探讨 (1/5):北美

- 依地区深入探讨 (2/5):欧洲

- 依地区深入探讨 (3/5):亚太地区

- 依地区深入探讨 (4/5):中东/非洲

- 依地区深入探讨 (5/5):南美洲

- 物联网新创公司的重点产业:依地区

- 大型新创企业的百分比:依地区划分

- d) 工业深度挖掘

- 产业定义

- 物联网新创公司:依产业分类

- 物联网新创公司在主要行业中的年度占有率

- 大型新创企业的百分比:依优先产业划分

第三章 主要物联网新创公司

- IoT Analytics 分析师选出的 IoT 新创公司

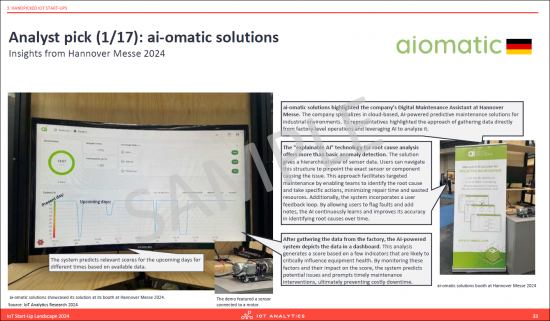

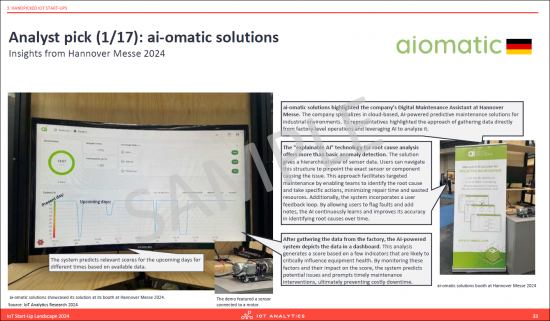

- 分析师选择 (1/17):ai-omatic solutions

- 分析师评选(2/17):DeepVu

- 分析师选择(3/17):Edge Impulse

- 分析师评选(4/17):Figure

- 分析师评选 (5/17):H2Ok Innovations

- 分析师选择 (6/17):Infogrid

- 分析师选择(7/17):Onehouse

- 分析师选择(8/17):peaq

- 分析师选择 (9/17):Pio

- 分析师评选(10/17):PUDU Robotics

- 分析师选择 (11/17):Scale AI

- 分析师选择(12/17):Skylo

- 分析师评选(13/17):Thundercomm

- 分析师选择(14/17):Timeseer.AI

- 分析师选择 (15/17):Scale AI

- 分析师选择(16/17):Wiliot

- 分析师选择(17/17):ZARIOT

- 2021级发生了什么事?

第 4 章. 关于 IoT 分析

The "IoT Start-Up Landscape and Database 2024 report" is part of IoT Analytics' ongoing coverage of general IoT.

SAMPLE VIEW

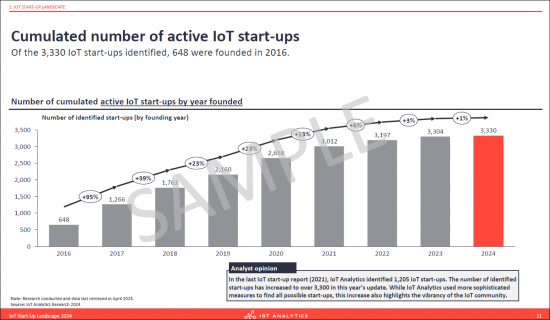

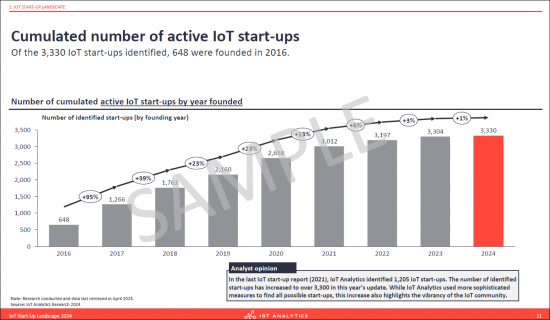

This database classifies over 3,330 IoT start-ups with more than 60 points for each start-up. The number of active IoT start-ups identified reached 3,330 in 2024, compared to significantly less in a similar exercise in 2021.The report reveals not only the top funded start-up but also detailed information for all of them.

SAMPLE VIEW

The most funded IoT start-ups include for example EswinComputing, Figure and Verkada.

The IoT Analytics analyst team handpicked 17 IoT start-ups that are innovative and promising. Examples include ai-omatic (AI-based predictive maintenance software), Pio (automated storage and retrieval system), and Zariot (IoT connectivity provider).

The database is suited for the following topics

- M&A target search

- IoT strategy / business case development

- Go-to-market / market entry strategy

- Customer / vendor selection

- Sector scan

- Competitive analysis

- Due diligence

- Investment opportunity search

The database of IoT start-up companies is structured along the following dimensions

- 1. General information (company name, description, type and location)

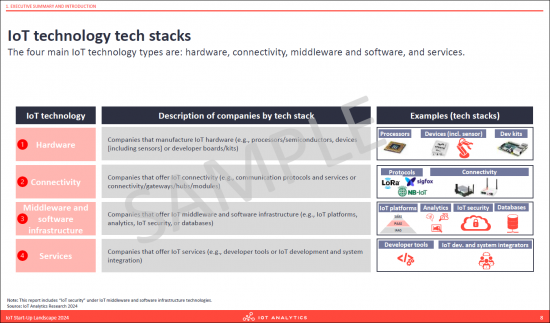

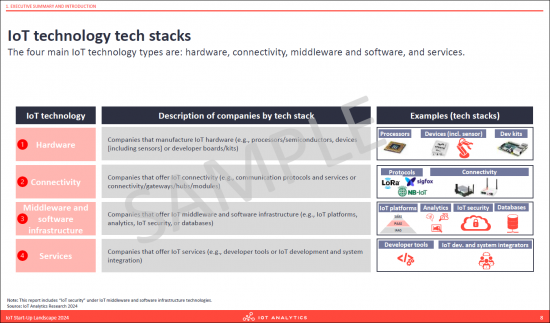

- 2. IoT Technology capabilities (IoT Hardware, IoT Connectivity, IoT Middleware & Software Infrastructure, and Application & Services, Other)

- 3. Segment focus (Finance, Agriculture, Connected buildings, Retail, Enterprise / IT infrastructure & Security, Health & Pharmaceuticals, Energy / utilities, Mobility, Smart Cities, Manufacturing / Industrial, Supply Chain, Public sector, Gov. & services, Other business, etc.) & Enablers (i.e., VC/Investors, Consulting, Incubators, etc.).

- 4. Further information (Founded, LinkedIn, Email, Phone, Founder, No. Of Employees, Last Funding Date, Last Funding Amount, Last Funding Amount Currency, Total funding, Total funding currency, Number of Investors, Top 5 investors, Funding type, Estimated revenue, Number of acquisitions)

- 5. Large start-ups (> 1M$ annual revenue, >50 employees, series B or higher, yes/no)

Questions answered

- How many IoT start-ups exist in 2024? How has that number changed over time?

- How has the IoT start-up landscape changed since 2021?

- Which IoT start-ups have the highest funding?

- Which IoT tech stack are IoT start-ups offering?

- Which countries/regions are home to the most IoT start-ups?

- What verticals are IoT start-ups focusing on?

- How many IoT start-ups have been acquired?

- Who are the most active investors in IoT start-ups?

- Which IoT start-ups do the IoT Analytics' analyst team find interesting?

Companies mentioned

A selection of companies mentioned in the report.

|

|

|

Table of Contents

1. Executive summary and introduction

2. IoT start-up landscape

- a) Overview

- Cumulated number of active IoT start-ups

- IoT start-ups by year founded

- Funding of IoT start-ups by funding stage

- Funding of IoT start-ups by year founded

- Average funding of active IoT start-ups by year founded

- Top funded IoT start-ups

- Number of acquisitions of IoT start-ups-2021 to 2024

- Selected acquisitions of IoT start-ups in 2023

- Selected recent IPOs of IoT start-ups

- Most active investors

- Share of large start-ups

- Share of large start-ups by founding year

- Share of AI-focused IoT start-ups

- b) Technological deep dive

- Share of identified IoT start-ups by tech type

- Share of active IoT start-ups by tech type between 2016 and 2023

- Percentage of IoT start-ups offering different types of IoT hardware

- % of IoT start-ups offering different types of IoT middleware and software

- Percentage of IoT start-ups offering different types of connectivity/services

- Share of large start-ups by tech stack and tech type

- c) Regional deep dive

- Global distribution of IoT start-ups

- Identified IoT start-ups and key insights by region (1/2)

- Identified IoT start-ups and key insights by region (2/2)

- Share of start-ups by region and founding year

- Technology focus of IoT start-ups by region

- Regional deep dive (1/5): North America

- Regional deep dive (2/5): Europe

- Regional deep dive (3/5): APAC

- Regional deep dive (4/5): Middle East and Africa

- Regional deep dive (5/5): South America

- Focus industry of IoT start-ups by region

- Share of large start-ups by region

- d) Industry deep dive

- Industry definitions

- IoT start-ups by industry

- Share of identified IoT start-ups in top industries by year (1/3)

- Share of identified IoT start-ups in top industries by year (2/3)

- Share of identified IoT start-ups in top industries by year (3/3)

- Share of large start-ups by focus industry

3. Handpicked IoT start-ups

- IoT start-ups handpicked by IoT Analytics analysts (1/2)

- IoT start-ups handpicked by IoT Analytics analysts (2/2)

- Analyst pick (1/17): ai-omatic solutions

- Analyst pick (1/17): ai-omatic solutions

- Analyst pick (2/17): DeepVu

- Analyst pick (3/17): Edge Impulse

- Analyst pick (3/17): Edge Impulse

- Analyst pick (4/17): Figure

- Analyst pick (5/17): H2Ok Innovations

- Analyst pick (5/17): H2Ok Innovations

- Analyst pick (6/17): Infogrid

- Analyst pick (7/17): Onehouse

- Analyst pick (8/17): peaq

- Analyst pick (9/17): Pio

- Analyst pick (10/17): PUDU Robotics

- Analyst pick (11/17): Scale AI

- Analyst pick (12/17): Skylo

- Analyst pick (13/17): Thundercomm

- Analyst pick (14/17): Timeseer.AI

- Analyst pick (15/17): Tomorrow Things

- Analyst pick (16/17): Wiliot

- Analyst pick (17/17): ZARIOT

- What happened to the class of 2021?